E-Bike Drive Unit Market Outlook:

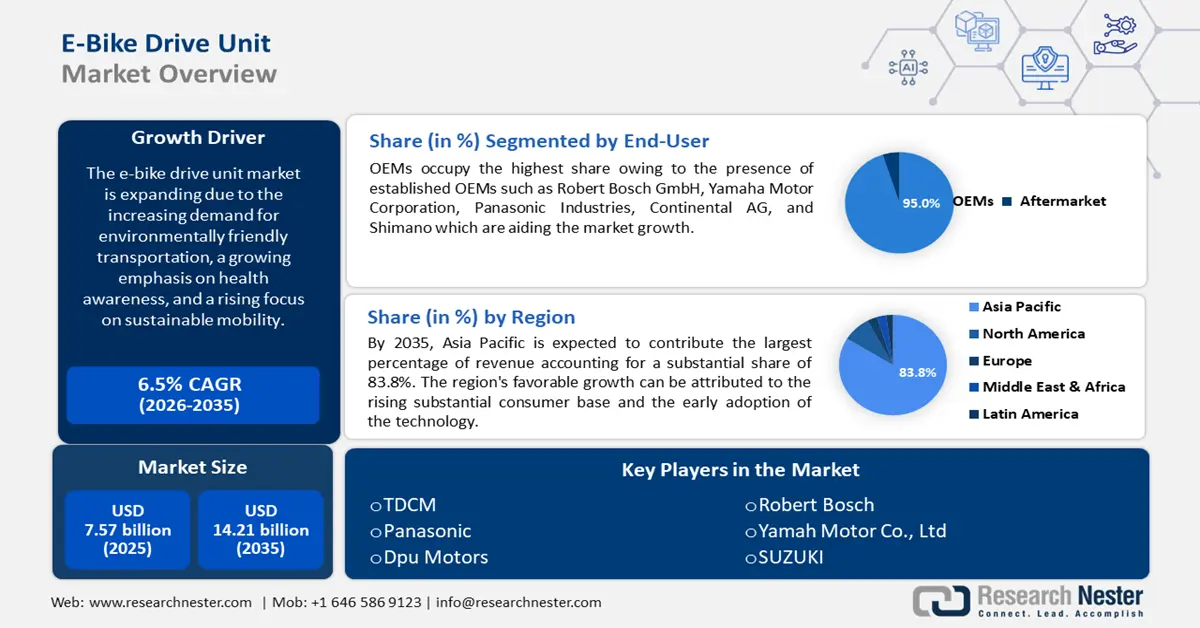

E-Bike Drive Unit Market size was valued at USD 7.57 billion in 2025 and is expected to reach USD 14.21 billion by 2035, registering around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of e-bike drive unit is evaluated at USD 8.01 billion.

The electric bicycle sector is experiencing substantial growth due to increased demand for eco-friendly transportation and an increasing emphasis on health and well-being. The rise in automobile carbon emissions and noise levels has increased pollution in major cities globally. As per a January 2024 report by the U.S. Environmental Protection Agency (EPA), the CO2 emission of a typical passenger vehicle amounts to 4.6 metric tons per year. The EPA and the Department of Transportation use similar statistics to ensure automobile manufacturers abide by federal greenhouse gas and corporate average fuel economy (CAFE) standards.

Despite the efforts to curb air pollution, greenhouse emissions reached a record high in 2023. This has driven the adoption of e-bikes and continuous innovation of the propulsion systems used in them. Component (ingredient) brands such as SRAM, Shimano, RockShox, Fox, Magura, and Bosch have become recognized marks of quality for the conventional and e-bike sector. An e-bicycle fitted with a Bosch drive unit is associated with superior quality by customers and dominates sales at a retail level. In 2022, e-bike sales in the U.S. reached a total of 1.1 million units and were a quadruple increase from 2019. In 2021, there was a significant spike in e-bike sales, with the number surpassing twice the amount in the previous year.