Halal Packaging Market Outlook:

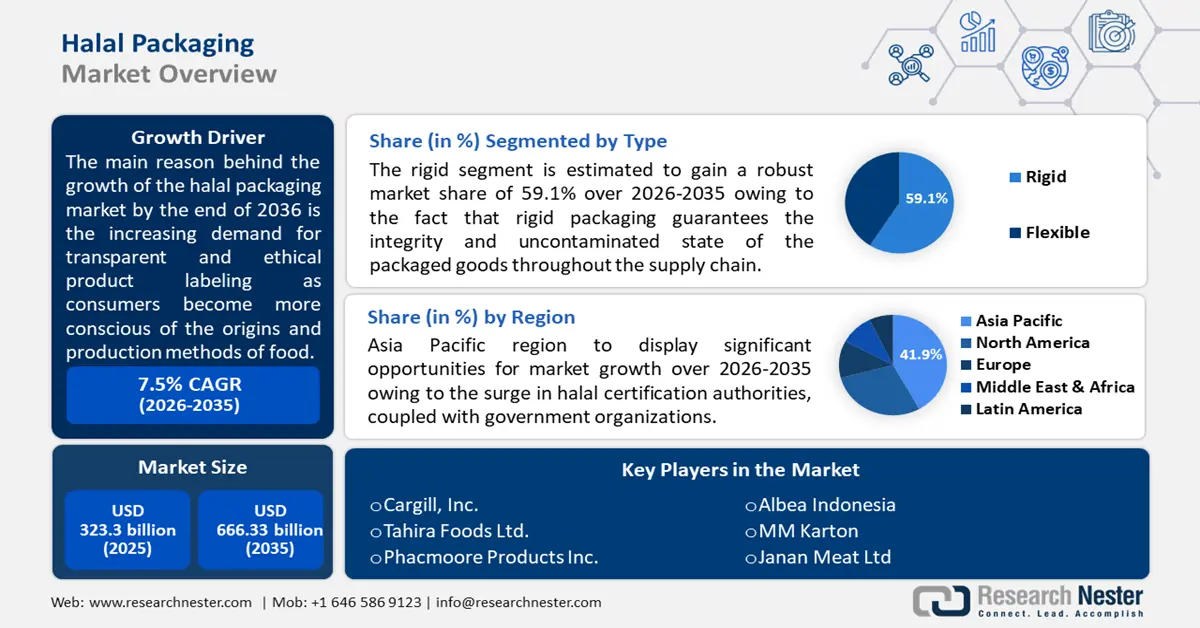

Halal Packaging Market size was valued at USD 323.3 billion in 2025 and is set to exceed USD 666.33 billion by 2035, registering over 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of halal packaging is estimated at USD 345.12 billion.

The market is driven by the growing demand for halal food as consumers have become aware of the origins and food production methods. The widespread demand for transparent and ethical product labeling influences this halal packaging market share. Furthermore, to maintain halal integrity throughout the production and consumption processes, the global halal food industry must find suitable packaging solutions. To meet this demand various initiatives are made to coordinate the halal food standards worldwide. For instance, the Standards and Metrology Institute for Islamic Countries (SMIIC), a division of the Organization of Islamic Cooperation (OIC), is responsible for developing the OIC-SMIIC Halal Standards. The general specifications, terminology, definitions, and guidelines for the halal certification bodies are covered by the OIC-SMIIC Halal Standards. Facilitating trade and collaboration between several nations is another goal of the OIC-SMIIC.

Halal compliance is of particular relevance while exporting to Indonesia, GCC, Middle East, and Malaysia. The Government of Malaysia has adopted a key approach to promote the comprehensive growth of the halal packaging market. In December 2018, the Malaysia Halal Hub Division was expanded into two main divisions namely Halal Management Division (HMD) and the Secretariat of the Malaysia Halal Council (MHC). The HMD manages domestic and overseas halal certification including inspection of company profiles and documents, product and premise inspections, halal packaging monitoring and enforcement, halal analysis center, and promotion of halal awareness. Meanwhile, the MHC Secretariat caters to the development of halal certification policy and implementation of international halal and multilateral halal programs.

Key Halal Packaging Market Insights Summary:

Regional Highlights:

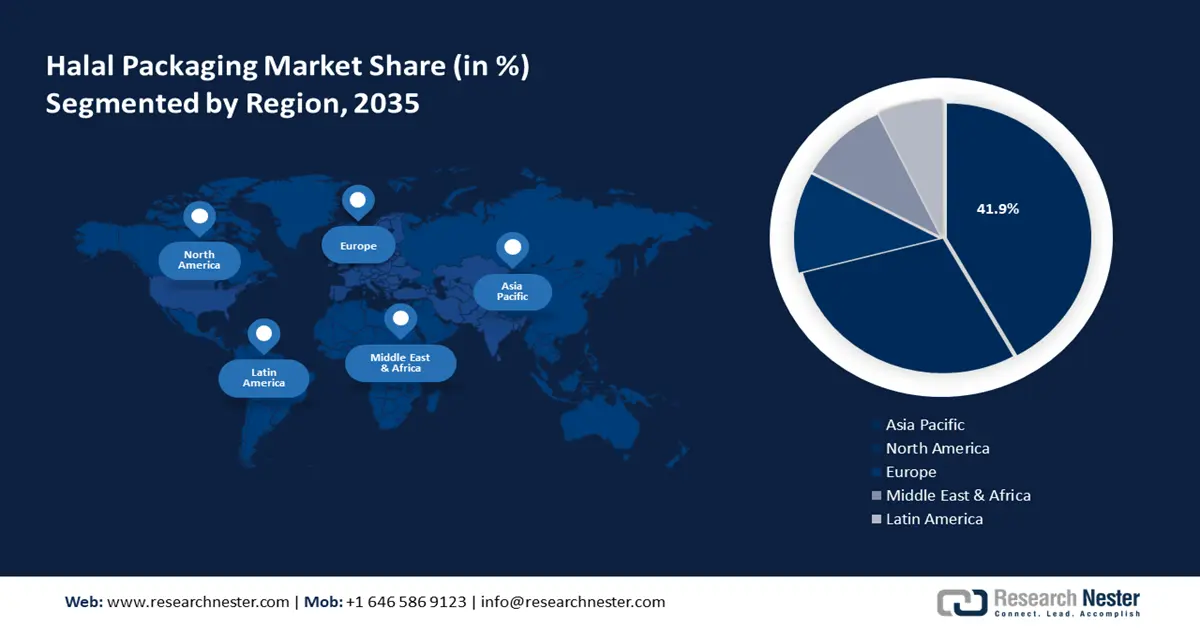

- The Asia Pacific halal packaging market will account for 42% share by 2035, driven by the surge in halal certification authorities and demand for clean-labeled products.

Segment Insights:

- The rigid segment in the halal packaging market is projected to hold a 59.10% share by 2035, driven by its ability to ensure product integrity and protection throughout the supply chain.

Key Growth Trends:

- Boost in government halal initiatives

- Growth in international trade of halal foods

Major Challenges:

- Expensive and complicated certification requirements

- Shortage of skilled workers

Key Players: Amcor, Novvia Group, AI Islamic Foods, QL Foods Sdn Bhd, Cargill, Inc., Tahira Foods Ltd., Phacmoore Products Inc., Albea Indonesia, MM Karton, Janan Meat Ltd.

Global Halal Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 323.3 billion

- 2026 Market Size: USD 345.12 billion

- Projected Market Size: USD 666.33 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Malaysia, Indonesia, United Arab Emirates, Turkey, Saudi Arabia

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Halal Packaging Market Growth Drivers and Challenges:

Growth Drivers

- Boost in government halal initiatives- There is widespread adoption of certifications and regulatory frameworks that are government-approved for halal packaging. To gain the trust of consumers these approval and certifications indicate that goods and packaging follow stringent halal guidelines. The global halal packaging market revenue share is experiencing substantial growth due to the implementation of policies by governments and regulatory bodies to support this industry and standardize certification procedures.For instance, a report by the International Trade Administration 2021 projected that in Indonesia, since 2019 several products had to go through a certification process. They are mandated to be labeled with whether they are "haram," which means they contain pork or alcohol, or "halal," which means they comply with Islamic law. This will impact the food packaging growth during the forecast period.

- Growth in international trade of halal foods- The demand for dependable and secure packaging solutions is rising credited to the expansion of e-commerce and international trade in halal products. Packaging needs to fulfill a variety of requirements as customer purchasing patterns move toward online channels. Additionally, maintaining product integrity while being transported over long distances, obeying adherence to global regulations, and providing tamper-evident features to fuel confidence in customers to make online purchases. For instance, according to the International Trade Association 2024, e-commerce revenue is propelled to surpass USD 5.5 trillion by 2027 and is predicted to gain a growth rate of 14.4%.

- Advances in halal bioactive packaging materials- Non-toxic and sustainable packaging, with superior bioactive materials has emerged as a promising solution in the food handling and processing industry. Bioactive ingredients such as anthocyanin, carotenoid, betalain, and chlorophyll, are used as packaging additive with nanoencapsulation and microencapsulation. It allows targeted and controlled release to mitigate pathogenic spoilage and oxidative degradation of food products. Furthermore, bioplastics derived from bamboo fibers, cellulose-based materials, starch, and chitosan sources from shrimp and crab shells are a few examples of halal biomaterials. These are biodegradable, renewable, and compostable, making them environmentally responsible solution for halal packaging market. NLYTech Biotech, Pulau Pinang, and ADA Biotech based are among the key players specializing in the manufacturing of halal-certified biomaterials for packaging applications.

- Multiculturalism and globalization to fuel the market- The effect of multiculturalism and globalization have increased the availability and accessibility of halal food items. As they embrace diversity, many countries are adapting their food market demand to suit a variety of dietary options. For instance, according to Our World Data 2024, over 50% of the world's total output is made up of the combined value of imports and exports from all countries. Conventional supermarkets, restaurants, and food manufacturers are now providing a wider range of halal products to cater to more diverse consumers.

Additionally, Halal cosmetics are becoming more and more popular among customers from different religions, backgrounds, and ethnicities as a result of growing globalization and cross-cultural interchange. Cosmetic companies are investing in halal-certified goods and packaging to satisfy a wide range of customer preferences because they see an opportunity in the valuable halal packaging market expansion.

Challenges

- Expensive and complicated certification requirements- Companies may incur extra costs to implement halal packaging practices, such as obtaining certification, using particular materials, and modifying production procedures. Some companies may be unwilling to pay these extra costs. Moreover, there may be misunderstandings in the sectors due to the existence of several halal certification standards and divergent interpretations of halal requirements. It is anticipated that this will adversely impact the halal packaging market during the projected period.

- Shortage of skilled workers- The industry's progress is restricted by the requirement for specialized knowledge, which may not be readily accessible, to design packaging that meets both halal practical and standards. Halal packaging regulations run the risk of being misinterpreted or miscommunicated, which could lead to unintentional noncompliance and possible reputational damage.

Halal Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 323.3 billion |

|

Forecast Year Market Size (2035) |

USD 666.33 billion |

|

Regional Scope |

|

Halal Packaging Market Segmentation:

Type

Rigid type segment is likely to dominate around 59.1% halal packaging market share by the end of 2035. This segment growth is augmented by the fact that rigid packaging guarantees the integrity and uncontaminated state of the packaged goods throughout the supply chain. The growing demand and untapped opportunities have implored the market players to adopt strategic initiatives such as expansion of product pipeline and acquisitions. For instance, in 2023, Amcor, a leader in developing and manufacturing ethical packaging solutions announced that it had executed a legally binding contract to acquire Moda Systems, a leading provider of automated, cutting-edge protein packaging equipment.

Products such as cans, jars, bottles, and blister packs are examples of rigid packaging materials that offer protection against environmental elements like light, moisture, and physical damage that could hamper the products integrity. Moreover, the halal packaging market may benefit from continuous advancements in rigid packaging technologies, such as anti-counterfeiting features such as RFID chips, QR codes, NFC tags, barrier coatings, and many more. Growth in this sector will boost the smart packaging size in the near future.

Product

The bottle & jars segment in halal packaging market is expected to be the fastest-growing segment with a lucrative size during the forecast period. This growth is attributed to its widespread application in personal care, food and beverage, and halal pharmaceutical products. Additionally, by providing halal-certified packaging materials and making investments in cutting-edge designs, packaging manufacturers are focused on satisfying the changing needs of consumers seeking halal-compliant products.

For instance, to meet the increasing demand from consumers for halal cosmetic packaging solutions, Albéa Services S.A.S., a manufacturer of packaging solutions for cosmetics and personal care, offers jars and bottles that have received halal certification.

Our in-depth analysis of the global halal packaging market includes the following segments:

|

Type |

|

|

Product |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Halal Packaging Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 42% by 2035. The growth in this region is driven by the surge in halal certification authorities and demand for clean-labeled products. There is a presence of several government-recognized bodies in the region for halal certification such as the Australian Halal Authority & Advisers (AHAA), Islamic Council of Victoria (ICV), Australian Halal Development & Accreditation (AHDAA), and many more.

In Indonesia, the non-halal contents of the Korean instant noodle brand Samyang were not disclosed on the container when it was introduced to the Indonesian halal packaging market. Therefore, the product was removed from the market until it obtained the necessary halal certification and had the halal label packaging to regain the trust of the country's customers. Stringent regulatory standards have driven the launch of reliant packaging solutions in the country.

There has been an increasing consumption of retail foods in Japan. USDA Foreign Agricultural Service in 2023 predicted that the sales of retail food and beverages in 2022 would be USD 327 billion. This will act as a growing factor for the fast-food market value in the coming years. Owing to this the fast food will show a tremendous growth rate in the forecast period.

North America Market Insights

The North America region will also encounter huge growth in the halal packaging market share during the forecast period with a notable size and will account for the second position. This growth is led by the increasing demand for certified halal packaging from government organizations such as Islamic Services of America (ISA), the American Halal Foundation (AHF), and more.

There is a high demand for environmentally sustainable packaging options in the U.S. According to the Islamic Services of America, halal packaging can appeal to customers who care about the environment and support conservation and halal values by using eco-friendly packaging.

There is an increasing innovation in cosmetic products in Canada attributed to the slated demand of consumers. These companies include FX Cosmetics, Clara International Beauty Group, One Pure, Inika, and Samina Pure Minerals Makeup Ltd. For instance, Faces Canada revealed a product lineup of nail varnishes with rainbow-hued designs to go with the Pride Month vibe. According to a report in 2023, the beauty brand Faces Canada launched a nail varnish range, that is designed to complement Pride Month spirit using their rainbow hues.

Halal Packaging Market Players:

- Amcor

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novvia Group

- AI Islamic Foods

- QL Foods Sdn Bhd

- Cargill, Inc.

- Tahira Foods Ltd.

- Phacmoore Products Inc.

- Albea Indonesia

- MM Karton

- Janan Meat Ltd

Halal packaging market expansion is predicted that these companies will occupy a tremendous share. Most of these companies are continuously collaborating, making agreements, expanding, and joining ventures for the growth of this industry. Several businesses are launching innovation and expansion in the halal packaging sector by confirming that their goods comply with the cultural and religious values of their desired consumer.

Some of the key players include:

Recent Developments

- In March 2023, JF Shelton was purchased by Novvia Group, a distributor of rigid containers and packaging for the life sciences, from Ravago Chemicals. The addition will strengthen Novvia's position on the West Coast in conjunction with Rhino Container, Novvia's Chino.

- In May 2023, Amcor, a leader in developing and manufacturing ethical packaging solutions—announced that it had inked a formal contract to acquire Moda Systems, a leading provider of automated, cutting-edge protein packaging equipment. Amcor will be able to provide an intriguing new approach and choices for automated protein packaging as a result of this acquisition.

- Report ID: 6283

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Halal Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.