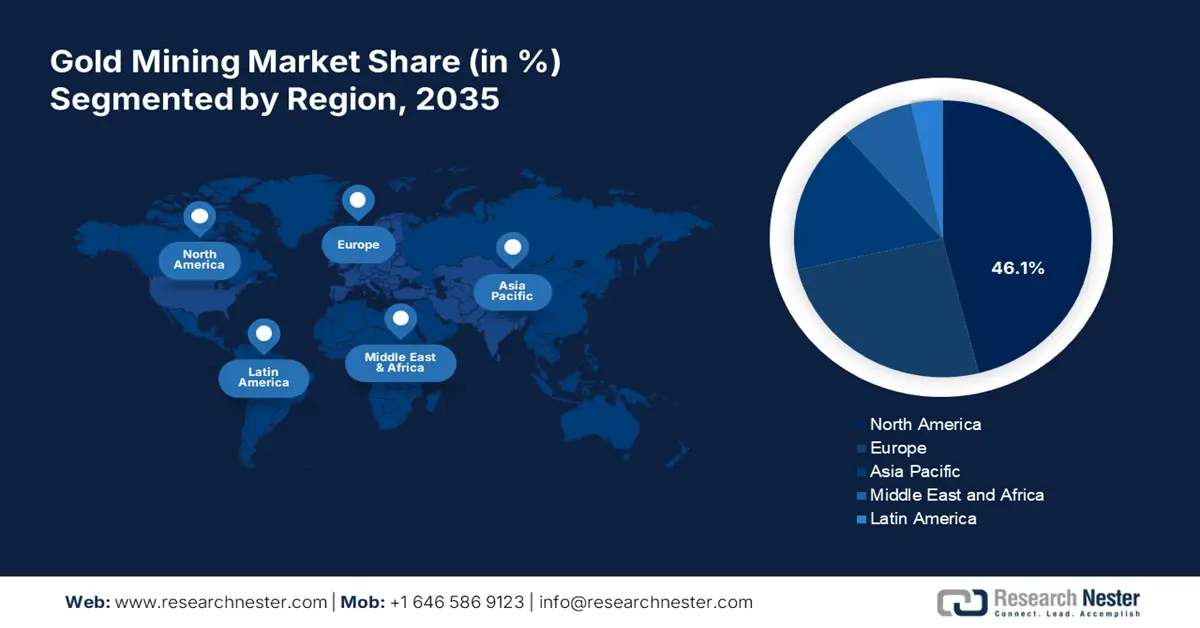

Gold Mining Market Regional Analysis:

North America Market Insights

By 2035, North America gold mining market is anticipated to hold more than 46.1% share. The growth in this region is driven by the presence of major gold producers and miners. Countries such as Canada and the U.S. hold large mines, creating business opportunities for leaders including Barrick, Newmont, Kinross, and Teck Resources. This further inspires international companies to contribute to the expansion of this industry in this region. For instance, in November 2024, Orla Mining acquired Musselwhite Gold Mine from Newmont Corporation. The acquisition aims to double the company’s gold production to 500 oz, making it a North America-focused Multi-Asset, Low Cost, Producing Gold Company.

The U.S. is one of the major frontiers in the regional gold mining market due to heavy investments and proactive participation from domestic leaders. The mining companies are paving the way for new trading lines in this country to consolidate their position. For instance, in October 2024, Newmount partnered with MKS PAMP to offer consumers a traceable gold bar. By launching PAMP 1oz Lady of Liberty gold bar at the largest U.S. wholesaler, the partnership aims to avail access to high-quality refined gold for wealth building.

Being home to some of the largest mining projects in the world, Canada is estimated to create great scope for investment in the gold mining market. Many global leaders are now capturing the country’s reservoirs to consolidate their supply chain across the world. For instance, in October 2024, Gold Field acquired Osisko Mining in a transaction of USD 1.3 billion. The acquisition is aimed at making the company the sole owner of the Windfall project and other exploration districts in Canada.

APAC Market Insights

Asia Pacific is projected to present remarkable growth in the gold mining market by the end of 2035 due to the massive production of gold in this region. With major producers such as China, Australia, India, and Indonesia, the region is marking its potential to generate profitable revenues. The large manufacturing facilities and supply chains of these businesses are growing the need for discovering domestic deposits to cope with the demand. For instance, in December 2024, Kula Gold launched a new reconnaissance drilling campaign at its Mustang gold project near Donnybrook in Weste Australia. The project aims to intensify the company’s dual exploration strategy at high-priority gold anomalies uncovered by ultra-fine soil sampling and rock chip samples.

India is becoming one of the major consumers of the gold mining market due to its limited domestic gold production. In addition, the shortage of limited resources is pushing the country to invest in foreign mining projects to secure a good supply of gold. For instance, in November 2023, NMDC expanded its mineral mining portfolio by inaugurating its first gold mine at Mount Celia Gold Operation in Western Australia. The project aims to signify the remarkable accomplishment of the organization in diversifying its mineral assets.

China is leading the regional gold consumption due to its enlarging electronics and jewelry industry, contributing to magnifying the surge in the gold mining market. The country is also expanding its domestic gold production to ensure sufficient supply for the growing demand. Mining leaders such as Shandong, Henan, and Jiangxi are securing the country’s leadership in the competitive landscape. In addition, technological advancements and large manufacturing facilities are contributing to its growth.