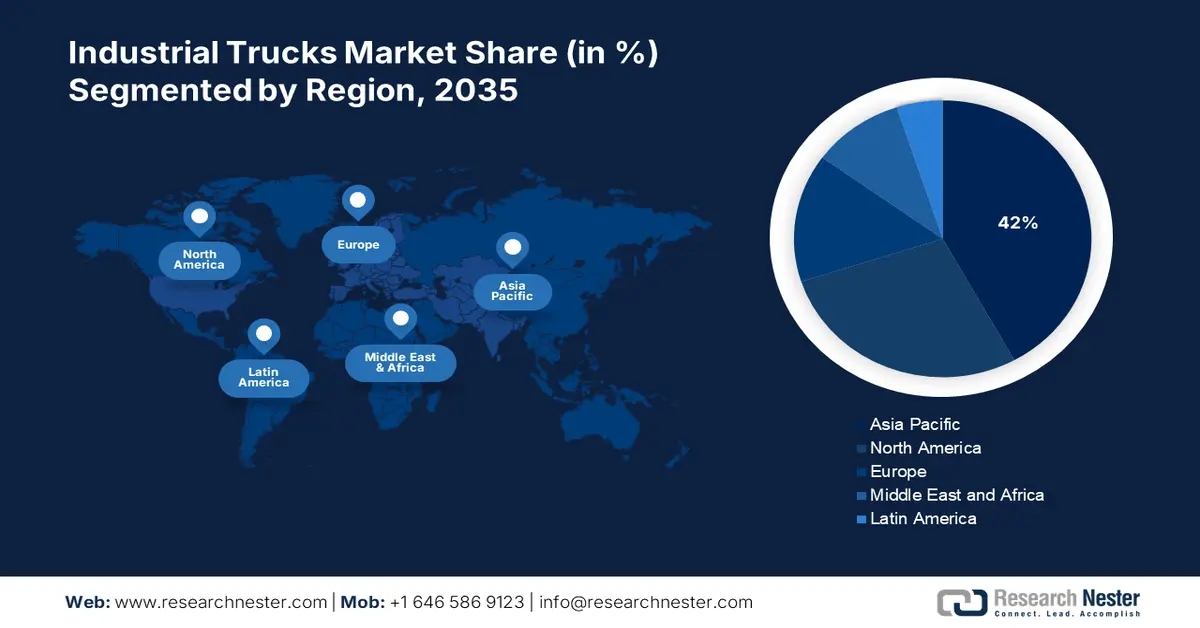

Industrial Truck Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific industry is likely to account for largest revenue share of 42% by 2035. In addition, the local government's support for smart manufacturing, accompanied by enormous investment in infrastructure, has sped up the trend toward advanced industrial truck, including electric and autonomous vehicles. Labor shortages, coupled with a need to increase productivity, accelerate automation and efficiency.

In India, the pivotal growth drivers for the industrial truck market are the rapidly emerging manufacturing and e-commerce sectors. For instance, in October 2023, it was announced that Amazon partnered with Eicher e-trucks, as its transport service partner to streamline its e-commerce deliveries efficiently in India. Moreover, continuous urbanization and industrialization have transformed the material handling and logistics process into effortless tasks and thus have raised the demand for industrial truck to carry out these activities in an efficient manner reducing more labor work.

The growing interest of China in supply chain modernization and the rapidly expanding nature of the logistics sector are the leading factors in the growth of the industrial truck market. It shows a great need for effective material handling and automation solutions to support the extensive industrial and distribution networks. For instance, in September 2023, FAW TRUCKS trucks were distinguished by their outstanding performance. Furthermore, FAW TRUCKS have had their chassis designs carefully optimized to offer superior handling and suspension, guaranteeing safe driving in a variety of road conditions.

North America Market Analysis

North America is the most rapidly growing region in the industrial truck market, driven by increased investment by leading manufacturers to expand manufacturing facilities and surge efficient operations. For instance, in December 2022, Kion North America, a manufacturer of industrial truck announced an investment of USD 40 million to expand its operations in South Carolina. It aimed to offer a comprehensive range of conventional lift trucks and specialized offerings such as automation, telematics, and fleet management and expand its clientele.

The U.S. industrial truck market has a huge existing and emerging network of companies in various sectors. This is a huge number of clients who are keen on investing in industrial vehicles to improve their material handling processes. For instance, in December 2023, U.S. companies are expanding their electric vehicle fleets, and last year was monumental. An astounding 10,265 electric trucks hit the road in 2023, according to a new EDF analysis of class 2b-8 fleet announcements.

Companies in Canada are optimizing their supply chain for operations efficiency in transportation and logistics solutions. For instance, in September 2024, the biggest food distributor in the country, Sysco, has started utilizing electric tractor trucks, and Freightliner Cascadia trucks to its fleet based in its operations in Victoria. In that area, Sysco provides services to more than 1,500 businesses, including eateries, medical facilities, and educational establishments.