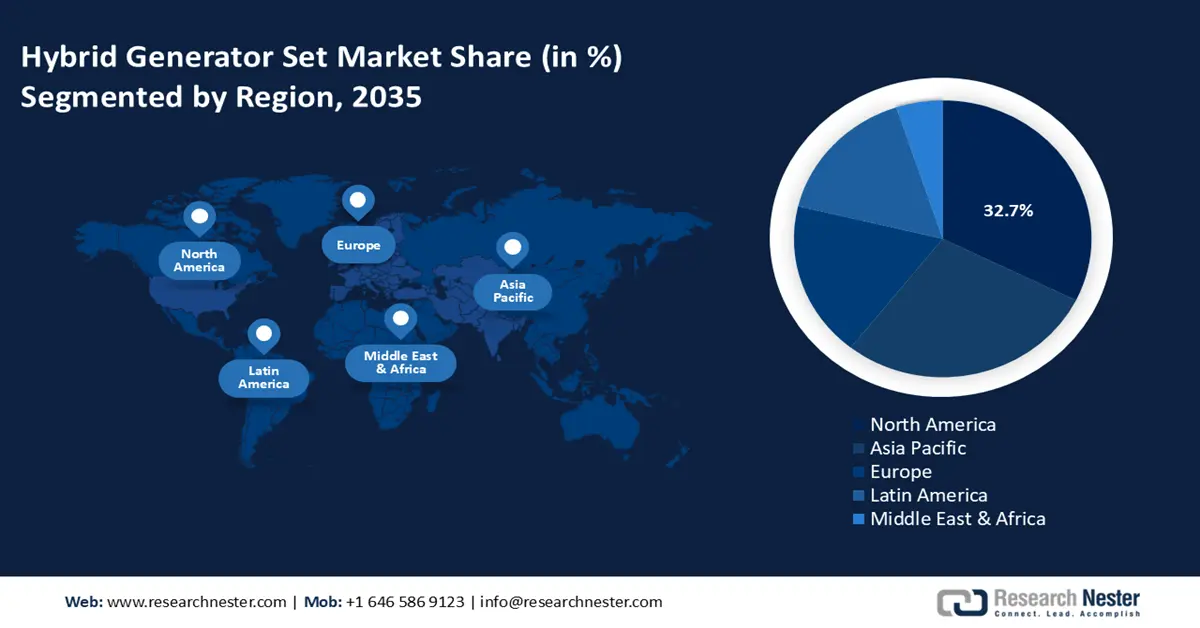

Hybrid Generator Set Market Regional Analysis:

North America Market Insights

North America in hybrid generator set market is expected to capture around 32.7% revenue share by the end of 2035. The market is growing due to the rapid population increase, unstable grid infrastructure, and the telecom industry's explosive growth. The electrical networks' incapacity will fuel the adoption of the product to handle an increased demand load and recent instances of major hurricane events. Additionally, the growing demand for uninterrupted power supply in enterprises and healthcare facilities will expand the range of applications for these generator sets.

The U.S. will grow significantly due to the increasing concerns of power outages, rapid developments in the industrial sector, and the surging demand for standby power in commercial and residential sectors. Also, the government is investing in upgrading the grid and infrastructure development projects. For instance, the U.S. Department of Energy (DOE) announced a USD 1.5 billion investment in four transmission projects that will increase grid resilience and dependability, alleviate expensive transmission congestion, and provide millions of Americans nationwide with access to reasonably priced energy. To find ways to preserve grid reliability, boost resilience, and cut costs while satisfying local, regional, interregional, and national interests and assisting with the evolving energy landscape, DOE also unveiled the final National Transmission Planning (NTP) Study, a collection of long-term planning tools and analyses that look at a wide range of possible future scenarios through 2050.

Moreover, power outages occur occasionally in every part of Canada; these are frequently brought on by severe weather conditions, such as strong winds and freezing rain, which harm equipment and power lines. Overloading the electric power system can occur during cold snaps and heat waves. To achieve net-zero emissions by 2050, Canada will need to upgrade its deteriorating transmission-line infrastructure. Over the past few years, provincial utility companies have increased transmission-line investments to meet rising electricity demands and facilitate the switch to renewable energy.

APAC Market Insights

Asia Pacific will hold a significant share of the hybrid generator set market by 2035. The market will be driven by population increase and urbanization as well as the growing requirement for a steady supply of electricity. Frequent power outages and rising investments in residential infrastructure expansion will also fuel company growth. Moreover, rising customer knowledge of power backup options and demands for increased security and comfort.

India's power grid is now among the world's biggest synchronous grids because of significant infrastructure development in the transmission sector and the use of cutting-edge technologies. Recognizing the need for robust and dependable energy systems in promoting economic stability, the government is likewise concentrating on modernizing aging power infrastructure. To provide continuous service during a period of climate volatility, these modernization projects usually entail replacing antiquated infrastructure with new, more effective transmission towers built to endure extreme weather and natural calamities.

Additionally, the Government of China is emphasizing the construction of infrastructure, such as constructing telecom towers and data centers and enhancing the transportation system; these actions are again driving industry expansion. According to the State Council, there are now 966 million 5G mobile users. Also, the nation's 5G network and commercialization have advanced quickly. Every city, town, and over 90% of villages are currently covered by its 5G network.

Moreover, factors such as an increase in power outages, better infrastructure development, and growth in the telecom sector are fueling the hybrid generator set market growth. The nation uses more generator sets due to the increased need for a steady power supply from homes, businesses, and industries.