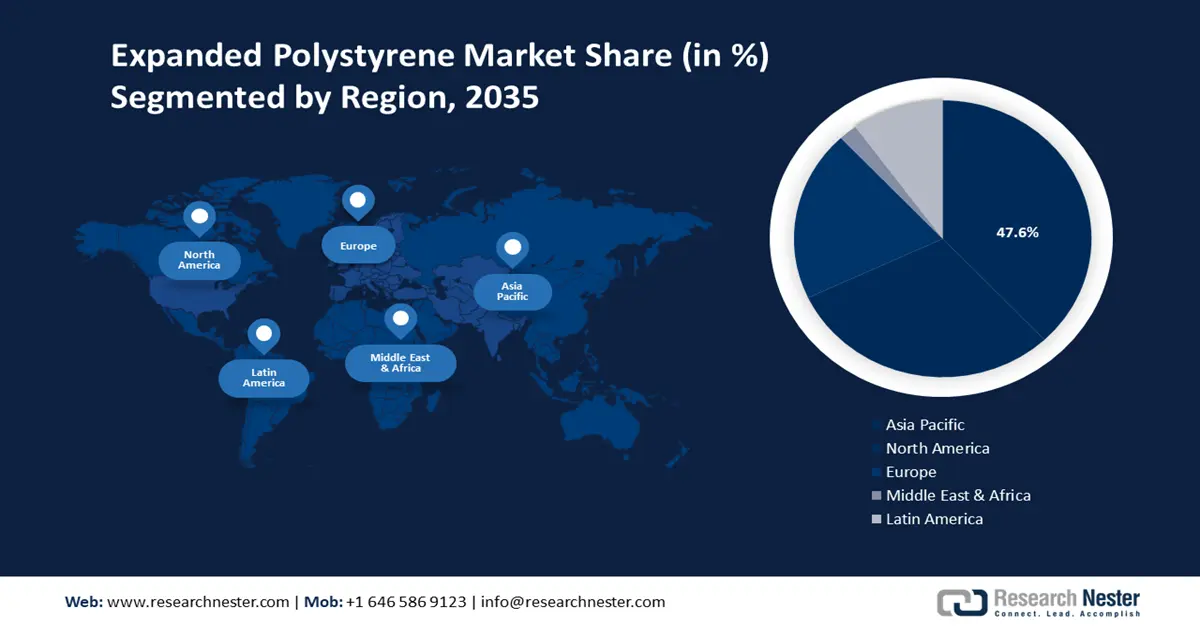

Expanded Polystyrene Market Regional Analysis:

Asia Pacific Market Insights

With a projected share of 47.6%, Asia Pacific is likely to continue dominance in the EPS market during the forecast period. Its rapid urbanization and industrial growth, especially in countries like China and India, have been driving significant demand for EPS in construction and packaging. This growth is also favored by extending infrastructure projects that emphasize energy-efficient building materials, thus supporting increased usage of EPS.

India’s e-commerce sector attained a gross merchandise value of USD 60 billion in FY 2023, which has shown an increase of 22% compared to the previous year. This demonstrates the fast-growing dependence on EPS for protective packaging, mainly for electronics and consumer goods that require cushioning against transport. Furthermore, the Society of Indian Automobile Association also reported that the auto industry in India produced close to 23 million vehicles from April 2021 to March 2022, a fact that has driven EPS to continue playing its vital role in protective packaging for auto parts and components.

In Japan, the second big market for EPS is the automotive sector, where a high requirement for light packaging and vibration absorption exists. According to the reports of the Japan Automobile Manufacturers Association (JAMA), in 2021 Japan produced about 7.8 million units of passenger cars and light vehicles. However, production went down compared with the 2020 level, which made companies take sustainable alternatives to meet the production gaps. For example, in February 2024, KleanNara Co. developed technologies of micro pellets of EPS, enabling full recycling of expanded polystyrene. This technology cuts greenhouse gas emissions by over 72% per kilogram of traditional EPS, an indication of the country’s stride towards eco-friendly solutions.

North America Market Insights

North America region is projected to register substantial growth through 2035 owing to increasing investments in sustainable infrastructure and eco-friendly construction practices. The U.S. Green Building Council emphasizes that buildings consume significant energy for heating, cooling, and lighting, and insulation plays a crucial role in energy conservation.

While being one of the biggest consumers, the U.S. is expected to show increased demand for packaging and construction materials that could stand in line with emerging ecological regulations. The strict regulations of the standards for green buildings will keep further expansion in the construction segment at a pace, especially in insulation and energy saving. Apart from this, initiatives to reduce single-use plastic will lead manufacturers toward the use of EPS to serve ecological packaging needs in specific industries such as electronics and food services.

Companies in Canada are also taking a step toward meeting gaps with innovations targeting more sustainable building materials. For example, in April 2023, Epsilyte LLC unveiled the launch of the new EPS product 124LR is SCS Global-certified, with up to 50% post-consumer recycled content to cater to the growing demand for sustainable building materials. This is one of the key examples of Epsilyte's commitment to environmentally responsible EPS solutions.