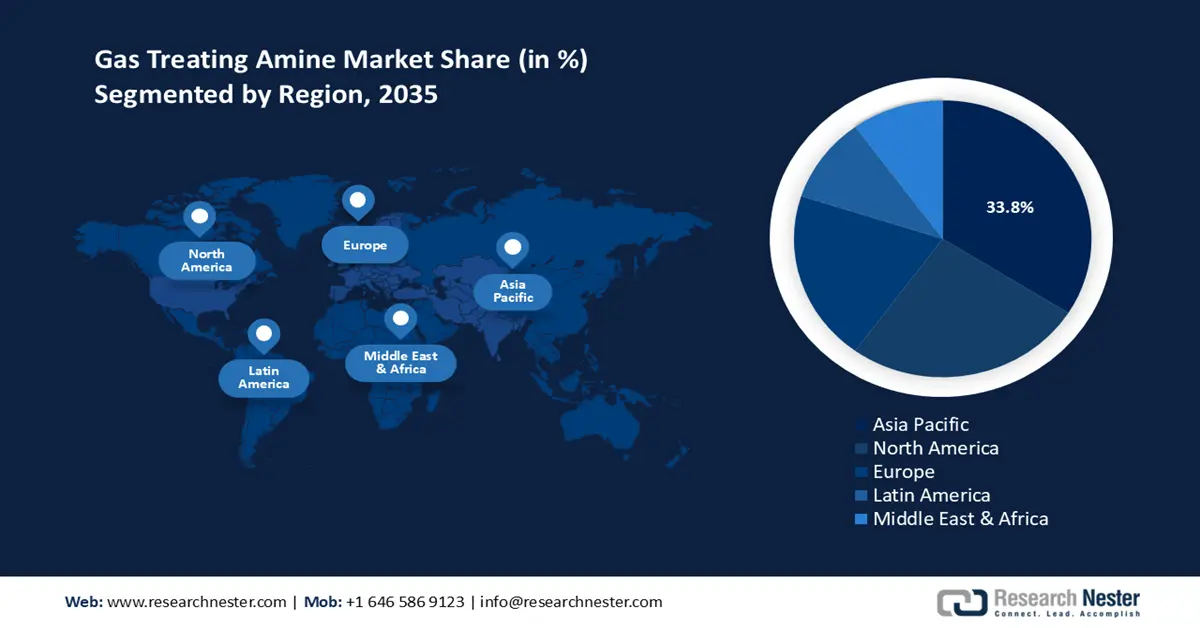

Gas Treating Amine Market Regional Analysis:

APAC Market Forecast

Asia Pacific gas treating amine market is expected to capture revenue share of over 33.8% by 2035. The market’s robust growth is attributed to rising demands for natural gas in countries such as China, India, and Southeast Asia. The growing liquefied natural gas sector in APAC contributes to the rise in demand for amine-based solutions to combat emissions of GHGs. For instance, the IEA estimates the global gas demand to grow by 2.5% in 2024 owing to the expected colder winter in 2024 increasing demands for space heating. The global fall in natural gas prices will also boost the recovery in gas demands. IEA’s report estimated a higher gas burn in the Asia Pacific that will enable the growing adoption of amine-based treatments in the region.

China is projected to dominate the gas treating amine market share in Asia Pacific. For instance, IEA reported that China was the global leader in LNG imports in 2023 while demand grew by 7%. The large-scale LNG imports correlate with the increasing demand for electricity in the country. For instance, the IEA 2024 Executive Summary estimates the electricity demand of China to have grown by 6.4% in 2023 and experienced a minor slowdown with a 5.1% increase in 2024. The per capita electricity consumption in the country is higher than in the European Union. This creates a continuous demand for electricity leading to greater production work in gas-powered plants that necessitates advanced amine-based treatment solutions. Additionally, the construction of new gas-powered plants in the country is poised to provide new opportunities for manufacturers to provide amine-based solutions. For instance, in July 2024, GE Vernova announced the beginning of commercial operation of the CHP plant in Huizhou, China.

India is projected to increase its market share by the end of the forecast period in the APAC gas treating amine market. The growth in the country is attributed to investments in new gas-fired plants and the imposition of environmental regulations to curb GHG gases that increase the adoption of amine-based treatments. A major driver of the gas treating amine market is the intense heat wave in the region that has increased the capacity utilization of gas-fired plants in India. For instance, in May 2024, power plants in Goa, India reported a plant load factor (PLF) of 28.7% due to rising demands for cooling solutions.

Additionally, the demand for natural gas has increased in the country to cater to rising power demands. The IEA reported that in 2022, domestic gas production had a 54.7% share while imports had a 45.3% share. The increasing dependency on natural gas to produce electricity to cater to surging demands is poised to create a steady need for amine-based treatment solutions. Local and global manufacturers and distributors in the country are positioned to offer new formulations of amine-based solutions to offer advanced gas sweetening solutions to boost the market’s growth.

North America Market Analysis

The gas treating amine market in North America is projected to have the fastest growth during the forecast period. The rapid growth is attributed to the large-scale production and consumption of natural gas. The U.S. and Canada lead the market growth in North America. For instance, the Global Oil and Gas Plant Tracker (GOGPT) reported in 2024, that 556728 oil and gas plants were currently operational in the U.S. while 34731 were in development or under construction. In Canada, GOGPT reported 26389 oil and gas plants to be operational and 7042 under construction. The large numbers of oil and gas plants lead to surging demands for amine-based treatments as the region looks to cut down on GHG emissions, leading to the growth surge of the gas treating amine market.

The U.S. leads the profit share in North America owing to the country’s position as the largest exporter of natural gas globally along with being the largest producer of natural gas domestically. This positions the country to have lucrative opportunities in the gas treating amine market owing to a large number of gas-fired plants requiring novel treatment solutions. U.S. has been actively pushing for a reduction in GHG emissions owing to the country ranking second in CO2 emissions globally behind China. In July 2024, the U.S. Environmental Protection Agency estimated the power sector in the country to be the second largest source of GHG emissions. T

he presence of multiple gas-fired power plants and the increasing percentage of GHG emissions is necessitating the rapid adoption of amine-based solutions. Key market players in the country are positioned to provide innovative treatment solutions to increase their profit share by the end of the forecast period.

Canada is projected to increase its revenue share by the end of the forecast period. The growth is attributed to the large-scale use of natural gas for the power sector leading to growing demands for gas treatment solutions. For instance, in June 2024, the Canada Energy Regulator estimated natural gas production in the country to have hit a record high in 2023 as production reached 18.8 Bcf/d. Higher capacity utilization of gas-fired plants boosts demand for amine-based solutions in the market. The IEA estimates a 40.8% share of gas in the energy supply of Canada in 2023 accounting for a 63% increase from 2000 to 2023. With an increasing dependency on natural gas for energy solutions, the gas treating amine market is projected to maintain its robust growth.