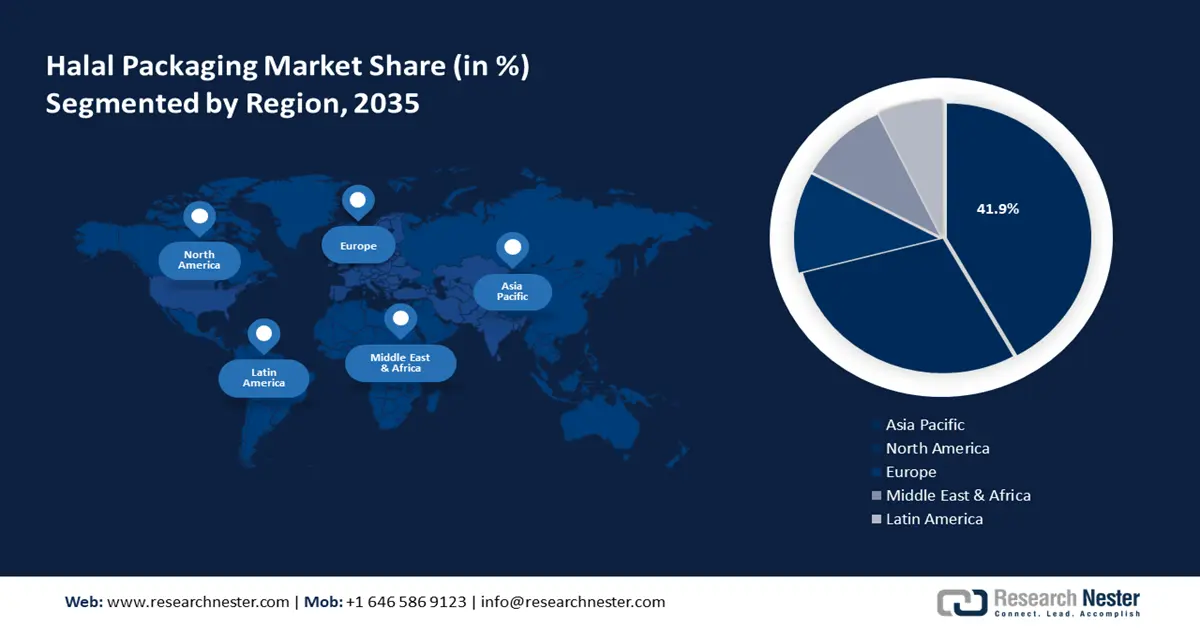

Halal Packaging Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 42% by 2035. The growth in this region is driven by the surge in halal certification authorities and demand for clean-labeled products. There is a presence of several government-recognized bodies in the region for halal certification such as the Australian Halal Authority & Advisers (AHAA), Islamic Council of Victoria (ICV), Australian Halal Development & Accreditation (AHDAA), and many more.

In Indonesia, the non-halal contents of the Korean instant noodle brand Samyang were not disclosed on the container when it was introduced to the Indonesian halal packaging market. Therefore, the product was removed from the market until it obtained the necessary halal certification and had the halal label packaging to regain the trust of the country's customers. Stringent regulatory standards have driven the launch of reliant packaging solutions in the country.

There has been an increasing consumption of retail foods in Japan. USDA Foreign Agricultural Service in 2023 predicted that the sales of retail food and beverages in 2022 would be USD 327 billion. This will act as a growing factor for the fast-food market value in the coming years. Owing to this the fast food will show a tremendous growth rate in the forecast period.

North America Market Insights

The North America region will also encounter huge growth in the halal packaging market share during the forecast period with a notable size and will account for the second position. This growth is led by the increasing demand for certified halal packaging from government organizations such as Islamic Services of America (ISA), the American Halal Foundation (AHF), and more.

There is a high demand for environmentally sustainable packaging options in the U.S. According to the Islamic Services of America, halal packaging can appeal to customers who care about the environment and support conservation and halal values by using eco-friendly packaging.

There is an increasing innovation in cosmetic products in Canada attributed to the slated demand of consumers. These companies include FX Cosmetics, Clara International Beauty Group, One Pure, Inika, and Samina Pure Minerals Makeup Ltd. For instance, Faces Canada revealed a product lineup of nail varnishes with rainbow-hued designs to go with the Pride Month vibe. According to a report in 2023, the beauty brand Faces Canada launched a nail varnish range, that is designed to complement Pride Month spirit using their rainbow hues.