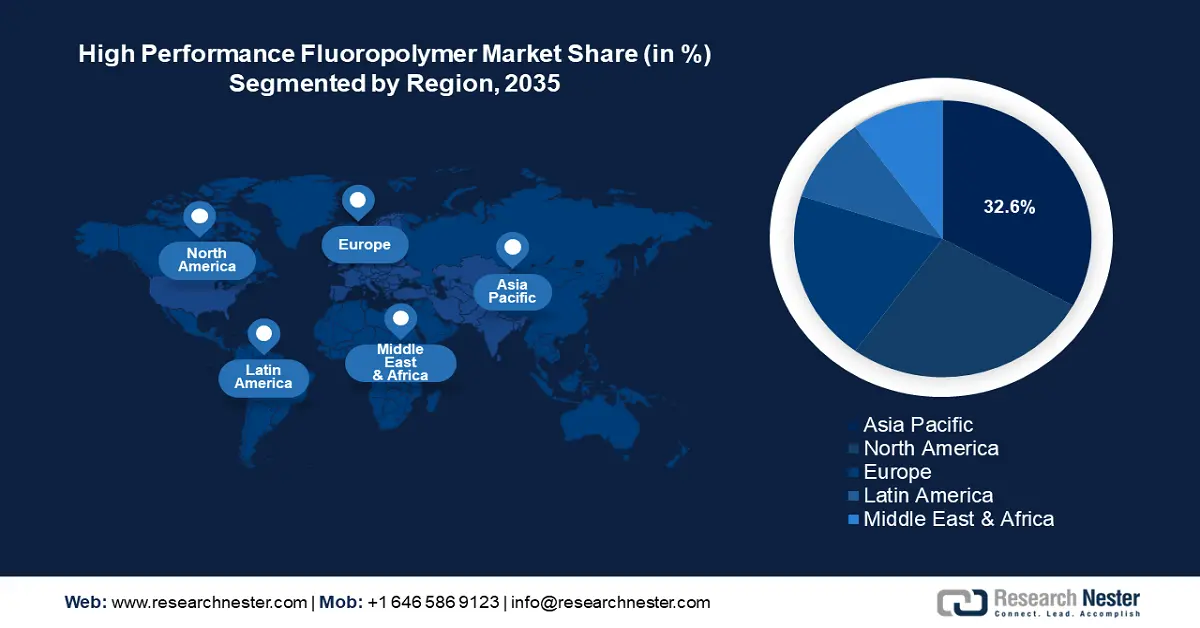

High Performance Fluoropolymer Market Regional Analysis:

APAC Market Forecast

Asia Pacific industry is poised to hold largest revenue share of 32.6% by 2035, owing to the rapidly expanding industrial base in the region across various sectors. Globally, Taiwan, South Korea, China, and Japan are leading manufacturers of semiconductors while India is rapidly increasing its share leading to high demand for HPF. The growing construction activities across the region due to rapid urbanization are increasing adoption rates of fluoropolymer coatings owing to increased durability. Additionally, investments and expansion in the healthcare sector are poised to boost demands for chemically inert materials benefiting the HPF industry.

China is projected to register a dominant market share in the high performance fluoropolymer market of APAC. The rapid growth is attributed to the country’s industrial expansion and leadership in key manufacturing sectors. China is a leading exporter across various verticals which has created a profitable domestic market for manufacturing, boosting demands for HPF solutions. For instance, the Observatory of Economic Complexity (OEC) estimated USD 2.1 trillion exports from the country in 2022 and leading in exports of solar PVs, semiconductor devices, integrated circuits, etc. OEC estimated China to have a positive trade balance in 2024 as exports accounted for USD 309 billion and imports were around USD 218 billion boding well for the domestic manufacturing sectors for various products and components.

Additionally, China is a leading market for electric vehicles (EVs) fueling demands for HPFs in EV batteries, cables, and coatings. By the end of the forecast period, the favorable regulatory ecosystem in China, i.e., pushing for the Made in China 2025 initiative to reduce reliance on imports, is poised to bolster the demands for HPF in various manufacturing verticals.

India is projected to increase its revenue share by the end of the forecast period in the high performance fluoropolymer sector. The HPF market’s growth in the country is owed to the burgeoning manufacturing trends as India looks to position itself as a hub for manufacturing various products. Favorable government initiatives such as Make in India promote manufacturing domestically driving demands for HPFs across various sectors. For instance, in July 2024, the India Brand Equity Foundation (IBEF) estimated India to become a hub for semiconductor manufacturing by leveraging its skilled workforce and filling the gap in semiconductor fabrication facilities in the country. The trends bode well for the growth of the HPF sector as semiconductor manufacturing is poised to fuel a considerable demand for robust fluoropolymer solutions.

North America Market Analysis

The high performance fluoropolymer market in North America is poised to register the fastest growth during the forecast period. The sector’s profitable growth is owed to a robust manufacturing ecosystem and an established aerospace and defense sector that fuels demand for HPF. North America is witnessing a surge of EV demands and production, that positions the HPF manufacturers to fulfill demands for fluoropolymer solutions. The U.S. and Canada lead the HPF market’s growth in North America. Additionally, large-scale investments in microgrids that require battery pack components and control systems are boosting demands for chemically resistant HPFs.

The U.S. holds the largest revenue share in the high performance fluoropolymer market in North America. A key driver of the market’s growth is the country’s position as one of the largest exporters of fluoropolymer resins globally. Between 2023 and 2024, the U.S. accounted for the second-largest fluoropolymer resin exports globally. In October 2024, General Motors announced a joint venture with Lithium Americas Corp to mine EV battery raw materials in the country. This opens opportunities for HPF manufacturers to provide durable and heat-resistant HPF solutions as companies focus on localizing their supply chains.

Canada is projected to increase its high performance fluoropolymer market share by the end of the forecast period. The country’s investments in building a clean energy-focused infrastructure are driving demands for HPF solutions. Additionally, Canada has a thriving mining and chemical processing ecosystem that requires high-performance materials for equipment. For instance, in June 2024, the government announced a USD 10 million investment supporting the mining of critical materials in Northern Ontario. HPF solutions are crucial in the manufacturing of gaskets, seals, and linings in pumps used during mining operations.