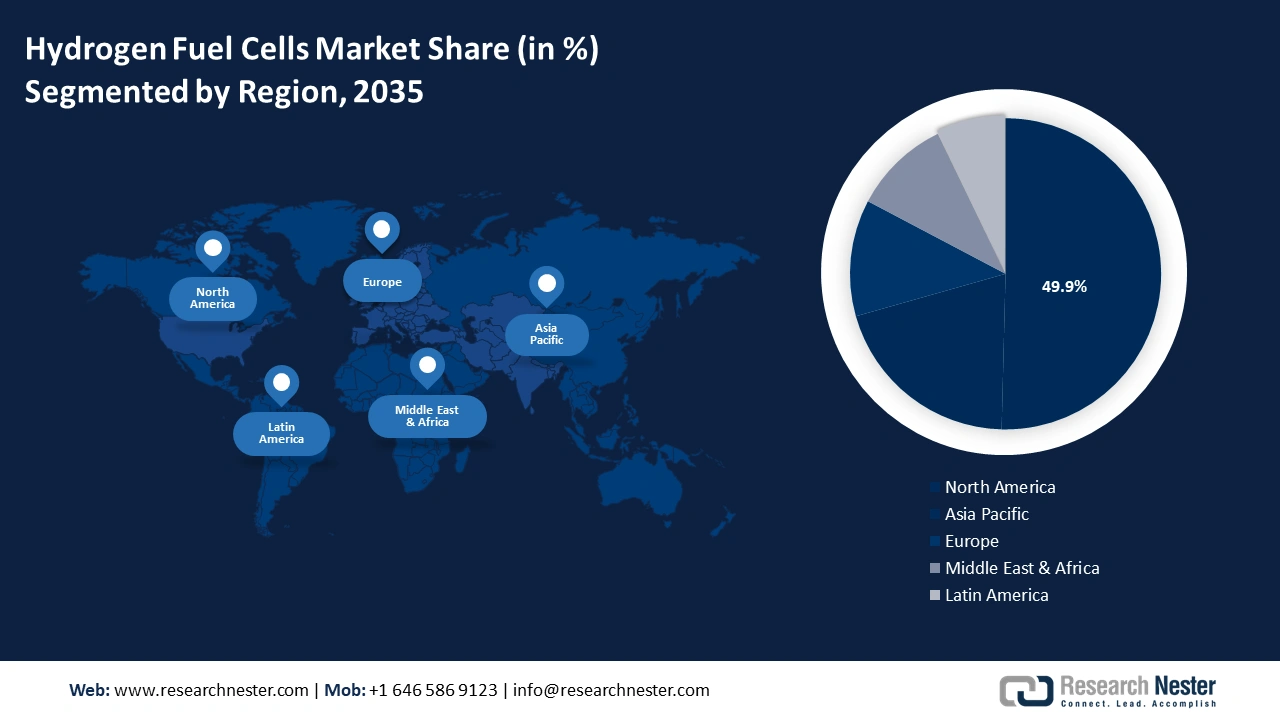

Hydrogen Fuel Cell Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 50% by 2035. The surge in Research & Development initiatives along with various programs and subsidies provided by the government is fueling the hydrogen fuel cell market revenue share. According to a report by the International Energy Agency 2023, the U.S. Department of Energy in March 2023 announced an R&D Programme for the adoption of advanced hydrogen technologies worth USD 750 million.

Fuel cell electric vehicles (FCEVs) are increasing in Canada due to the increasing number of original equipment manufacturers (OEMs). Ressources Naturelles Canada 2019 promoted the deployment of FCEVs while announcing the opening of a new public hydrogen station under Toyota’s plan to bring 50 FCEVs. Additionally, in a report from Natural Resources Canada 2021, according to Canada’s Zero-Emission Vehicles Awareness Initiative, the government provided an incentive of USD 5000 for accessibility and affordability for consumers to buy Zero-Emission Vehicles (ZEVs).

The U.S. government has announced an award for providing USD 750 million to about 52 hydrogen projects as a grant across 24 states to reduce the production cost of hydrogen. This initiative by the government will encourage manufacturers to plant a hydrogen fuel cell and will act as a growth factor for this segment.

Asia Pacific Market Insights

Asia Pacific will also encounter huge growth in the hydrogen fuel cell market share during the forecast period with a notable size. This region will account for the second position in this landscape owing to the increasing investments for shifting towards renewables and clean energy sources. According to the World Economic Forum in June 2023, SPIC Hydrogen Energy, in China announced the funding of USD 890 million to improve and develop HFC technology.

In Japan, the demand for hydrogen fuel cell revenue share is increasing led by the growing demand for clean and renewable electrical energy coupled with the growing concerns about the environment. International Energy Agency along with the European Patent Office 2023 published a report stating that by 2020, Japan was the country with the highest percentage of hydrogen-related patent applications of about 24%.

The sale of hydrogen-powered vehicles in China is expected to grow at a rate of 70%. For instance, in April 2024, Panasonic published a report estimating the launch of a 10kW pure HFC generator, H2 KIBOU in China, Australia, and Europe by October 2024.