Gas Separation Membranes Market

- Project Objective

- Project Description

- Research Methodology

- Executive Summary

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Incremental $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Region, Value (USD Million)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Material Type, Value (USD Million)

- Cross-Analysis of application w.r.t. material type

- Competitive Landscape

- DROT

- Gas Separation Membranes Application Outlook

- Patent Analysis

- Material Type Analysis

- Carbon Capture & Storage Industry Outlook

- Gas Separation Membranes Market Impact on Carbon Capture & Storage Industry

- Case Study Analysis

- Technological Advancement Analysis

- Biogas Industry Outlook

- Gas Separation Membranes In Biogas Industry

- Emerging Material in Gas Separation Membranes Market

- Regional Demand Analysis

- Country Wise Pricing Analysis

- Global Overview

- North America Gas Separation Membranes Market

- North America Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Incremental $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Country, Value (USD Million)

- U.S.

- Canada

- Material Type, Value (USD Million)

- U.S. Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Incremental $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Canada Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Incremental $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- North America Overview

- Europe Gas Separation Membranes Market

- Europe Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Incremental $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Europe Overview

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Country, Value (USD Million)

- U.K.

- Germany

- France

- Italy

- Spain

- NORDIC

- Rest of Europe

- Cross-Analysis of Application w.r.t. Material Type

- Material Type, Value (USD Million)

- U.K. Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in the U.K.

- Government Regulation: How Would They Aid Market Growth?

- Market Share in the U.K. – By Material Type

- Biogas Production in the U.K.

- Natural Gas Production in the U.K.

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- U.K. Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Germany Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Germany

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Germany – By Material Type

- Biogas Production in Germany

- Natural Gas Production in Germany

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Germany Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- France Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in France

- Government Regulation: How Would They Aid Market Growth?

- Market Share in France – By Material Type

- Biogas Production in France

- Natural Gas Production in France

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- France Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Italy Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Italy

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Italy – By Material Type

- Biogas Production in Italy

- Natural Gas Production in Italy

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Italy Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Spain Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Spain

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Spain – By Material Type

- Biogas Production in Spain

- Natural Gas Production in Spain

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Spain Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- NORDIC Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in NORDIC

- Government Regulation: How Would They Aid Market Growth?

- Market Share in NORDIC – By Material Type

- Biogas Production in NORDIC

- Natural Gas Production in NORDIC

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- NORDIC Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Asia Pacific Gas Separation Membranes Market

8.1 Asia Pacific Overview- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Country, Value (USD Million)

- China

- India

- Japan

- Indonesia

- Malaysia

- Thailand

- Australia

- Singapore

- South Korea

- Philippines

- Mongolia

- Rest of Asia Pacific

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- China Overview

- Market Value (USD Million), Current and Future Projections (2024–2037)

- Incremental $ Opportunity Assessment (2024–2037)

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in China

- Government Regulation: How Would They Aid Market Growth?

- Market Share in China – By Material Type

- Biogas Production in China

- Natural Gas Production in China

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- China Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- India Overview

- Market Value (USD Million), Current and Future Projections (2024–2037)

- Incremental $ Opportunity Assessment (2024–2037)

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in India

- Government Regulation: How Would They Aid Market Growth?

- Market Share in India – By Material Type

- Biogas Production in India

- Natural Gas Production in India

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- India Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Japan Overview

- Market Value (USD Million), Current and Future Projections (2024–2037)

- Incremental $ Opportunity Assessment (2024–2037)

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Japan

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Japan – By Material Type

- Biogas Production in Japan

- Natural Gas Production in Japan

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Japan Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Indonesia Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Indonesia

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Indonesia – By Material Type

- Biogas Production in Indonesia

- Natural Gas Production in Indonesia

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Indonesia Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Malaysia Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Malaysia

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Malaysia – By Material Type

- Biogas Production in Malaysia

- Natural Gas Production in Malaysia

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Malaysia Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Singapore Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Singapore

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Singapore – By Material Type

- Biogas Production in Singapore

- Natural Gas Production in Singapore

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Singapore Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Thailand Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Thailand

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Thailand – By Material Type

- Biogas Production in Thailand

- Natural Gas Production in Thailand

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Thailand Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Australia Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Australia

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Australia – By Material Type

- Biogas Production in Australia

- Natural Gas Production in Australia

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Australia Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- South Korea Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in South Korea

- Government Regulation: How Would They Aid Market Growth?

- Market Share in South Korea – By Material Type

- Biogas Production in South Korea

- Natural Gas Production in South Korea

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- South Korea Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Philippines Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Philippines

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Philippines – By Material Type

- Biogas Production in Philippines

- Natural Gas Production in Philippines

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Philippines Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Mongolia Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Mongolia

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Mongolia – By Material Type

- Biogas Production in Mongolia

- Natural Gas Production in Mongolia

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Mongolia Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Latin America Gas Separation Membranes Market

- Latin America Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Incremental $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- By Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- By Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Country, Value (USD Million)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Cross-Analysis of Application w.r.t. Material Type

- By Material Type, Value (USD Million)

- Brazil Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Incremental $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- By Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- By Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- By Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Brazil

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Brazil – By Material Type

- Biogas Production in Brazil

- Natural Gas Production in Brazil

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Brazil Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Mexico Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Incremental $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- By Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- By Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- By Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Mexico

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Mexico – By Material Type

- Biogas Production in Mexico

- Natural Gas Production in Mexico

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Mexico Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Argentina Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Incremental $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- By Material Type, Value (USD Million)

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- By Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- By Material Type, Value (USD Million)

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Argentina

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Argentina – By Material Type

- Biogas Production in Argentina

- Natural Gas Production in Argentina

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Argentina Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Latin America Overview

- Middle East & Africa Gas Separation Membranes Market

- Middle East & Africa Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Country, Value (USD Million)

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Material Type, Value (USD Million

- Cross-Analysis of Application w.r.t. Material Type

- GCC Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in the GCC

- Government Regulation: How Would They Aid Market Growth?

- Market Share in the GCC – By Material Type

- Biogas Production in GCC

- Natural Gas Production in GCC

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- GCC Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- Israel Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million

- Cross-Analysis of Application w.r.t. Material Type

- Evolution of the Industry in Israel

- Government Regulation: How Would They Aid Market Growth?

- Market Share in Israel – By Material Type

- Biogas Production in Israel

- Natural Gas Production in Israel

- Comparative Market Share Analysis By Application

- Application Analysis

- Demand from the Hydrogen Recovery Segment

- Oil and Gas Industry Outlook

- Gas Separation Membranes Impact on Oil and Gas Industry

- Technological Advancement Analysis

- Current Project Analysis

- Israel Competitive Landscape

- Recent Developments By Key Players

- Industry Risk Assessment

- SWOT Analysis

- South Africa Overview

- Market Value (USD Million), Current and Future Projections, 2024–2037

- Increment $ Opportunity Assessment, 2024–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024–2037, By

- Material Type, Value (USD Million

- Polyimide & Polyamide

- Polysulfone

- Cellulose Acetate

- Cellulose Triacetate

- Others

- Application, Value (USD Million)

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- H2S Removal

- Vapor Separation

- Others

- Material Type, Value (USD Million

- Middle East & Africa Overview

- Global Economic Scenario

- About Research Nester

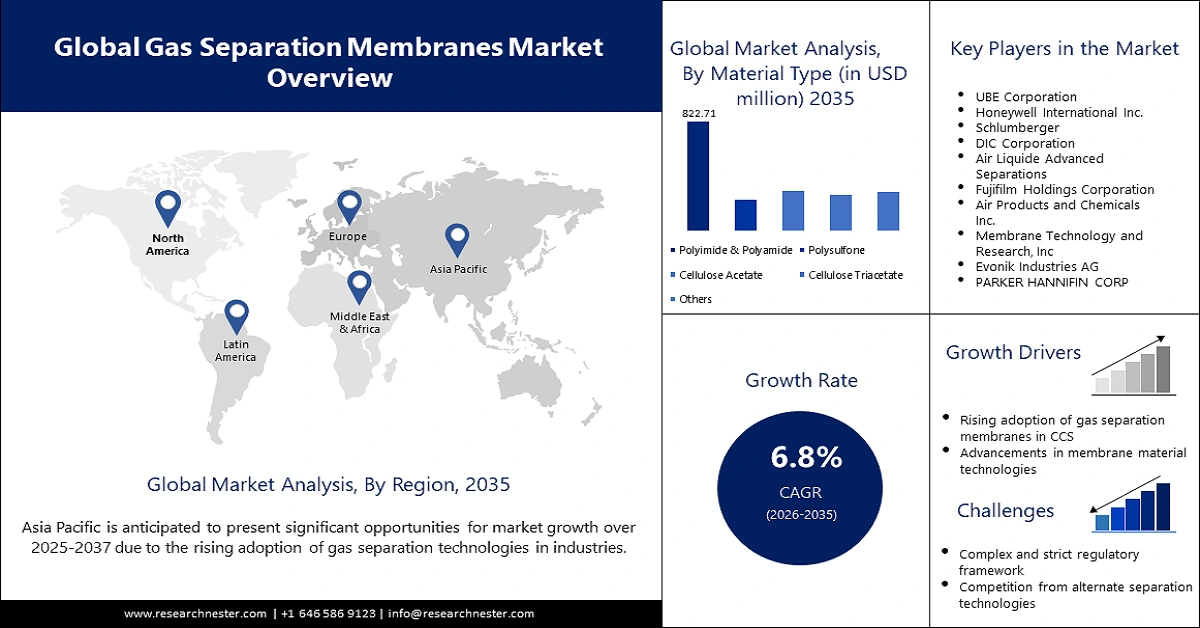

Gas Separation Membrane Market Outlook:

Gas Separation Membrane Market size was valued at USD 1.58 billion in 2025 and is likely to cross USD 3.05 billion by 2035, expanding at more than 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gas separation membrane is assessed at USD 1.68 billion.

The surge in demand for cleaner energy sources to mitigate greenhouse gas emissions is anticipated to boost the adoption of gas separation membrane. This represents a major opportunity for process developers and licensors looking to commercialize efficient and low-cost methods for gas separation technologies. For instance, in February 2023, Air Products Membrane Solutions introduced the state-of-the-art PRISM InertPro Nitrogen Membrane System to meet evolving customer requirements in the energy, oil, and gas industry.

Government regulations and initiatives also push the demand for gas separation membrane. Policies of various regions are creating an environment that encourages clean energy sources, and setting various targets has reduced GHF emissions. This set of policies is developing a favorable environment for gas separation membrane as companies try to comply with environmental standards and capitalize on incentives offered for sustainable practices. For example, the U.S. Department of Energy has crafted ambitious carbon capture, utilization, and storage goals by 2050. This initiative is foreseen to boost the demand for gas separation membrane in carbon-capturing applications.

Key Gas Separation Membrane Market Insights Summary:

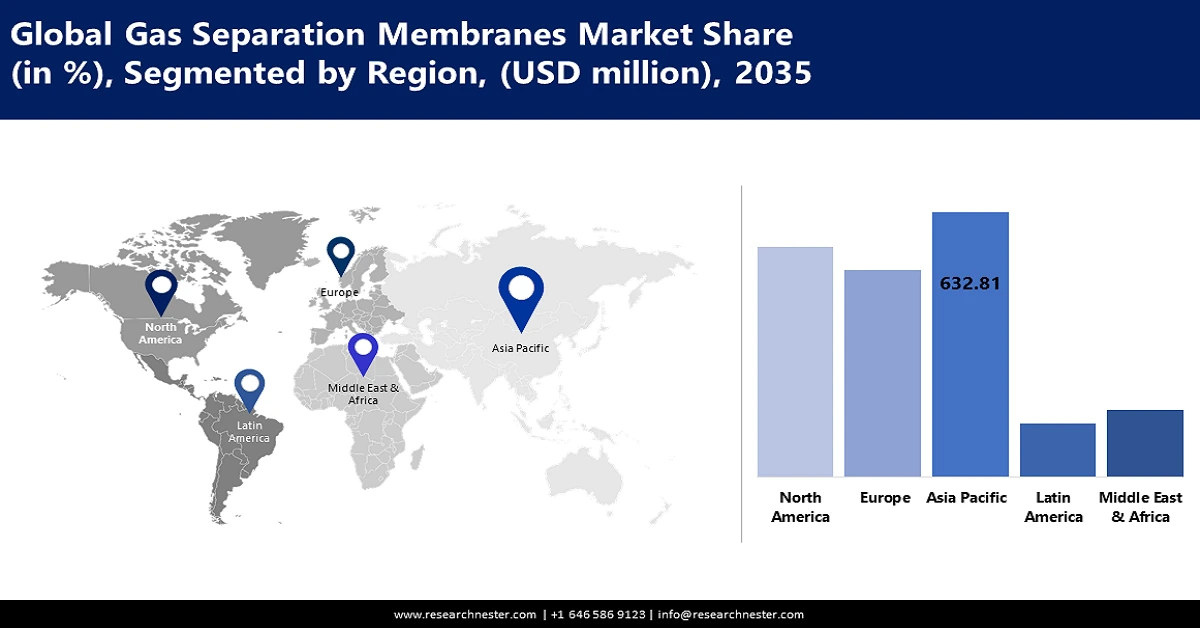

Regional Highlights:

- The Asia Pacific gas separation membrane market will dominate over 41% share, forecasted to grow by 2035, driven by rapid industrialization, government efforts, stringent emission limits, increased demand for cleaner energy sources, and rising investments in renewable energy and biogas upgrading.

- The Asia Pacific gas separation membrane market will command a 41% share, forecasted to grow by 2035, driven by rapid industrialization, government efforts, stringent emission limits, increased demand for cleaner energy sources, and rising investments in renewable energy and biogas upgrading.

Segment Insights:

- The polyimide & polyamide segment in the gas separation membrane market is expected to secure a 41.80% share by 2035, driven by their superior permeability and thermal stability for gas separation applications.

- The polyimide & polyamide segment in the gas separation membrane market is anticipated to capture a 41.80% share by 2035, driven by their superior permeability and thermal stability for gas separation applications.

Key Growth Trends:

- Growth in the use of gas separation membrane in carbon capture and storage (CCS)

- Advancements in membrane material technologies

Major Challenges:

- Complex and strict regulatory framework

- Competition from alternate separation technologies

Key Players: UBE Corporation, Honeywell International Inc., Schlumberger, DIC Corporation, Air Liquide Advanced Separations, Fujifilm Holdings Corporation, and Air Products and Chemicals Inc.

Global Gas Separation Membrane Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.58 billion

- 2026 Market Size: USD 1.68 billion

- Projected Market Size: USD 3.05 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Gas Separation Membrane Market Growth Drivers and Challenges:

Growth Drivers:

- Growth in the use of gas separation membrane in carbon capture and storage (CCS): Rising concerns for greenhouse emissions (GHG) emissions are raising the adoption rate of CCS. As such, it rapidly becomes one of the most critical technologies to mitigate climate change. Companies are collaborating with a view to alleviate these concerns. For instance, in October 2022, Linde and SLB announced their strategic collaboration to further advance carbon capture, utilization, and storage projects. The joint venture brings together several decades of carbon capture and sequestration expertise, blending innovative technology portfolios with project development and execution capabilities, besides EPC expertise.

- Advancements in membrane material technologies: Research on the membrane materials domain has been constantly in process to achieve better selectivity, permeability, and durability. These innovations make the application scope of gas separation membrane much broader and more competitive against conventional separation techniques. In April 2021, Toray Industries, Inc. announced a breakthrough CO2 separation membrane with a dual-all-carbon structure. CO2 separation technology is crucial in applying CO2 to actualize a circular carbon economy. Such technology developments that use absorption- and adsorption-based facilities drive gas separation membrane market growth, creating opportunities for new players.

Challenges:

- Complex and strict regulatory framework: The gas separation membrane industry is governed by several legislation and standards related to safety, emissions, and the protection of the environment. For instance, in November 2023, the Industrial Emissions Directive of the European Union set threshold limit values for preventing and controlling significant accidents involving various types of pollutants, including those that can be controlled through gas separation membrane. Compliance can be time-consuming, sometimes challenging, and difficult for SMEs to navigate appropriately.

- Competition from alternate separation technologies: Gas separation membrane must compete with independently developed separation technologies, including cryogenic distillation and absorption. Most of these competing technologies have more considerable capital costs but can offer the advantages of greater scalability and efficiency in some applications.

Gas Separation Membrane Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 1.58 billion |

|

Forecast Year Market Size (2035) |

USD 3.05 billion |

|

Regional Scope |

|

Gas Separation Membrane Market Segmentation:

Material Type Segment Analysis

By material type, the polyimide and polyamide segment is estimated to dominate the gas separation membrane market with a 41.8% share by the end of the forecast period. The high selectivity, permeability, and thermal stability enable these membranes in nitrogen generation, hydrogen recovery, and natural gas sweetening processes. For example, Membrane Technology and Research Inc. built the world’s largest carbon capture plant based on membrane at Gillette, Wyoming in September 2023. Through this expansionary effort alone, it is estimated that more than 150 tons of CO2 could be captured using the new membrane.

Application Segment Analysis

Nitrogen generation and oxygen enrichment segment is poised to dominate over 22.3% gas separation membrane market share by 2035. This growth may be attributed to the increasing need for oxygen and nitrogen purity in industries including, food & beverage, pharmaceuticals, and electronics industries, among others. Furthermore, advancements in membrane technology increases the efficiency of nitrogen production and oxygen produced through membrane and lowers economic mitigation expenses attributed to this part of growth. For example, Air Products and Chemicals Inc. announced its latest nitrogen membrane system specialized for the energy sector in February 2022.

Our in-depth analysis of the gas separation membrane market includes the following segments:

|

Material Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gas Separation Membrane Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is expected to account for largest revenue share of 41% by 2035, driven primarily by rapid industrialization stakes, increased apprehensions about environmental sustainability, and the rise in demand for cleaner energy sources in the region. This can be attributed to an upsurge in manufacturing sectors, government efforts, and stringent set emissions limits in countries such as China, Japan, India, and South Korea. Furthermore, market growth can be propelled by increased utilization of gas separation membrane for biogas upgrading and carbon capture and storage activities within the area.

India's gas separation membrane market is projected to surge due to the rising demand for gas separation membrane propelled by growing investments in renewable energy and the high-purity industrial gases required. Additionally, expanding pharmaceutical and chemical sectors and rapidly rising usage of gas separation membrane in biogas purification & nitrogen generation are other factors contributing towards expansion. In May 2024, the Government of India declared that they would increase spending on green hydrogen manufacturing. As a result, this move will create immense opportunities for manufacturers and suppliers in India.

China is anticipated to lead with a considerable share of the gas separation membrane market in Asia Pacific. Stringent emission norms in the country, a growing focus on energy efficiency, and increasing investments in CCS technologies are boosting demand for products in different applications. The deployment of gas separation membrane is growing for processing and refining natural gas.

Air Liquide inaugurated a high-performance manufacturing site in August 2023 in Penglai, Yantai. With a unit-sized manufacturing capability, this infrastructure will contribute significantly to developing a job presence locally and incrementally enhancing operational efficiency in China.

North America Market Insights

North America region is poised to witness substantial growth through 2035. This growth can be attributed to increasing focus on CC and storage technologies, stringent environmental regulations to cut GHG emissions, and increasing demand from several industries for high-purity gases. The presence of an established oil and gas industry and the increasing use of gas separation membrane in biogas upgrading applications are likely to drive market growth further.

The U.S. accounts for the largest share of North America's gas separation membrane market. This is driven by abundant natural gas reserves and a growing concern over the reduction of carbon emissions from power plants and industrial facilities of gas separation membrane in applications including, nitrogen generation, hydrogen recovery, and carbon dioxide removal.

For instance, Osmoses Inc. was granted USD 11.0 million in funding to decarbonize its novel technology for gas separation membrane in October 2023. Such an investment will be channeled toward the development of industrial-size membrane modules for deployment in the field, underlining Osmoses Inc.'s commitment to developing sustainable solutions in the gas separation industry. This launch is one of several recent examples of industry commitment to innovation and the ability to meet new demands with new products.

Canada is anticipated to contribute significantly to North America's gas separation membrane market. The growth has been influenced by its large oil and gas reserves, a growing petrochemical industry, and rising investments in clean energy technologies. The market is anticipated to rise further, driven by efforts to reduce methane emissions from its oil and gas operations and the increasing adoption of gas separation membrane in hydrogen production and carbon capture.

In November 2023, the Canadian government announced a massive investment in the development of large-scale CCS projects in Alberta. This can create significant opportunities for gas separation membrane manufacturers and their suppliers.

Gas Separation Membrane Market Players:

- UBE Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Schlumberger

- DIC Corporation

- Air Liquide Advanced Separations

- Fujifilm Holdings Corporation

- Air Products and Chemicals Inc.

- Membrane Technology and Research, Inc

- Evonik Industries AG

- PARKER HANNIFIN CORP

The gas separation membrane market demonstrates a competitive landscape including established players such as UBE Corporation, Honeywell International Inc., Evonik Industries AG, Air Products and Chemicals Inc., and Air Liquide Advanced Separations. Innovation amongst these leading companies is instigated through several strategic initiatives involving investments in research and development, new product launches, technological innovations, and collaborations.

For instance, Honeywell UOP announced a 40% increase in capacity at a gas separation membrane production facility in 2023 to capture rising demand. The development exemplifies the continuous initiatives of significant players toward improving efficiency and delivering solutions to suit the changing requirements across industries.

Here are some leading companies in the gas separation membrane market:

Recent Developments

- In July 2024, BORSIG GmbH announced that it had successfully installed and commissioned a hydrogen PSA plant in Stade, Germany. Its capacity of 20,000 Nm³/h houses state-of-the-art membrane technology for efficient hydrogen purification will help decarbonize the chemical industry.

- In December 2023, Sumitomo Chemical and OOYOO worked on a joint project to develop and demonstrate a sophisticated system for the separation and capture of CO2. This can be called one of the biggest milestones in carbon-capture technology, which is critical to reducing GHG emissions and arresting climate change. If this system is developed successfully, the implications will be huge for industries interested in reducing their carbon footprint.

- In March 2023, SLB launched hydrogen production technology to address the challenge of scaling up green hydrogen production. This new solution will have a huge impact on the renewable energy sector by providing a more efficient and scalable way for green hydrogen production.

- In January 2023, SPG Steiner GmbH further increased its collaboration with Evonik. Such cooperation increases sustainability in the chemical industry by decreasing dependency on fossil resources and enhancing general efficiency in production processes.

- Report ID: 3643

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gas Separation Membrane Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.