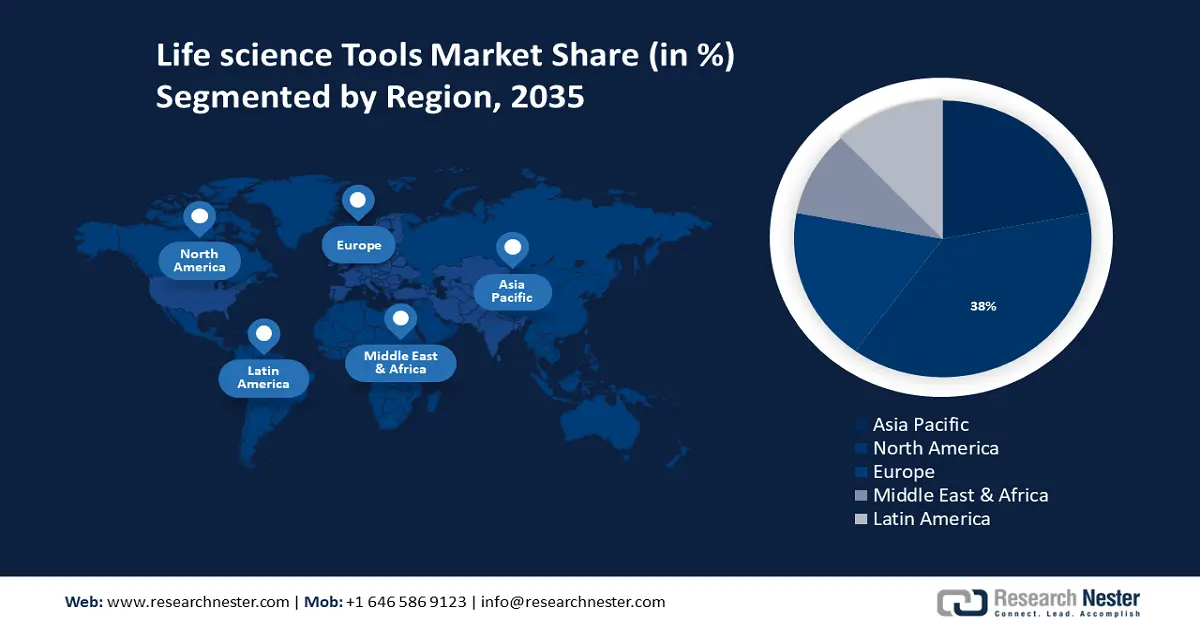

Life Science Tools Market Regional Analysis:

North America Market Insight

North America industry is likely to hold largest revenue share of 38% by 2035. The market growth in the region is due to adoption of proteomics, oncology, and genomics, oncology, and diagnostic screening in the region.

In 2019, North America represented more than 40.0% of overall revenue in the proteomics market. The expansion of the market in the area may be attributed to the increasing use of genomic medicine, biopharmaceuticals, diagnostic techniques, and novel technologies for the diagnosis and treatment of clinical illnesses in the United States and Canada.

The area also benefits from the existence of numerous industry participants who are consistently working to produce cutting-edge instruments for life science research. Additionally, throughout the course of the forecast period, the market is anticipated to rise at a rapid pace due to the existence of a well-regulated environment for the approval and utilization of genomic and tissue diagnostic tests.

In 2023, the United States held a market share of more than 44.8% for life science tools worldwide. The market is driven by funds and investments intended for the development of advanced therapeutics as well as a steadfast need for cutting-edge medications and therapies. This demand is fuelled by the escalating prevalence of diseases like cancer, kidney and thyroid disorders, and diabetes. An estimated 1.9 million new instances of cancer will be identified in the US in 2021, and 608,570 people will die from cancer.

Moreover, there will probably be additional clinical trials for gene therapy as recombinant protein advances. For instance, as of 2020, the FDA expected to receive more than 200 applications annually for clinical trials of gene and cell therapies by 2029.

APAC Market Insight

The APAC region will also encounter huge growth for the life science tools market during the forecast period. Growth will be stimulated by investments and efforts of world companies in this region to exploit the opportunities which exist, as well as increasing their presence there. For instance, in January 2022, it was revealed that FUJIFILM Corporation would pay USD 100 million to acquire the Atara Biotherapeutics T-Cell Operations and Manufacturing (ATOM) facility in order to produce CAR-T and T-cell immunotherapies, among other commercial and clinical treatments. Furthermore, this area provides reasonably priced manufacturing and operating units for research. The growth of life science instruments and technology in this area is anticipated to be significantly influenced by these variables.

Leading companies in the life science tools sector typically see 10% to 20% of their revenues come from Chinese acquisitions, which have contributed to their disproportionate growth.

A number of new projects are scheduled to be introduced by Japan's Ministry of Economy, Trade, and Industry (METI; Tokyo) to aid in the development of biodevices and research equipment for the life sciences industry.

Additionally, as the population ages and chronic diseases become more common, medical research efforts have increased, which has increased the demand for life science tools in disease knowledge and diagnostics. Additionally, the market is growing due to the strong demand for high-throughput sequencing and gene editing technologies created by South Korea's ambitious genomics and genetic research projects. It was predicted that in 2020, the CRISPR genome editing market in South Korea would reach a valuation of USD 70 million.