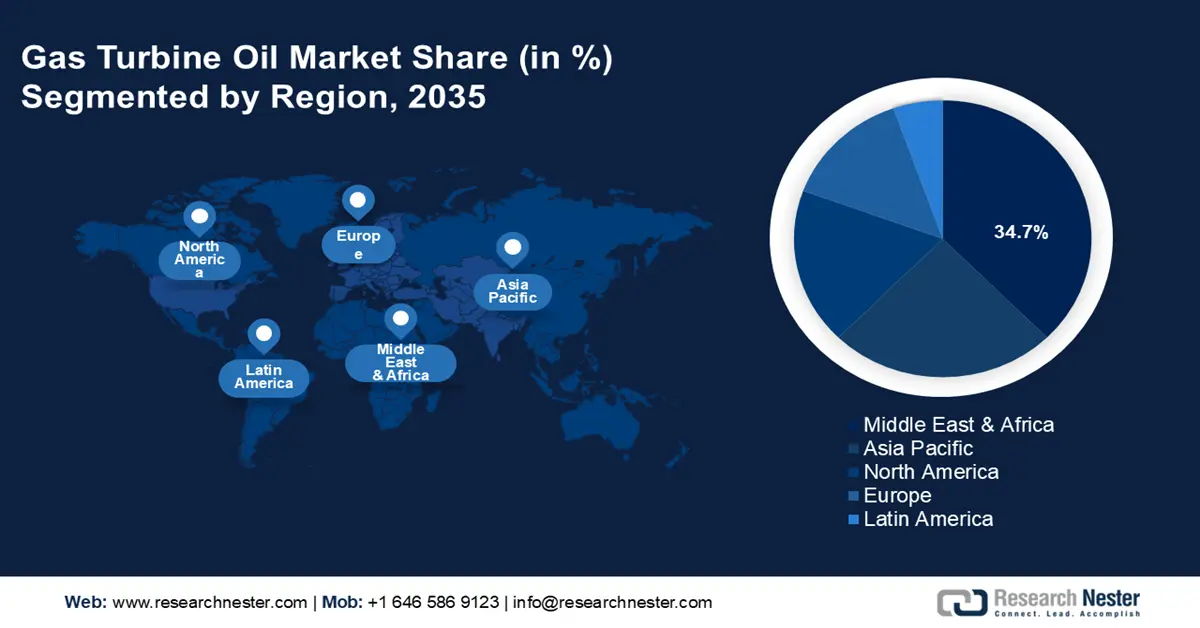

Gas Turbine Oil Market Regional Analysis:

Middle East and Africa Market Insights

Middle East and Africa industry is anticipated to account for largest revenue share of 34.7% by 2035. The market growth can be attributed to a strong emphasis on oil and gas and growing energy demand. Significant investments in infrastructure development, aligned with the drive to diversify energy sources by incorporating natural gas and renewables, significantly shaping the industry landscape.

Saudi Arabia is investing in updating its power generation capacity to satisfy the rising need for electricity and lessen carbon emissions will boost industry potential. For instance, compared to 2019 when consumption was 288,713 GWh, electrical energy consumption climbed by 0.21% in 2020 to reach 289,333 GWh in the nation. Large-scale industrial projects and the need for more environmentally friendly and effective power production options support the sector even more.

APAC Market Insights

Asia Pacific gas turbine oil market is expected to gain a significant share by the end of 2035. The market is growing in the region owing to the increased programs for renewable sources, increased demand for wind and hydro energy generation, and urbanization. UN-Habitat stated that over 2.2 billion people, or 54% of the world's metropolitan population, reside in Asia Pacific. The region’s urban population is predicted to increase by 50% by 2050, adding 1.2 billion new residents. Furthermore, the growth prospects for gas turbine oil are expected to be enhanced due to the increasing use of turbine oil in wind turbines, steam turbines, and other energy-generating projects.

In China, rapid industrialization and urbanization have upsurged the energy demand, and demand for clean energy technologies such as renewable energy is propelling the growth of the gas turbine oil market. According to the Climate Cooperation China, the nation’s energy supply was more secure in 2022 due to renewable energy, which accounted for 2,700 TWh, or 31.6% of the nation's electrical consumption, a growth of 1.7% annually.

The growth of India's economy has resulted in higher power demand, leading to a rise in the use of gas turbines. According to the India Development Update (IDU), India's GDP expanded at a fast rate of 8.2% in 2023-2024, making it the largest economy in the world.