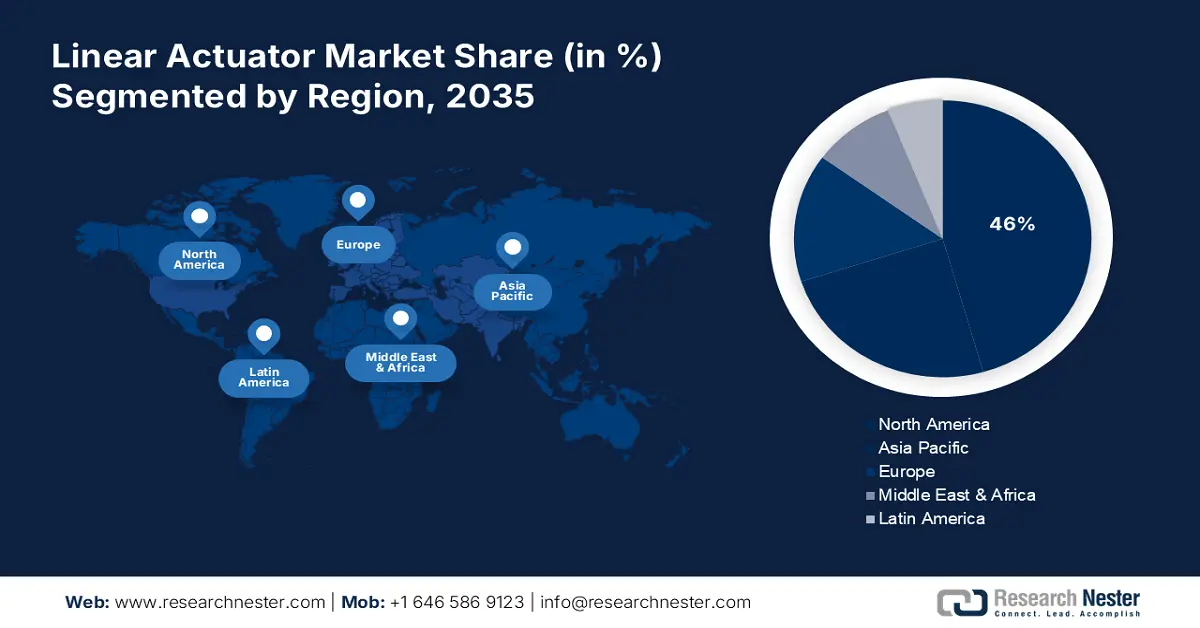

Linear Actuator Market Regional Analysis:

North America Market Insights

North America industry is estimated to account for largest revenue share of 46% by 2035. The market is anticipated to lead due to high levels of automation and technological innovation. Some major drivers in the market include extensive automation in manufacturing, healthcare, and automotive, among many others. Further, the presence of key companies for manufacturing the actuator in the region will further facilitate the growth of the market with the continuous introduction of innovation and new products. This is likely to further boost the market by encouraging the uptake of developed, cost-effective, and sustainable actuator solutions that will once again strengthen North America in the lead of the global market.

The U.S. market is growing at a considerable rate due to a rise in demand for accurate solutions for motion control. In June 2022, Emerson announced the launch of the AVENTICS Series SPRA Electric Actuators, which were quickly adopted across multiple industries for their high accuracy and flexibility. This, in effect, translates to continued regional interest in scaling up automation capabilities, something that keeps pushing growth forward in the market. This trend is also witnessed in Canada, whereby organizations are increasingly investing in more advanced actuator technologies to cater to the growing needs of the industrial sector.

Asia Pacific Market Insights

Asia Pacific linear actuator market is projected to show the fastest growth and expansion during the forecast period on account of a rapidly increasing industrial base and huge investments in automation. The major countries in this region include China, India, and Japan, which are growing on the strength of government support and increasing industrial bases that demand high-end manufacturing technologies. The market has seen rapid growth in China due to an increasing need for automation in its manufacturing.

Statistics from China's National Bureau of Statistics show that, for the first half-year of 2023, compared with the same period last year, industrial output increased by 3.7%, while the high and new technology reached 17.0% of the proportion within the total industrial gross output. Also, the value-added output for high and new technology manufacturing jumped 8.1% in 2023. This rapid growth shows how automation technologies are increasingly finding their place in the manufacturing sector, a fact that will further support the demand for advanced linear actuators.

India is also expected to register rapid expansion in the industry. The Government of India encourages industrial development through the shaping of supportive policies via taxation benefits and subsidies that drive investments in manufacturing and automation. In 2023, the Government of India announced further incentives for the sectors identified under the Production-Linked Incentive scheme for automation technologies, including electronics, automotive, and industrial machinery. This further adds to the growth prospects in the country for new entrants.