Marine Antifouling Coatings Market Outlook:

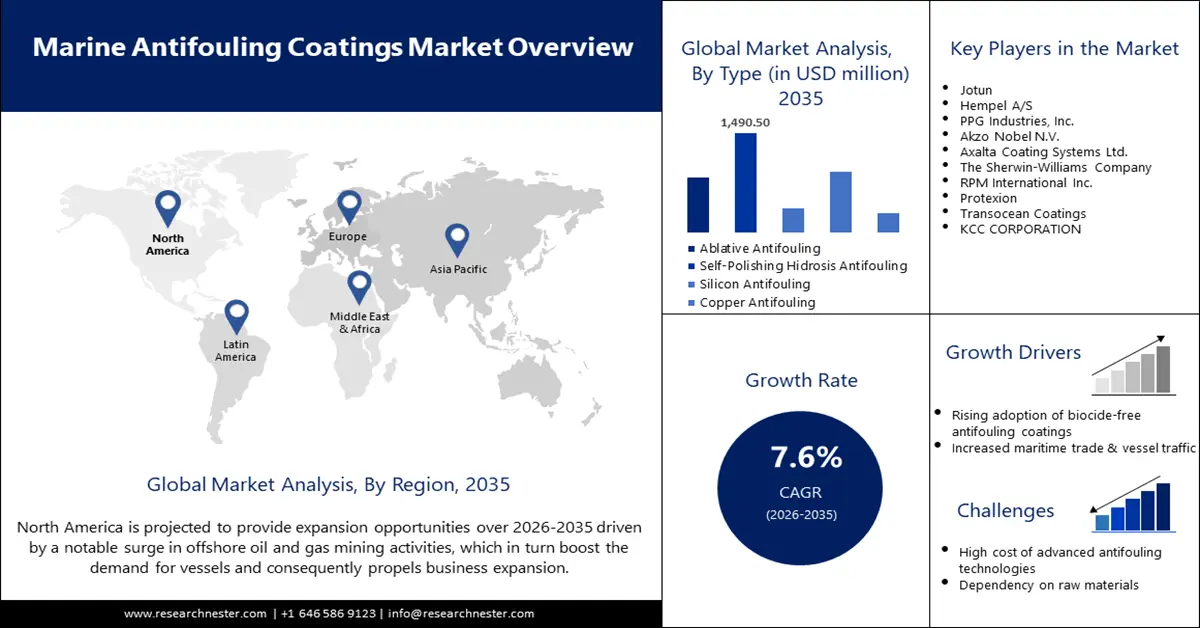

Marine Antifouling Coatings Market size was over USD 2.6 billion in 2025 and is anticipated to cross USD 5.41 billion by 2035, growing at more than 7.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of marine antifouling coatings is assessed at USD 2.78 billion.

The growth in the marine antifouling coatings market is robust, driven by high demand for eco-friendly solutions and rapid improvements in vessel efficiencies. Companies are focused on developing such coating, to prevent biofouling and decrease hydrodynamic drag and fuel consumption. For instance, Jotun introduced its Hull Skating Solutions in March 2021, launching an active clean technology that keeps a vessel's hull clean and free of fouling without the use of harmful biocides. This growth underlines the industry's development in using sustainable practices and deploying advanced technologies addressing strict environmental regulations, thereby improving operational efficiencies.

Government initiatives also have a substantial impact on marine antifouling coatings market expansion. Regulatory bodies advocate for sustainable maritime operations, which persuades manufacturers to produce eco-friendly antifouling coatings. According to the United Nations Conference on Trade and Development, there were approximately 105,500 vessels as of January 2023, a relatively large number of which require effective antifouling solutions. Due to this regulatory support and the innovative ability of the industry to meet environmental standards without compromising vessel performance, the market is expanding at a rapid rate.

Key Marine Antifouling Coatings Market Insights Summary:

Regional Highlights:

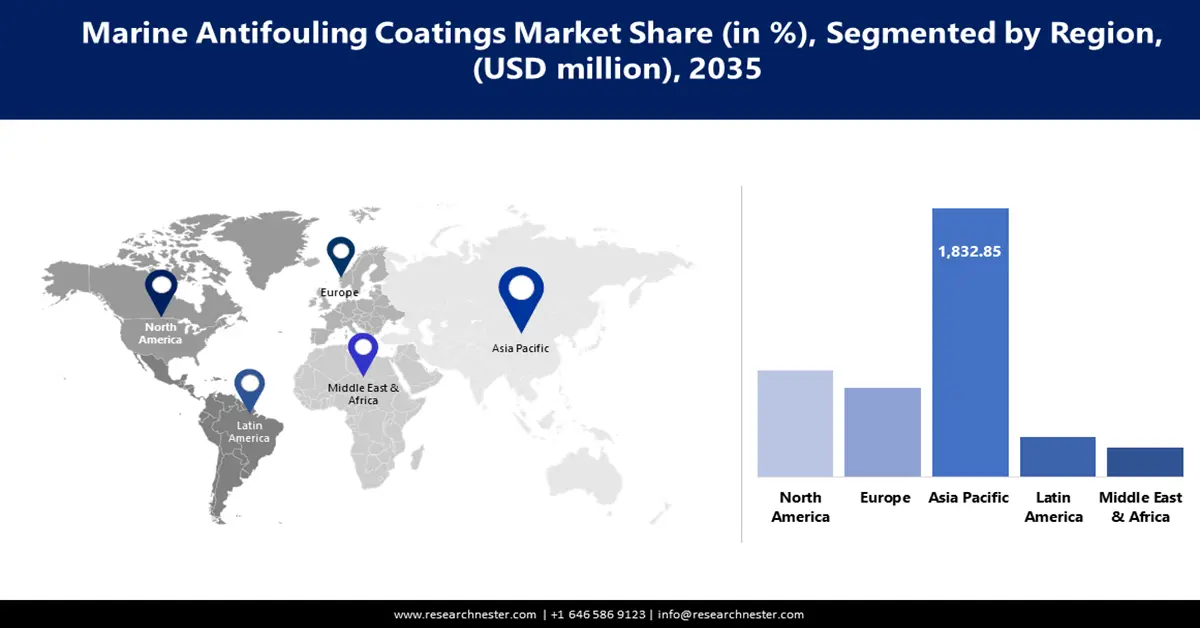

- Asia Pacific commands a 56.5% share in the Marine Antifouling Coatings Market, driven by massive shipbuilding industry and large-scale maritime activities, ensuring robust growth through 2035.

- North America’s marine antifouling coatings market is projected to grow rapidly by 2035, driven by advances in technology and focus on environmental sustainability.

Segment Insights:

- The Cargo Ships segment is projected to achieve significant growth by 2035, driven by expanding global commerce and the need to reduce fuel consumption and costs.

- The Self-Polishing Hydrolysis segment is anticipated to achieve 38.1% market share by 2035, propelled by consistent biocide release improving vessel performance and reducing maintenance.

Key Growth Trends:

- Environmental regulations and sustainability objectives

- Growing global seaborne trade

Major Challenges:

- High research and development costs

- Environmental and health-related concerns

- Key Players: Jotun, Hempel A/S, PPG Industries, Inc., Akzo Nobel N.V., Axalta Coating Systems Ltd., The Sherwin-Williams Company, RPM International Inc., Protexion, Transocean Coatings, and KCC CORPORATION.

Global Marine Antifouling Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.6 billion

- 2026 Market Size: USD 2.78 billion

- Projected Market Size: USD 5.41 billion by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (56.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, India, South Korea, Singapore, Vietnam

Last updated on : 14 August, 2025

Marine Antifouling Coatings Market Growth Drivers and Challenges:

Growth Drivers

- Environmental regulations and sustainability objectives: The marine industry is increasing its focus on reducing emissions by using eco-friendly marine antifouling coatings. The latest trend in product development has been toward the development of biocide-free and low-toxicity products as regulatory demands increase. For example, in August 2024, Hempel launched an advanced two-layer coating system under the name, Hempaguard Ultima. Drawing from the success of Hempaguard X7, featuring more than 4,000 applications and certified by DNV, Hempaguard Ultima answers customer needs for meeting progressive environmental regulations.

- Growing global seaborne trade: The increase in international trade has boosted the demand for antifouling coatings since more protection is needed to maintain efficiency. This further suggests that with increased shipping, the demand for coatings that can increase the life of vessels while minimizing costs is anticipated to rise by the end of 2035. Consolidation of the trade routes and competitiveness raises awareness in the search for sustainable coatings that support environmental objectives, further fueling the marine antifouling coatings market growth.

- Technological advances in coating formulations: Technological innovations are driving improvements in the efficiency and durability of antifouling coatings. Companies are increasingly investing in research to develop longer-lasting protection with reduced environmental impact. In May 2023, Chugoku Marine Paints Ltd. launched SEAFLO NEO CF PREMIUM, a new antifouling coating based on unique polymer technology that extends service life and supports fuel savings. Such advancements are essential to meet the growing demands of the shipping industry.

Challenges

-

High research and development costs: Advanced marine antifouling coatings formulations require heavy R&D investment, which may be the major entry barrier to this marine antifouling coatings market, especially for small-scale participants. Increasing demand for more innovative products that are compliant with environmental laws adds to the financial burden. Furthermore, strict regulations regarding the use of biocides demand further research into alternatives, thus increasing costs.

-

Environmental and health-related concerns: Despite the developments, certain antifouling coatings pose a danger to the environment and human health due to the inhalation of toxic substances. In the last few years, regulatory pressures have increased to eliminate harmful biocides, and this can reduce product offerings. The European Chemicals Agency (ECHA) proposed further restrictions on various biocides used in antifouling coatings in June 2023, forcing companies to seek other alternatives for effective and environmentally friendly solutions.

Marine Antifouling Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 2.6 billion |

|

Forecast Year Market Size (2035) |

USD 5.41 billion |

|

Regional Scope |

|

Marine Antifouling Coatings Market Segmentation:

Type (Ablative Antifouling, Self-Polishing Hidrosis Antifouling, Silicon Antifouling, Copper Antifouling, Others)

The self-polishing hydrolysis antifouling segment in the marine antifouling coatings market is anticipated to dominate, with a revenue share of 38.1% during the forecast period. Its dominance is due to offering consistent biocide release that improves vessel performance and cuts maintenance costs. In April 2024, BASF’s Coatings division introduced an eco-efficient range of clearcoats and undercoats, enhancing quality, productivity, and sustainability while reducing CO2 emissions. Made with BASF's biomass balance approach and approved by top automotive OEMs, these coatings reflect segment growth as demand for environmentally compliant antifouling solutions rises.

Application (Shipping Vessels, Drilling Rigs, Fishing Boat, Yachts, Cargo Ships, Others)

The cargo ships segment is anticipated to account for 23.2% of the global marine antifouling coatings market by 2035. The burgeoning volumes of international trade are increasing the cargo vessel fleet that requires antifouling protection to work effectively. This rise in cargo ship demand is fueled by expanding global commerce and the need to reduce fuel consumption and maintenance costs. Advanced antifouling solutions are critical for supporting these vessels, as they enhance operational efficiency and promote environmental compliance.

Our in-depth analysis of the marine antifouling coatings market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Marine Antifouling Coatings Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is poised to dominate majority revenue share of 56.5% by 2035. The region dominates the market due to its massive shipbuilding industry and large-scale maritime affairs. In 2023, over 50% of the shipping fleet in the world was concentrated in Asia Pacific, according to the United Nations Conference on Trade and Development (UNCTAD). This indicates a huge demand for antifouling coatings to protect the fleet and keep it operational.

In China, the market growth is elevated by governmental support provided to the maritime industry. The China government announced in March 2023 an increase in investments being channeled toward sustainable shipping technologies that would eventually stir the adoption of environmentally friendly, economically efficient advanced antifouling coatings. Major coating manufacturer Chugoku Marine Paints Ltd. announced its expansion in April 2023 to cater to the growing demand for high-performance antifouling coatings in the country.

India marine antifouling coatings market is witnessing steady expansion due to several positive government initiatives being instituted to modernize the country’s maritime infrastructure. For example, the Maritime India Vision 2030 launched by the Ministry of Ports, Shipping and Waterways in April 2023, focuses on responsible practices and technology in maritime operations. Such an initiative is likely to spur demand for antifouling products as the country positions itself to improve efficiencies and compliance within its shipping industry.

North America Market Analysis

North America marine antifouling coatings market is expected to witness a rapid CAGR till 2035, owing to continuous advances in technology along with increasing stress on environmental sustainability. The strict environmental regulations and greater awareness regarding the potential benefits of sustainable maritime practices increase the consumption rate of eco-friendly coating in this region.

Companies in the U.S. continue to invest heavily in research and development of advanced antifouling solutions. For example, in June 2023, Sherwin-Williams introduced SeaGuard Hybrid, an advanced antifouling coating based on the combination of biocide-free technology with strong durability that reduces fuel consumption, resulting in lower emissions of greenhouse gases. Such product launches indicate how companies are moving toward sustainable products that meet environmental standards while offering superior performance.

Canada is also among the key contributors to marine antifouling coatings market growth, making investments in maritime innovation. In May 2023, the Canada government announced key funding for research into antifouling coatings, among other marine technologies, showing its green maritime credentials. By investing in research and development for advanced antifouling coatings, Canada aims to support both local innovation and global maritime sustainability standards. These initiatives position Canada as a leader in promoting eco-friendly practices within the maritime industry, attracting attention from global stakeholders and businesses.

Key Marine Antifouling Coatings Market Players:

- Jotun

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hempel A/S

- PPG Industries, Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- The Sherwin-Williams Company

- RPM International Inc.

- Protexion

- Transocean Coatings

- KCC CORPORATION

- Nippon Paint Holdings Co., Ltd.

- Kansai Paint Marine Co., Ltd.

- Chugoku Marine Paints, Ltd

Competition in the marine antifouling coatings market is aggressive, with key innovators such as Jotun, Hempel A/S, Chugoku Marine Paints Ltd., BASF SE, and PPG Industries leading innovation. Companies are competing to develop eco-friendly, high-performance coating products that will help them stay ahead of environmental regulations and continue to meet customer needs. The latest development of biocide-free and advanced self-polishing coatings suggests a huge increase in the efforts toward sustainability and efficiency in the industry.

Manufacturers have become focused on prioritizing solutions that align with the evolving environmental standards of the industry, and these are headed toward reduced ecological impact without sacrificing performance. This has triggered rapid R&D into antifouling technologies that could avoid biofouling and ensure fuel efficiency and carbon emission reduction while offering longer vessel life.

Here are some leading companies in the marine antifouling coatings market:

Recent Developments

- In March 2024, PPG Industries launched PPG NEXEON 810, a copper-free, ultra-low-friction antifouling coating designed for the marine industry. This product provides an eco-friendly alternative amid discussions of potential copper coating bans. NEXEON 810 delivers enhanced performance while minimizing environmental impact. PPG’s innovation reinforces its role as a leader in sustainable marine coatings.

- In September 2023, Hempel A/S opened a new, state-of-the-art antifouling coatings facility in Zhangjiagang, China, to meet the growing demand for advanced marine coatings. This facility enhances production capacity, catering to a market increasingly focused on sustainability. Hempel’s expansion supports the region’s need for eco-friendly and high-performance coatings. The move strengthens Hempel’s position in the Asian maritime sector.

- In April 2023, Damen Shipyards, AkzoNobel, and Philips collaborated to develop a groundbreaking fouling control solution using UV-C light technology. This innovation keeps ship hulls clean without relying on traditional biocides, offering a more sustainable approach. The partnership reflects a commitment to environmentally friendly maritime practices. This solution reduces ecological impact while maintaining hull performance.

- Report ID: 6576

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Marine Antifouling Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.