Industrial Truck Market Outlook:

Industrial Truck Market size was over USD 31.03 billion in 2025 and is anticipated to cross USD 47.27 billion by 2035, witnessing more than 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial truck is estimated at USD 32.23 billion.

Industrial truck play a significant role as they are designed to shift heavy loads within industrial complexes, such as warehouses, factories, and distribution centers. Industrial truck offer whole range of equipment, such as forklifts, pallet jacks, tow tractors, and platform trucks, with specifications depending on load-carrying capacity, terrain, and maneuverability requirements.

Their design integrates high-tech approaches aimed at optimizing the operational efficiency, safety, and durability of industrial truck. For instance, in April 2024, Daimler India Commercial Vehicles, declared to enter the Indian zero-emission truck market. It has begun a nationwide clinical trial for its eCanter light-duty electric truck, anticipated to go on sale within the next six to twelve months. Moreover, how they affect improving supply chain operations with reduced operational cost is key to evaluating the general impact on industrial productivity.

Key Industrial Truck Market Insights Summary:

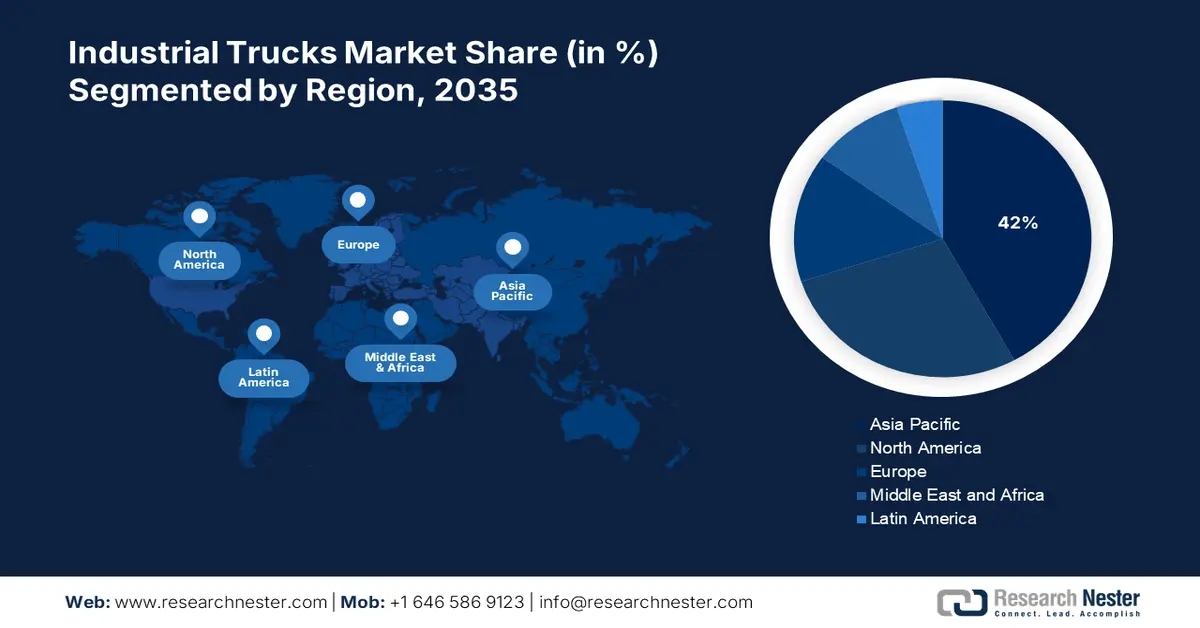

Regional Highlights:

- Asia Pacific holds a 42.00% share in the Industrial Truck Market, driven by local government support for smart manufacturing and investment in infrastructure, ensuring robust growth through 2035.

- North America’s industrial truck market is projected to experience rapid growth by 2035, driven by increased investment by manufacturers to expand facilities and improve operations.

Segment Insights:

- The ICE (Propulsion) segment of the Industrial Truck Market is expected to capture a 74% share by 2035, fueled by proven reliability, high load capacity, and operation in diverse environments.

Key Growth Trends:

- Automation and technology advancements

- Expansion in infrastructural structure

Major Challenges:

- Maintenance and downtime

- Labor shortages and skill gaps

- Key Players: Anhui Heli Co., Ltd., BYD Company Ltd., Jungheinrich AG, KION Group AG.

Global Industrial Truck Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.03 billion

- 2026 Market Size: USD 32.23 billion

- Projected Market Size: USD 47.27 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 14 August, 2025

Industrial Truck Market Growth Drivers and Challenges:

Growth Drivers

-

Automation and technology advancements: The innovation and revolution in the technological area enables material handling to reach great heights. In addition, automation helps lowering manual intervention and the ability to effectively manage their fleet while improving workflows for further optimization. For instance, in May 2024, automated forklift trucks at Ostendorf Kunststoffe GmbH facilitated the supply chain and carried out time-consuming, monotonous, and unsightly tasks outdoors. With the use of sensor technology known as SICK, it accomplished a safe and effective autonomous operation outdoors.

-

Expansion in infrastructural structure: The spacious warehouses that companies of e-commerce, retail, and logistics build up require a resilient fleet of industrial truck to move goods within warehouses effectively. For instance, in September 2024, Commercial Specialty Truck Holdings (CSTH) inaugurated the opening of a new, state-of-the-art manufacturing facility in Cynthiana. The USD 28 million project will help the company meet the growing demands of the industry while contributing to the state's expanding manufacturing sector. Thus, infrastructure development is one of the stimulators for industrial truck since they are crucial for scalable operations in industrial environments.

Challenges

-

Maintenance and downtime: Industrial truck with high content of mechanical and electronic features require regular maintenance to perform at their best, without failure. The equipment failure and other types of repairs result in downtime that affects the material handling processes by causing a loss in productivity as well as inefficiency of supply chains. Maintenance costs, which involve labor, parts replacement, and service contracts, can be quite high, especially when the fleets are large or specialized trucks. With increased complexity in features such as automation and telematics, the maintenance requires specific skills, which further adds to the cost and time of downtime.

-

Labor shortages and skill gaps: The industrial truck market has a very important challenge associated with labor shortages and gaps. The direct consequence of labor shortages and the skills gap is reflected in the material handling efficiency as well as the aspect of safety. The increasing demand to acquire skilled truck operating professionals arises in the highly technical trucks and through the critical shortages in competent personnel both within the logistical and manufacturing industries. Many firms experience a critical lack of experts who should manage sophisticated trucks with or without automation or even telematics in which sub-optimal equipment usage and raised accidents often characterize its use.

Industrial Truck Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 31.03 billion |

|

Forecast Year Market Size (2035) |

USD 47.27 billion |

|

Regional Scope |

|

Industrial Truck Market Segmentation:

Propulsion (ICE, Electric)

ICE segment is anticipated to account for industrial truck market share of more than 74% by the end of 2035. The segment’s growth is majorly driven by its proven reliability, high load-bearing capacity, and ability to operate in various environments, especially in outdoor and heavy-duty applications. While the pressure for sustainability and increasing adoption of electric alternatives is shifting this industry, ICE is still the go-to choice for most industrial options. For instance, in August 2021, Hangcha Group introduced the new XH series of 2.0t to 3.5t high-voltage electric forklift trucks with lithium-ion batteries. It offers excellent performance as an IC truck, including low cost of ownership, reduced noise level, efficiency, productivity, and zero emissions.

End user (Food & beverage, automotive, Retail & e-commerce, Construction & mining, Manufacturing, Pharmaceuticals, Logistics & warehousing, Others)

In the industrial truck market, manufacturing companies are dominating the end users segment. More automated and electric-powered trucks are being adopted inside manufacturing facilities as companies seek productivity improvements, lower labor costs, and less downtime. For instance, in March 2024, MAN leverages the proficiency of Plus to support the growth of driverless transportation between logistics hubs. This partnership aimed to expedite the deployment of autonomous trucks with the promise of mitigating driver shortages, reducing fatigue accidents, and optimizing transport procedures. The industrial truck market is a significant contributor to the application that supports an automated and efficient environment.

Our in-depth analysis of the industrial truck market includes the following segments:

|

Propulsion |

|

|

Operator Type |

|

|

End user |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Truck Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific industry is likely to account for largest revenue share of 42% by 2035. In addition, the local government's support for smart manufacturing, accompanied by enormous investment in infrastructure, has sped up the trend toward advanced industrial truck, including electric and autonomous vehicles. Labor shortages, coupled with a need to increase productivity, accelerate automation and efficiency.

In India, the pivotal growth drivers for the industrial truck market are the rapidly emerging manufacturing and e-commerce sectors. For instance, in October 2023, it was announced that Amazon partnered with Eicher e-trucks, as its transport service partner to streamline its e-commerce deliveries efficiently in India. Moreover, continuous urbanization and industrialization have transformed the material handling and logistics process into effortless tasks and thus have raised the demand for industrial truck to carry out these activities in an efficient manner reducing more labor work.

The growing interest of China in supply chain modernization and the rapidly expanding nature of the logistics sector are the leading factors in the growth of the industrial truck market. It shows a great need for effective material handling and automation solutions to support the extensive industrial and distribution networks. For instance, in September 2023, FAW TRUCKS trucks were distinguished by their outstanding performance. Furthermore, FAW TRUCKS have had their chassis designs carefully optimized to offer superior handling and suspension, guaranteeing safe driving in a variety of road conditions.

North America Market Analysis

North America is the most rapidly growing region in the industrial truck market, driven by increased investment by leading manufacturers to expand manufacturing facilities and surge efficient operations. For instance, in December 2022, Kion North America, a manufacturer of industrial truck announced an investment of USD 40 million to expand its operations in South Carolina. It aimed to offer a comprehensive range of conventional lift trucks and specialized offerings such as automation, telematics, and fleet management and expand its clientele.

The U.S. industrial truck market has a huge existing and emerging network of companies in various sectors. This is a huge number of clients who are keen on investing in industrial vehicles to improve their material handling processes. For instance, in December 2023, U.S. companies are expanding their electric vehicle fleets, and last year was monumental. An astounding 10,265 electric trucks hit the road in 2023, according to a new EDF analysis of class 2b-8 fleet announcements.

Companies in Canada are optimizing their supply chain for operations efficiency in transportation and logistics solutions. For instance, in September 2024, the biggest food distributor in the country, Sysco, has started utilizing electric tractor trucks, and Freightliner Cascadia trucks to its fleet based in its operations in Victoria. In that area, Sysco provides services to more than 1,500 businesses, including eateries, medical facilities, and educational establishments.

Key Industrial Truck Market Players:

- BYD Company Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Crown Equipment Corporation

- Anhui Heli Co., Ltd.

- Doosan Corporation Industrial Vehicle

- Hyster-Yale Materials Handling Inc.

- Jungheinrich AG

- KION Group AG

- Hyundai Heavy Industries Co., Ltd.

The competitive environment in the industrial truck market is largely driven by the growing demand for automation and diligent logistics solutions, which has made many businesses invest in the creation of electric and driverless industrial truck. The industrial truck market is also impacted by strategic alliances, mergers, and acquisitions that would increase operational capabilities and product offerings. For instance, in June 2023, GM announced an investment worth USD 632 million in its Fort Wayne facility to render funding for new tools, conveyors, and equipment to facilitate its Chevrolet Silverado 1500 and GMC Sierra 1500 trucks.

Here’s the list of some key players of industrial truck market:

Recent Developments

- In May 2024, Daimler Truck announced to build a USD 40 million engineering facility. It further announced investment of USD 3 million towards a training center at its Swan Island headquarters to support its electric truck manufacturing operations in Oregon.

- In June 2023, General Motors intended to invest over USD 1 billion in two plants in Michigan to produce heavy-duty trucks of the future. USD 788 million of the investment will go toward preparing the Flint Assembly plant to produce heavy-duty gas and diesel trucks. Furthermore, an additional USD 233 million to help with the vehicles' production.

- Report ID: 6668

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Truck Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.