Hydrogen Fuel Cell Market Outlook:

Hydrogen Fuel Cell Market size was over USD 5.54 billion in 2025 and is poised to exceed USD 32.63 billion by 2035, growing at over 19.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrogen fuel cell is estimated at USD 6.51 billion.

Growing demand for hydrogen fuel cell electric vehicles (HFCEVs) such as Toyota Mirai and Honda CR-V has led to a crucial increase in the hydrogen fuel cells (HFC) landscape. Automobiles such as buses, trains, and personal vehicles need the implementation of HFC in their application, as when driven, these vehicles emit no greenhouse gases. According to the International Energy Agency 2024, sales of EVs increased by 3.5 million in 2023, with an annual increase of 35% as compared to 2022. Moreover, around 2.5 million new EV registrations were held per week, this data is higher than the 2012 annual registration.

Furthermore, unmanned aerial vehicles (UAVs) such as Royal NLR use HFC technology to produce clean DC power in a robust, cost-effective, and lightweight package. For instance, Intelligent Energy launched IE-SOAR 2.4 UAV in July 2020, which offers boosted operational efficiency for applications such as cinematography, agriculture, LiDAR, military surveillance, and mapping for defense while providing power from 800W to 2.4kW.

Key Hydrogen Fuel Cell Market Insights Summary:

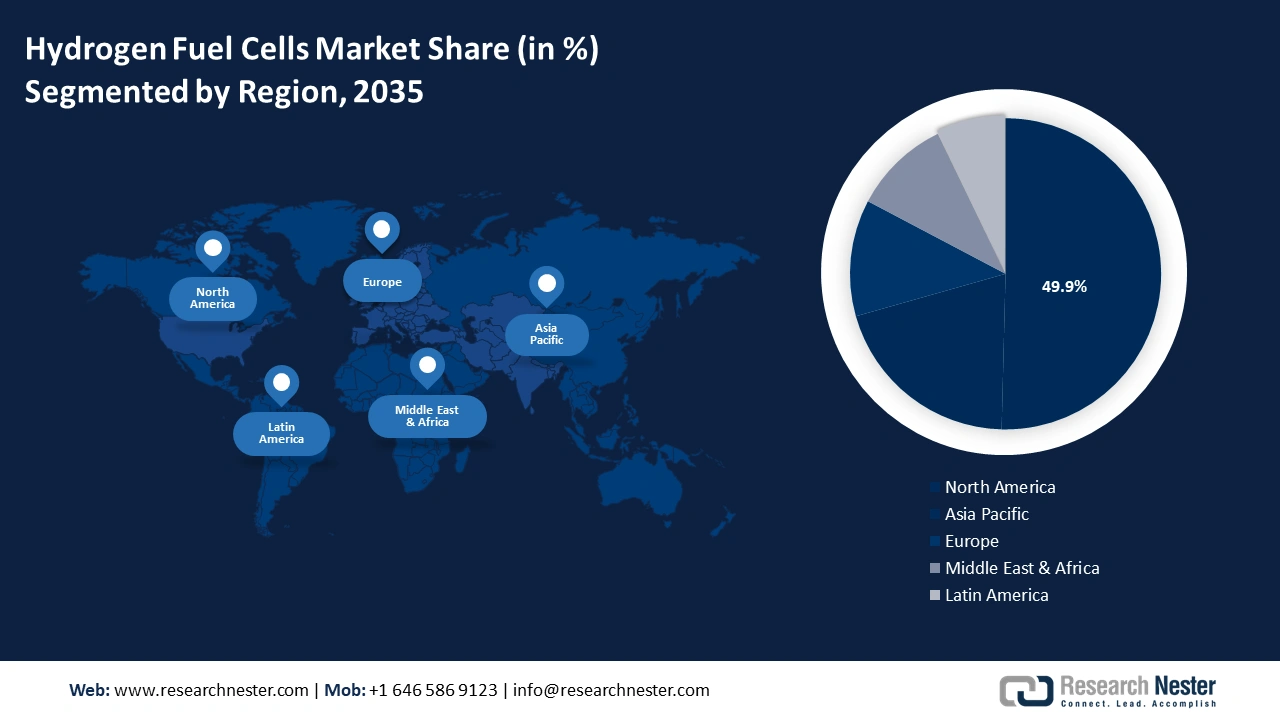

Regional Highlights:

- The North America hydrogen fuel cell market will secure over 50% share by 2035, driven by government R&D initiatives and subsidies for hydrogen technologies.

Segment Insights:

- Stationary segment in the hydrogen fuel cell market is forecasted to achieve 45.10% growth by the forecast year 2035, driven by the ability to use various fuels with high efficiency and clean power supply for multiple sectors.

- The proton exchange membrane fuel cells segment in the hydrogen fuel cell market is projected to experience lucrative growth till 2035, driven by versatility, high efficiency, and rapid start-up times suitable for various applications.

Key Growth Trends:

- Automobile switch to HFCs due to fuel price surge

- Demand for mobile and backup power generation

Major Challenges:

- High initial investment & production cost

- Volatile raw material

Key Players: Hyzon Motors Inc., Plug Power Inc., Volvo Group, Toyota Motor Corporation, Honda Motor Co. Ltd, MAN SE, Hyundai Motor Group, Audi AG, BMW Group, Daimler AG.

Global Hydrogen Fuel Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.54 billion

- 2026 Market Size: USD 6.51 billion

- Projected Market Size: USD 32.63 billion by 2035

- Growth Forecasts: 19.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Thailand

Last updated on : 18 September, 2025

Hydrogen Fuel Cell Market Growth Drivers and Challenges:

Growth Drivers

-

Automobile switch to HFCs due to fuel price surge: The increasing exploitation of fossil fuels releases several harmful gases into the environment which will necessities HFCs in the coming years. Moreover, the price of diesel and motor gasoline showed a tremendous gain of 55% and 40% respectively from January to June 2022 as stated by the United States Department of Transportation. Credited to this automotive are being influenced and switching towards the adoption and growing use of HFCs.

There is also a high demand for minimizing the dependability on oil and diesel globally while prioritizing the need for decarbonization. According to the International Energy Agency 2023, with a 1.8% or 261 Mt (metric tons) increase in emissions in 2022, the production of heat and electricity accounted for the largest growth in emissions. Meanwhile, emerging economies such as Asia led the global increase in emissions from coal-fired electricity and heat generation, which increased by 224 Mt or 2.1%. The gas engine share has increased, augmented by the automotive shift towards sustainability. - Demand for mobile and backup power generation: Uninterruptible power supply (UPS) systems are highly used in stationary and mobile fuel cells due to their continuous supply of power. Data centers and Hospitals are demanding UPS to meet their power demand. For instance, Microsoft published a report in July 2022, stating that their HFCs help the data centers to be operational 99.999% of the time. They also launched a sustainable datacenter region in Sweden in November 2021, which consists of 50% of renewable raw material.

Additionally, various mobile HFCs were developed by NASA, especially for providing electricity to shuttles and rockets in space. In January 2022, General Motors announced the launch of their HYDROTEC fuel cell technology, useful for locomotives, aerospace, and heavy-duty trucks. Furthermore, General Motors is also planning to expand its usage of power generation.

Challenges

-

High initial investment & production cost: Steam methane reforming is the most widely used method of producing hydrogen. It is relatively affordable, but it is not environmentally friendly. This has an impact on many stages of the hydrogen value chain, including infrastructure development and production. Furthermore, due to its advanced technology and energy requirements, green hydrogen production, which includes electrolysis powered by renewable energy is expensive but also more environmentally friendly.

-

Volatile raw material: A major issue that is anticipated to limit the expansion of the global hydrogen fuel cell market revenue is its high cost of production. For instance, the preferred electric power trains that do not emit greenhouse gases, particulate matter, or other dangerous pollutants like nitrogen oxides from their exhaust use HFC technology which is expensive compared to other fuels like diesel. Owing to this the landscape is slated to be constrained by their high production and raw material costs.

Hydrogen Fuel Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.4% |

|

Base Year Market Size (2025) |

USD 5.54 billion |

|

Forecast Year Market Size (2035) |

USD 32.63 billion |

|

Regional Scope |

|

Hydrogen Fuel Cell Market Segmentation:

Application Segment Analysis

The stationary segment is poised to capture a share of 45.1% in the coming years, impacting the hydrogen fuel cells market. Significant growth in the revenue share is anticipated as a result of various factors it offers such as the ability to use a variety of fuels such as coal, while providing high efficiency. In addition, stationary HFCs are also used in several sectors including industrial, commercial, and residential. They provide clean and reliable power which decreases emissions and generates efficient power. This makes them ideal for powering buildings, critical infrastructure, and telecommunication towers. According to a report by the Department of Energy, while fuel cell systems can readily produce electricity at efficiencies up to 60%, a conventional combustion-based power plant typically generates electricity at efficiencies of about 35%. Growth in this sector will boost the hydrogen fuel cell vehicle value in the near future.

Technology Segment Analysis

The proton exchange membrane fuel cells segment in the hydrogen fuel cell market is set to be a faster-growing with a lucrative size by the end of the forecast period. This growth is propelled by the versatility, high efficiency, and rapid start-up times it provides, making it an ideal option for applications in several sectors such as automotive, stationary power generation, along portable electronics. Moreover, according to the Multidisciplinary Digital Publishing Institute in 2023, polymer electrolyte membrane fuel cell (PEMFC) technology is a potential alternative for PEMFC while providing high efficiency by 50-70%. Their broad acceptance and market dominance are partly driven by their capacity to function at low temperatures and provide clean energy with low emissions.

Our in-depth analysis of the hydrogen fuel cell market includes the following segments:

|

Application |

|

|

Technology |

|

|

Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogen Fuel Cell Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 50% by 2035. The surge in Research & Development initiatives along with various programs and subsidies provided by the government is fueling the hydrogen fuel cell market revenue share. According to a report by the International Energy Agency 2023, the U.S. Department of Energy in March 2023 announced an R&D Programme for the adoption of advanced hydrogen technologies worth USD 750 million.

Fuel cell electric vehicles (FCEVs) are increasing in Canada due to the increasing number of original equipment manufacturers (OEMs). Ressources Naturelles Canada 2019 promoted the deployment of FCEVs while announcing the opening of a new public hydrogen station under Toyota’s plan to bring 50 FCEVs. Additionally, in a report from Natural Resources Canada 2021, according to Canada’s Zero-Emission Vehicles Awareness Initiative, the government provided an incentive of USD 5000 for accessibility and affordability for consumers to buy Zero-Emission Vehicles (ZEVs).

The U.S. government has announced an award for providing USD 750 million to about 52 hydrogen projects as a grant across 24 states to reduce the production cost of hydrogen. This initiative by the government will encourage manufacturers to plant a hydrogen fuel cell and will act as a growth factor for this segment.

Asia Pacific Market Insights

Asia Pacific will also encounter huge growth in the hydrogen fuel cell market share during the forecast period with a notable size. This region will account for the second position in this landscape owing to the increasing investments for shifting towards renewables and clean energy sources. According to the World Economic Forum in June 2023, SPIC Hydrogen Energy, in China announced the funding of USD 890 million to improve and develop HFC technology.

In Japan, the demand for hydrogen fuel cell revenue share is increasing led by the growing demand for clean and renewable electrical energy coupled with the growing concerns about the environment. International Energy Agency along with the European Patent Office 2023 published a report stating that by 2020, Japan was the country with the highest percentage of hydrogen-related patent applications of about 24%.

The sale of hydrogen-powered vehicles in China is expected to grow at a rate of 70%. For instance, in April 2024, Panasonic published a report estimating the launch of a 10kW pure HFC generator, H2 KIBOU in China, Australia, and Europe by October 2024.

Hydrogen Fuel Cell Market Players:

- Hyzon Motors Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Plug Power Inc.

- Volvo Group

- Toyota Motor Corporation

- Honda Motor Co. Ltd

- MAN SE

- Hyundai Motor Group

- Audi AG

- BMW Group

- Daimler AG

Hydrogen fuel cell market expansion is estimated to witness a lucrative share during the forecast period. The competitive environment is attributed to the tremendous spike in automobiles switching to HFCs as fuel prices are at a surge. More companies are entering this sector owing to the potential growth opportunities. In the forecast period, the hydrogen fuel cell market will observe emerging competitors and a growing demand for hydrogen fuel cells around the world.

Some of the key players include:

Recent Developments

- In January 2024, Hyzon Motors Inc. announced their business updates showing that the company had reached an operational and commercial benchmark for 2023. As of December 2023, Hyzon had fulfilled its annual target of 15-20 vehicles by deploying 19 vehicles to customers under commercial agreements.

- In July 2020, Plug Power Inc., a leading supplier of hydrogen cell engines and fueling systems that facilitate e-mobility, purchased United Hydrogen Group Inc. and Giner ELX. Plug Power's vertical integration strategy in the hydrogen market is aligned with these two acquisitions made by the company.

- Report ID: 6348

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogen Fuel Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.