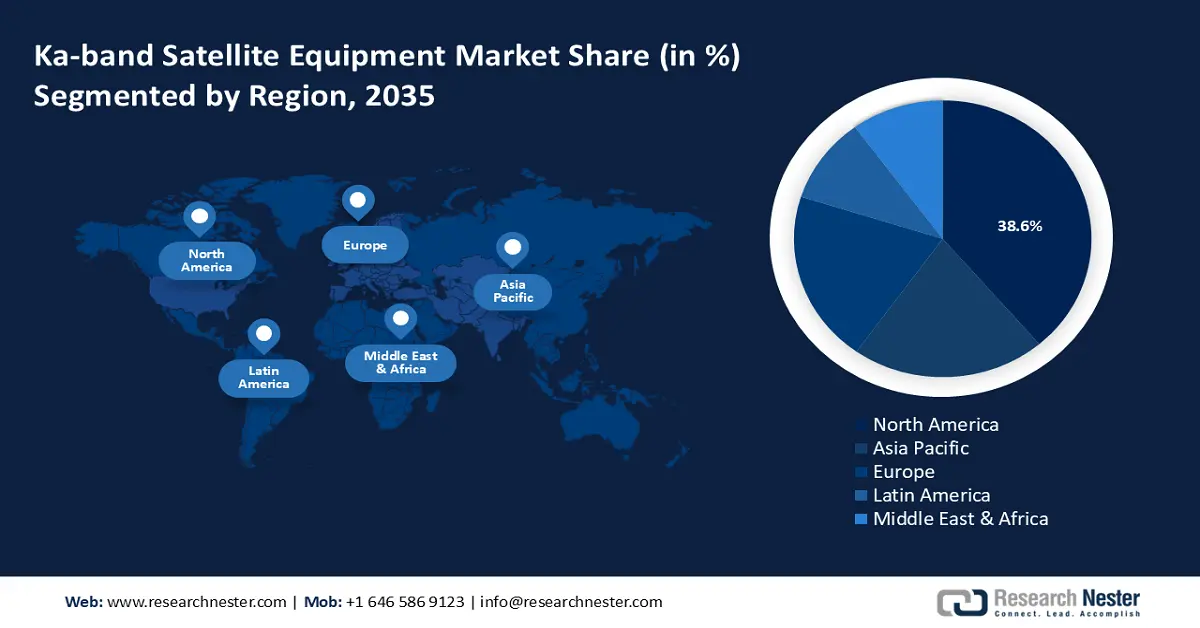

Ka-band Satellite Equipment Market - Regional Analysis

North America Market Insights

North America will account for the highest share in the global Ka-band satellite equipment market with an impressive 38.6% by 2035. The market share is poised to increase during the forecast period. The growth is attributed to growing demands and integration in telecommunications, media, and defense sectors. A robust regulatory system led by the Federal Communications Commission (FCC) provides a favorable environment for the market’s growth. Additionally, North America boasts the presence of top space agencies and global leaders in the communications sector, boosting the revenue generation opportunities in the region.

The U.S. accounts for a dominant share in the North America market and the growth opportunities in the country’s market uniquely position it to increase its revenue share by the end of the forecast period. The U.S. government has heavily invested in the defense sector, with the Department of Defense (DoD) reporting in March 2023 that it had requested USD 842 billion for defense investments. The high rate of investment is a major growth driver for the Ka-band satellite equipment market as demands grow exponentially in the defense sector for seamless connectivity solutions. For instance, in September 2023, SES Space & Defense were awarded a five-year blanket purchase agreement valued at around USD 134 million in support of DoD to deliver network services.

Canada is estimated to have a robust growth curve during the forecast period. The market’s growth is owed to the government’s push for connectivity through satellite initiatives. For instance, in August 2021, the government of Canada announced a USD 1.44 billion investment in Telesat to support connectivity in rural and remote communities. Additionally, Canada has 37 active satellites in its orbit. The future of the market in Canada is promising, as ka-band technology plays a crucial role in the country’s communication infrastructure that is poised to open new opportunities in the Ka-band satellite equipment market.

APAC Market Insights

The APAC Ka-band satellite equipment market is poised to register the fastest growth during the forecast period. The market’s growth is owed to rapid improvements in the telecommunications sector in China, India, Japan, and South Korea. China has 493 satellites in orbit, Japan has 210, India has 124, and Australia has 50. Additionally, the emerging economies in the region are witnessing a rapid digitization drive, increasing demands for advanced communications solutions to bridge gaps in connectivity. The trends have led to the rapid growth in revenue share in APAC.

India is projected to have a robust market share in APAC. The growth curve in the regional market is owed to the rising push for advanced connectivity solutions across the country. The Indian Space Research Organization (ISRO) has assisted the rapid connectivity boost in the country by deploying satellites. For instance, in September 2023, ISRO reported the launch of GSAT-11 from the spaceport in French Guiana, which will provide a high rate of connectivity through 8 hub beams in the Ka-band and 32 beams in the Ku-band. Additionally, the Make in India initiative is promoting indigenous light-weight terminals for mobiles and aviation, opening up opportunities for local players.

China is a leading Ka-band satellite equipment market in APAC owing to ambitious space programs and a large-scale push to improve communication infrastructure in the nation. China is also emerging as a major power in the global landscape and has seen an increase in defense spending over the years. The rising investment in defense increases demands for advanced communication solutions. For instance, in November 2022, China launched a high-powered Ka-band communications satellite to connect airline passengers, maritime vessels, and users across China, Southeast Asia, and for remote routes between APAC and North America. Additionally, local market players in China are boosting the supplies for Ka-band antennas. For instance, Research Nester estimates antenna band exports from China to around 128 countries globally.