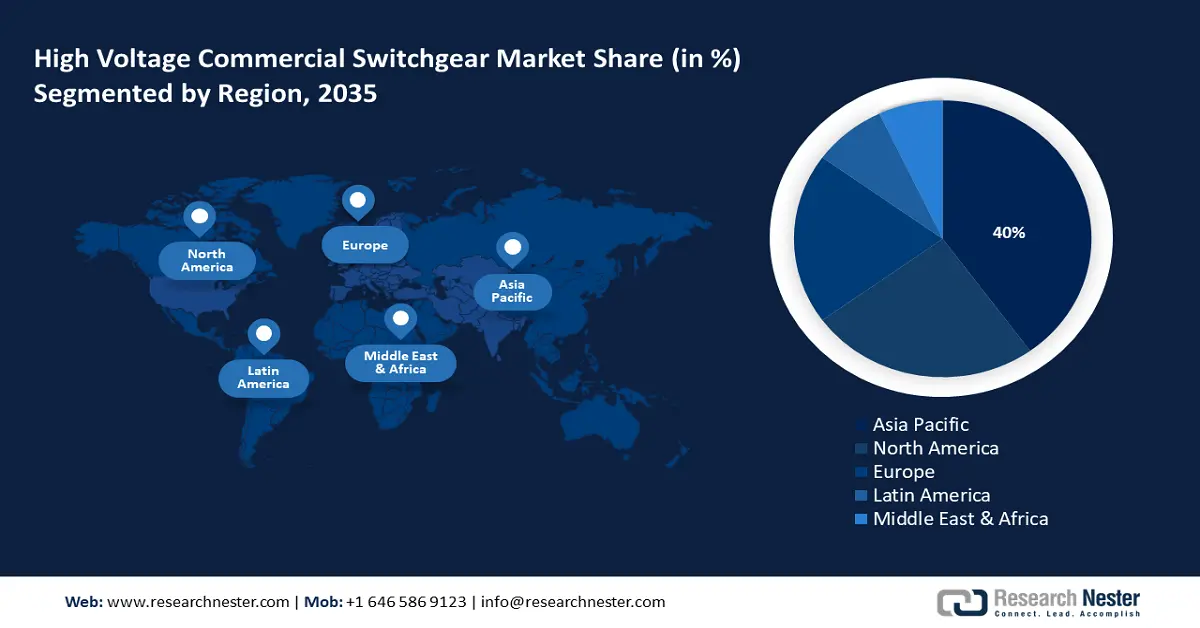

High Voltage Commercial Switchgear Market Regional Analysis:

APAC Market Forecast

Asia Pacific industry is estimated to account for largest revenue share of 40% by 2035. APAC’s dominant share is attributed to rising investments in grid modernization and rapid urbanization in APAC countries. China, India, Japan, and South Korea are leading the market growth in APAC. China accounts for the largest high voltage commercial switchgear market share in APAC. The dominant profitable share of China is attributed to its status as a global leader in switchgear circuit exports and large-scale investment in renewable energy. In June 2024, IEAA reported China registered the largest investment in clean energy reaching an estimated USD 675 billion, bolstered by demands across the solar, lithium batteries, and electric vehicles market. These trends bode well for the high voltage commercial switchgear sector in the country as it is positioned to witness large-scale investments in the energy sector and integration of clean energy in grids. Additionally, China aims to create a national power system by 2030 that will merge six regional grids into a unified electricity market. Large-scale projects as such are set to bolster the demands for high voltage switchgears fueling the market’s growth.

In India, the high voltage commercial switchgear market is poised for rapid growth and is projected to increase its revenue share by the end of the forecast period. The market’s growth in India is attributed to push for grid modernization projects and investments in microgrids to strengthen energy solutions. For instance, the Asian Infrastructure Development Bank has an ongoing project of USD 135.0 million in funding to modernize the electricity grid of West Bengal. Large-scale projects to modernize grids and integrate smart grid solutions benefit the market. Companies around the world are leveraging the opportunities in India. For instance, in February 2023, ABB announced the inauguration of its new factory that will double its Gas Insulated Switchgear (GIS) capacity.

North America Market Analysis

North America is projected to register the fastest growth in the global high voltage commercial switchgear market and increase its revenue share by the end of the forecast period. The market’s growth in North America is attributed to rising demands to integrate green energy into grids and modernization of aging power infrastructure. Additionally, the increasing adoption of Electric Vehicles (EV) boosts demands for high voltage switchgear for their use in charging infrastructure. The U.S. and Canada lead the market in North America. Key market players are investing in the region to increase their market share. For instance, in September 2024, Hitachi Energy announced additional investments of over USD 155 million to boost manufacturing capacity in North America.

The U.S. accounts for the largest share in North America. The government bodies such as the Department of Energy have pushed for large-scale grid modernization projects that are set to boost the demand for high voltage switchgear. For instance, in October 2024, the National Renewable Energy Laboratory (NREL) and U.S. Department of Energy’s (DOE) Grid Deployment office reported a multiyear study that will help developers to modernize the U.S. power grid to support the future of transmission needs and provide larger benefits to customers. Additionally, increasing installation of microgrids and increase in charging points for electric vehicles increase market opportunities for the high voltage commercial switchgear market. For instance, the U.S. Department of Transportation estimated around 192000 publicly available charging points across the country in August 2024, and the number is expected to increase.

The market in Canada is positioned to increase its revenue share during the forecast period. The market benefits from the abundance of natural resources in the country. For instance, the Government of Canada reported that renewable energy sources accounted for 16.9% of the primary energy supply in the country. This positions Canada to integrate renewable power sources in grids in modernization efforts that are poised to benefit the robust growth of the market. Companies are leveraging the opportunities in the region by investing greater funds in manufacturing high volage and medium voltage switchgear to increase their revenue share.