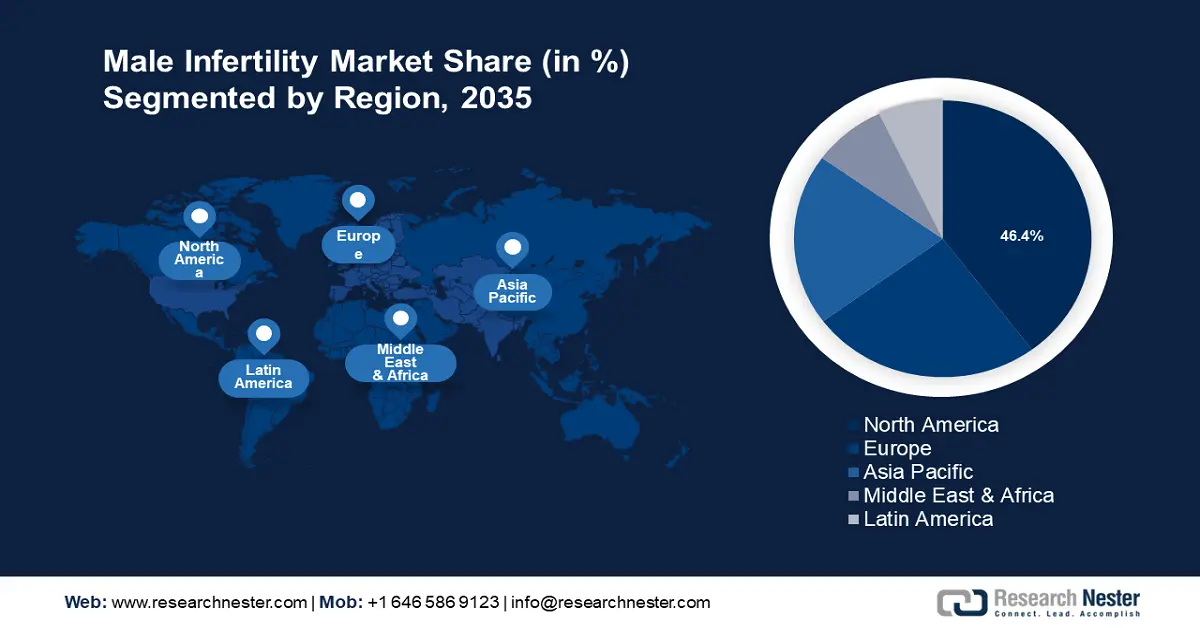

Male Infertility Market Regional Analysis:

North America Market Insights

North America industry is expected to account for largest revenue share of 46.4% by 2035. Innovations of ART have assisted the rapid growth in the market share of the region. A recent meta-analysis found that male fertility had declined by more than 50% in North America which has led to greater demands for male infertility care. A key market driver is the increasing awareness drives such as the National Infertility Awareness Week (NIAW) conducted by the American Society for Reproductive Medicine that help dispel stigma around male infertility care. The growing awareness opens access to male fertility care to a wider set of demographics which in turn assists the robust growth of the market.

The U.S. is at the forefront of the revenue boom in North America. The Centers for Disease Control (CDC) estimates the male infertility rate in the United States to be around 11.4% of men aged between 15 to 49 years between 2015 to 2019. CDCs report found that infertility had increased from 7.8% in ages 15-24 to 14.3% between 2015 to 2019. The increase in male infertility in the U.S. is leading to greater demand for male fertility care which helps the market’s growth. CDC’s report also indicated that male infertility has increased in married men compared to single and cohabiting men and social factors indicate that married men are more likely to seek fertility care. Additionally, the U.S. general fertility rate fell by 3% from 2022 as per a CDC report released in April 2024, which is poised to increase the government investments in awareness drives to combat the falling fertility rates.

Canada is a leading male infertility market in North America and profits from the region’s overall growth. The market in Canada benefits from the robust regulatory ecosystem for healthcare and the growing demands for male fertility care. Canada is witnessing trends where paternal age is increasing which may increase infertility cases. For instance, in April 2024, Institut de la Statistique du Québec published a report stating paternal age had increased to 33.8 in 2022 from 30.3 in 1976. Additionally, the report stated that men in their twenties are facing a decrease in fertility over the past decade. Such trends are projected to increase the demand for quality male fertility care in Canada during the forecast period.

Europe Market Insights

Europe is poised to have profitable male infertility market growth during the forecast period owing to several factors such as the declining rate of birth, increasing cases of male infertility, awareness drives, and expansion of fertility preservation services. With the cases of cancer rising, the demand for male fertility preservation before treatment is increasing. In 2024, a study published in Oxford Academic stated that centers providing specialized crypto preservation of immature human testicular issues in Europe had increased in the last 20 years indicating a growing demand for male fertility care.

UK is poised to lead the male infertility market revenue share in Europe. UK is at the forefront of research on male infertility in Europe. For instance, in January 2022, Newcastle University published groundbreaking research showing new mutations during the reproduction process when the DNA of both parents is replicated can lead to infertility in men. Fertility awareness among the younger generations is increasing owing to a positive dissemination of information in social media channels regarding male infertility. The fertility index survey indicated that 11% of all men reported fertility issues with the highest concentration in the 18-24 age group in males. The rising cases and increasing awareness in younger demographics are poised to maintain the robust market growth in the UK.

Germany is expected to have a rapid increase in its revenue share during the forecast period. In December 2016, a researched published in Demographic Research indicated that fertility has decreased in German men compared to 1991 owing to various factors. The decline in sperm count of men in Europe in the past 50 years affects Germany and increases the demand for premium fertility care for men.