Gas Treating Amine Market Outlook:

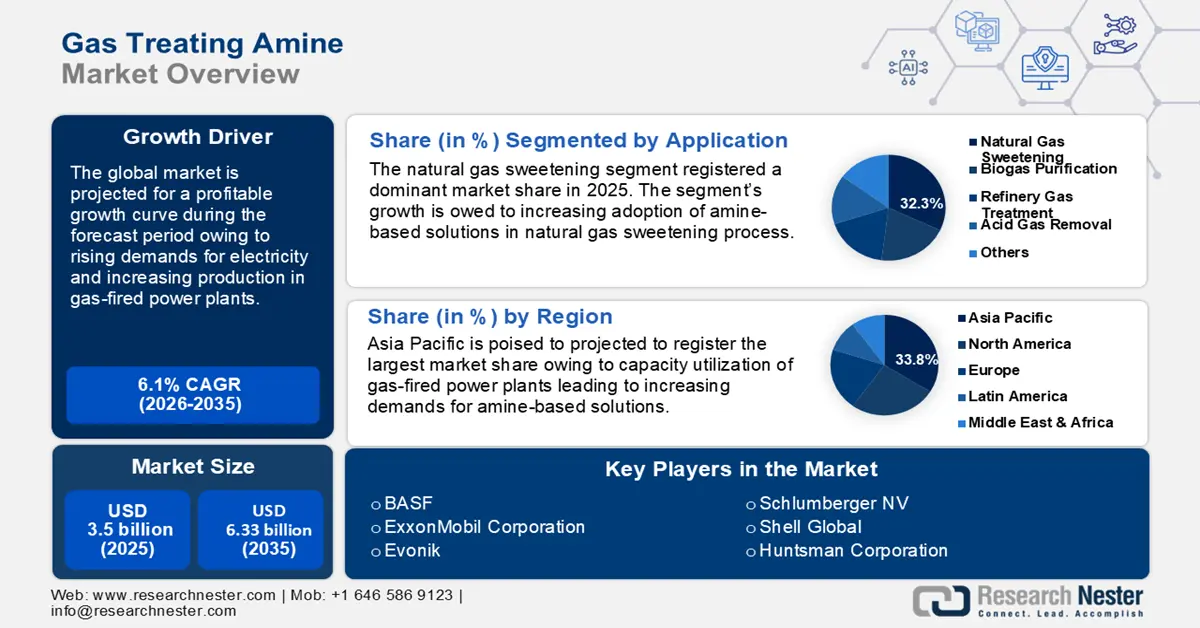

Gas Treating Amine Market size was over USD 3.5 billion in 2025 and is poised to exceed USD 6.33 billion by 2035, growing at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gas treating amine is estimated at USD 3.69 billion.

The gas treating amine market’s growth curve is attributed to rising demands for natural gas and the global push to reduce carbon footprint. In October 2024, the International Energy Agency (IEA) forecasted the global gas demand to rise more than 2.5% in 2024. The IEA expects the rise in demand to remain stable in 2025 with Asia leading in demand and Europe contributing to the surge. Despite the fragile balance between demand and supply for natural gas, the gas treating anime market is projected to benefit enormously from the surge in demand.

The rapid expansion of industrial and power sectors in emerging economies drives demands for gas treating technologies that can reduce carbon footprint and comply with stringent environmental regulations. Amine-based gas treatment has large-scale applications in oil and gas industries to remove contaminants such as carbon dioxide (CO2) and hydrogen sulfide (H2s). Additionally, the surge in global demand for electricity correlates with the increase in production from gas-fired power plants that require amine-based gas treatment, fueling the market’s robust growth. For instance, the IEA forecasts global electricity demand to surge by 3.4% annually from 2024 to 2026. Global Energy Monitor’s Global Oil and Gas Plant Tracker (GOGPT) estimated the capacity of oil and gas-fired power stations under development globally to have grown by 90 GW (13%) in July 2023. The trends of growth in gas plants are positioned to fuel the gas treating amine market’s growth by the end of the forecast period.

The gas treating amine market presents opportunities to key players through innovations in gas processing technologies as global consumers as well as organizations push for renewable energy solutions. Key market players are positioned to benefit from the surge in demands for high-performance amines that can efficiently capture and treat CO2 emissions. The rise of biogas and syngas production opens new segments for amine-based solutions. For instance, in June 2023, Imerys reported the construction of a new onsite recovery plant in Belgium that can turn syngas into electricity. The continued expansion of the gas sector is poised to continue offering opportunities for global and local gas treating amine market players in the gas treating amine sector.