Linear Actuator Market Outlook:

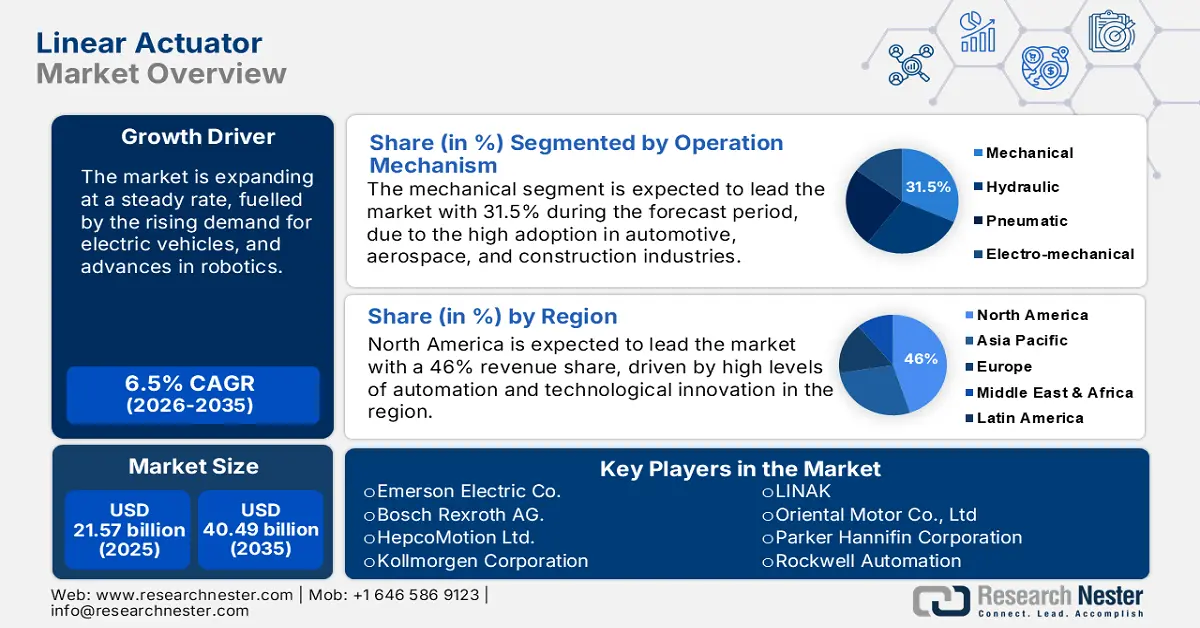

Linear Actuator Market size was valued at USD 21.57 billion in 2025 and is likely to cross USD 40.49 billion by 2035, registering more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of linear actuator is assessed at USD 22.83 billion.

The market is expanding due to the growing trend of automation in many industries. Key drivers to this growth are the rise of electric vehicles, advances in robotics and smart factories, and the demand for more accurate motion control in the manufacturing processes. Moreover, the drive toward energy efficiency by integrating advanced technologies into actuators also brings new opportunities for manufacturers to innovate and gain market share. Several companies in the linear actuator market are aggressively innovating to stay afloat in their respective areas of operation and meet dynamic industrial needs.

Government initiatives also contribute towards the adoption of linear actuators in industrial automation. In July 2023, the U.S. Department of Energy launched an initiative on the energy efficiency of industrial equipment, including the actuators. The program, therefore, supports incentives that have been made towards the industry in line with adopting energy-efficient technologies, which helps in encouraging manufacturers to adopt advanced actuators within their operations. The aforementioned regulatory support is likely to drive the growth of the markets by ensuring sustainable and efficient manufacturing practices.

Key Linear Actuator Market Insights Summary:

Regional Highlights:

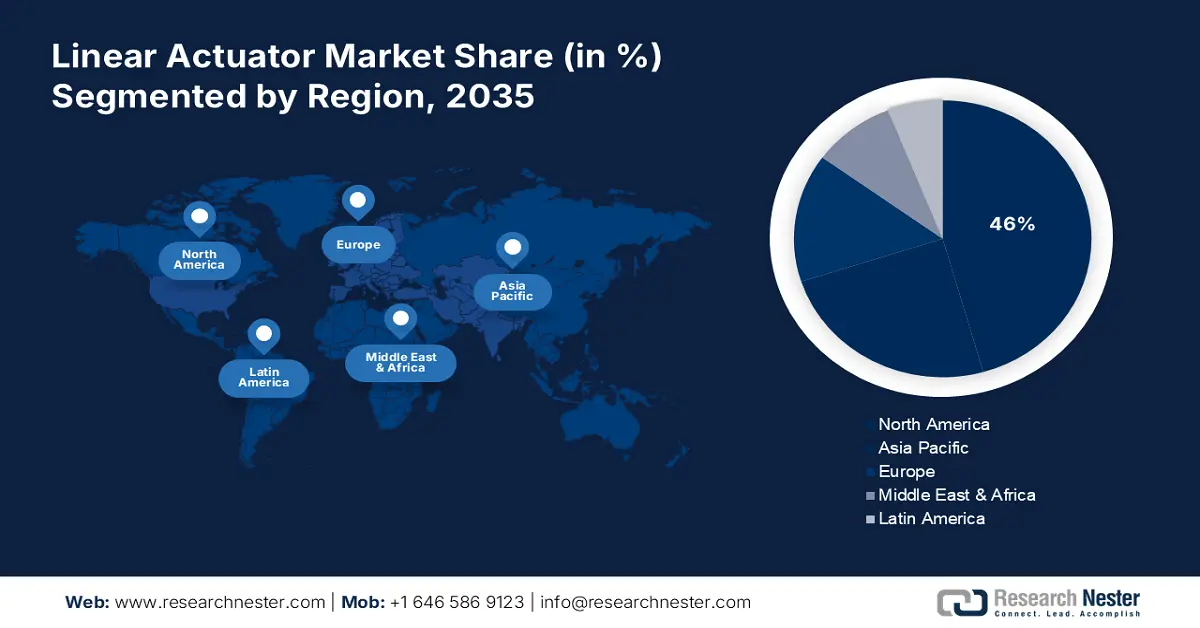

- The North America linear actuator market will dominate around 46% share by 2035, driven by high automation and innovation across industries.

Segment Insights:

- The mechanical actuators segment in the linear actuator market is projected to hold a 31.50% share by 2035, fueled by wide applications in automotive, aerospace, and construction.

- The automotive segment in the linear actuator market is expected to lead by 2035, influenced by the traction of automation in vehicle manufacturing.

Key Growth Trends:

- Automation in manufacturing

- Adoption of electric vehicles

Major Challenges:

- Regulatory compliance

- Supply-chain disruptions

Key Players: Bosch Rexroth AG., Emerson Electric Co., HepcoMotion Ltd., Kollmorgen Corporation., LINAK., Oriental Motor Co., Ltd., Parker Hannifin Corporation., Rockwell Automation.

Global Linear Actuator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.57 billion

- 2026 Market Size: USD 22.83 billion

- Projected Market Size: USD 40.49 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 18 September, 2025

Linear Actuator Market Growth Drivers and Challenges:

Growth Drivers

-

Automation in manufacturing: Automation is one of the major factors in the growth of the market, as most industries around the world are adapting to automated systems to gain better and higher levels of precision. Such development points towards the importance of advanced actuators in automation processes, thereby driving the market ahead as industries look to optimize their processes and reduce operational costs.

-

Adoption of electric vehicles: Another key market growth factor in the linear actuator can be attributed to the fast adoption rates of electrical vehicles. Demand for high-performing actuators has been increasing gradually. In August 2023, LINAK introduced the LA33 Electric Linear Actuator in their powering options to meet this demand-the next progressive step to offer a potent and efficient solution to the automotive sector. This move complements the growth in the market and comes in line with the trend toward sustainable transportation, which is expected to further push demand for such technologies.

- Energy efficiency and sustainability: The increasing need for energy efficiency and promoting sustainability within the bigger global activity has significant effects on the linear actuator market. In April 2022, Bosch Rexroth launched the CytroMotion actuator system which is aimed at achieving energy efficiency by combining the robustness of hydraulic systems with the sustainability of electric actuators. This indicates how the innovation correctly reacts to the growing demand for actuators that contribute to the reduction of energy consumption and carbon footprints of industrial processes. As more and more industries search for ways to increase their sustainability factor, the demand for such energy-efficient actuators will increase, hence driving market growth.

Challenges

-

Regulatory compliance: Another challenge that linear actuator manufacturers face is the demanding regulatory environment. Complying with such demands so far as regards energy efficiency directives and environmental legislation calls for the highest possible investments from the producers themselves in the products they manufacture. New regulations have been applied as of July 2023 by the European Union, focusing on increased energy efficiency for industrial machinery, which includes actuators. This may be expensive in terms of compliance and pose huge challenges to manufacturers, particularly the smaller players who may lack the resources to meet such requirements.

-

Supply-chain disruptions: Global uncertainties have developed new challenges and disruptions in the supply chain for linear actuator companies. However, continuous perturbations in the supply chain may further be a restraint to the growth in the industry and hence would require sound supply chain management strategies by the manufacturers.

Linear Actuator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 21.57 billion |

|

Forecast Year Market Size (2035) |

USD 40.49 billion |

|

Regional Scope |

|

Linear Actuator Market Segmentation:

Operation Mechanism Segment Analysis

Mechanical actuators are anticipated to account for the 31.5% revenue share of the linear actuator market by 2035. This is majorly owed to the wide application of this segment across the automotive, aerospace, and construction industries in a manner where such an actuator is used, focusing on reliability and cost-effectiveness. Rollon, Inc. introduced the TLS Series Telescoping Linear Actuators in August 2023. The recent launch of the product in the mechanical actuator segment has further redeemed this trend as it caters to certain niche applications in which compactness and precision drive market growth.

End user Industry Segment Analysis

During the forecast period, the leading end user segment in the linear actuator market is likely to be the automotive industry. This is due to the greater traction of automation that is gripping vehicle manufacturing, involving critical motion control solutions. Thomson released the Electrak XD electric linear actuators targeted at applications needing high speeds and capacities, especially in automotive production, in June 2023. This factor is critical to the segment growth by improving manufacturing efficiency. As a result, such innovations push the industry in the direction of increased automation and the integration of such technologies into production lines.

Our in-depth analysis of the global market includes the following segments

|

Operation Mechanism

|

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Linear Actuator Market Regional Analysis:

North America Market Insights

North America industry is estimated to account for largest revenue share of 46% by 2035. The market is anticipated to lead due to high levels of automation and technological innovation. Some major drivers in the market include extensive automation in manufacturing, healthcare, and automotive, among many others. Further, the presence of key companies for manufacturing the actuator in the region will further facilitate the growth of the market with the continuous introduction of innovation and new products. This is likely to further boost the market by encouraging the uptake of developed, cost-effective, and sustainable actuator solutions that will once again strengthen North America in the lead of the global market.

The U.S. market is growing at a considerable rate due to a rise in demand for accurate solutions for motion control. In June 2022, Emerson announced the launch of the AVENTICS Series SPRA Electric Actuators, which were quickly adopted across multiple industries for their high accuracy and flexibility. This, in effect, translates to continued regional interest in scaling up automation capabilities, something that keeps pushing growth forward in the market. This trend is also witnessed in Canada, whereby organizations are increasingly investing in more advanced actuator technologies to cater to the growing needs of the industrial sector.

Asia Pacific Market Insights

Asia Pacific linear actuator market is projected to show the fastest growth and expansion during the forecast period on account of a rapidly increasing industrial base and huge investments in automation. The major countries in this region include China, India, and Japan, which are growing on the strength of government support and increasing industrial bases that demand high-end manufacturing technologies. The market has seen rapid growth in China due to an increasing need for automation in its manufacturing.

Statistics from China's National Bureau of Statistics show that, for the first half-year of 2023, compared with the same period last year, industrial output increased by 3.7%, while the high and new technology reached 17.0% of the proportion within the total industrial gross output. Also, the value-added output for high and new technology manufacturing jumped 8.1% in 2023. This rapid growth shows how automation technologies are increasingly finding their place in the manufacturing sector, a fact that will further support the demand for advanced linear actuators.

India is also expected to register rapid expansion in the industry. The Government of India encourages industrial development through the shaping of supportive policies via taxation benefits and subsidies that drive investments in manufacturing and automation. In 2023, the Government of India announced further incentives for the sectors identified under the Production-Linked Incentive scheme for automation technologies, including electronics, automotive, and industrial machinery. This further adds to the growth prospects in the country for new entrants.

Linear Actuator Market Players:

- Emerson Electric Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bosch Rexroth AG

- HepcoMotion Ltd.

- Kollmorgen Corporation

- LINAK

- Oriental Motor Co., Ltd

- Parker Hannifin Corporation

- Rockwell Automation

The competition in the linear actuator market is considered to be relatively high. Some of the key players include Parker Hannifin Corporation, Thomson Industries, Inc. subsidiary of Altra Industrial Motion Corp., and Bosch Rexroth AG. Other major players are SKF Group, Rockwell Automation, and Tolomatic Inc. Other contributors towards market diversification include regional manufacturers and specialized providers like Ewellix, earlier known as SKF Motion Technologies, and Actuonix Motion Devices. Some key factors governing competition in the industry include technological innovation, product differentiation, pricing strategy, and the capability of companies to provide customized solutions to different applications across manufacturing, healthcare, and automotive industries.

In a key development, Tolomatic Inc. introduced its new RSX128 electric rod-style actuator in March 2023 for extreme force applications as high as 100,000 lbf (445 kN). The high-force actuator is very suitable for high demands on industrial applications in pressing, punching, stamping, and assembly in the automotive and general industries. Such developments further intensify the competitive outlook of the market.

Here are some leading players in the market:

Recent Developments

- In August 2024, Kimray Inc., an Oklahoma City-based solutions provider for the energy industry, introduced its new Electric Actuator, designed to reduce emissions and automate control in oil and gas applications.

- In June 2024, SMC Corporation launched its latest electric actuator series, the EQ series, featuring integrated controllers designed to streamline automation processes and reduce energy consumption and CO2 emissions.

- In December 2023, Flowserve Corporation unveiled its new Limitorque QX Series B (QXb) quarter-turn smart electric actuator, aimed at enhancing operational efficiency and reliability in global infrastructure markets.

- Report ID: 6373

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Linear Actuator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.