Gold Mining Market Outlook:

Gold Mining Market size was valued at USD 213.54 billion in 2025 and is expected to reach USD 304.14 billion by 2035, registering around 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gold mining is evaluated at USD 220.46 billion.

The rise in gold prices is one of the major drivers for growing interest in mining and related technologies. The height in pricing during economic uncertainty or inflation makes exploration and extraction more viable and profitable. This attracts mining companies to invest in this sector. According to a report published by the World Bank, in May 2024, geopolitical tensions and uncertainty fueled the price rate of gold by 9% during the first quarter of the same year.

Recent advancements in technologies for mining, processing, and cost management have propelled production, increasing product availability in the gold mining market. Innovative solutions driven by automation, robotics, and improved techniques are allowing miners to access deeper and more complex deposits. Such increment in extraction efficiency is inspiring more mining companies to participate in this field. For instance, in August 2024, RG Gold collaborated with Narxoz University to automate the financial processes in production. This digitalization aims to work as a tool for better assessment while optimizing available sources and various developments of the company. Such strategic partnerships are further creating scope for more R&D investments.

Key Gold Mining Market Insights Summary:

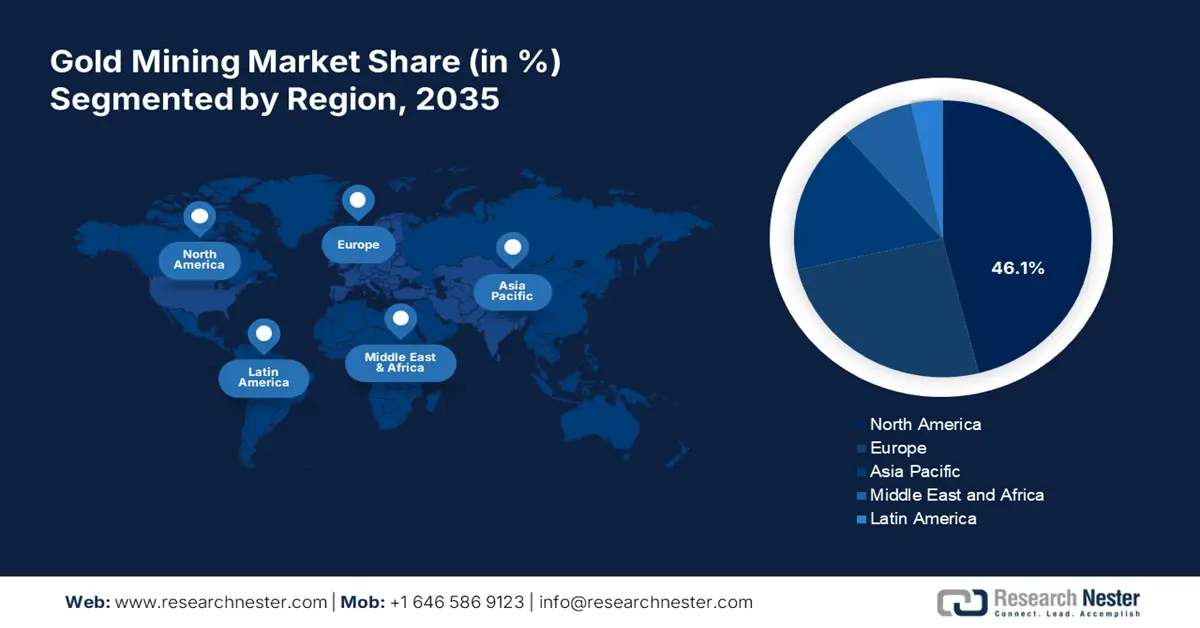

Regional Highlights:

- North America gold mining market will account for 46.10% share by 2035, attributed to presence of major gold producers and miners.

Segment Insights:

- The placer mining segment in the gold mining market is expected to hold a 56.70% share by 2035, influenced by its effectiveness in gold extraction from alluvial deposits and the introduction of advanced technologies for hassle-free mining.

- The jewelry segment in the gold mining market is expected to experience great business opportunities by 2035, fueled by the increasing demand for gold jewelry in emerging markets such as India and China.

Key Growth Trends:

- Rising demand for gold

- Increasing investments in exploration

Major Challenges:

- Increasing pressure due to environmental impact

- Depleting global natural resources

Key Players: Barrick Gold Corporation, Newmont Mining Corporation, AngloGold Ashanti Ltd, Goldcorp Inc., Kinross Gold Corporation, Newcrest Mining Ltd, Gold Fields Ltd, Polyus Gold International Ltd, Agnico Eagle Mines Ltd.

Global Gold Mining Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 213.54 billion

- 2026 Market Size: USD 220.46 billion

- Projected Market Size: USD 304.14 billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Australia, United States, Canada, Russia

- Emerging Countries: China, India, Japan, Indonesia, Thailand

Last updated on : 18 September, 2025

Gold Mining Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for gold: Besides being a safe-haven asset, the novel metal is also a crucial part is manufacturing electronics, raising the surge for gold. Its contribution to producing circuitry and aesthetic crafts has secured a steady consumer base for the gold mining market. The industry is gaining demand from several developing sectors such as jewelry, technology, and reserve banks. According to the report published by the World Gold Council, in October 2024, the value of gold demand increased by 35%, exceeding USD 100 billion. Irrespective of the reduced quantity of purchased jewelry, expenditure increased by 13% achieving around USD 36 billion.

- Increasing investments in exploration: The continuous investments from mining corporations in exploration activities are creating new reservoirs for the gold mining market. This is further resulting in the long-term growth of untapped regions and geological formations, creating a profitable scope for investors. For instance, in July 2024, Siguiri Gold unveiled the IPO for raising funds between USD 8 million to USD 10 million for advanced exploration in its Guinea project. The location of the SGP lies within the prolific Birimian Greenstone belt, holding +300MOzAu and hosting many multi-million-ounce gold mines and projects.

Challenges

- Increasing pressure due to environmental impact: Continuous mining activities can cause massive deforestation, water contamination, and biodiversity loss. This may raise concerns about the environmental effects, creating regulatory pressure on the gold mining market. This can further restrict the progress of this sector by limiting future exploration and extraction projects. It may increase the operational cost by adding the expense of maintaining compliance with the strict environmental regulations in the production budget.

- Depleting global natural resources: The limited source of high-grade ores can reduce the product quality, resulting in a loss of consumers in the gold mining market. The declining number of new deposits may further hamper the overall profitability of gold production. This can make it difficult for companies to retain their interest in this sector. The lack of new exploration projects may also prevent investors from funding projects, creating financial challenges and risks in continuing mining. Moreover, the reservoir scarcity in natural resources may hinder the growth in this sector.

Gold Mining Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 213.54 billion |

|

Forecast Year Market Size (2035) |

USD 304.14 billion |

|

Regional Scope |

|

Gold Mining Market Segmentation:

Mining Method

The placer mining segment is expected to capture gold mining market share of around 56.7% by the end of 2035. The growth in this segment is impelled due to its effectiveness in gold extraction from alluvial deposits with natural concentration. Being a major part of gold production in small-scale and artisanal mining, this method is continuing to be widely used. In efforts to make such mining hassle-free, traders are introducing advanced technologies. For instance, in June 2024, Society Artisanal partnered with Minespider to track conflict-free, artisanal gold from the Democratic Republic of Congo. The company aims to utilize its blockchain-based traceability platform and Digital Product Passports to attain sustainable production of gold. This subsequently propelled the usage of the placer method.

End use

Based on end use, the jewelry segment is predicted to garner great business opportunities for the gold mining market during the forecast period. The increasing demand for gold jewelry in emerging geographical landscapes such as India and China is inflating the demand for mining. According to the report published by the World Gold Council, in January 2024, the global gold jewelry demand secured a marginal gain from 2,089t to 2,093t in the same year. In many countries, gold is considered a valuable asset, showcasing their socio-economic standards. In addition, this metal is highly preferred for crafting jewelry due to its beauty, rarity, and malleability, inflating the need for gold supply. This is further fostering a steady distribution channel for global miners.

Our in-depth analysis of the global market includes the following segments:

|

Mining Method |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gold Mining Market Regional Analysis:

North America Market Insights

By 2035, North America gold mining market is anticipated to hold more than 46.1% share. The growth in this region is driven by the presence of major gold producers and miners. Countries such as Canada and the U.S. hold large mines, creating business opportunities for leaders including Barrick, Newmont, Kinross, and Teck Resources. This further inspires international companies to contribute to the expansion of this industry in this region. For instance, in November 2024, Orla Mining acquired Musselwhite Gold Mine from Newmont Corporation. The acquisition aims to double the company’s gold production to 500 oz, making it a North America-focused Multi-Asset, Low Cost, Producing Gold Company.

The U.S. is one of the major frontiers in the regional gold mining market due to heavy investments and proactive participation from domestic leaders. The mining companies are paving the way for new trading lines in this country to consolidate their position. For instance, in October 2024, Newmount partnered with MKS PAMP to offer consumers a traceable gold bar. By launching PAMP 1oz Lady of Liberty gold bar at the largest U.S. wholesaler, the partnership aims to avail access to high-quality refined gold for wealth building.

Being home to some of the largest mining projects in the world, Canada is estimated to create great scope for investment in the gold mining market. Many global leaders are now capturing the country’s reservoirs to consolidate their supply chain across the world. For instance, in October 2024, Gold Field acquired Osisko Mining in a transaction of USD 1.3 billion. The acquisition is aimed at making the company the sole owner of the Windfall project and other exploration districts in Canada.

APAC Market Insights

Asia Pacific is projected to present remarkable growth in the gold mining market by the end of 2035 due to the massive production of gold in this region. With major producers such as China, Australia, India, and Indonesia, the region is marking its potential to generate profitable revenues. The large manufacturing facilities and supply chains of these businesses are growing the need for discovering domestic deposits to cope with the demand. For instance, in December 2024, Kula Gold launched a new reconnaissance drilling campaign at its Mustang gold project near Donnybrook in Weste Australia. The project aims to intensify the company’s dual exploration strategy at high-priority gold anomalies uncovered by ultra-fine soil sampling and rock chip samples.

India is becoming one of the major consumers of the gold mining market due to its limited domestic gold production. In addition, the shortage of limited resources is pushing the country to invest in foreign mining projects to secure a good supply of gold. For instance, in November 2023, NMDC expanded its mineral mining portfolio by inaugurating its first gold mine at Mount Celia Gold Operation in Western Australia. The project aims to signify the remarkable accomplishment of the organization in diversifying its mineral assets.

China is leading the regional gold consumption due to its enlarging electronics and jewelry industry, contributing to magnifying the surge in the gold mining market. The country is also expanding its domestic gold production to ensure sufficient supply for the growing demand. Mining leaders such as Shandong, Henan, and Jiangxi are securing the country’s leadership in the competitive landscape. In addition, technological advancements and large manufacturing facilities are contributing to its growth.

Gold Mining Market Players:

- Barrick Gold Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Newmont Mining Corporation

- AngloGold Ashanti Ltd

- Goldcorp Inc.

- Kinross Gold Corporation

- Newcrest Mining Ltd

- Gold Fields Ltd

- Polyus Gold International Ltd

- Agnico Eagle Mines Ltd

- Orla Mining

- RG Gold

Integrating technology in the gold mining market is propelling production, creating a lucrative opportunity for the sector to develop further. The new extraction and management methods are mitigating the issues related to the expensive operations. Many global leaders are now partnering with other competitors to adopt their innovative and eco-friendly solutions. For instance, in July 2024, Dignity Gold signed a strategic partnership with GS Mining Holdings to promote sustainable practices in mining. The collaborative program aims to boost GS Mining’s operational efficiency and growth in this sector by ensuring robust governance and ethical practices. Such key players include:

Recent Developments

- In August 2024, Shandong Gold announced its plan to boost gold production in Ghana by commissioning new mines, enhancing its position as the leading gold producer in Africa. Its new Cardinal Namdini mine is expected to yield around 350,000oz of gold annually.

- In August 2024, RG Gold collaborated with Park of Innovative Technologies to present new IT solutions for gold mining. The joint industrial tour with the autonomous cluster fund aims to incorporate Kazakhstan IT companies in demonstrating advanced solutions for implementation in the enterprise.

- Report ID: 6806

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gold Mining Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.