Exosomes Market Outlook:

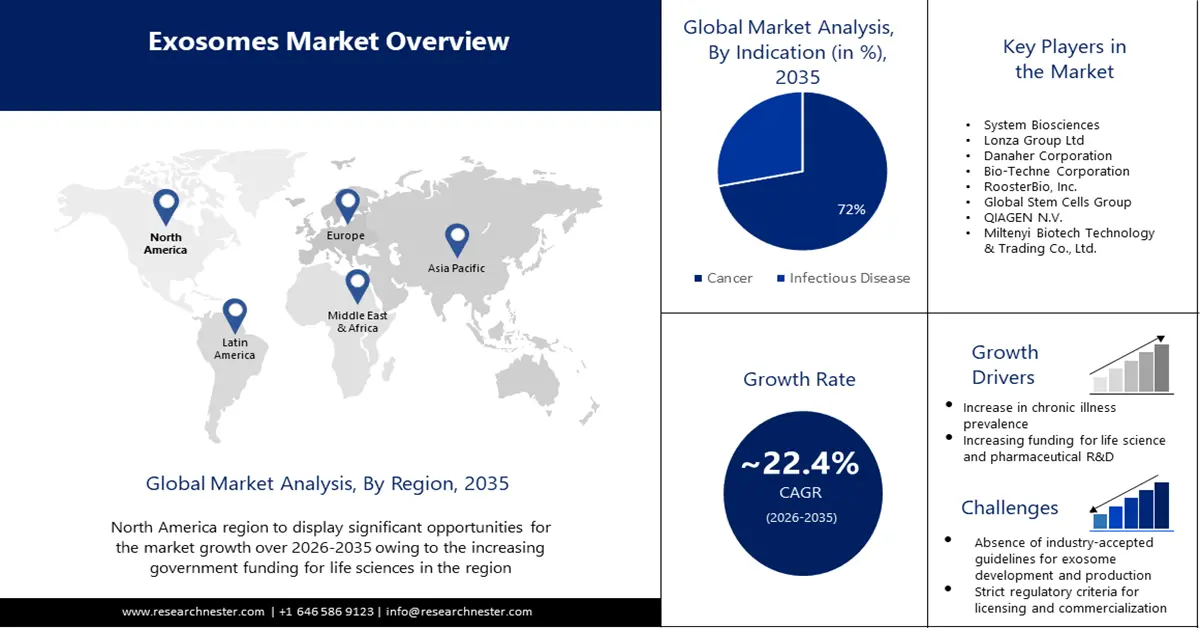

Exosomes Market size was valued at USD 215.79 million in 2025 and is set to exceed USD 1.63 billion by 2035, expanding at over 22.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of exosomes is estimated at USD 259.29 million.

The growth of the market is due to an increase in percentage of the people suffering from neurodegenerative diseases which is the main cause of death and disability, as well as a significant financial strain on healthcare systems. In strongly growing nations, the number of dementia cases is predicted to rise from 13.5 million in 2000 to 21.2 million in 2025 and 36.7 million in 2050, according to a United Nations assessment.

In addition to these, the market is growing since major firms have been making developments on exosome therapies. For example, in 2021, the biotechnology research company Cell Guidance Systems, located in the United States, announced that it would be creating exosome therapies to treat COVID-19. Furthermore, there will probably be a significant increase in government and non-government initiatives for exosome research during the study period.

Key Exosomes Market Insights Summary:

Regional Highlights:

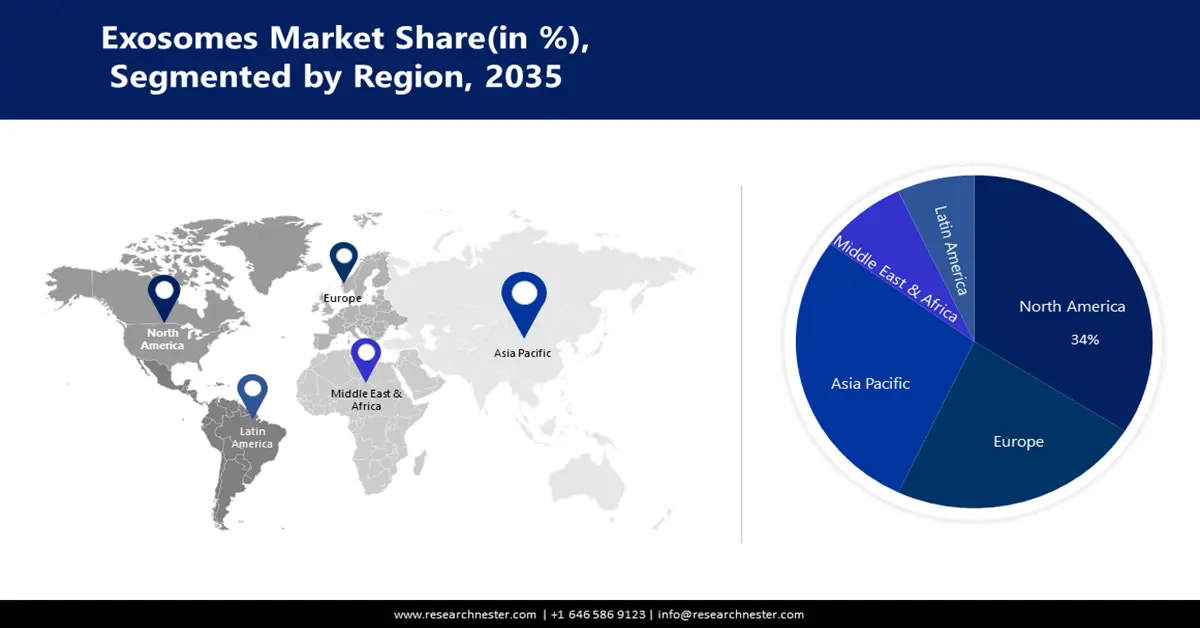

- North America exosomes market is projected to capture a 34% share by 2035, driven by extensive government-funded research in cancer diagnostics.

- Asia Pacific market is forecasted to secure a 28% share by 2035, driven by investment from major firms and rising chronic disease burden.

Segment Insights:

- The cancer segment in the exosomes market is expected to achieve a 72% share by 2035, driven by the wide range of applications of exosomes in cancer detection, therapy, and prognosis, along with rising global cancer incidence.

- The therapeutic segment in the exosomes market is expected to achieve a 67% share by 2035, driven by exosomes’ potential as regenerative and anti-inflammatory therapeutic platforms with high biocompatibility for various diseases.

Key Growth Trends:

- An Increase in Chronic Illness Prevalence

- Increasing Funding for Life Science and Pharmaceutical R&D

Major Challenges:

- Absence of industry-accepted guidelines for exosome development and productio

- Events that could limit the exosomes market growth are likely to occur if there are insufficient funds available.

Key Players: System Biosciences, Lonza Group Ltd, Danaher Corporation, Bio-Techne Corporation, RoosterBio, Inc., Global Stem Cells Group, QIAGEN N.V., Miltenyi Biotech Technology & Trading Co., Ltd.

Global Exosomes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 215.79 million

- 2026 Market Size: USD 259.29 million

- Projected Market Size: USD 1.63 billion by 2035

- Growth Forecasts: 22.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 11 September, 2025

Exosomes Market Growth Drivers and Challenges:

Growth Drivers

-

An Increase in Chronic Illness Prevalence- Globally, chronic illnesses like cancer, heart disease, and neurological conditions are the main causes of morbidity and death. Numerous causes, such as an aging population, sedentary lifestyles, poor dietary habits, and environmental variables like pollution, are contributing to the rise in the prevalence of chronic diseases. Approximately one in three persons worldwide are afflicted with several chronic illnesses. In the United States, four out of ten persons have two or more chronic diseases, and six out of ten adults have one. Additionally, exosomes can be modified to transport medicines, microRNA, and therapeutic compounds to specific cells, opening up a possible new therapeutic option for the management of chronic illnesses.

-

Increasing Funding for Life Science and Pharmaceutical R&D- The majority of pharmaceutical, biopharmaceutical, and medical device businesses make significant investments in the creation of novel medications and equipment. The pharmaceutical sector invests a lot of money in R&D. Pharmaceutical firms make R&D investments in order to provide the market with unique and high-quality products. According to trends, the leading pharmaceutical companies are improving the efficiency of their research and development by investing heavily in R&D to see profits in the long run and by working together on joint projects. According to the research, global pharmaceutical R&D spending was estimated to be worth USD 136 billion in 2012 and USD 186 billion in 2019.

- Growing End-User Demand for Specialised Testing Services- As part of an attempt to increase efficiencies, collaborating earlier in the drug development process has become more and more popular in recent years. Specialized testing services like RNA sequencing, gene expression analysis, liquid chromatography-mass spectrometry (LC/MS), wet chemistry analysis of compendia raw materials, trace metal analysis with Inductively Coupled Mass Spectrometry (ICP-MS), and many more are being outsourced by businesses at a much earlier stage of the API process development cycle. These specialist services are primarily utilized for risk analysis, class I and II solvent removal, column chromatography removal, structural elucidation of important impurities, and overall cost and process efficiency reduction initiatives.

Challenges

- Absence of industry-accepted guidelines for exosome development and production- As the area of exosomes is still in its infancy, no gold standards have yet been established. Professionals thus use new processes and approaches that are brought to the market without reluctance. Apart from human error in exosome production, scientists encounter other obstacles in the process of researching, developing, and producing exosomes. Exosomes generated from MSCs have attracted a lot of attention lately because they function as intercellular messengers. Their unique quality attracts attention in medicinal applications, including medication delivery, gene therapy, cell treatment, cancer diagnosis, and vaccine development. Therefore, in order to create efficient exosome harvesting techniques and establish industry standards for exosome characterization and purification, inventors of MSC-exosome therapy must modify their stem cell-free therapy workflow to meet the new exosome manufacturing needs.

- Events that could limit the exosomes market growth are likely to occur if there are insufficient funds available.

- The strict regulatory criteria for the licensing and commercialization of exosome products are factors impeding this market's growth.

Exosomes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

22.4% |

|

Base Year Market Size (2025) |

USD 215.79 million |

|

Forecast Year Market Size (2035) |

USD 1.63 billion |

|

Regional Scope |

|

Exosomes Market Segmentation:

Indication

The cancer segment in the exosomes market is expected to hold the largest share of about 72% during the forecast period. The growth of the segment is due to the wide range of uses of exosomes in the identification, assessment, and management of cancer. Exosomes have the potential to be highly effective therapeutic delivery vehicles for proteins, small chemicals, and RNAs intended to specifically target cancer cells. Furthermore, exosome-borne lipids, proteins, and nucleic acids are being investigated as potential targets for cancer therapy and as promising biomarkers for cancer prognosis and detection. The industry is anticipated to grow in the near future because of the rising incidence of cancer and the growing need for early disease detection. In 2020, there were projected to be 18.1 million cases of cancer worldwide. Men accounted for 9.3 million of these instances, while women made for 8.8 million.

Application

Exosomes market from the therapeutic segment is anticipated to hold largest revenue share of about 67% during the forecast period. It is possible to use exosomes as a treatment platform for COVID-19 and other disorders. Exosomes can be used in clinical settings as cell-free substitutes to treat a variety of illnesses and promote tissue regeneration since they can carry therapeutic cargo components without causing cellular toxicity or immunological rejection. Furthermore, exosomes produced from stem cells have the benefit of utilizing the regenerative and anti-inflammatory properties of their parent cells; as a result, exosome therapy can be developed to treat respiratory viral illnesses like SARS-CoV-2. Given their natural material transportation qualities, capacity to sustain intrinsic long-term circulation, and high biocompatibility—all of which make them ideal for the delivery of a wide range of proteins, chemicals, and nucleic acids—exosomes hold great promise as a drug delivery vehicle.

Our in-depth analysis of the global exosomes market includes the following segments:

|

Product & Services |

|

|

Indication |

|

|

Work Flow |

|

|

Application |

|

|

Manufacturing Services |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Exosomes Market Regional Analysis:

North American Market Insights

Exosomes market in North America is expected to hold the largest share of about 34% in the near future. This is because of the region’s superior healthcare system, sensible laws, an extensive network of multinational corporations, and high level of public knowledge of healthcare and diagnostics. Numerous government-funded studies have been carried out to investigate the potential involvement of medications utilizing exosomes in various cancer types, including pancreatic cancer, melanoma, lung cancer, and breast cancer. In 2020, there were 1,603,844 new cancer cases recorded in the US, and 602,347 cancer-related deaths. 403 new cases of cancer were reported for every 100,000 persons, and 144 people lost their lives to the disease. In addition, universities like Yale University and Michigan State University have partnered and been supported by companies like Merck and Exosome Diagnostic to carry out clinical trials in the US. Moreover, government funding for these endeavors is excellent. Most of the research was done on neoplasms.

APAC Market Insights

Exosomes market in the Asia Pacific region is predicted to hold second largest share of about 28% during the forecast period. The growth of the market in this region is due to growing investment by major companies in emerging economies like China and India, Asia Pacific is anticipated to grow at the quickest rate over the projection period. Due to the enormous patient pools in these nations suffering from chronic illnesses like cancer, there are market potential for companies working in the exosome technology field.

Exosomes Market Players:

- Thermo Fisher Scientific, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- System Biosciences

- Lonza Group Ltd

- Danaher Corporation

- Bio-Techne Corporation

- RoosterBio, Inc.

- Global Stem Cells Group

- QIAGEN N.V.

- Miltenyi Biotech Technology & Trading Co., Ltd.

- Clara Biotech

Recent Developments

- February 2022: Bio-Techne Corporation (NASDAQ: TECH) today announced an agreement with Thermo Fisher Scientific to exclusively complete development of and commercialize the ExoTRU kidney transplant rejection test developed by Exosome Diagnostics, a Bio-Techne brand. ExoTRU is a non-invasive multigene urine based liquid biopsy assay that provides critical allograft health information to assist clinician decision making in managing kidney transplant patients and optimizing patient care. The assay has the potential to discriminate between T-cell mediated rejection (TCMR) and antibody mediated rejection (ABMR), which is critical to improving patient management and outcomes. ExoTRU was developed in collaboration with the Azzi Laboratory at the Transplantation Research Center at Brigham and Women's Hospital, Harvard Medical School.

- November 2021: Lonza, a global manufacturing partner to the pharma, biotech and nutrition industries, announced today the acquisition of an exosome manufacturing facility located in Lexington, Massachusetts (US) from Codiak BioSciences, a clinical-stage biopharmaceutical company pioneering the development of exosome-based therapeutics. Codiak will retain its pipeline of therapeutic candidates as well as its exosome engineering and drug-loading technologies. Codiak will receive as part of the deal approximately $65 million of cGMP manufacturing services in kind. Lonza will gain worldwide access and sub-licensable rights to Codiak's high-throughput perfusion-based cGMP process for exosome manufacturing.

- Report ID: 5373

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Exosomes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.