E-Bike Drive Unit Market Outlook:

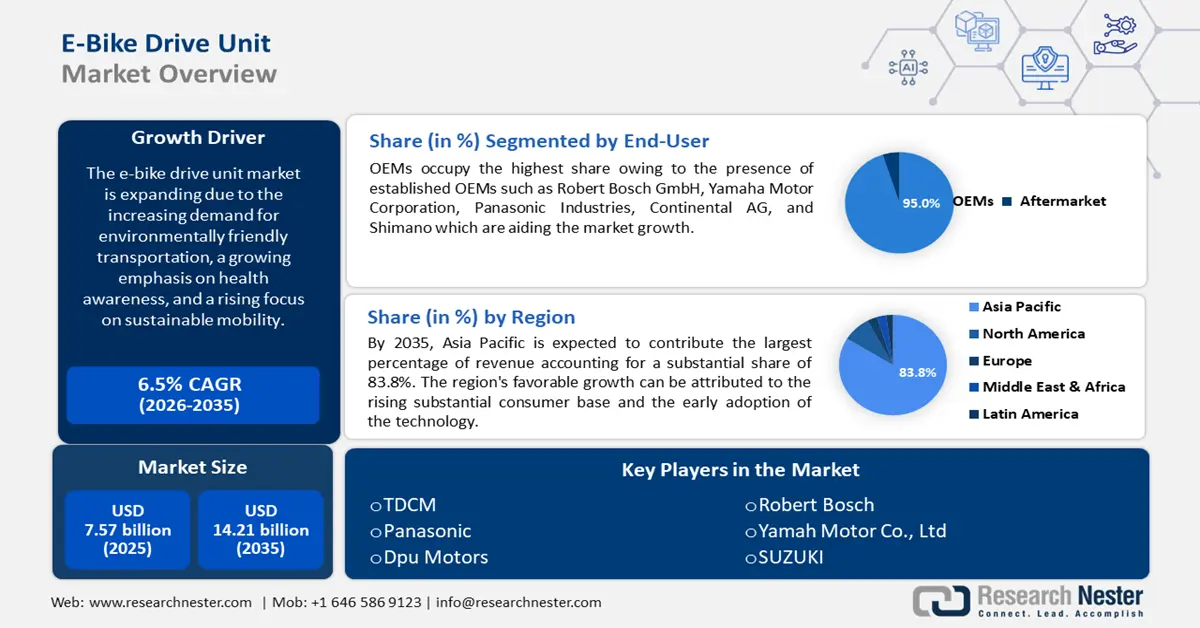

E-Bike Drive Unit Market size was valued at USD 7.57 billion in 2025 and is expected to reach USD 14.21 billion by 2035, registering around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of e-bike drive unit is evaluated at USD 8.01 billion.

The electric bicycle sector is experiencing substantial growth due to increased demand for eco-friendly transportation and an increasing emphasis on health and well-being. The rise in automobile carbon emissions and noise levels has increased pollution in major cities globally. As per a January 2024 report by the U.S. Environmental Protection Agency (EPA), the CO2 emission of a typical passenger vehicle amounts to 4.6 metric tons per year. The EPA and the Department of Transportation use similar statistics to ensure automobile manufacturers abide by federal greenhouse gas and corporate average fuel economy (CAFE) standards.

Despite the efforts to curb air pollution, greenhouse emissions reached a record high in 2023. This has driven the adoption of e-bikes and continuous innovation of the propulsion systems used in them. Component (ingredient) brands such as SRAM, Shimano, RockShox, Fox, Magura, and Bosch have become recognized marks of quality for the conventional and e-bike sector. An e-bicycle fitted with a Bosch drive unit is associated with superior quality by customers and dominates sales at a retail level. In 2022, e-bike sales in the U.S. reached a total of 1.1 million units and were a quadruple increase from 2019. In 2021, there was a significant spike in e-bike sales, with the number surpassing twice the amount in the previous year.

Key E-Bike Drive Unit Market Insights Summary:

Regional Highlights:

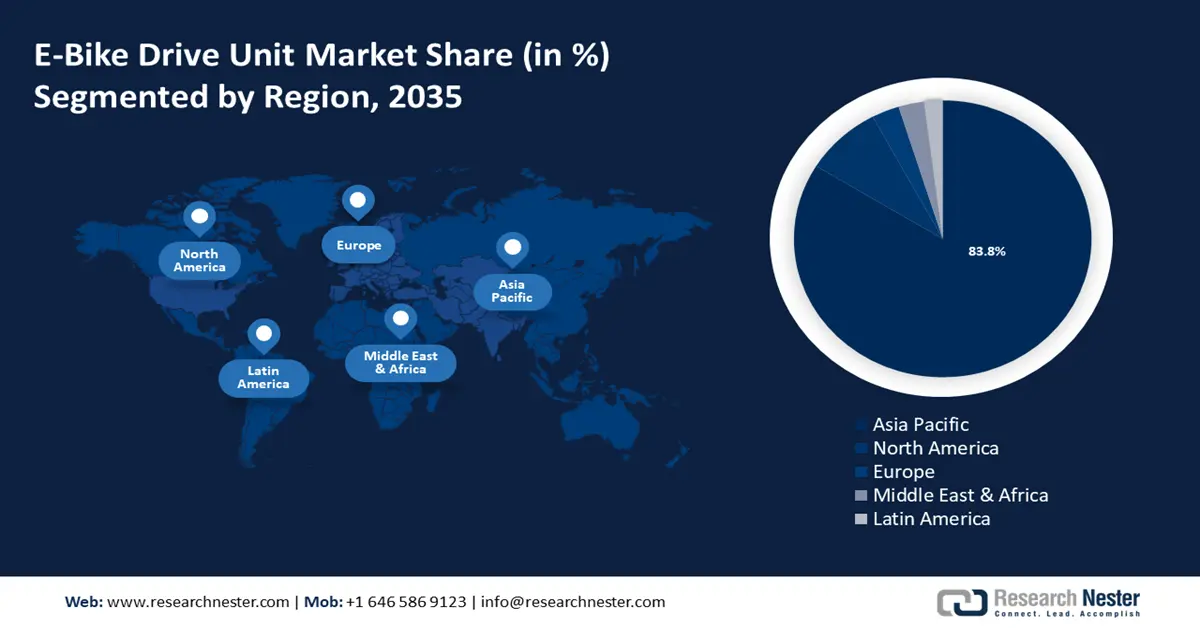

- The Asia Pacific e-bike drive unit market is anticipated to capturen 84% share by 2035, driven by the rising substantial consumer base and early adoption of technology.

Segment Insights:

- The oem segment in the e-bike drive unit market is projected to achieve significant growth till 2035, fueled by heavy investments and innovation from leading OEMs in electric vehicle component development.

- The hub motors segment in the e-bike drive unit market is projected to see substantial growth till 2035, driven by their lightweight, low-cost design, and reduced maintenance needs.

Key Growth Trends:

- Technological advancements-

- Emphasis on brand awareness and co-branding strategies in the fairly consolidated market

Major Challenges:

- High cost

- Increasing cases of accidents

Key Players: Bafang Electric (Suzhou) Co., Ltd., Dapu Motors, Suzuki Motor Corporation, Mahle GmbH, Robert Bosch, Shimano Inc, Suzhou Xiongda, TDCM.

Global E-Bike Drive Unit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.57 billion

- 2026 Market Size: USD 8.01 billion

- Projected Market Size: USD 14.21 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (84% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Germany, Japan, United States, Netherlands

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

E-Bike Drive Unit Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancements- Electric bicycle motor advancements contribute significantly to the growth of the e-bike drive unit market. The integration of cutting-edge technologies appeals to a larger consumer base and drives product sales. In March 2023, Tata-backed Stryder introduced the Zeeta e-bike, which is equipped with a robust 36V 250W BLDC rear hub motor, ensuring a smooth and uninterrupted riding experience. The power efficiency of the product is optimized using a lithium-ion battery and controller within the frame. Zeeta's safety features are equipped with an automatic braking system that cuts off power to ensure the highest level of protection for the rider.

-

Emphasis on brand awareness and co-branding strategies in the fairly consolidated market- E-mobility solutions such as pedelecs, scooters, e-bikes, and cars are driven by rapid urbanization and other megatrends. Consumers are looking for e-mobility solutions to replace their present vehicle fleets with sustainable and efficient means of transport. This has impelled key component manufacturers for e-bikes to consider ingredient branding strategy to gain a competitive edge. They face potential price pressure and loss of margin, as established players are heavily investing in R&D and promotional activities.

Ingredient branding is vertically oriented and creates differentiation, awareness, visibility, and preference in the downstream value chain. Key examples of ingredient marketing in the e-bike drive unit market are Shimano or SRAM drivetrain, Bosch propulsion system, and Rockshox or Fox for suspension systems. Furthermore, the prominence of co-branding or horizontal-orientated cooperation between two manufacturers to collaborate for a joint marketing program that capitalizes on individual brand image. - Energy saving capability of e-bikes– E-Bike drive units exhibit higher energy efficiency compared to traditional automobiles. An e-bike typically has an energy consumption of approximately 0.025 kWh per mile and are 10 times more energy-efficient than cars. In July 2023, researchers from NREL discovered that the utilization of e-bikes resulted in energy savings of approximately 40 megawatt-hours. The energy savings are almost equal to the energy consumption of 1,000 residences with an average size of 2,000 square feet for a whole day.

Challenges

-

High cost– E-Bike drive units' high cost is a major market growth constraint. Drive units can make up a large part of an e-bike's costs, depending on its motor. E-bikes cost approximately three times more than pedelec systems. Germany sells e-bikes for between USD 1,600 and USD 2,200, whereas regular bicycles cost around USD 560. Additional expenditures include charging and battery replacement leading to more cost.

-

Increasing cases of accidents- In recent years, there have been numerous reports of electric two wheelers and four-wheelers are catching fire, which has led to vehicle damage and injuries. Additionally, the government has implemented measures to investigate the situation and guarantee the safety of all parties. Nevertheless, there have been numerous battery fires in recent years, which has raised concerns about the safety of e-bikes. The high energy density of these batteries may be one of the primary causes of these accidents.

E-Bike Drive Unit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 7.57 billion |

|

Forecast Year Market Size (2035) |

USD 14.21 billion |

|

Regional Scope |

|

E-Bike Drive Unit Market Segmentation:

Product

Hub motors segment is anticipated to hold more than 70% e-bike drive unit market share by 2035. These motors are the most common e-bike motors because they are simple, lightweight, and cheap to make. Hub motors are electric motors in the hubs of the bike's front or rear wheels. Their demand is driven by less maintenance because they run independently and do not stress the drivetrain.

Moreover, MAHLE SmartBike Systems, an eBike division of automotive component supplier MAHLE, introduced its X30 drive system on June 13, 2024. Its new hub motor weighs 1.9kg and has 45 Nm torque (compared to a mid-drive motor) for exceptional performance on any terrain. Thus, the MAHLE X30 has revolutionized hub motors and lightweight eBike systems driving market expansion.

End use

By the end of 2035, original equipment manufacturer (OEM) segment is projected to account for more than 95% e-bike drive unit market share. OEMs occupy the highest share owing to the presence of established OEMs such as Robert Bosch GmbH, Yamaha Motor Corporation, Panasonic Industries, Continental AG, and Shimano which are aiding the market growth. Since these organizations invest heavily in product creation and development, competition is fierce. For instance, in September 2022, Ford invested USD 163.7 million to scale up the manufacturing of electric vehicle (EV) components at Halewood Plant, England.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

E-Bike Drive Unit Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is poised to account for largest revenue share of 84% by 2035. The region's favorable growth can be attributed to the rising substantial consumer base and the early adoption of the technology.

The significant manufacturing of e-bikes in China is the primary catalyst for the market expansion in the country. China solely provides subsidies for almost 90% of the overall manufacturing of e-bikes, and this pattern is projected to continue in the next years. During the 31st China International Bicycle Fair in Shanghai, the China Bicycle Association announced that China produced 49.238 million e-bikes, showing an 8.2% increase compared to the previous year.

India is experiencing a higher demand for e-bikes owing to the increasing customer demand. Notable electric bike manufacturers in India include Hero Electric, Ather Energy, Okinawa Autotech, Ampere Electric, Revolt Motors, Avon Cycles, Lectro Electric, Yulu Bikes, Kabira Mobility, and Earth Energy EV. On March 15, 2023, Hero Electric unveiled their newest electric two-wheeler, namely the Optima CX5.0 (Dual-battery), Optima CX2.0 (Single Battery), and NYX CX5.0 (Dual-Battery) and have supported the domestics manufacturing of e-bike components.

The Japan e-bike drive unit market is driven by wide product offerings, strong brand awareness and customer support, and established supply chain networks. The country’s persistent growth is ascribed to advancements in product offerings and fast-charging technology. In July 2022, Kawasaki introduced the Elektrode bicycle to the market. The product features three customizable speed settings, a disc braking system, a built-in battery, and a wheel-mounted motor. Consequently, these inventions contribute significantly to the substantial growth in market expansion.

North America Market Insights

The e-bike drive unit market in North America is experiencing consistent expansion, with a notable acceptance of the technology in the region. The demand for electric bicycles in North America is rapidly increasing as commuters seek appropriate methods of personal mobility.

The U.S. government is implementing several measures to encourage the use of electric bikes in the country. The Electric Bicycle Incentive Kickstart for the Environment (E-BIKE) Act bill was introduced by the U.S. government in March 2023. This bill offers American citizens a federal rebate of USD 1,500 to assist them in purchasing high-quality and affordable e-bikes. The aim is to reduce the occurrence of battery fires caused by e-bikes.

The sales of e-bikes in Canada are driven by manufacturers' growing emphasis on integrating enhanced motors, Anti-lock Braking Systems (ABS), and various other features into newly manufactured e-bikes. Therefore, the incorporation of these elements is intended to improve the rider's experience, thereby generating new prospects for growth for e-bike producers. Manufacturers of electric bikes, such as Velcro Canada Inc., iGO Electric Bikes CA, and Cycling Sports Group, Inc., see linked e-bike portfolios as a strategic chance to establish product differentiation in the local market.

E-Bike Drive Unit Market Players:

- Panasonic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bafang Electric (Suzhou) Co., Ltd.

- Dapu Motors

- Suzuki Motor Corporation

- Mahle GmbH

- Robert Bosch

- Shimano Inc

- Suzhou Xiongda.

- TDCM

The e-bike drive unit market is highly competitive, with multiple companies offering a wide range of modern goods and designs to cater to the needs of E-Bike riders. These firms possess an extensive global presence and offer a diverse range of E-Bikes, which include sophisticated engines, automotive braking systems, and additional specifications. To remain competitive in the market, companies must provide high-quality products that are backed by investigation and stick to industry norms.

Recent Developments

- In February 2024, Bafang Electric (Suzhou) Co., Ltd. aims to establish a state-of-the-art testing facility for two-wheel drive systems, with the goal of enhancing industry standards for product quality. The Bafang Laboratory Center has recently received its accreditation certificate from the China National Accreditation Service for Conformity Assessment (CNAS). This accomplishment follows the company's ongoing efforts to improve quality management procedures and commitment to product quality, which are essential factors for the success and growth of businesses.

- In 2023, SHIMANO introduced the CUES 11/10/9-speed line-up, offering a single solution for several cycling categories such as trekking and mountain biking. SHIMANO has expanded its line-up this year to incorporate a revised ergonomic design that is specifically tailored for cyclists with smaller hands. This enhancement aims to offer a riding experience that is both more pleasant and instills greater confidence in every rider.

- Report ID: 6301

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

E-Bike Drive Unit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.