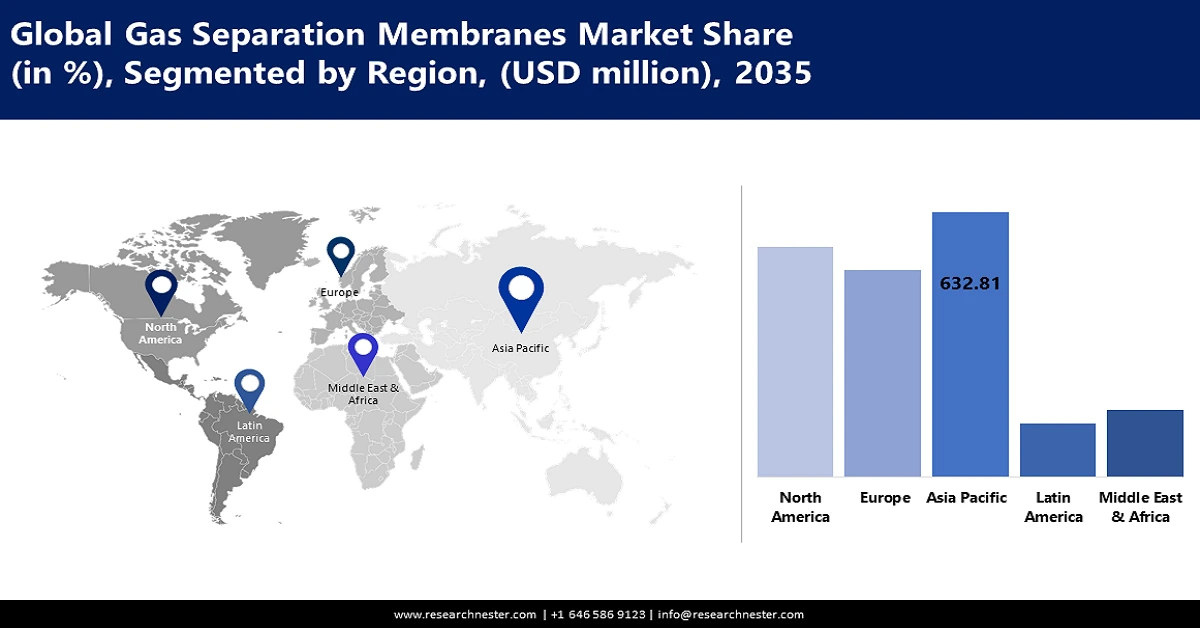

Gas Separation Membrane Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is expected to account for largest revenue share of 41% by 2035, driven primarily by rapid industrialization stakes, increased apprehensions about environmental sustainability, and the rise in demand for cleaner energy sources in the region. This can be attributed to an upsurge in manufacturing sectors, government efforts, and stringent set emissions limits in countries such as China, Japan, India, and South Korea. Furthermore, market growth can be propelled by increased utilization of gas separation membrane for biogas upgrading and carbon capture and storage activities within the area.

India's gas separation membrane market is projected to surge due to the rising demand for gas separation membrane propelled by growing investments in renewable energy and the high-purity industrial gases required. Additionally, expanding pharmaceutical and chemical sectors and rapidly rising usage of gas separation membrane in biogas purification & nitrogen generation are other factors contributing towards expansion. In May 2024, the Government of India declared that they would increase spending on green hydrogen manufacturing. As a result, this move will create immense opportunities for manufacturers and suppliers in India.

China is anticipated to lead with a considerable share of the gas separation membrane market in Asia Pacific. Stringent emission norms in the country, a growing focus on energy efficiency, and increasing investments in CCS technologies are boosting demand for products in different applications. The deployment of gas separation membrane is growing for processing and refining natural gas.

Air Liquide inaugurated a high-performance manufacturing site in August 2023 in Penglai, Yantai. With a unit-sized manufacturing capability, this infrastructure will contribute significantly to developing a job presence locally and incrementally enhancing operational efficiency in China.

North America Market Insights

North America region is poised to witness substantial growth through 2035. This growth can be attributed to increasing focus on CC and storage technologies, stringent environmental regulations to cut GHG emissions, and increasing demand from several industries for high-purity gases. The presence of an established oil and gas industry and the increasing use of gas separation membrane in biogas upgrading applications are likely to drive market growth further.

The U.S. accounts for the largest share of North America's gas separation membrane market. This is driven by abundant natural gas reserves and a growing concern over the reduction of carbon emissions from power plants and industrial facilities of gas separation membrane in applications including, nitrogen generation, hydrogen recovery, and carbon dioxide removal.

For instance, Osmoses Inc. was granted USD 11.0 million in funding to decarbonize its novel technology for gas separation membrane in October 2023. Such an investment will be channeled toward the development of industrial-size membrane modules for deployment in the field, underlining Osmoses Inc.'s commitment to developing sustainable solutions in the gas separation industry. This launch is one of several recent examples of industry commitment to innovation and the ability to meet new demands with new products.

Canada is anticipated to contribute significantly to North America's gas separation membrane market. The growth has been influenced by its large oil and gas reserves, a growing petrochemical industry, and rising investments in clean energy technologies. The market is anticipated to rise further, driven by efforts to reduce methane emissions from its oil and gas operations and the increasing adoption of gas separation membrane in hydrogen production and carbon capture.

In November 2023, the Canadian government announced a massive investment in the development of large-scale CCS projects in Alberta. This can create significant opportunities for gas separation membrane manufacturers and their suppliers.