Global Halal Cosmetic Product Market Overview

Halal cosmetics are personal care products which are free from ingredients forbidden by the Islamic law. These cosmetics do not contain animal derived material such as blood from any animal, pork and pork products as well as alcoholic constituents in their manufacturing. Halal cosmetic products include hair shampoos, conditioners, bath and shower gels, cleansers, creams, lotions, talc and baby powders, toners, make up, perfumes, eau de colognes and oral care products. As the Islamic law only permits the use of halal cosmetic products, this religion segment holds the largest consumer base of halal cosmetic products across the globe.

Market Size & Forecast

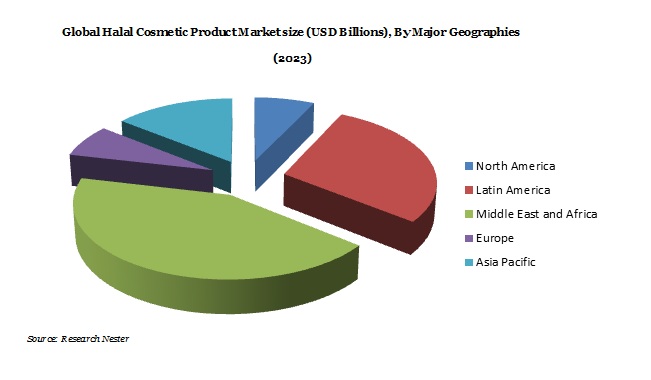

The global halal cosmetic product market is anticipated to reach USD 53 billion by the end of 2023 witnessing a promising compound annual growth rate of 14.1% over the period of forecast i.e. 2016-2023.

Middle East is anticipated to hold the largest consumer base owing to the dominance of Islamic culture. Absence of halal certification body in the region is anticipated to fuel the supply of halal cosmetic product in the region.

Europe halal cosmetic market is anticipated to grow at a high pace due to the dominance of well-established cosmetic manufacturers in the region such as Saint Laurent and L’Oreal. In 2009, European Commission banned animal testing for cosmetic ingredients and other products. This has forced the cosmetic manufacturers to increase the incorporation of plant based ingredients. This is likely to pave the demand for halal cosmetic products in the region.

Asia Pacific halal cosmetic product market is estimated to reach USD 2.9 billion by the end of 2023 witnessing a compound annual growth rate of 9.4% over the period of forecast, Asia Pacific market is expected to be remunerative region owing to the increasing Muslim consumer base with rising personal grooming needs and rising demand of vegan friendly cosmetics in the region.

Get more information on this report: Download Sample PDF

Research study states that 20% of the global Muslim population is concerned about halal issues with the products they are using. Growth of the market is mirrored by the consumer knowledge about the ingredient used and product awareness. Social media has raised the awareness of use of halal certified cosmetic products which is going to boost the demand for halal cosmetic products across the globe.

According to the halal industry development corporation, many well recognised and international brands are now considering to establish their market in halal industry by adding halal cosmetics and personal care products in their product line.

Market Segmentation

By Product

On the basis of cosmetic products offered under halal integrity, the market can be segmented into following product type:-

- Skin Care

- Colour Cosmetics

- Hair Care

- Fragrances

By Distribution Channel

Deep dive study has been carried out on following distribution channel segment:-

- Hypermarket/supermarket

- Convenience/Departmental Store

- Specialty Store

- Online Store

- Others

By Region

Global Halal Cosmetic Product Market is further classified on the basis of region as follows:

- North America (United States, Canada), Market size, Y-O-Y growth Market size, Y-O-Y growth & Opportunity Analysis, Future forecast & Opportunity Analysis

- Latin America (Brazil, Mexico, Argentina, Rest of LATAM), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Europe (U.K., Germany, France, Italy, Spain, Hungary, BENELUX (Belgium, Netherlands, Luxembourg), NORDIC (Norway, Denmark, Sweden, Finland), Poland, Russia, Rest of Europe), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Taiwan, Hong Kong, Australia, New Zealand, Rest of Asia-Pacific), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

Growth Drivers and Challenges

Rising awareness about the percutaneous essence of conventional cosmetic products along with rising demand of vegan friendly cosmetics is anticipated to propel the growth of global halal cosmetic product market across the globe.

Rising Muslim population (nearly two billion) and increasing expenditure of Muslim consumers on food and lifestyle is anticipated to fuel the demand for halal cosmetic products. The global expenditure of Muslim consumers has increased by 10% in 2015, and is expected to reach USD 3.9 trillion by the end of 2023 witnessing a compound annual growth rate of 11% over the forecast period i.e. 2016-2023.

Growing health concerns due to harmful effects of ingredient that are used in manufacturing of cosmetic product is increasing the demand for halal cosmetic products not only among the Muslim populations, globally consumers are now more inclined towards the adoption of cruelty free product.

Factor such as lack of authentication laws, liberal government regulations and challenges faced in positioning and marketing as well as short shelf life of the organic products are some factor restraining the market growth.

Top Featured Companies Dominating the Market

- Amara Cosmetics Inc

- INIKA Cosmetics

- Martha Tilaar Group

- EL Asira

- SAAF International

- Samina Pure Makeup

- Wardah Cosmetics

- Zuii Organic

- Clara International

- OnePure

- Report ID: 207

- Published Date: Feb 14, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Halal Cosmetic Product Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert