Gas Turbine Oil Market Outlook:

Gas Turbine Oil Market size was over USD 1.94 billion in 2025 and is anticipated to cross USD 3.22 billion by 2035, growing at more than 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gas turbine oil is assessed at USD 2.03 billion.

The gas turbine oil market is expanding owing to the surge in electricity demand and the increased expansion of clean & reliable power generation capacities. The International Energy Agency (IEA) reported that by 2026, almost half of the electricity generated worldwide is anticipated to come from low-emission sources, up from slightly less than 40% in 2023. By early 2025, renewables are expected to surpass coal as the primary source of power generation, accounting for almost one-third of the total. These oils are necessary for gas turbines widely utilized in power plants, aircraft, and industrial uses, to run smoothly and efficiently.

The market has been in a constant state of reform as several end user operational pitfalls and challenges are being addressed. Varnish and sludge formations have a long history in machinery, but in recent times it has taken center stage and the principal reason behind the noticeable increase in sludge formation is the use of traditional Group I base oils. Heavy duty industries are transitioning toward advanced Group II and Group III base oils with effective antioxidant properties. The switch has facilitated the operation of gas turbines with oxidative and thermal stability and new added-performance capabilities.

Furthermore, the fast-growing market for power generation underscores the importance of focusing on this category, thus, positively impacting crude oil manufacturing and companies are capitalizing on this trend. Earlier this year, Petrobras announced that it would charter approximately 200 OSVs by 2028 to increase the fleet. Meanwhile, the company launched ROV support vessels to charter 12 locally built units. In September 2024, it mulled its market position with the launch of a lubrication plant in Rio de Janeiro, marking another milestone in its turbine oil production.

Gas turbines use case was pioneered with the development of aeronautical jet engines. Owing to their outstanding operational capabilities in the peak load range, they are now a crucial component in an array of industrial applications. Gas turbines are typically used in the electrical and power generation sector along with the oil and gas industry. The market has opened up new opportunities for additive manufacturers, allowing the use of 3D metal printing to develop gas turbine engines. Aurora Labs (A3D) has progressed the innovation of a 200N Class micro gas turbine using 3D printing. A3D managed to consolidate 18 components of the engine into a single printed part, which reduced its weight by 20%. The penetration of technology, implored by the rising demand for cost-effective and energy-efficient gas turbines is fostering gas turbine oil market growth.

Key Gas Turbine Oil Market Insights Summary:

Regional Highlights:

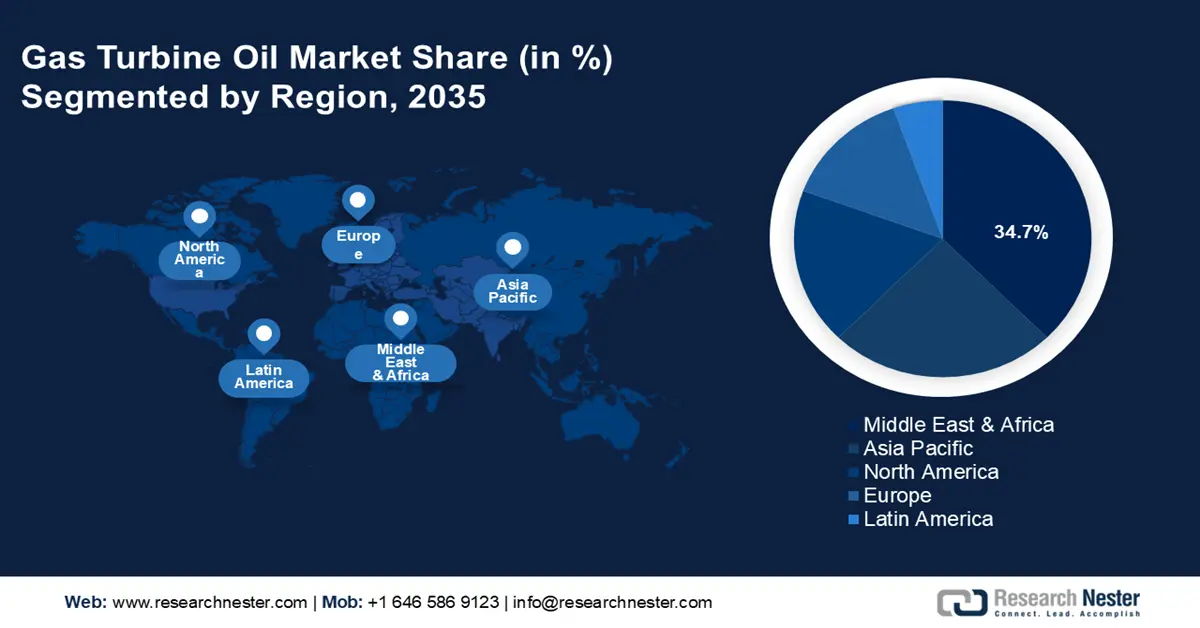

- Middle East & Africa's gas turbine oil market will account for 34.70% share by 2035, attributed to emphasis on oil & gas and infrastructure investments to diversify energy sources.

- Asia Pacific market will account for significant revenue share by 2035, driven by urbanization and renewable energy programs boosting turbine oil demand in the region.

Segment Insights:

- The industrial segment in the gas turbine oil market is anticipated to achieve an 86% share by 2035, fueled by global energy needs and the shift toward renewable electricity sources.

- The mineral oil-based segment in the gas turbine oil market is expected to hold a 50.10% share by 2035, attributed to reliability in older turbine systems and investments in power infrastructure.

Key Growth Trends:

- Increased stringent emission regulations

- Advancements in gas turbine technology

Major Challenges:

- Volatile raw material prices

- High operational and maintenance costs

Key Players: Afton Chemical Corporation, BP plc, Chevron U.S.A. Inc., ExxonMobil Corporation, GE Vernova Inc., NYCO SA, Kluber Lubrication, Shell plc, Phillips 66, TotalEnergies.

Global Gas Turbine Oil Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.94 billion

- 2026 Market Size: USD 2.03 billion

- Projected Market Size: USD 3.22 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Middle East & Africa (34.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Russia, Thailand

Last updated on : 18 September, 2025

Gas Turbine Oil Market Growth Drivers and Challenges:

Growth Drivers

- Increased stringent emission regulations: The need for gas turbine oil is driven by strict pollution standards. Gas turbines produce fewer emissions compared to other power plants, such as coal-fired plants, making them a preferable choice for nations such as Europe and Japan that have stringent environmental laws. For instance, the EU electricity industry is anticipated to make one of the biggest contributions to climate mitigation by 2030 and serve as a keystone for the Union to achieve net carbon neutrality by 2050.

Moreover, the market for gas turbine oil is expanding due to the growing use of gas turbines in various sectors. Numerous industries, including the oil and gas and maritime sectors, use gas turbines due to their minimal emissions and excellent efficiency. - Advancements in gas turbine technology: End users prioritize equipment dependability and effectiveness, which presents huge growth prospects for companies. Real-time monitoring of gas turbines, identification of possible problems, and performance optimization are made possible by sophisticated sensors, data analytics, and machine learning algorithms. Predictive maintenance techniques reduce downtime, increase overall operating efficiency, and prolong the life of gas turbines.

Also, these oils offer vital advantages that improve the industry perspective by protecting against corrosion, foaming, and deposit formation. Therefore, the gas turbine oil industry will continue to grow due to ongoing research and development in these turbines, becoming more environmentally friendly, efficient, and flexible in response to changing energy demands. - Shift towards eco-friendly lubricants: The demand for more adaptable and efficient gas turbines is driven by the expansion of renewable energy sources and the requirement for grid stability. This has increased the use of specialist lubricating systems that can survive harsh working environments. Furthermore, strict environmental laws encourage the development of novel gas turbine oil compositions and the uptake of biodegradable and environmentally friendly lubricants.

Also, major airline businesses are opting for these lubricants due to their effectiveness and eco-friendliness, fueling the market expansion. For instance, in June 2023, NYCO announced that PLAY, a new Icelandic low-cost airline that operates flights between North America and Europe, had chosen Turbonycoil 600, a synthetic standard turbine oil, to lubricate the engines of its entire fleet of A320neo and A321neo powered by LEAP-1A.

Challenges

- Volatile raw material prices: The production of gas turbine oil heavily depends on mineral oils, fluctuations in mineral oil prices directly impact the production cost for gas turbine oil manufacturers. Also, natural disasters and geopolitical conflicts are other two major causes that may disrupt supply chains, leading to price increases and material shortages. Therefore, the fluctuating raw material prices may hinder the growth of the gas turbine market.

- High operational and maintenance costs: High heat temperature exposure can cause formulation changes and hazards, which raises the cost of operation and maintenance. Moreover, the turbine oil business expects a significant growth challenge and slowdown since the production of gas turbines necessitates high-cost capital and direct-drive technology, which raises costs and expensive hardware and software utilities.

Gas Turbine Oil Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 1.94 billion |

|

Forecast Year Market Size (2035) |

USD 3.22 billion |

|

Regional Scope |

|

Gas Turbine Oil Market Segmentation:

End use Segment Analysis

The industrial segment in the gas turbine oil market is poised to garner the largest revenue share of 86% during the forecast period. Modern turbine oils with improved performance and reduced environmental effects are increasing in demand as energy solutions become eco-friendly and more efficient. The need for power generation and electricity globally has been steadily growing, which has improved the business outlook. The expansion of this segment will be additionally impacted by the widespread incorporation of renewable energy sources, such as solar and wind power, on a global scale.

Product Segment Analysis

The mineral oil-based gas turbine oil segment in the gas turbine oil market is likely to hold the second-largest share of 50.1% by 2035. Due to their dependable performance in several gas turbine applications—especially in older, less demanding systems—these lubricants have long been preferred. The industrial outlook will improve with increased investments in infrastructure for electricity generation, especially in emerging markets due to increased energy demand. According to the National Infrastructure Pipeline 2019-2025, projects in the energy sector accounted for the largest portion (24%) of the overall projected capital expenditure of USD 1.4 trillion in India. ​ Moreover, the segment growth will be further supported by growing consumer knowledge of the advantages of premium turbine oils and the significance of routine equipment maintenance.

Our in-depth analysis of the gas turbine oil market includes the following segments

|

Product |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gas Turbine Oil Market Regional Analysis:

Middle East and Africa Market Insights

Middle East and Africa industry is anticipated to account for largest revenue share of 34.7% by 2035. The market growth can be attributed to a strong emphasis on oil and gas and growing energy demand. Significant investments in infrastructure development, aligned with the drive to diversify energy sources by incorporating natural gas and renewables, significantly shaping the industry landscape.

Saudi Arabia is investing in updating its power generation capacity to satisfy the rising need for electricity and lessen carbon emissions will boost industry potential. For instance, compared to 2019 when consumption was 288,713 GWh, electrical energy consumption climbed by 0.21% in 2020 to reach 289,333 GWh in the nation. Large-scale industrial projects and the need for more environmentally friendly and effective power production options support the sector even more.

APAC Market Insights

Asia Pacific gas turbine oil market is expected to gain a significant share by the end of 2035. The market is growing in the region owing to the increased programs for renewable sources, increased demand for wind and hydro energy generation, and urbanization. UN-Habitat stated that over 2.2 billion people, or 54% of the world's metropolitan population, reside in Asia Pacific. The region’s urban population is predicted to increase by 50% by 2050, adding 1.2 billion new residents. Furthermore, the growth prospects for gas turbine oil are expected to be enhanced due to the increasing use of turbine oil in wind turbines, steam turbines, and other energy-generating projects.

In China, rapid industrialization and urbanization have upsurged the energy demand, and demand for clean energy technologies such as renewable energy is propelling the growth of the gas turbine oil market. According to the Climate Cooperation China, the nation’s energy supply was more secure in 2022 due to renewable energy, which accounted for 2,700 TWh, or 31.6% of the nation's electrical consumption, a growth of 1.7% annually.

The growth of India's economy has resulted in higher power demand, leading to a rise in the use of gas turbines. According to the India Development Update (IDU), India's GDP expanded at a fast rate of 8.2% in 2023-2024, making it the largest economy in the world.

Gas Turbine Oil Market Players:

- Afton Chemical Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BP plc

- Chevron U.S.A. Inc.

- ExxonMobil Corporation

- GE Vernova Inc.

- NYCO SA

- Kluber Lubrication

- Shell plc

- Phillips 66

- TotalEnergies

The leading companies in the gas turbine oil market are always looking for new approaches to enhance their offerings. To develop new, cutting-edge products, they are also investing in research and development. Due to the intense competition in the gas turbine oil market, businesses are striving to increase their market share. Some of the prominent players in the market include

Recent Developments

- In July 2024, GE Vernova Inc. announced that Korea Southern Power Co. Ltd. (KOSPO)'s Shinsejong Combined Cycle Power Plant has begun operations in Nuri-ri, Yeongi-myon, Sejong Multifunctional Administrative City, South Korea's administrative capital. The plant, which uses a 7HA.03 gas turbine from GE Vernova, is the first in South Korea and the 100th HA unit in the company's global fleet.

- In January 2020, ExxonMobil released the Mobil SHC 800 Ultra Series of high-performance turbine oils. These cutting-edge lubricants are made specially to increase the efficiency of combined cycle turbines, turbo compressors, steam, and gas applications—all of which operate in extremely harsh environments.

- Report ID: 6557

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gas Turbine Oil Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.