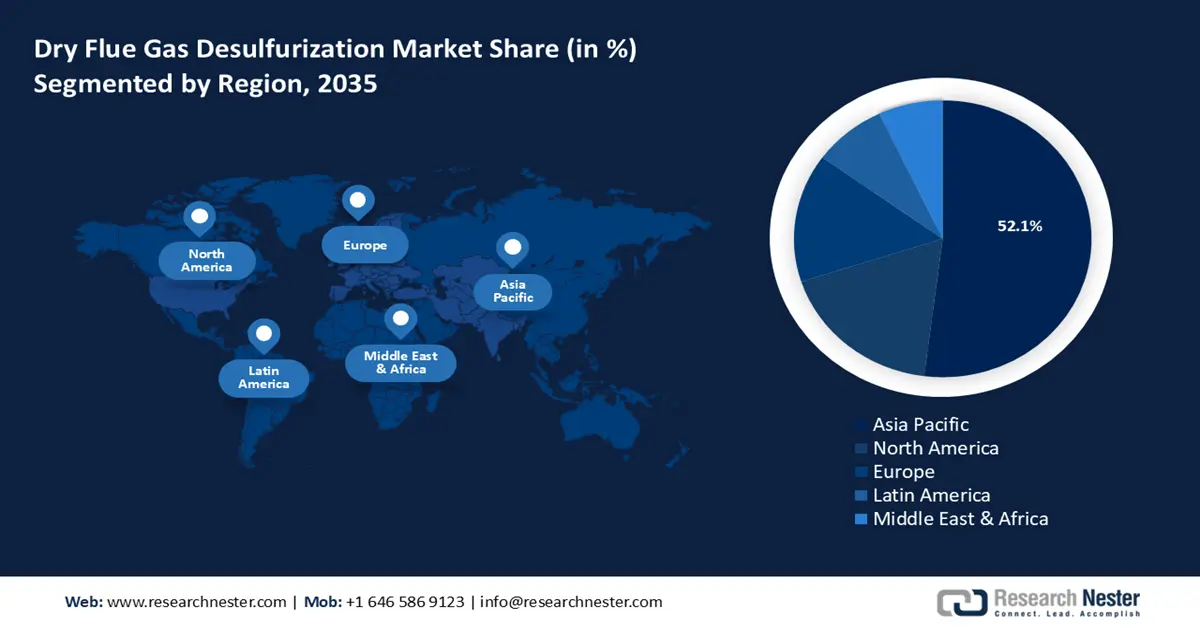

Dry Flue Gas Desulfurization System Market - Regional Analysis

APAC Market Insights

Asia Pacific dry flue gas desulfurization system market is projected to register a dominant global revenue share of 52.1% by the end of the forecast period. The market’s growth is led by China and India with high demands for electricity and large-scale thermal power plant emissions urgently necessitating dry FGD solutions to be retrofitted. Governments are identifying the scourge of air pollution and are actively seeking novel means to combat it, by strictly enforcing environmental regulations on manufacturers to curb the release of greenhouse gases (GHG). For instance, IEA reported China to account for 31.1% share of global emissions from combustible fuels in 2022. This prompts manufacturers to install FGD systems in the plants to ensure GHG emissions are at a permissible limit. Key market players are manufacturing advanced dry FGD systems that offer lesser carbon footprints.

China is projected to dominate the dry flue gas desulfurization system market share in APAC during the forecast period. The surge in profitable opportunities in the market is attributed to the substantial demand for electricity. The IEA estimated the electricity demand in China to have risen by 6.4% in 2023 boosted by the industrial and services sectors and projects the total electricity demand in the country to reach about 1400 TWh more than half of the European Union’s annual consumption. In July 2024, Carbon Brief reported that coal accounted for 53% of power generation in the country.

Although Solar PV is gaining popularity in the country and reducing coal dependency, the percentage of energy generated by coal is high, leading to increasing emissions of SF2. This is evident in growing coal exports by China; in 2023, the country imported 474.2 million tons of coal and the amount is forecasted to increase in 2024 to range between 450 and 500 million tons. The trends are favorable toward the rapid expansion of the dry flue gas desulfurization market as more manufacturers seek to retrofit FGD solutions in thermal power plants.

India is poised to rapidly increase its revenue share in APAC by the end of the forecast period. The growth is attributed to rising calls to install robust FGD systems in the industrial sector. For instance, IEA reported India to account for the third highest per capita CO2 emissions, ranking behind China and the U.S. The push for net zero goals is set to hasten the demands for dry flue gas desulfurization systems in the dry flue gas desulfurization system market. The country still depends on coal for a substantial percentage of power generation evidenced by imports, mainly from Indonesia and South Africa. For instance, the Ministry of Coal reported in February 2024, the overall coal imports in FY 2023-2024 were 123.53 million tons.

The trend is indicative of growing opportunities in the market that key players are taking advantage. For instance, in January 2023, Ducon Infratechnologies Limited increased its footprint in the country’s FGD market by taking advantage of new emission norms in the country to reduce carbon footprint, and estimated market opportunities to account for approximately USD 1.2-1.8 billion.

North America Market Insights

North America dry flue gas desulfurization system market is poised to register the fastest growth during the forecast period. The growth is owed to aging power plants that demand urgent retrofitting of FGD solutions. The cost-effectiveness of dry FGD solutions positions it to lead the race in FGD solutions to be adopted by major thermal power plants. The U.S. and Canada lead the market share in North America. Additionally, the region is investing in the FGD Gypsum byproduct owing to its use in agriculture and construction activities which favorably boosts the adoption of dry FGD solutions.

The U.S. accounts for the largest share in North America. The energy and climate policy reforms introduced by the U.S. boost the rapid growth surge of the dry flue gas desulfurization system market. For instance, the White House announced plans to reduce U.S. GHG emissions by 50% in 2030 and reach 100% carbon pollution-free electricity by 2050. The IEA estimated U.S. to account for 13.5% of global CO2 emissions in 2022. The U.S. accounts for a total of 215 operational coal-fired power plants. In August 2024, the U.S. Environmental Protection Agency stated that the majority of coal-fired power plants had retrofitted FGD systems but uncontrolled power plants remain in operation. This creates opportunities for market players to offer dry FGD services as well as maintenance services of existing FGD systems.

Canada is projected to increase its revenue share by the end of 2035. The market is driven by the push to reduce industrial emissions and stringent environmental regulations. For instance, in 2021, Canada passed the Net-Zero Emissions Accountability Act to push for net zero goals by 2050. This creates a favorable regulatory framework in the country to push for large-scale adoption of dry flue gas desulfurization systems. Additionally, in March 2022, Canada announced the objective to reduce GHG emissions by 20% by 2026, further necessitating the implementation of robust FGD solutions to cut down GHG emissions. These trends are positioned to assist the robust growth of the dry dry flue gas desulfurization system market.