Environmental Consulting Services Market Outlook:

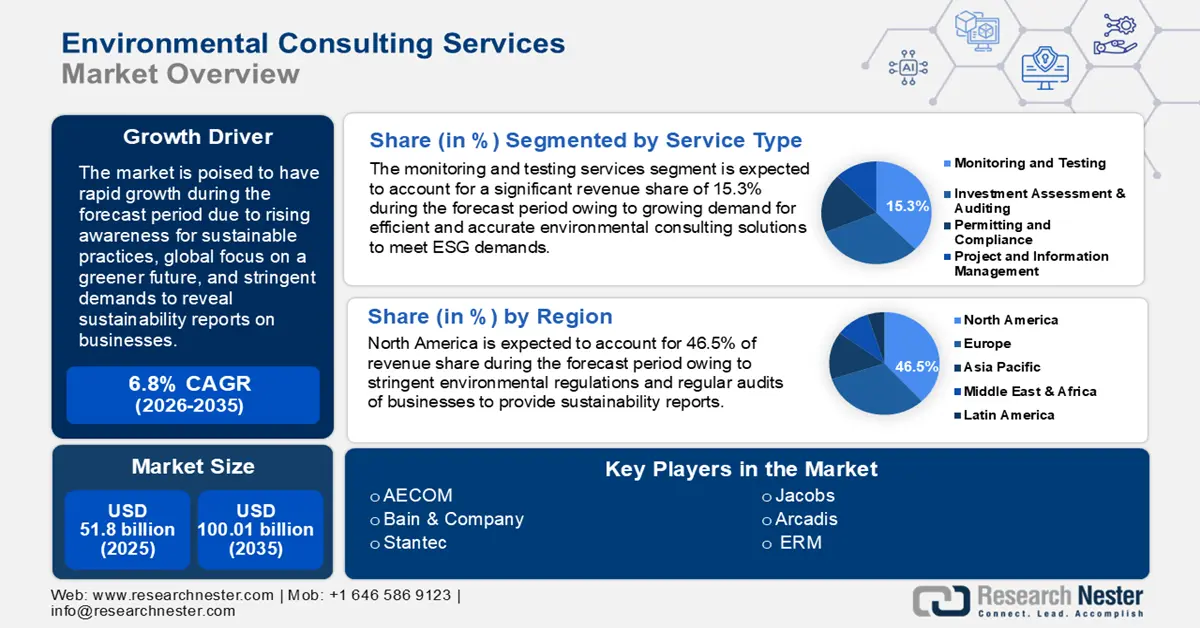

Environmental Consulting Services Market size was over USD 51.8 billion in 2025 and is poised to exceed USD 100.01 billion by 2035, growing at over 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of environmental consulting services is estimated at USD 54.97 billion.

The environmental consulting services market growth is attributed to increasing regulatory compliances on sustainable practices which is pushing various sectors to seek expert guidance in minimizing their ecological footprint.

Environmental advisory services provide expertise in areas such as sustainability strategies, environmental assessments, pollution control, regulatory compliance, waste management, etc. Consultants actively assist governments and private entities in reducing adverse ecological impact, while adhering to local, national, and international environmental laws. The demand for environmental consulting is projected to boom as the global environmental crisis worsens and calls for swift action to tackle ecological hazards intensify. In July 2023, Thames Water was fined USD 4.3 million for polluting the river Thames by the Lewes Crown Court signifying the rising costs of environmental non-compliance.

It is observed that a growing number of companies in scientific, construction, agriculture, and other sectors are actively hiring environmental consulting services. Companies are identifying green marketing as a viable tool for greater customer loyalty and a positive brand reputation. For instance, in August 2024, Emeritus published a report stating Patagonia and The Body Shop as two companies that have benefitted from green marketing. Additionally, running an eco-friendly business can lead to tax breaks and government subsidies. Globally, environmental laws are becoming more stringent due to increasing concerns about lack of sustainable practices. In January 2023, the European Commission announced the Corporate Sustainability Reporting Directive (CSRD) that strengthened the rules regarding the social and environmental information that companies have to disclose. CSRD requires companies, including small and medium-sized enterprises (SMEs), to provide sustainability reports annually.

Key Environmental Consulting Services Market Insights Summary:

Regional Highlights:

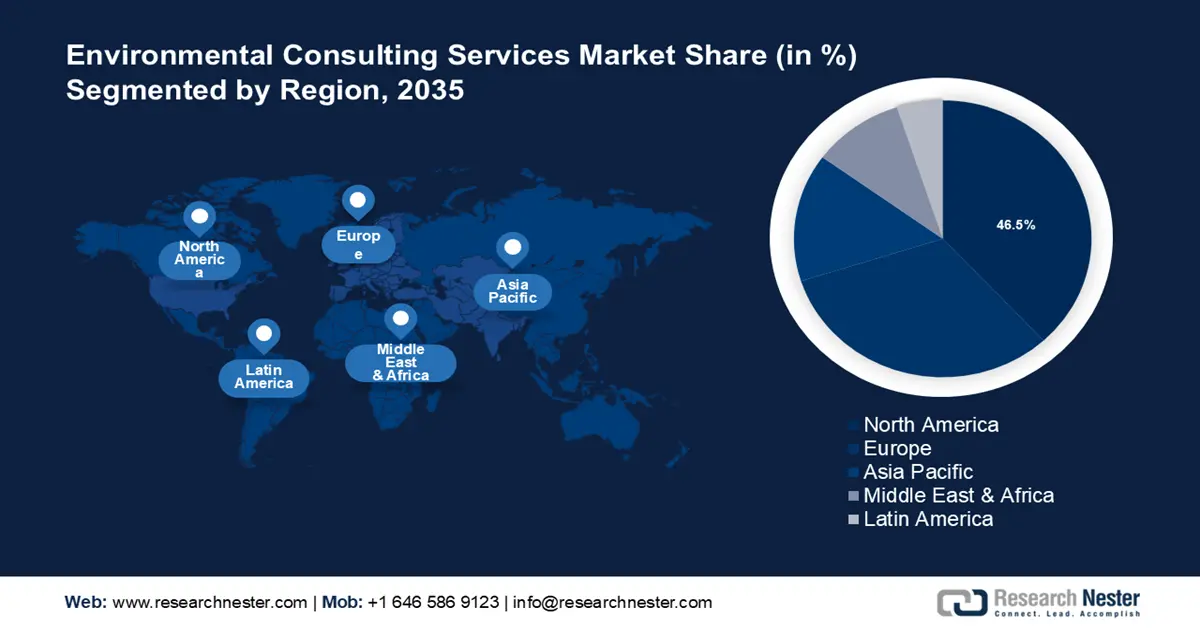

- North America environmental consulting services market will account for 46.50% share by 2035, driven by stringent environmental regulations and sustainability compliance needs.

- Europe market will exhibit the fastest growth during the forecast timeline, driven by proactive sustainability goals and stringent reporting standards.

Segment Insights:

- The monitoring & testing segment in the environmental consulting services market is projected to achieve a 15.30% share by 2035, driven by demand for accurate environmental data and rapid technological advancements.

- Water management segment in the environmental consulting services market is anticipated to secure the lion’s share of revenue by the forecast year 2035, driven by rising water scarcity and increasing demand for water management solutions.

Key Growth Trends:

- Rising need for sustainable supply chain management

- Growing sustainability initiatives and environmental concerns

Major Challenges:

- Data availability and technological disruptions

- High costs and pricing constraints

Key Players: AECOM, Jacobs Engineering Group Inc., WSP Global Inc., Stantec Inc., ERM Group, Tetra Tech, Inc., Ramboll Group A/S, Arcadis NV, GHD Group, Antea Group.

Global Environmental Consulting Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 51.8 billion

- 2026 Market Size: USD 54.97 billion

- Projected Market Size: USD 100.01 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Environmental Consulting Services Market Growth Drivers and Challenges:

Growth Drivers

- Rising need for sustainable supply chain management: Due to increasing environmental regulations prompting companies to seek greener alternatives, the need for a robust sustainable supply chain is growing so as to mitigate disruption to operations while maintaining sustainable practices. Environmental consulting firms assist in identifying the environmental impact of supply chains. Many companies are turning to sustainable supply chains to comply with environmental regulations and honor corporate environmental, social, and governance (ESG) commitments. For instance, the Godrej Group pledged to achieve zero deforestation in its supply chain by 2020. A Harvard Business Review report in 2020 highlighted the Responsible Business Alliance (RBA) consisting of Intel, HP, Apple, Dell, and Philips to provide assessment tools and training to suppliers to build a robust sustainable supply chain.

- Growing sustainability initiatives and environmental concerns: The global public perception has positively shifted to sustainable practices. For instance, in June 2024, Clean Energy Wire published a report on the Edelman Trust Barometer survey in fourteen countries where 93% of responders stated that climate change is a major threat to the planet. The 2024 People’s Climate Vote survey by the UN Development Program which included responders from 77 countries representing 85% of the global population stated 80% of survey respondents seeking their governments to take stronger actions to combat the climate crisis.

The younger demographics are also pushing the call for sustainable practices by governments and industries. Environmental consulting services are projected to partake in the booming trends for sustainable practices by assisting governments and private entities in managing their sustainability reports. In May 2023, UN Climate Champions reported Unilever, Microsoft, Nike, Salesforce, and L’Oréal pledging to net zero emissions. - Technological advancements for efficient consultancy: Rapid advancements in technology have enabled environmental consulting firms to improve the efficiency of their services. Firms have navigated efficient means to manage data, conduct environmental assessments, and deliver solutions. For instance, Geographic Information Systems (GIS) and remote sensing technologies enable environmental consultants to accurately map and monitor land use, vegetation, and water resources.

IoT devices such as air and water quality sensors provide real-time data to monitor pollution levels while satellite imagery can help collect data from areas difficult to access. Environmental consultancy firms can provide customized solutions and assist in risk planning for various industries using accurate data, leading to growing demand for the services. For instance, in December 2022, UltraSystems announced the use of GIS in their consultancy services to analyze projects ensuring clients produce documents for the California Environmental Quality Act and the National Environmental Policy Act.

Challenges

- Data availability and technological disruptions: The environmental consulting services market depends on data and any disruptions in the accuracy of data can be a major impediment in meeting deadlines for the clients. Clients have high expectations on reliability, quality, and cost-effectiveness of environmental consulting and any impediment in providing accurate data and faulty risk planning solutions can adversely affect the environmental consulting services market growth. Due to variable environmental regulations in various regions, gathering high-quality data can be challenging.

- High costs and pricing constraints: The environmental consulting services market is extremely competitive with numerous firms offering their services which causes the issue of pricing pressure. This increasing competition in the sector puts a downward pricing pressure of consultancy services forcing firms to reduce prices to differentiate themselves in the environmental consulting services market. This can negatively affect operations as well as affect new and smaller players competing in the market. Consultancies will need to curate strategies for pricing structures that allows them to recuperate investments in research and development.

Environmental Consulting Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 51.8 billion |

|

Forecast Year Market Size (2035) |

USD 100.01 billion |

|

Regional Scope |

|

Environmental Consulting Services Market Segmentation:

Service Type Segment Analysis

The monitoring and testing segment in the environmental consulting services market is projected to account for significant revenue share of 15.3% during the forecast period. The segment involves measuring, assessing, and analyzing environmental conditions to ensure business compliance with regulations. A wide range of services fall under this segment such as air quality monitoring, water quality testing, soil analysis, noise measurement, wildlife surveys, formaldehyde monitoring, etc. The segment is poised for growth owing to increasing demand for reliable and accurate data, coupled with the rapid technological advancements that are improving the efficacy of monitoring systems. For instance, in April 2023, Bain & Company backed a new artificial intelligence integrated data management solution called ESG Flo that provides more transparent, traceable, and efficient data helping businesses achieve their ESG goals.

The investment assessment and auditing segment in the environmental consulting services market is poised to increase its profit share during the forecast period as the rate of businesses seeking expert analysis and evaluation to support sustainable investment decisions increase. Environmental consulting services can offer B2B solutions for green finance consulting and sustainability assessments. The segment assists in stabilizing a robust sustainable supply channel by assessing corporate transactions and mergers. For instance, in February 2024, Walmart announced their Project Gigaton a success for reducing one billion metric tons of greenhouse gas emissions from their suppliers much ahead of the 2030 target. In March 2022, the British Safety Council announced a 5-star environmental sustainability audit to help companies improve their sustainability performance.

Application Segment Analysis

The water management segment is projected to hold the lion’s share of revenue during the forecast period in the larger environmental consulting services market. The segment provides services such as water quality assessments, water resource management, wastewater treatment, flood risk assessment, etc. The growth of the segment is attributed to the rising water scarcity driven by climate change and rapid population growth leading to increasing demands for water management solutions. In March 2024, the UN World Water Development Report stated 2.2 billion people globally living without access to safe water highlighting the importance of water management by governments and corporations alike.

In May 2020, the UK government environment agency selected Jacobs in collaboration with JBA Consulting to develop and implement a National Flood Risk Assessment system. As regulatory requirements intensify globally, environmental consulting services are geared to provide customized water management solutions to businesses and governments leading to considerable environmental consulting services market growth. The waste management segment is poised to have a rapid growth during the forecast period to cater to needs of effective waste management solutions. Waste management services include waste audits, waste minimization strategies, waste segregation and collection, landfill management, hazardous waste management, etc.

In February 2024, the UN report on Global Waste Management Outlook 2024 projects municipal solid waste generation to reach 3.8 billion tons by 2050 and estimated the global cost of waste management at USD 252 billion in 2020. The report indicates urgent action on waste management to reduce the waste management costs. This puts further impetus on businesses to find effective waste management solutions to reduce costs as well as comply with the stringent environmental regulations leading to growing demands for professional environmental consulting services.

Our in-depth analysis of the environmental consulting services market includes the following segments:

|

Service Type |

|

|

Application |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Environmental Consulting Services Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 46.5% by 2035 of revenue share during the forecast period owing to stringent environmental regulations and regular audits of businesses to provide sustainability reports. The robust regulatory ecosystem prompts businesses to hire environmental consultancy services to ensure their reports adhere to sustainability guidelines. Additionally, there are high penalties associated with non-compliance to environmental regulations putting the onus on businesses to seek sustainable solutions. For instance, in December 2023, truck engine maker Cummins was fined USD 1.6 billion for violation of the Clean Air Act by installing devices on engines allowing them to emit excess pollution.

The U.S. environmental consulting services market is poised to lead the revenue share in North America owing to strict enforcement of environmental regulations, rising public awareness on sustainability, growing demands to hold corporations liable for non-sustainable practices, and technological advancements improving the efficacy of environmental monitoring. Additionally, U.S. companies are subject to ESG disclosures which fuels the demand for environmental consulting services. For instance, in October 2023, two new laws i.e. Climate Corporate Data Accountability Act (SB 253) and Greenhouse Gasses: Climate related Financial Risk (SB261) came into effect and became the first government mandated ESG reporting requirements for companies in U.S.

The laws are projected to affect a significant number of corporations as they will be required to release ESG reports and disclosures. The complex regulatory infrastructure is added to by the Securities and Exchange Commission (SEC) and Federal Acquisition Regulations (FAR) Council proposing their own mandates requiring ESG disclosures. Investors and businesses seeking environmental consulting solutions to navigate the complex and strict regulatory framework is projected to increase the market share of U.S. during the forecast period.

Canada is projected to increase its revenue share in the larger North America environmental consulting services market during the forecast period owing to strict enforcement of non-compliance penalties on corporations for regulatory violations, growing demands for ESG reporting by investors and stakeholders, and robust technological advancements facilitating accurate collection and interpretation of data. ESG disclosures are not yet mandatory in Canada but the government plans to implement ESG disclosures from large Canadian banks, finance companies, and federally regulated financial institutions from 2024 stoking a trend where complete ESG disclosures may become mandatory for companies of other sectors in the future.

Additionally, Canada has imposed strict fines on businesses violating environmental laws that has led to growing demands for environmental consulting solutions. For instance, in February 2024, Suncor was fined USD 10 million for air pollution violations. In December 2023, Manitoba Paper Mill was fined USD 1 million for leaking toxins in the Saskatchewan river.

Europe Market Insights

Europe environmental consulting services market is projected to have the fastest growth in revenue share during the forecast period. The market’s rapid rise is owing to rising investments owing to proactive measures to achieve sustainability goals and growing public demand for corporations to adhere to environment friendly practices. For instance, the Corporate Sustainability Reporting Directive (CSRD) came into effect from January 2023 and the companies subject to it will have to report as per the European Sustainability Reporting Standards (ESRS). The directives will also be subjected to companies outside Europe but having a presence in the European environmental consulting services market. Proactive measures as such lead the drive for environmental consulting services to help businesses navigate the stringent regulatory ecosystem in the region.

Germany is poised to register a dominant revenue share in the Europe environmental consulting services market. The robust regulatory ecosystem of Germany for ESG disclosures leads to businesses seeking environmental consulting solutions to effectively navigate the stringent rules. Germany aims at becoming carbon neutral by 2045 by investing massively in decarbonization which puts impetus on various sectors to reduce carbon emissions. In January 2023, Germany passed the Supply Chain Due Diligence Act for ESG disclosures by companies with more than 3000 employees.

The act prompts businesses in Germany to invest in building sustainable supply chains requiring expert environmental consultancy services. In June 2024, the Federal Statistical Office of Germany reported the environmental protection sector to be booming with the climate protection sector registering a turnover of USD 120 billion. The high rate of growth is conducive for environmental consulting services to increase the revenue share of the environmental consulting services market.

France is poised to increase its revenue share in the environmental consulting services market in Europe during the forecast period. France imposes stringent regulations on companies to follow sustainability guidelines. For instance, the French Commercial Code requires certain companies to disclose a non-financial performance statement on the social and environmental consequences of their activities.

The environmental consulting services market in France is also boosted by the European Union directives such as CSRD coming into practice from 2024. In June 2024, the French Competition Authority announced an open-door policy to support companies seeking to pursue sustainable development projects. In recent market developments, in June 2022, management and technology consultancy BearingPoint acquired the sustainable strategy development consultancy firm I Care.

Environmental Consulting Services Market Players:

- AECOM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bain & Company

- Stantec

- Jacobs

- Mckinsey

- Deloitte

- Tetra Tech

- Arcadis

- WSP

- EY

- ERM

Environmental consulting services market is estimated for a rapid growth during the forecast period. The sector is competitive with global, national, and local players vying to increase their market share. Key market players are investing to improve the efficacy of their services, engaging in acquisitions, and launching customized services for businesses to cater to growing requirements for adhering sustainable guidelines.

Some of the key players in the market are:

Recent Developments

- In September 2024, AECOM was appointed to Northern Ireland Water’s services network. AECOM will deliver site supervision, asset management, and project management services to support strategic objectives of Northern Ireland Water.

- In September 2024, Stantec was appointed by Southern Water for planning, engagement, and consultation services framework for a duration of 5 years. Southern Water provides drinking water to around 2.5 million households and recycles wastewater from more than 4.7 million households.

- In July 2024, the Justice Department of U.S. and EPA announced USD 241.5 million settlement with Marathon Oil to reduce adverse climate emissions in North Dakota. The settlement is the largest Clean Air Act penalty.

- In April 2024, Julhiet Sterwen announced collaboration with the specialist consulting firm in economic and environmental transition, (RE)SET. The joining of the two companies is expected to give rise to a powerhouse in the environmental consulting services sector.,

- Report ID: 6458

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.