Ka-band Satellite Equipment Market Outlook:

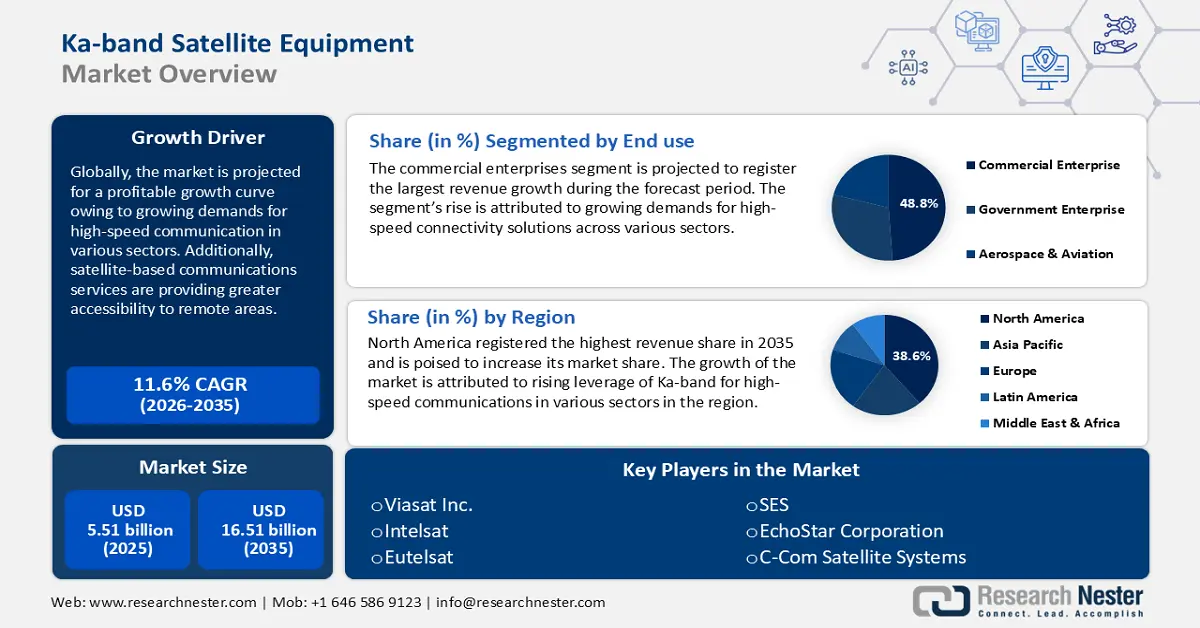

Ka-band Satellite Equipment Market size was over USD 5.51 billion in 2025 and is anticipated to cross USD 16.51 billion by 2035, growing at more than 11.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of Ka-band satellite equipment is assessed at USD 6.09 billion.

The market’s rapid growth is attributed to growing demands for high-speed communication in various sectors such as defense, satellite communication, and aerospace. Ka-band frequencies, ranging between 26.5 and 40 GHz, offer higher data transmission capabilities and efficient spectrum use than lower bands such as C-band and Ku-band.

A major growth driver of the market is the increasing reliance on satellite-based internet services to cater to global demands. For instance, in 2022, the National Aeronautics and Space Administration (NASA) stated that their systems and missions are shifting to higher frequency operations, especially Ka-band, to cater to high data volume management. In February 2024, NASA launched the Plankton, Aerosol, Cloud, and Ocean Ecosystem (PACE) that utilizes Ka-band for the transmission of data. With a growing percentage of industries and governments focusing on reducing the digital divide, investments in Ka-band technology have significantly risen contributing to the market’s growth.

Additionally, the opportunities in the global market are expanding in sectors such as maritime, aviation, and defense. There is a growing usage of Ka-band in providing seamless connectivity solutions in airlines, ships, and military operations. For instance, in December 2022, Viasat Inc. announced that their Ka-band in-flight connectivity solution for Gulfstream G450 aircraft had been approved by the Federal Aviation Administration (FAA). Key market players are poised to leverage the opportunities in the rapidly growing global market in various segments.

Key Ka-band Satellite Equipment Market Insights Summary:

Regional Highlights:

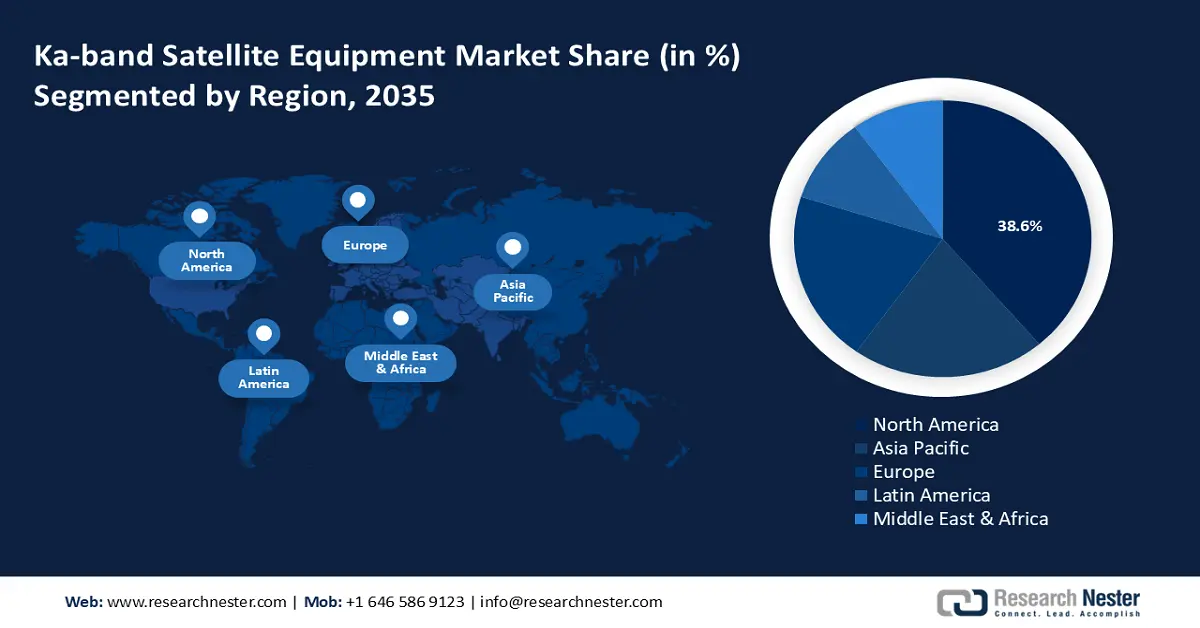

- By 2035, North America is expected to command a 38.6% share of the Ka-band satellite equipment market, supported by expanding integration across telecommunications, media, and defense sectors.

- Asia Pacific is set to elevate its regional share by 2035 as rapid advancements in the telecommunications landscape accelerate adoption of Ka-band satellite solutions.

Segment Insights:

- By 2035, the commercial enterprises segment in the Ka-band satellite equipment market is projected to hold around a 48.8% share, propelled by escalating requirements for high-speed connectivity solutions.

- The high-frequency segment above 27 GHz is anticipated to strengthen its market share by 2035 owing to its capability to deliver higher data transmission rates and broader bandwidths.

Key Growth Trends:

- Increasing penetration of 5G networks

- Expansion of satellite constellations

Major Challenges:

- Vulnerability to weather conditions

- High cost of infrastructure

Key Players: Viasat Inc., Intelsat, Eutelsat, EchoStar Corporation, Starwin, C-Com Satellite Systems, SES, SpaceX, and Immarsat.

Global Ka-band Satellite Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.51 billion

- 2026 Market Size: USD 6.09 billion

- Projected Market Size: USD 16.51 billion by 2035

- Growth Forecasts: 11.6%

Key Regional Dynamics:

- Largest Region: North America (38.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, United Kingdom, Germany

- Emerging Countries: India, South Korea, Canada, Australia, United Arab Emirates

Last updated on : 1 December, 2025

Ka-band Satellite Equipment Market - Growth Drivers and Challenges

Growth Drivers

- Increasing penetration of 5G networks: The large-scale penetration of 5G networks is driving the demand for robust satellite communication infrastructure. In remote areas that lack terrestrial infrastructure, Ka-band satellites play a vital role in supporting 5G networks. For instance, in February 2024, GSMA reported that 5G network is poised to account for 51% of mobile connections by 2029 and rise to 5.5 billion connections globally by 2030. Ka-band satellites fill the gap of effectively deploying 5G services in remote regions by assisting high-speed, low-latency services. For instance, in June 2022, SES S.A. reported that their geostationary band satellite SES-17 is fully operational over the Caribbean, Americas, and the Atlantic Ocean. Commercial, aviation, maritime, and defense sectors are increasingly leveraging the connectivity benefits of Ka-band, thus, fueling the market growth.

- Expansion of satellite constellations: The rising number of low-Earth orbit (LEO) satellite constellations boosts the demand for Ka-band satellite equipment. These satellites aim to provide global connectivity solutions and are reliant on Ka-band frequencies. There are more than 5000 low-orbit satellite constellations currently, including OneWeb, Project Kuiper, and Starlink, seeking to expand their revenue share in global connectivity solutions. Research Nester estimates robust growth of the satellite internet market benefits the revenue boom in the Ka-band satellite equipment market. In September 2024, United signed an agreement with SpaceX’s Starlink to bring seamless Wi-Fi services to its fleet of airlines.

- Growth in satellite TV and media broadcasting: The entertainment and mass media industries are leveraging Ka-band frequencies for high-definition (HD) and 4K content owing to high data throughput capabilities. Ka-band technology allows media companies to stream live events and broadcast content globally without latency. For instance, Intellian Technologies WorldView Trio enables DirecTV HD. UHD Ka-band reception. In September 2023, DirecTV and Nexstar Media Group, Inc. announced a new multi-year distribution agreement covering 176 Nexstar owned local television stations and the national cable news network.

Challenges

- Vulnerability to weather conditions: Ka-band satellites are vulnerable to adverse weather conditions such as rain and moisture. The high frequency of ka-band signals increases their susceptibility to rain fade, leading to degradation of frequency. This can stymie the market growth in regions with higher rainfall percentages. Since consumers expect uninterrupted service, frequent outages owing to weather can cause consumer dissatisfaction, and resolving outages can also lead to high costs.

- High cost of infrastructure: Deploying Ka-band satellite networks involves considerable capital investment. Sourcing equipment, resources, ground station infrastructure, launch costs, and user terminals can be expensive. Additionally, the operational costs of maintaining infrastructures are high. Owing to this, the entry barrier in the market can prove to be a challenge, limiting the participation of smaller players to various segments within the market.

Ka-band Satellite Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.6% |

|

Base Year Market Size (2025) |

USD 5.51 billion |

|

Forecast Year Market Size (2035) |

USD 16.51 billion |

|

Regional Scope |

|

Ka-band Satellite Equipment Market Segmentation:

End use Segment Analysis

The commercial enterprises segment dominated the Ka-band satellite equipment market share with a 48.8% revenue share in 2024 and is projected to increase its revenue share by the end of the forecast period. The growth of the segment is attributed to growing demands for high-speed connectivity solutions across various sectors. Businesses are leveraging the demands in the telecommunications, defense, maritime, aviation, and media sectors for seamless connectivity solutions. For instance, in June 2022, Thinkom Solutions and Carlisle Interconnect Technologies announced plans to launch a fully integrated phased Ka-band antenna solution to answer demands for high-speed connectivity on regional jet flights. Additionally, internet of things (IoT) connectivity has integrated seamlessly into day-to-day life, shifting consumer behavior to demand regular internet connectivity, and Ka-band connectivity solutions are poised to address the demands.

The government enterprise segment is projected to increase its revenue share during the forecast period. The segment’s growth is attributed to government investment in leveraging Ka-band satellite technology for defense, communications, disaster management, and efficient public communications services. Market players are increasingly finding opportunities in government contracts for Ka-band solutions for various segments. For instance, in August 2024, Atheras Analytics announced the defense ministry of the UK will use their Ka-band propagation analysis to determine the location of new Ka-band ground infrastructure to support the SKYNET 6 military satellite network.

Frequency Segment Analysis

The high-frequency segment above 27 GHz is projected to witness the fastest growth owing to its ability to support high-data transmission rates and larger bandwidths. The segment operating between 27 GHz and 40 GHz has large-scale applications for high-speed internet services and advanced military communications. Owing to the higher frequencies, the segment enables the use of smaller antennas and focused satellite beams, improving signal efficiency and reducing interference from other bands. For instance, in September 2024, CRFS announced the world’s first 40 Ghz spectrum monitoring receiver.

Our in-depth analysis of the Ka-band satellite equipment market includes the following segments

|

End use |

|

|

Frequency |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ka-band Satellite Equipment Market - Regional Analysis

North America Market Insights

North America will account for the highest share in the global Ka-band satellite equipment market with an impressive 38.6% by 2035. The market share is poised to increase during the forecast period. The growth is attributed to growing demands and integration in telecommunications, media, and defense sectors. A robust regulatory system led by the Federal Communications Commission (FCC) provides a favorable environment for the market’s growth. Additionally, North America boasts the presence of top space agencies and global leaders in the communications sector, boosting the revenue generation opportunities in the region.

The U.S. accounts for a dominant share in the North America market and the growth opportunities in the country’s market uniquely position it to increase its revenue share by the end of the forecast period. The U.S. government has heavily invested in the defense sector, with the Department of Defense (DoD) reporting in March 2023 that it had requested USD 842 billion for defense investments. The high rate of investment is a major growth driver for the Ka-band satellite equipment market as demands grow exponentially in the defense sector for seamless connectivity solutions. For instance, in September 2023, SES Space & Defense were awarded a five-year blanket purchase agreement valued at around USD 134 million in support of DoD to deliver network services.

Canada is estimated to have a robust growth curve during the forecast period. The market’s growth is owed to the government’s push for connectivity through satellite initiatives. For instance, in August 2021, the government of Canada announced a USD 1.44 billion investment in Telesat to support connectivity in rural and remote communities. Additionally, Canada has 37 active satellites in its orbit. The future of the market in Canada is promising, as ka-band technology plays a crucial role in the country’s communication infrastructure that is poised to open new opportunities in the Ka-band satellite equipment market.

APAC Market Insights

The APAC Ka-band satellite equipment market is poised to register the fastest growth during the forecast period. The market’s growth is owed to rapid improvements in the telecommunications sector in China, India, Japan, and South Korea. China has 493 satellites in orbit, Japan has 210, India has 124, and Australia has 50. Additionally, the emerging economies in the region are witnessing a rapid digitization drive, increasing demands for advanced communications solutions to bridge gaps in connectivity. The trends have led to the rapid growth in revenue share in APAC.

India is projected to have a robust market share in APAC. The growth curve in the regional market is owed to the rising push for advanced connectivity solutions across the country. The Indian Space Research Organization (ISRO) has assisted the rapid connectivity boost in the country by deploying satellites. For instance, in September 2023, ISRO reported the launch of GSAT-11 from the spaceport in French Guiana, which will provide a high rate of connectivity through 8 hub beams in the Ka-band and 32 beams in the Ku-band. Additionally, the Make in India initiative is promoting indigenous light-weight terminals for mobiles and aviation, opening up opportunities for local players.

China is a leading Ka-band satellite equipment market in APAC owing to ambitious space programs and a large-scale push to improve communication infrastructure in the nation. China is also emerging as a major power in the global landscape and has seen an increase in defense spending over the years. The rising investment in defense increases demands for advanced communication solutions. For instance, in November 2022, China launched a high-powered Ka-band communications satellite to connect airline passengers, maritime vessels, and users across China, Southeast Asia, and for remote routes between APAC and North America. Additionally, local market players in China are boosting the supplies for Ka-band antennas. For instance, Research Nester estimates antenna band exports from China to around 128 countries globally.

Ka-band Satellite Equipment Market Players:

- Viasat Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Intelsat

- Eutelsat

- Boeing Satellite Systems

- SpaceX

- Amazon

- C-Com Satellite Systems

- Starwin Science & Technology Co., Ltd.

- EchoStar Corporation

- Thales Group

- Avanti Communications

- SES

- Immarsat

- Gazprom Space Systems

Companies are investing in R&D to enhance satellite capabilities, increase bandwidth, and improve signal quality. Collaborations with telecommunication providers, government agencies, and technology firms help expand service offerings and market reach.

Here are some key players in the Ka-band satellite equipment market:

Recent Developments

- In August 2024, LeafSpace deployed the first ground antenna with high-speed Ka band to meet the demands for higher data rate applications. LeafSpace stated that the antenna had entered into service in June and is using Ka-band link to download large amounts of data from orbit.

- In January 2024, NewSpace India Limited announced the second demand driven satellite mission, i.e., GSAT-20, in the second quarter of 2024. The mission will be undertaken to meet the broadband communications need of the country.

- In August 2023, KDDI signed an agreement with SpaceX to bring satellite-to-cellular services in Japan. The collaboration is poised to provide KDDIs cellular services to areas beyond the reach of traditional 4G and 5G networks.

- In April 2022, SSI Canada provided contract to SES’s newest satellite, SES-17, to answer rising consumer needs and Canadian broadband government goals. K-band capacity from SES-17 will be used to improve services and support expansion across Northern Canada.

- Report ID: 6525

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ka-band Satellite Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.