High Voltage Commercial Switchgear Market Outlook:

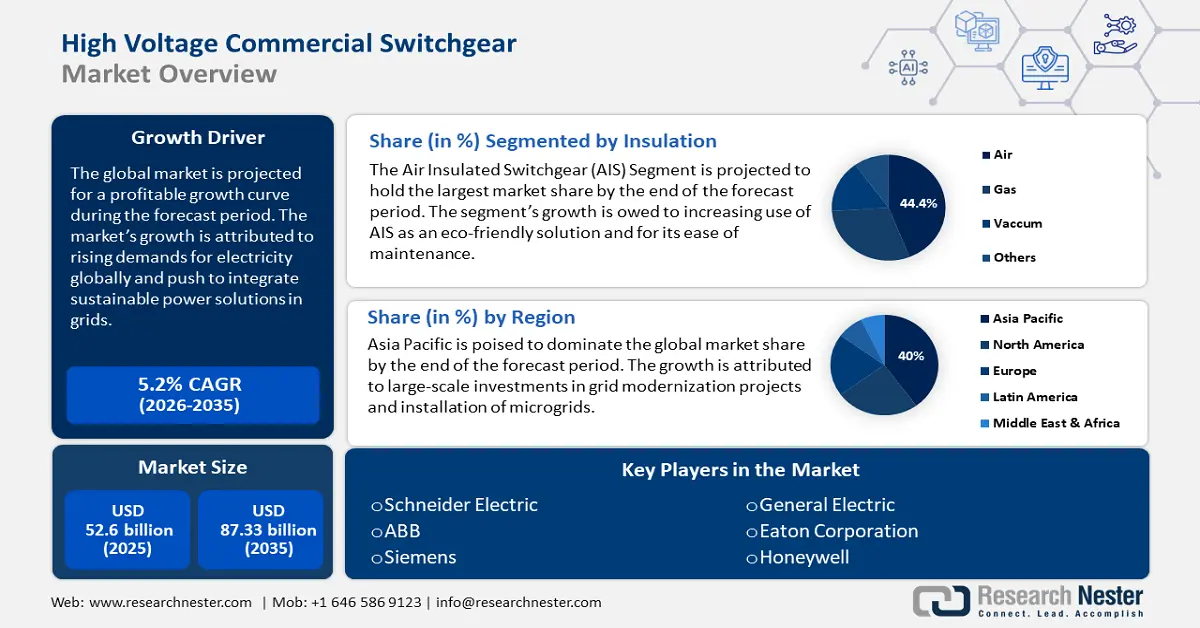

High Voltage Commercial Switchgear Market size was valued at USD 52.6 billion in 2025 and is expected to reach USD 87.33 billion by 2035, registering around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high voltage commercial switchgear is evaluated at USD 55.06 billion.

The market’s robust growth is attributed to rising demands for electricity globally. For instance, the International Energy Agency (IEA) reported the global electricity demand to have grown by 2.2% and the global electricity demand to rise by 3.4% annually till 2026. The rising demands benefit the market’s growth as high voltage switchgears are crucial in managing and protecting electrical networks.

The rapid industrialization and global push for renewable power sources have boosted the market’s profit share. Countries around the globe are investing in modernizing their electrical grids which creates a steady demand for high-performance switchgear. Global organizations such as the United Nations Development Program (UNDP) and national governments are pushing for remote microgrids to offer reliable power solutions to rural communities and successful installation of microgrids requires high voltage switchgear. Additionally, defense bases in remote areas and industrial sector require reliable power solutions which boosts the demand for high voltage commercial switchgear, contributing to the revenue surge of the market.

The high voltage commercial switchgear market is poised to provide major opportunities in various segments, especially in the commercial and industrial sectors. In the commercial sector, the rapid development of smart cities globally opens opportunities for key market players to provide automated systems that enhance energy efficiency and grid management. The growing focus on sustainable solutions is prompting manufacturers to seek smart high voltage switchgears. For instance, in August 2024, Hitachi Energy launched the high voltage SF6 free switchgear called EconiQ 550 kV circuit breaker that is poised to replace SF6 switchgear around the world owing to its ability to eliminate carbon equivalent of more than 160 fully packed jumbo jets. Innovations as such are expected to herald the future of the global market with manufacturers seeking to reinvent and usher new innovative high voltage switchgears to meet the shifting demands globally.

Key High Voltage Commercial Switchgear Market Insights Summary:

Regional Highlights:

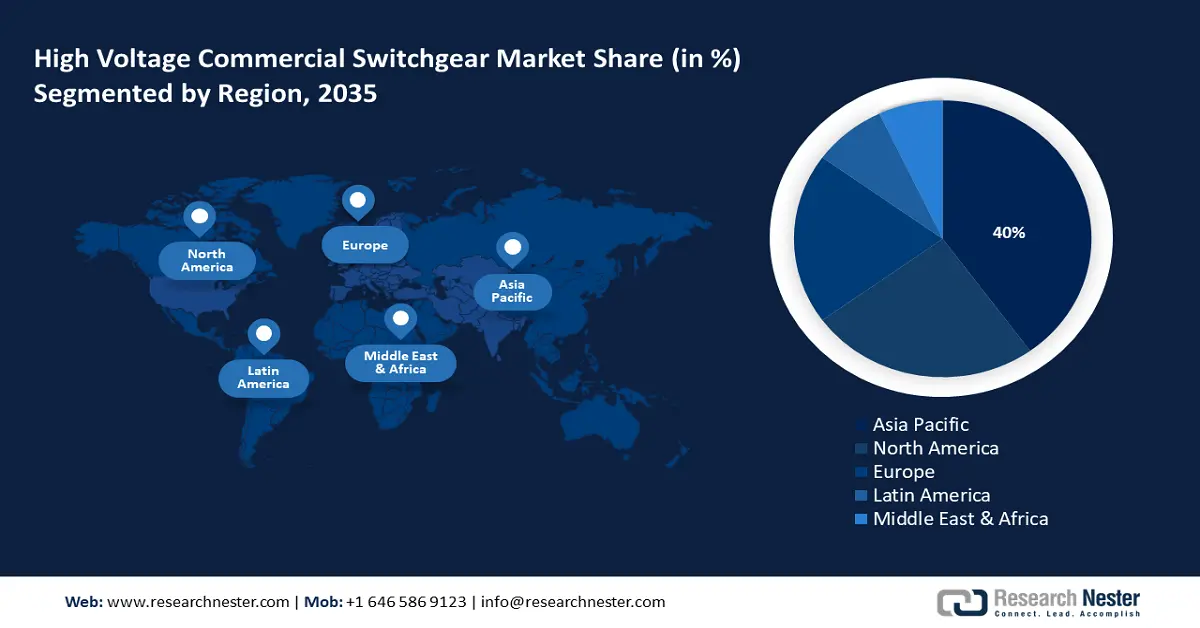

- Asia Pacific leads the High Voltage Commercial Switchgear Market with a 40% share, propelled by rising investments in grid modernization and rapid urbanization across APAC countries, ensuring strong growth through 2026–2035.

- North America’s high voltage commercial switchgear market is expected to see rapid growth by 2035, driven by increasing demand for green energy integration and the modernization of aging power infrastructure.

Segment Insights:

- The Alternating Current (AC) segment is expected to experience rapid growth from 2026 to 2035, propelled by the modernization of power grids and rising rural electrification projects.

- The Air segment is expected to capture 44.4% market share by 2035, driven by the cost-effectiveness and eco-friendliness of air-insulated switchgear.

Key Growth Trends:

- Rising shift to renewable energy power sources

- Aging power infrastructure and investments in grid modernization

Major Challenges:

- Volatility of raw materials & supply chain disruptions

- Regulatory hurdles and environmental concerns

- Key Players: Schneider Electric, ABB, Eaton Corporation, Hitachi Energy, Siemens, Havells India Ltd., Orecco, General Electric, Honeywell.

Global High Voltage Commercial Switchgear Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 52.6 billion

- 2026 Market Size: USD 55.06 billion

- Projected Market Size: USD 87.33 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

High Voltage Commercial Switchgear Market Growth Drivers and Challenges:

Growth Drivers

- Rising shift to renewable energy power sources: The global push towards adopting clean energy sources to mitigate the rate of climate change and achieve net zero goals by 2050 opens new opportunities for the global market as demand for high voltage commercial switchgear rises in solar PVs and wind turbines. For instance, the International Energy Agency (IEA) estimated USD 2 trillion will be invested in clean energy globally in 2024. The IEA’s report estimates clean energy investments to be currently higher than the global spending on gas, coal, and oil. The industrial expansion of renewable energy power sources is poised to continue boosting demands for high voltage switchgear to ensure maintenance of grid stability.

Additionally, growing fiscal expenditure on infrastructure development provides market players with increased opportunities. For instance, in June 2024, the World Bank announced an investment of USD 35.0 million to enable solar power generation and increase access to electricity in Guinea-Bissau. - Aging power infrastructure and investments in grid modernization: The power infrastructure in many nations is aging and requires modernization to meet the growing demands for electricity. Government increases in fiscal expenditure to upgrade power grids provide immense opportunities to manufacturers of high voltage switchgear. The U.S. Department of Energy has released statements on its commitment to grid modernization by adopting smart grids. For instance, in May 2024, the U.S. government released a joint grid modernization initiative with 21 states to upgrade 100,000 miles of existing transmission lines over the next five years.

Large-scale projects such as the one by the U.S. raises demands for advanced connected switchgear. Additionally, reliable and efficient energy supports consumer price stability and reduces cost burden. - Increasing investments in rural electrifications: The increase in investments in rural electrification projects increases the market scope for the high voltage commercial switchgear market. An increase in electrification projects boosts demands for high voltage switchgears. Governments across the world are actively seeking to provide reliable energy solutions to remote areas through the installation of remote microgrids, which require switchgear solutions. For instance, in September 2024, the United States Department of Agriculture (USDA) announced a USD 7.3 billion investment in rural clean energy, that is set to increase demands for high voltage switchgears.

Emerging economies are set to provide market opportunities with growing investments in rural electrification supported by the national government and international organizations. For instance, in May 2024, the European Union and Nepal announced the 28 km extension of Chilime-Trishuli 220 kV double circuit electricity transmission line and sub-stations to support electrification in rural areas of Nepal.

Challenges

- Volatility of raw materials & supply chain disruptions: The global market is susceptible to disruptions in supply chains for raw materials such as steel, copper, and aluminum. Increase in import/export tariffs and fluctuations in producer prices can adversely affect production and increase manufacturing costs. Additionally, geopolitical issues and trade restrictions in regions can stymie the market’s growth.

- Regulatory hurdles and environmental concerns: Sulfur hexafluoride (SF6), a potent greenhouse gas, is widely used in switchgear. The use of SF6 is heavily scrutinized by environmental and regulatory bodies. For instance, the European Commission proposed the ban of SF6 from most new electrical equipment by 2026. This can slow the market’s growth as manufacturers are under pressure to seek alternatives to SF6, which can increase costs and require additional funding for research and development.

High Voltage Commercial Switchgear Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 52.6 billion |

|

Forecast Year Market Size (2035) |

USD 87.33 billion |

|

Regional Scope |

|

High Voltage Commercial Switchgear Market Segmentation:

Insulation (Air, Gas, Vacuum, Others)

The air segment based on insulation is poised to dominate the high voltage commercial switchgear market with a 44.4% revenue share by the end of 2035. The segment’s dominant market share is attributed to the cost-effectiveness of Air Insulated Switchgear (AIS) and ease of maintenance. The use of air as a primary insulation medium makes AIS an eco-friendly alternative to the use of SF6. This positions the segment to tap into the growing push for sustainable energy trends. For instance, in December 2023, Linxon announced that it was awarded another turnkey substation contract by Svenska Kraftnät (SvK) to deliver new 400 kV air insulated switchgear (AIS) substation.

The gas insulated switchgear (GIS) segment is projected to increase its revenue share by the end of the forecast period. The segment is widely used in many emerging economies owing to its reliability and ability to handle high loads in limited space. SF6 is the primary insulation medium of GIS and offers superior performance in electric insulation. Additionally, new innovations to replace SF6 with green gas is poised to boost demands for GIS. For instance, in August 2024, GE Vernova announced that it will manufacture, deliver, and commission the world’s first SF free gas insulated substation (GIS) in France.

Current (AC, DC)

The alternating current (AC) segment in the high voltage commercial switchgear market is projected to register a rapid growth during the forecast period owing to the segment cementing itself as a standard choice to manage high voltage power flow. The segment benefits from modernization efforts for power grids in emerging economies. Additionally, growing investments in rural electrification projects boosts the market’s growth as demands for high voltage AC switchgear increases. For instance, in September 2024, Honeywell announced its BESS technologies are being integrated into the microgrid of the remote Kavaratti islands of Lakshadweep.

Our in-depth analysis of the high voltage commercial switchgear market includes the following segments

|

Insulation |

|

|

Current |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Voltage Commercial Switchgear Market Regional Analysis:

APAC Market Forecast

Asia Pacific industry is estimated to account for largest revenue share of 40% by 2035. APAC’s dominant share is attributed to rising investments in grid modernization and rapid urbanization in APAC countries. China, India, Japan, and South Korea are leading the market growth in APAC. China accounts for the largest high voltage commercial switchgear market share in APAC. The dominant profitable share of China is attributed to its status as a global leader in switchgear circuit exports and large-scale investment in renewable energy. In June 2024, IEAA reported China registered the largest investment in clean energy reaching an estimated USD 675 billion, bolstered by demands across the solar, lithium batteries, and electric vehicles market. These trends bode well for the high voltage commercial switchgear sector in the country as it is positioned to witness large-scale investments in the energy sector and integration of clean energy in grids. Additionally, China aims to create a national power system by 2030 that will merge six regional grids into a unified electricity market. Large-scale projects as such are set to bolster the demands for high voltage switchgears fueling the market’s growth.

In India, the high voltage commercial switchgear market is poised for rapid growth and is projected to increase its revenue share by the end of the forecast period. The market’s growth in India is attributed to push for grid modernization projects and investments in microgrids to strengthen energy solutions. For instance, the Asian Infrastructure Development Bank has an ongoing project of USD 135.0 million in funding to modernize the electricity grid of West Bengal. Large-scale projects to modernize grids and integrate smart grid solutions benefit the market. Companies around the world are leveraging the opportunities in India. For instance, in February 2023, ABB announced the inauguration of its new factory that will double its Gas Insulated Switchgear (GIS) capacity.

North America Market Analysis

North America is projected to register the fastest growth in the global high voltage commercial switchgear market and increase its revenue share by the end of the forecast period. The market’s growth in North America is attributed to rising demands to integrate green energy into grids and modernization of aging power infrastructure. Additionally, the increasing adoption of Electric Vehicles (EV) boosts demands for high voltage switchgear for their use in charging infrastructure. The U.S. and Canada lead the market in North America. Key market players are investing in the region to increase their market share. For instance, in September 2024, Hitachi Energy announced additional investments of over USD 155 million to boost manufacturing capacity in North America.

The U.S. accounts for the largest share in North America. The government bodies such as the Department of Energy have pushed for large-scale grid modernization projects that are set to boost the demand for high voltage switchgear. For instance, in October 2024, the National Renewable Energy Laboratory (NREL) and U.S. Department of Energy’s (DOE) Grid Deployment office reported a multiyear study that will help developers to modernize the U.S. power grid to support the future of transmission needs and provide larger benefits to customers. Additionally, increasing installation of microgrids and increase in charging points for electric vehicles increase market opportunities for the high voltage commercial switchgear market. For instance, the U.S. Department of Transportation estimated around 192000 publicly available charging points across the country in August 2024, and the number is expected to increase.

The market in Canada is positioned to increase its revenue share during the forecast period. The market benefits from the abundance of natural resources in the country. For instance, the Government of Canada reported that renewable energy sources accounted for 16.9% of the primary energy supply in the country. This positions Canada to integrate renewable power sources in grids in modernization efforts that are poised to benefit the robust growth of the market. Companies are leveraging the opportunities in the region by investing greater funds in manufacturing high volage and medium voltage switchgear to increase their revenue share.

Key High Voltage Commercial Switchgear Market Players:

- Schneider Electric

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB

- Eaton Corporation

- Hitachi Energy

- Siemens

- Havells India Ltd.

- Orecco

- General Electric

- Honeywell

The global high voltage commercial switchgear market is positioned to register a profitable growth curve during the forecast period. The market is characterized by the presence of global and local players vying to increase their revenue share. Key players in the market are investing in switchgears that are sustainable to provide robust solutions in commercial and industrial sectors.

Here are some key players in the market:

Recent Developments

- In July 2024, Hitachi Energy announced plans to invest USD 250.0 million in India in the next 5 years to expand its capacity, portfolio, and talent base. The investment is geared towards the country’s goal of achieving net zero transformation.

- In April 2024, World Bank announced a partnership with the African Development Bank to provide electricity access to 300 million people in Africa. The World Bank aims to connect 250 million people to electricity through renewable energy systems and distribution grid while the African Development Bank aims to provide electricity access to 50 million people.

- Report ID: 6555

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Voltage Commercial Switchgear Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.