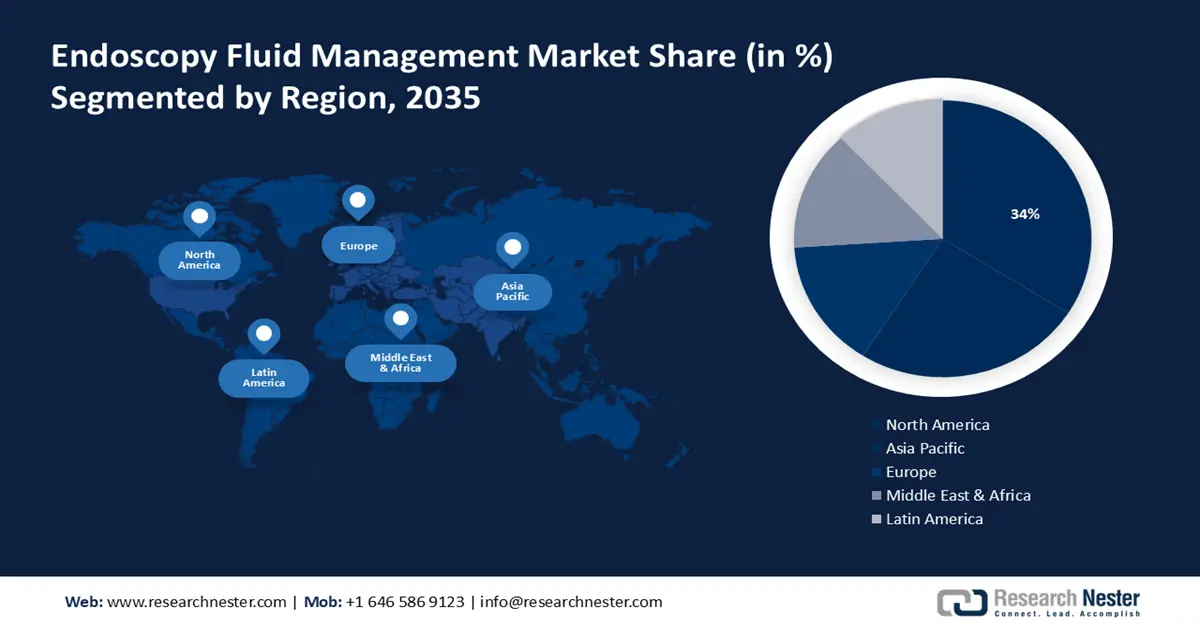

Endoscopy Fluid Management Market Regional Analysis:

North American Market Insights

North America endoscopy fluid management market is poised to dominate around 34% revenue share by the end of 2035. The market growth in the region is expected on account of the coming together of technological advancements and preference for minimally invasive procedures with endoscopy devices. According to the United States Census Bureau, in the year 2020, 87% of full-time, year-round workers had private insurance coverage in North America, whereas the people who worked less than full-time, year-round were less likely to be covered by private insurance in 2020 than in 2018 (68.5 percent in 2018 and 66.7 percent in 2020). The government has initiated various programs in the region to cover the medical insurance of workers in the region.

As per the latest report, the United States exports most of its industrial endoscope to various countries including Vietnam, India, and Peru. The export shipments of industrial endoscopes from the United States stood at 213 position which were exported by 34 United States Exporters to 39 Buyers.

According to a recent report, the total number of endoscopy procedures performed in Canada was 97,448 in 2022. These procedures were performed to diagnose and treat disorders of the esophagus, stomach, duodenum, terminal ileum, and colon.

APAC Market Insights

The APAC region will also encounter huge growth in the endoscopy fluid management market during the forecast period and will hold the second position owing to the presence of key players and manufacturers of endoscopy fluid management in the region and the increasing demand for laparoscopy procedures.

According to a study conducted from year 2014-2020 which showed that H. pylori accounted for 66.1% of all abnormal upper GI endoscopies in children due to stomach infections in Southeast Asia. With the growing rate of diseases, the demand for endoscopy procedures is gradually increasing. Additionally, the growing frequency of gastrointestinal endoscopy procedures and improvisation in endoscopic infrastructure are set to drive the market growth of the endoscopy fluid management system market in the region.

In China, companies around the world have started investing and are developing robust systems and services. They are mainly focusing on training healthcare professionals through educational support to boost the endoscopy medical network. For instance, from 2012 to 2019, the number of hospitals performing digestive endoscopy in mainland China increased from 6128 to 7470, and the number of hospitals performing EUS increased from 531 to 1236 leading to higher demand for endoscopy systems.

Gastric endoscopic resection (ER) is widely performed in Korea to investigate the overall status of gastric ER in Korea.

As per a recent study, the total number of endoscopy procedures performed in Japan due to the growing rate of gastroenterology diseases was 245,854 in 2022.