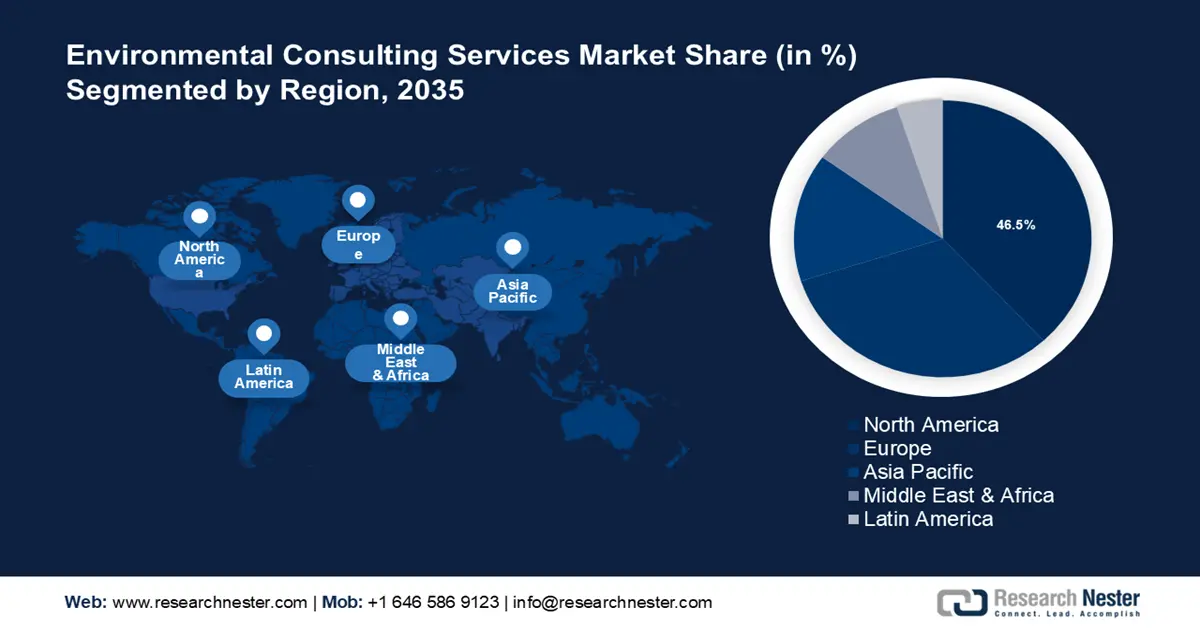

Environmental Consulting Services Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 46.5% by 2035 of revenue share during the forecast period owing to stringent environmental regulations and regular audits of businesses to provide sustainability reports. The robust regulatory ecosystem prompts businesses to hire environmental consultancy services to ensure their reports adhere to sustainability guidelines. Additionally, there are high penalties associated with non-compliance to environmental regulations putting the onus on businesses to seek sustainable solutions. For instance, in December 2023, truck engine maker Cummins was fined USD 1.6 billion for violation of the Clean Air Act by installing devices on engines allowing them to emit excess pollution.

The U.S. environmental consulting services market is poised to lead the revenue share in North America owing to strict enforcement of environmental regulations, rising public awareness on sustainability, growing demands to hold corporations liable for non-sustainable practices, and technological advancements improving the efficacy of environmental monitoring. Additionally, U.S. companies are subject to ESG disclosures which fuels the demand for environmental consulting services. For instance, in October 2023, two new laws i.e. Climate Corporate Data Accountability Act (SB 253) and Greenhouse Gasses: Climate related Financial Risk (SB261) came into effect and became the first government mandated ESG reporting requirements for companies in U.S.

The laws are projected to affect a significant number of corporations as they will be required to release ESG reports and disclosures. The complex regulatory infrastructure is added to by the Securities and Exchange Commission (SEC) and Federal Acquisition Regulations (FAR) Council proposing their own mandates requiring ESG disclosures. Investors and businesses seeking environmental consulting solutions to navigate the complex and strict regulatory framework is projected to increase the market share of U.S. during the forecast period.

Canada is projected to increase its revenue share in the larger North America environmental consulting services market during the forecast period owing to strict enforcement of non-compliance penalties on corporations for regulatory violations, growing demands for ESG reporting by investors and stakeholders, and robust technological advancements facilitating accurate collection and interpretation of data. ESG disclosures are not yet mandatory in Canada but the government plans to implement ESG disclosures from large Canadian banks, finance companies, and federally regulated financial institutions from 2024 stoking a trend where complete ESG disclosures may become mandatory for companies of other sectors in the future.

Additionally, Canada has imposed strict fines on businesses violating environmental laws that has led to growing demands for environmental consulting solutions. For instance, in February 2024, Suncor was fined USD 10 million for air pollution violations. In December 2023, Manitoba Paper Mill was fined USD 1 million for leaking toxins in the Saskatchewan river.

Europe Market Insights

Europe environmental consulting services market is projected to have the fastest growth in revenue share during the forecast period. The market’s rapid rise is owing to rising investments owing to proactive measures to achieve sustainability goals and growing public demand for corporations to adhere to environment friendly practices. For instance, the Corporate Sustainability Reporting Directive (CSRD) came into effect from January 2023 and the companies subject to it will have to report as per the European Sustainability Reporting Standards (ESRS). The directives will also be subjected to companies outside Europe but having a presence in the European environmental consulting services market. Proactive measures as such lead the drive for environmental consulting services to help businesses navigate the stringent regulatory ecosystem in the region.

Germany is poised to register a dominant revenue share in the Europe environmental consulting services market. The robust regulatory ecosystem of Germany for ESG disclosures leads to businesses seeking environmental consulting solutions to effectively navigate the stringent rules. Germany aims at becoming carbon neutral by 2045 by investing massively in decarbonization which puts impetus on various sectors to reduce carbon emissions. In January 2023, Germany passed the Supply Chain Due Diligence Act for ESG disclosures by companies with more than 3000 employees.

The act prompts businesses in Germany to invest in building sustainable supply chains requiring expert environmental consultancy services. In June 2024, the Federal Statistical Office of Germany reported the environmental protection sector to be booming with the climate protection sector registering a turnover of USD 120 billion. The high rate of growth is conducive for environmental consulting services to increase the revenue share of the environmental consulting services market.

France is poised to increase its revenue share in the environmental consulting services market in Europe during the forecast period. France imposes stringent regulations on companies to follow sustainability guidelines. For instance, the French Commercial Code requires certain companies to disclose a non-financial performance statement on the social and environmental consequences of their activities.

The environmental consulting services market in France is also boosted by the European Union directives such as CSRD coming into practice from 2024. In June 2024, the French Competition Authority announced an open-door policy to support companies seeking to pursue sustainable development projects. In recent market developments, in June 2022, management and technology consultancy BearingPoint acquired the sustainable strategy development consultancy firm I Care.