Hybrid Generator Set Market Outlook:

Hybrid Generator Set Market size was valued at USD 4.72 billion in 2025 and is set to exceed USD 10.28 billion by 2035, registering over 8.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hybrid generator set is estimated at USD 5.06 billion.

The hybrid generator set market is expanding due to increasing diesel costs and a growing focus on lowering carbon footprint. According to the U.S. Department of Energy, the average retail diesel price in the U.S. in July 2022, reached USD 5.02/GGE up from USD 2.90/GGE in 2021.

The ability to combine renewable energy sources with conventional power generation in hybrid systems is a significant driver, especially in off-grid and remote locations. These generators are increasingly used in remote areas, such as mining sites, oil and gas fields, construction sites, and rural electrification projects, where grid access is limited. Thus, by addressing challenges like high fuel costs, maintenance issues, and the need for reliable power, hybrid generators are becoming the preferred solution for powering remote locations sustainability and cost-effectively.

Key Hybrid Generator Set Market Insights Summary:

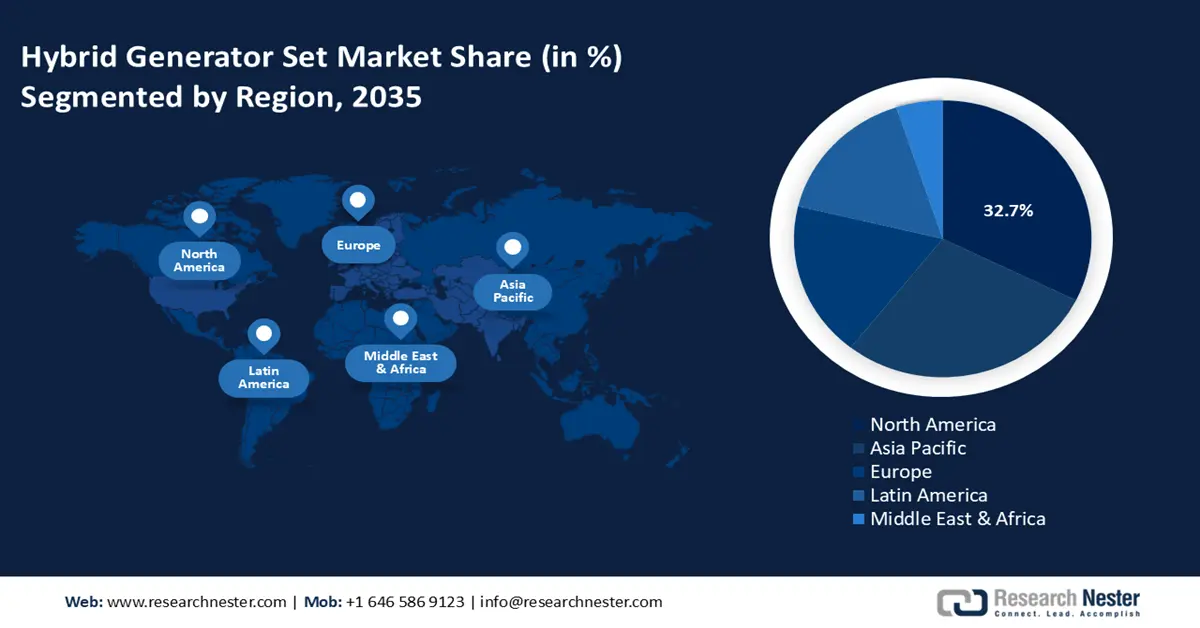

Regional Highlights:

- North America hybrid generator set market will account for 32.70% share by 2035, driven by the growing demand for uninterrupted power supply due to unstable grid infrastructure.

- Asia Pacific market will account for significant revenue share by 2035, fueled by urbanization and rising power outage frequencies.

Segment Insights:

- The 50 kw segment in the hybrid generator set market is projected to hold an 83.90% share by 2035, driven by increased demand for small-scale hybrid generators for residential and commercial use.

- The commercial industrial segment in the hybrid generator set market is projected to hold a notable revenue share by 2035, attributed to demand for efficient hybrid power in industrial sectors and advancements in generator tech.

Key Growth Trends:

- Surging demand for uninterrupted power supply

- Increasing need for reliable power solutions in the telecom sector

Major Challenges:

- Higher initial cost

- Complex maintenance & operation

Key Players: Cummins, Inc., Kirloskar Group, Briggs & Stratton Corporation, Kohler Co., Generac Holdings Inc., Powerica Limited, Sterling and Wilson Pvt. Ltd., Caterpillar Inc., Atlas Copco AB, Supernova Gensets.

Global Hybrid Generator Set Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.72 billion

- 2026 Market Size: USD 5.06 billion

- Projected Market Size: USD 10.28 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 18 September, 2025

Hybrid Generator Set Market Growth Drivers and Challenges:

Growth Drivers

-

Surging demand for uninterrupted power supply: The demand for continuous power supply is increasing due to the rapid shift towards urbanization and industrialization. The International Energy Agency (IEA) estimated that the electricity demand will increase steadfastly worldwide, averaging 3.4% annually until 2026. For any operation, a steady, dependable power source is essential. Hybrid generators use a fully automated battery system to provide power continuously and without interruption. The system may recognize a power outage on its own and immediately restore power to the connected residence, place of employment, or building location.

The widespread installation of these units provides a consistent and dependable power source for the real estate and car manufacturing sectors. Unexpected power outages due to weather-related or grid problems cause revenue losses in these industries, which accelerates the hybrid generator set market. Strong data center growth with genset’s growing applicability boosts industry dynamics by preventing system outages, starting problems, and loss of in-process data. - Increasing need for reliable power solutions in the telecom sector: One of the primary issues with telecommunications infrastructure is the availability of dependable electricity, particularly in rural regions or during catastrophes. The growing need to reduce the energy crisis and a rapid increase in operational expenses have raised the demand for hybrid generator sets in telecom applications. According to the World Bank, 685 million people lacked access to electricity in 2022, which is 10 million higher than in 2021.

Major telecommunication businesses are shifting towards hybrid power and regional governments are encouraging the adoption of these generator sets through favorable programs and incentives. In regions plagued by power instability, hybrid generators have become an essential component of telecom infrastructure, enabling operators such as MTN, Airtel, and Vodafone Idea to ensure smoother connectivity and minimize environmental impact. - Increased technological advances: New and improved hybrid generator sets with increased performance, dependability, and efficiency are constantly being developed by manufacturers. Hybrid generator sets are becoming more efficient and cost-effective due to the incorporation of cutting-edge technology such as digital controls, remote monitoring, and artificial intelligence. For instance, the integration of diesel generators (DG) with photovoltaic (PV) system technology, known as DG PV Integration, has grown in importance as the demand for dependable and sustainable energy sources increases. These developments are increasing end users' interest in hybrid generator sets, propelling hybrid generator set market expansion.

Challenges

-

Higher initial cost: The initial cost of hybrid generators can be considerably raised by integrating renewable energy sources like solar panels and wind turbines with sophisticated energy management systems. Adoption may be hampered due to higher costs, especially for small and medium-sized businesses with limited budgets.

- Complex maintenance & operation: Hybrid generator systems require highly skilled workers to operate and maintain since they are intricate systems with numerous, sometimes extremely sophisticated, components. A complicated system like this requires more maintenance than a single system, which raises expenses and increases the likelihood of downtime for service.

Hybrid Generator Set Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 4.72 billion |

|

Forecast Year Market Size (2035) |

USD 10.28 billion |

|

Regional Scope |

|

Hybrid Generator Set Market Segmentation:

Power Output Segment Analysis

50 kw segment is poised to account for hybrid generator set market share of more than 83.9% by the end of 2035. The segment is expanding due to a growing need for small-scale hybrid generator sets for commercial and residential applications. Moreover, power outages caused by aging grid infrastructure and more frequent natural disasters will support segment expansion. For instance, the U.S. (USD 86.5 billion, or 27.9%) and China (USD 78.9 billion, or 25.4%) accounted for the majority of grid investment in 2023, with Germany, Canada, and India following closely behind. Also, a paradigm shift toward adopting less expensive and powerful power solutions due to various companies’ operational acceptability and economic viability will drive growth.

Application Segment Analysis

The commercial industrial segment in hybrid generator set market is estimated to garner a notable share in the forecast period. The segment growth can be attributed to the growing demand for reliable and efficient power supply in commercial and industrial facilities. Hybrid diesel generators give industrial users the best of both energy sources by combining the dependability of diesel generators with the financial savings of solar electricity. Furthermore, growing demand for a continuous power supply and ongoing advancements in hybrid generator set technology, such as improved engine efficiency, sophisticated control systems, and real-time monitoring capabilities, will drive its growth in the commercial industrial sector.

Our in-depth analysis of the hybrid generator set market includes the following segments:

|

Power Output |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hybrid Generator Set Market Regional Analysis:

North America Market Insights

North America in hybrid generator set market is expected to capture around 32.7% revenue share by the end of 2035. The market is growing due to the rapid population increase, unstable grid infrastructure, and the telecom industry's explosive growth. The electrical networks' incapacity will fuel the adoption of the product to handle an increased demand load and recent instances of major hurricane events. Additionally, the growing demand for uninterrupted power supply in enterprises and healthcare facilities will expand the range of applications for these generator sets.

The U.S. will grow significantly due to the increasing concerns of power outages, rapid developments in the industrial sector, and the surging demand for standby power in commercial and residential sectors. Also, the government is investing in upgrading the grid and infrastructure development projects. For instance, the U.S. Department of Energy (DOE) announced a USD 1.5 billion investment in four transmission projects that will increase grid resilience and dependability, alleviate expensive transmission congestion, and provide millions of Americans nationwide with access to reasonably priced energy. To find ways to preserve grid reliability, boost resilience, and cut costs while satisfying local, regional, interregional, and national interests and assisting with the evolving energy landscape, DOE also unveiled the final National Transmission Planning (NTP) Study, a collection of long-term planning tools and analyses that look at a wide range of possible future scenarios through 2050.

Moreover, power outages occur occasionally in every part of Canada; these are frequently brought on by severe weather conditions, such as strong winds and freezing rain, which harm equipment and power lines. Overloading the electric power system can occur during cold snaps and heat waves. To achieve net-zero emissions by 2050, Canada will need to upgrade its deteriorating transmission-line infrastructure. Over the past few years, provincial utility companies have increased transmission-line investments to meet rising electricity demands and facilitate the switch to renewable energy.

APAC Market Insights

Asia Pacific will hold a significant share of the hybrid generator set market by 2035. The market will be driven by population increase and urbanization as well as the growing requirement for a steady supply of electricity. Frequent power outages and rising investments in residential infrastructure expansion will also fuel company growth. Moreover, rising customer knowledge of power backup options and demands for increased security and comfort.

India's power grid is now among the world's biggest synchronous grids because of significant infrastructure development in the transmission sector and the use of cutting-edge technologies. Recognizing the need for robust and dependable energy systems in promoting economic stability, the government is likewise concentrating on modernizing aging power infrastructure. To provide continuous service during a period of climate volatility, these modernization projects usually entail replacing antiquated infrastructure with new, more effective transmission towers built to endure extreme weather and natural calamities.

Additionally, the Government of China is emphasizing the construction of infrastructure, such as constructing telecom towers and data centers and enhancing the transportation system; these actions are again driving industry expansion. According to the State Council, there are now 966 million 5G mobile users. Also, the nation's 5G network and commercialization have advanced quickly. Every city, town, and over 90% of villages are currently covered by its 5G network.

Moreover, factors such as an increase in power outages, better infrastructure development, and growth in the telecom sector are fueling the hybrid generator set market growth. The nation uses more generator sets due to the increased need for a steady power supply from homes, businesses, and industries.

Hybrid Generator Set Market Players:

- Cummins, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kirloskar Group

- Briggs & Stratton Corporation

- Kohler Co.

- Generac Holdings Inc.

- Powerica Limited

- Sterling and Wilson Pvt. Ltd.

- Caterpillar Inc.

- Atlas Copco AB

- Supernova Gensets

To take the lead, major players in the hybrid generator set market are constantly producing cutting-edge products and growing their businesses throughout different locations. To improve their position in the industry, major companies are implementing several tactics, including partnerships, acquisitions, mergers, and collaborations. In the upcoming years, it is anticipated that the competitive environment will continue to be extremely fierce.

Recent Developments

- In February 2024, Allmand Bros, Inc. debuted its new Hybrid LT-Series, a concept hybrid light tower, at The ARA Show in New Orleans, LA. At booth #6139, the internationally respected designer and high-performance portable job site equipment manufacturer will demonstrate their Maxi-Power generator series, which includes the new compact MP8XR.

- In December 2023, Cummins Inc. introduced C1760D5, C1875D5, and C2000D5B generator models are the result of nearly 60 years of innovation, delivering even greater power for a broader range of applications. The three new models will provide more power options by joining the two existing products built on the same engine architecture.

- Report ID: 6862

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hybrid Generator Set Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.