High Performance Fluoropolymer Market Outlook:

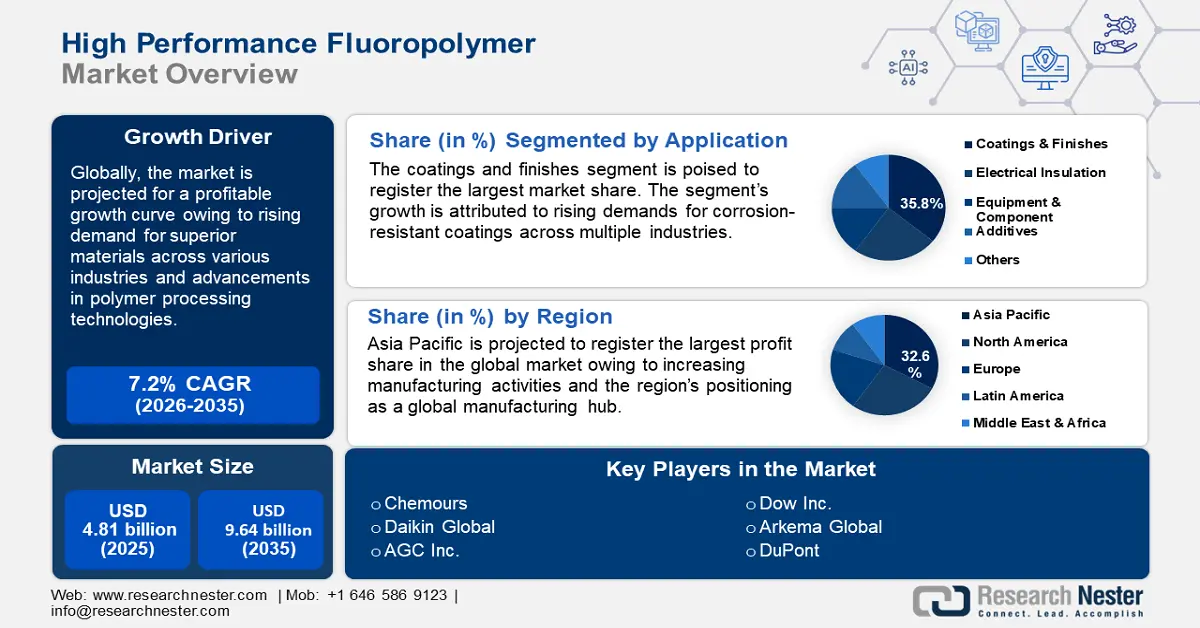

High Performance Fluoropolymer Market size was over USD 4.81 billion in 2025 and is projected to reach USD 9.64 billion by 2035, witnessing around 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high performance fluoropolymer is assessed at USD 5.12 billion.

The HPF market’s profitable growth curve is attributed to rising demands for materials offering superior chemical resistance and thermal stability across various industries. Industries such as automotive, aerospace, and electronics that witness extreme environmental conditions fuel the demands for HPFs. The surge in demand for HPFs is poised to remain steady during the forecast period owing to the rising need for advanced materials that ensure product longevity in corrosive and high-temperature environments. Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF), Perfluoro alkoxy Polymer (PFA), and Ethylene Tetrafluoroethylene (ETFE) are some specific high-performance polymers.

A major growth driver of the high performance fluoropolymer market is the increased reliance on the materials by the semiconductor sector. HPFs are critical in manufacturing components such as cables, semiconductors, and circuit boards where superior electrical insulation and high-temperature resistance are essential. For instance, in August 2024, the chemicals maker Chemours expanded Teflon PFA production in West Virginia to cater to increasing semiconductor driver demands for the forever chemical resin.

The demands for HPFs are poised to increase in the renewable energy sector and manufacturers are positioned to leverage the rising demands to find new revenue streams in the global high performance fluoropolymer market. The global shift towards the integration of renewable energy is poised to boost demands for HPFs in PV solar panels and solar cells to be used as encapsulants and connector coatings. Additionally, advancements in new product formulations benefit the global market as manufacturers invest in research and development to improve the mechanical properties of HPFs. Advancements open new revenue streams for the market through penetration into new industries that previously relied on traditional polymers. For instance, in August 2023, a study published in the National Library of Medicine (NLM) on the cryogenic mechanical properties of polymer films for liquid oxygen hoses found four fluoropolymers were compatible with liquid oxygen before and after immersion for 60 days. By the end of 2037, the global HPF market is projected to maintain its robust growth curve by leveraging the growth drivers.

Key High Performance Fluoropolymer (HPF) Market Insights Summary:

Regional Highlights:

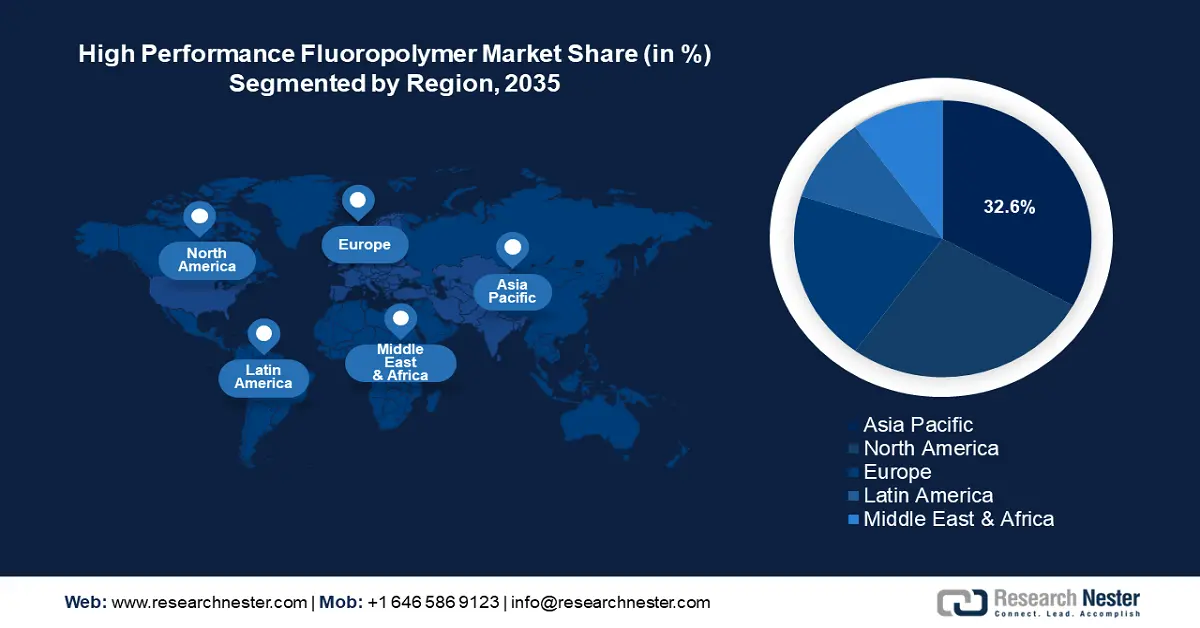

- Asia Pacific dominates the High Performance Fluoropolymer Market with a 32.6% share, fueled by the rapidly expanding industrial base across various sectors, driving significant growth by 2035.

Segment Insights:

- The Electrical Insulation segment is expected to increase its revenue share by 2035, driven by demand for high-temperature insulation in telecom and power sectors.

- The Polytetrafluoroethylene (PTFE) segment is expected to increase its revenue share from 2026-2035, fueled by its chemical resistance and durability in diverse industrial uses.

Key Growth Trends:

- Growing demand for lightweight and high-performance materials

- Sustainability trends in the plastic industry

Major Challenges:

- Technological barriers in market expansion

- High production costs

- Key Players: Chemours, Daikin Global, AGC Inc., Solvay, Dow Inc., DuPont, Westlake Plastics, Arkema Global, Gujarat Fluorochemicals Ltd..

Global High Performance Fluoropolymer (HPF) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.81 billion

- 2026 Market Size: USD 5.12 billion

- Projected Market Size: USD 9.64 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 14 August, 2025

High Performance Fluoropolymer Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for lightweight and high-performance materials: A key growth driver for the global high performance fluoropolymer market is the increasing demand for lightweight, durable materials across aerospace, automative, and electronics. HPFs are essential in reducing the overall weight of the components without affecting structural integrity. For instance, in September 2024, AGC Chemicals America stated that weight reduction is a priority in the aerospace sector and advanced aerospace materials are required to cater to the demands. High performance fluoropolymers can maintain a high strength-to-weight ratio with lighter composites positioning it to be adopted by the aerospace sector on a large scale.

Additionally, the growth of the semiconductor sector benefits the HPF sector owing to a boost in demand for superior electrical insulation. For instance, the semiconductor equipment manufacturing sector is estimated to reach USD 325.4 billion by 2037 which bodes favorably for the HPF market owing to fluoropolymers being critical materials in semiconductor products. - Sustainability trends in the plastic industry: Globally, there is a shift towards reduction of greenhouse gases in emissions and a push to integrate green energy sources. The trends are favorable for the high performance fluoropolymer market to find opportunities in wind turbines, fuel cells, and solar panels owing to HVFs resistance to UV radiation and the ability to handle harsh environmental conditions. With the rising development of smart grids and energy storage, high-performance fluoropolymer demands are expected to soar.

Additionally, sustainability trends in the broader plastics market positively affect the HPF sector, as HPFs' high durability and resistance to degradation ensure greater product longevity. HPF solutions are positioned to align with circular economy initiatives across various sectors and continue their profitable growth curve. - Advancements in polymer processing technologies: Advancements in polymer processing enable manufacturers to produce and supply HPFs with improved properties such as greater flexibility, chemical resistance, and greater tensile strength. This expands the high performance fluoropolymer sector as HPFs become applicable in industries such as healthcare in implantable medical devices.

Additionally, investment in research to improve fluoropolymer coatings is poised to strengthen HPF adoption. For instance, a 2024, study on interfacially adhesive corrosion protective fluoropolymer coatings modified by soybean extract, stated that with companies investing more in the development of new formulations, additional growth opportunities for the global HPF market are projected to open as the materials will cater to specialized applications.

Challenges

- Technological barriers in market expansion: The high performance fluoropolymer market can face challenges in market expansions due to complex manufacturing processes that can limit adoption in emerging economies. Specialized equipment required to extrude and bond HPFs can increase operational costs, dissuading small-scale manufacturers from entering the market. Additionally, there can be challenges in integrating HPFs into existing production lines that have the potential to stymie the HPF market’s growth.

- High production costs: Fluoropolymers are expensive to manufacture due to the complex synthesis process and the high cost of raw materials such as fluorspar, which is a key component in production. This can limit adoption, especially in cost-sensitive industries.

High Performance Fluoropolymer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 4.81 billion |

|

Forecast Year Market Size (2035) |

USD 9.64 billion |

|

Regional Scope |

|

High Performance Fluoropolymer Market Segmentation:

Application (Coatings & Finishes, Electrical Insulation, Equipment & Components, and Additives)

By application, the coatings and finishes segment is set to hold high performance fluoropolymer market share of more than 35.8% by 2035. The segment’s growth is attributed to rising demands for corrosion-resistant coatings in multiple sectors such as automotive, construction, and aerospace. For instance, the American Coatings Association advocated the use of fluoropolymers as protective coatings in architectural coating formulations, especially those meant for exterior applications owing to the need for robust weatherability.

Additionally, the American Coatings Association highlighted cool roofing as a recent growth application for HPF coatings due to enhanced dirt pickup resistance. Also, the growing demand and research of HPF coatings in the healthcare sector for surgical instrument coating boosts the segment’s growth.

The electrical insulation segment is poised to increase its revenue share in the high performance fluoropolymer market owing to rising demands for high-temperature insulation in telecommunications and power distribution. HPFs are highly valued for their dielectric properties and resistance to electrical breakdown leading to high demands for insulating wires, cables, and electronic components. For instance, the Institute of Electrical and Electronics Engineer (IEEE) published a study in 2024 indicating minimal changes in surface chemistry and roughness of fluorinated ethylene propylene (FEP) and perfluoro alkoxy (PFA) in cable insulation over a three-week aging process. As the growth for insulation materials that can withstand temperature fluctuations and high voltage increases, the electrical insulation segment is positioned to register increased application of HPFs.

Type (Polytetrafluoroethylene, Polyvinylidene Fluoride, Ethylene Tetrafluoroethylene, Perfluoroalkoxy Polymer, and Fluorinated Ethylene Propylene)

The polytetrafluoroethylene (PTFE) segment is projected to increase its revenue share by the end of the forecast period in the high performance fluoropolymer market owing to its chemical resistance and non-stick properties, which have increased demands in cookware and industrial applications. PTFE more popularly known as Teflon is in demand owing to its resistance to corrosive substances.

Additionally, the segment is experiencing steady growth owing to demands in the manufacture of chemical tanks and gaskets. Despite concerns on its environmental and health impact, the industry has continued the use of polytetrafluoroethylene evident in the segment’s growth curve. Moreover, the versatility and high-performance capabilities of Teflon are projected to maintain a steady demand across manufacturing of laboratory equipment, surgical devices coating, non-stick cookware, waterproof fabric, etc., as alternative materials are yet to provide the durability of polytetrafluoroethylene.

Our in-depth analysis of the global market includes the following segments

|

Application |

|

|

Type

|

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Performance Fluoropolymer Market Regional Analysis:

APAC Market Forecast

Asia Pacific industry is poised to hold largest revenue share of 32.6% by 2035, owing to the rapidly expanding industrial base in the region across various sectors. Globally, Taiwan, South Korea, China, and Japan are leading manufacturers of semiconductors while India is rapidly increasing its share leading to high demand for HPF. The growing construction activities across the region due to rapid urbanization are increasing adoption rates of fluoropolymer coatings owing to increased durability. Additionally, investments and expansion in the healthcare sector are poised to boost demands for chemically inert materials benefiting the HPF industry.

China is projected to register a dominant market share in the high performance fluoropolymer market of APAC. The rapid growth is attributed to the country’s industrial expansion and leadership in key manufacturing sectors. China is a leading exporter across various verticals which has created a profitable domestic market for manufacturing, boosting demands for HPF solutions. For instance, the Observatory of Economic Complexity (OEC) estimated USD 2.1 trillion exports from the country in 2022 and leading in exports of solar PVs, semiconductor devices, integrated circuits, etc. OEC estimated China to have a positive trade balance in 2024 as exports accounted for USD 309 billion and imports were around USD 218 billion boding well for the domestic manufacturing sectors for various products and components.

Additionally, China is a leading market for electric vehicles (EVs) fueling demands for HPFs in EV batteries, cables, and coatings. By the end of the forecast period, the favorable regulatory ecosystem in China, i.e., pushing for the Made in China 2025 initiative to reduce reliance on imports, is poised to bolster the demands for HPF in various manufacturing verticals.

India is projected to increase its revenue share by the end of the forecast period in the high performance fluoropolymer sector. The HPF market’s growth in the country is owed to the burgeoning manufacturing trends as India looks to position itself as a hub for manufacturing various products. Favorable government initiatives such as Make in India promote manufacturing domestically driving demands for HPFs across various sectors. For instance, in July 2024, the India Brand Equity Foundation (IBEF) estimated India to become a hub for semiconductor manufacturing by leveraging its skilled workforce and filling the gap in semiconductor fabrication facilities in the country. The trends bode well for the growth of the HPF sector as semiconductor manufacturing is poised to fuel a considerable demand for robust fluoropolymer solutions.

North America Market Analysis

The high performance fluoropolymer market in North America is poised to register the fastest growth during the forecast period. The sector’s profitable growth is owed to a robust manufacturing ecosystem and an established aerospace and defense sector that fuels demand for HPF. North America is witnessing a surge of EV demands and production, that positions the HPF manufacturers to fulfill demands for fluoropolymer solutions. The U.S. and Canada lead the HPF market’s growth in North America. Additionally, large-scale investments in microgrids that require battery pack components and control systems are boosting demands for chemically resistant HPFs.

The U.S. holds the largest revenue share in the high performance fluoropolymer market in North America. A key driver of the market’s growth is the country’s position as one of the largest exporters of fluoropolymer resins globally. Between 2023 and 2024, the U.S. accounted for the second-largest fluoropolymer resin exports globally. In October 2024, General Motors announced a joint venture with Lithium Americas Corp to mine EV battery raw materials in the country. This opens opportunities for HPF manufacturers to provide durable and heat-resistant HPF solutions as companies focus on localizing their supply chains.

Canada is projected to increase its high performance fluoropolymer market share by the end of the forecast period. The country’s investments in building a clean energy-focused infrastructure are driving demands for HPF solutions. Additionally, Canada has a thriving mining and chemical processing ecosystem that requires high-performance materials for equipment. For instance, in June 2024, the government announced a USD 10 million investment supporting the mining of critical materials in Northern Ontario. HPF solutions are crucial in the manufacturing of gaskets, seals, and linings in pumps used during mining operations.

Key High Performance Fluoropolymer Market Players:

- Chemours

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Daikin Global

- AGC Inc.

- Solvay

- Dow Inc.

- DuPont

- Westlake Plastics

- Arkema Global

- Gujarat Fluorochemicals Ltd.

The high performance fluoropolymer sector is positioned for a lucrative growth surge during the forecast period. The market is characterized by the presence of global and local players. Companies are investing in research to improve the durability of HPF solutions and penetrate new revenue streams in various sectors.

Here are some key players in the market:

Recent Developments

- In July 2024, Alfa Chemistry announced the expansion of its product line with advanced fluoropolymers. The extended range will have high performance fluoropolymers such as PTFE (Polytetrafluoroethylene), PCTFE (Polychlorotrifluoroethylene), ETFE (Ethylene Tetrafluoroethylene), and various other fluoropolymer coatings.

- In November 2023, Clariant announced that it will showcase a new portfolio of industrial coatings at ChinaCoat 2023. The new portfolio will have wetting and dispersing agents for water-based formulations to be used in industrial coating applications.

- Report ID: 6593

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Performance Fluoropolymer (HPF) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.