Dry Flue Gas Desulfurization System Market Outlook:

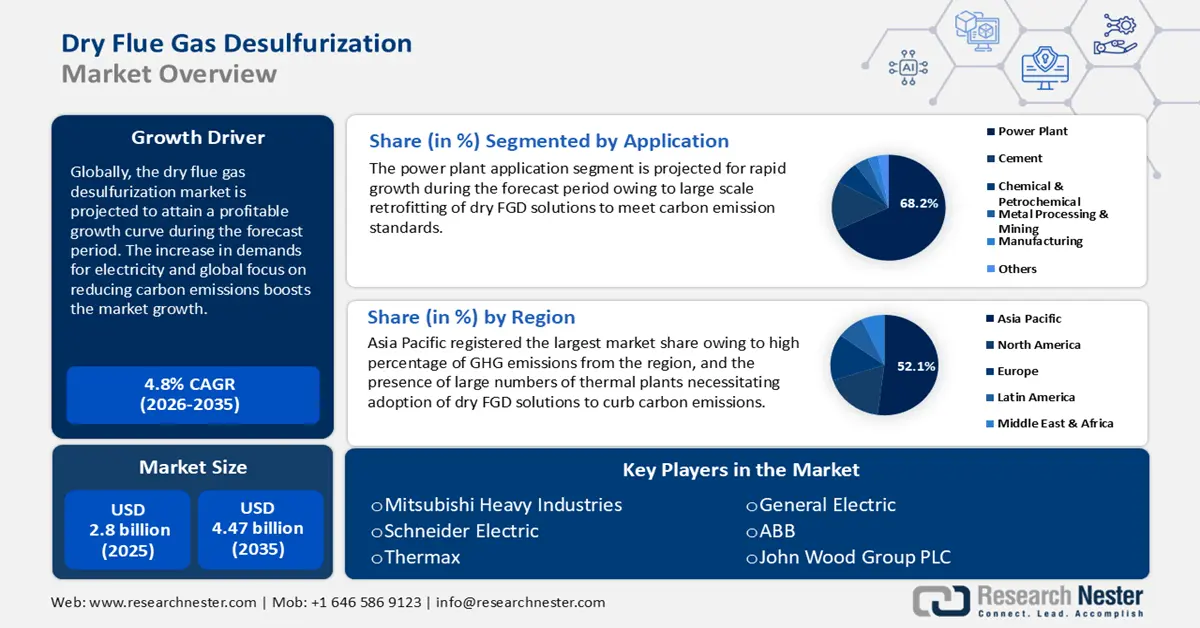

Dry Flue Gas Desulfurization System Market size was valued at USD 2.8 billion in 2025 and is likely to cross USD 4.47 billion by 2035, registering more than 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dry flue gas desulfurization system is assessed at USD 2.92 billion.

The market’s robust growth curve is attributed to industries seeking solutions to reduce sulfur emissions. FGD system is used widely in power plants, cement manufacturing, and industrial processes where sulfur dioxide (SF2) is a byproduct and removes SF2 from furnaces, boilers, and other sources. The dry flue gas desulfurization system market is in an advantageous position owing to the cost-effective nature of the FGD system and comparatively less usage of water than wet FGD which encourages large-scale adoption.

A major contributor to the dry flue gas desulfurization system market growth is the increasing demand for electricity globally and the rise in gas and coal-based power sources, boosting the need for dry flue gas desulfurization solutions to comply with stringent environmental standards. For instance, the International Energy Agency (IEA) estimated global electricity demand to rise annually at 3.4% from 2023 to 2026. Additionally, IEA reported that global coal consumption to have surged, reaching an all-time high on 2022, and is poised to increase in 2023 owing to growth in countries like China and India. In 2022, the global consumption of coal was 8.4 billion tons. This has prompted governments across the world to push for mandatory installation of FGD systems in power plants.

International organizations and national governments are pushing for companies to disclose their environmental, social, and governance (ESG) impacts via sustainability reports. Trends as such put the onus on operators to install robust FGD solutions to reduce carbon footprints. The global push for green solutions opens opportunities for key market players, especially in emerging economies, as requirements to retrofit older plants with FGD technology rise. Market players are benefit from advancements in FGD systems such as electrodialysis systems and ion-exchange membranes that allow efficient treatment of FGD wastewater. As the Environmental Protection Agency tightens its regulations, the demand for robust dry flue gas desulfurization systems is poised to witness a surge by the end of the forecast period.

Key Dry Flue Gas Desulfurization System Market Insights Summary:

Regional Highlights:

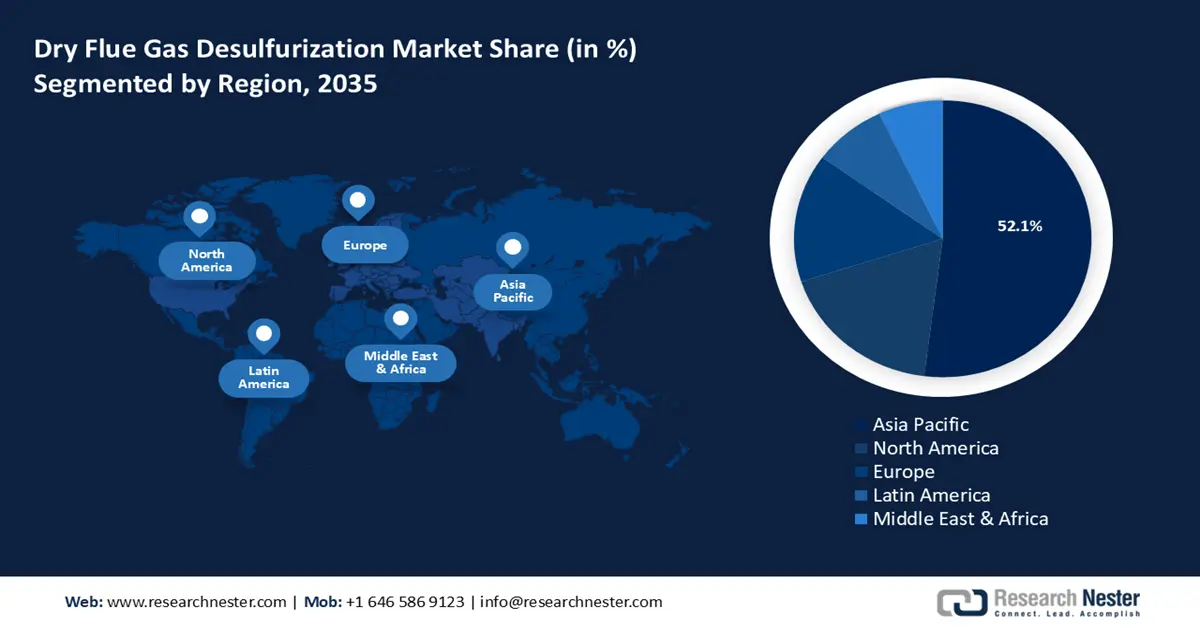

- By 2035, Asia Pacific is anticipated to secure a 52.1% share of the dry flue gas desulfurization system market, propelled by the strict enforcement of environmental regulations.

- By 2035, North America is expected to expand rapidly in dry FGD adoption, supported by aging power plants requiring urgent retrofitting.

Segment Insights:

- By 2035, the power plant application segment in the dry flue gas desulfurization system market is projected to command a 68.2% share, supported by the need for systems characterized by low water consumption and compact design.

- By 2035, the cement segment is set to increase its revenue share, underpinned by stringent regulations to cut down greenhouse gas emissions.

Key Growth Trends:

- Technological advancements of FGD

- Rapid industrialization in emerging economies

Major Challenges:

- Competition with alternative technologies

- High operational costs

Key Players: Mitsubishi Heavy Industries, Ducon Infratechnologies Limited, Schneider Electric, Thermax, Babcock & Wilcox, Hamon Corporation, RAFAKO, Fujian Longking, ABB, John Wood Group PLC, Doosan Lentjes.

Global Dry Flue Gas Desulfurization System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.8 billion

- 2026 Market Size: USD 2.92 billion

- Projected Market Size: USD 4.47 billion by 2035

- Growth Forecasts: 4.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (52.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, Indonesia, Vietnam, Turkey, United Arab Emirates

Last updated on : 2 December, 2025

Dry Flue Gas Desulfurization System Market - Growth Drivers and Challenges

Growth Drivers

-

Technological advancements of FGD: Technological advancements in dry flue gas desulfurization systems boost the dry flue gas desulfurization system market growth by increasing adoption in thermal power plants. For instance, in January 2024, published study on advances in process and materials for dry desulfurization of industrial flue gas highlights the newly developed dry desulfurization methods such as source/end control technologies and materials including calcium, magnesium, sodium, carbon-based, and transition metal oxide desulfurizers. Additionally, dry desulfurization is cost-effective owing to low transportation costs, employs smaller equipment, and is beneficial for low water pollution and lack of secondary pollution. This contributes to the rising popularity of the system fueling the dry flue gas desulfurization system market growth.

-

Rapid industrialization in emerging economies: The rapid rate of industrialization in emerging economies and China benefits robust dry flue gas desulfurization system market growth. For instance, the coal imports of India have risen by almost 40% to reach 25.2 million tons in July 2024. The rising industrialization leads to increase in output of the power generation sector and cement manufacturing industry where the demands for FGD systems are high. The reliance on fossil fuels to meet energy demands increases sulfur dioxide emissions, which requires urgent adoption of FGD systems. Additionally, the benefits of a dry desulfurization system such as its lack of additional pollution increase adoption rates in power plants.

- Stringent environmental regulations: The stringent imposition of environmental regulations by national governments as per United Nations guidelines to be carbon neutral by 2050 has prompted operators to hasten the adoption of FGD systems in their operations. For instance, in April 2024, the National Green Tribunal (NGT) fined the Punjab Government in India USD 4.8 million annually for failure in the timely installation of FGD systems in the state’s thermal power plants.

Manufacturers are increasingly seeking green energy solutions to meet the ESG requirements. Additionally, an increase in hiring of environmental consultancy services bodes well for the dry flue gas desulfurization market as professional consultants recommend FGD solutions as a vital component in reducing carbon footprints.

Challenges

-

Competition with alternative technologies: Dry flue gas desulfurization system faces competition with alternative technologies such as wet desulfurization systems. Industries emitting high sulfur content often adopt wet FGDS systems over dry systems stifling the dry flue gas desulfurization system market’s growth. Technological advancements in dry FGD are poised to answer this challenge and increase adoption rates.

-

High operational costs: Dry FGD systems can have high operational costs that can deter certain manufacturers from adopting these solutions. The high operational costs are associated with sorbent consumption and disposal. Lack of resources to manage the systems efficiently can also prove to be a barrier to adoption.

Dry Flue Gas Desulfurization System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 2.8 billion |

|

Forecast Year Market Size (2035) |

USD 4.47 billion |

|

Regional Scope |

|

Dry Flue Gas Desulfurization System Market Segmentation:

Application Segment Analysis

The power plant application segment in the dry flue gas desulfurization system market is poised to account for a dominant share of 68.2% by the end of the forecast period. The segment’s growth is owed to large-scale sulfur dioxide (So2) emissions from power plants that have pushed for the adoption of dry FGD solutions. Another growth driver of the segment is the rising global awareness of the health impacts of air pollution resulting in stricter enforcement of environmental regulations. These trends have pushed power plants to adopt dry FGD solutions to cap SF2 emissions boosting the segment’s growth. Dry FGD systems are effective for power plants owing to low water consumption and compact design.

Additionally, a market opportunity within the segment is retrofitting existing power plants which opens lucrative opportunities for dry flue gas desulfurization system market players. For instance, in August 2022, Power Mech Projects Limited announced that it had acquired 5 FGD projects worth USD 73.5 million from the Adani Group.

The cement segment in the dry flue gas desulfurization system market is poised to increase its revenue share by the end of the forecast period. The growth of the segment is attributed to high levels of sulfur dioxide emissions in cement manufacturing. Dry FGD solutions in cement plants reduce sulfur dioxide and also contribute to the production of FGD gypsum, which is widely used in cement manufacturing as a substitute for natural gypsum. This provides an additional economic benefit to cement plans in integrating dry FGD solutions boosting the segment’s growth. Additionally, stringent regulations to cut down greenhouse gas emissions are prompting industries to retrofit FGD solutions in cement plants and adapt them in the construction of new plants.

The chemical and petrochemical segment is projected to register steady growth during the forecast period. The segment’s growth curve is owed to high levels of sulfur dioxide emissions during industrial processes such as chemical production, oil refining, waste incineration, and gas operations. Dry FGD solutions are in high demand in this segment owing to their use in arid regions with the scarcity of water.

Additionally, the ease of installation makes it cost-effective to retrofit the systems to aging petrochemical plants. The increasing expansion projects of petrochemical plants are poised to maintain the demands for dry FGD solutions. For instance, in July 2023, McDermott International was awarded a contract for the Naphtha Cracker Expansion (Phase II) polypropylene expansion and new ethylene derivative unit project from the Indian Oil Corporation Limited (IOCL), and the project is poised to increase ethylene production capacity of the cracker unit by 20%

Our in-depth analysis of the dry flue gas desulfurization system market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dry Flue Gas Desulfurization System Market - Regional Analysis

APAC Market Insights

Asia Pacific dry flue gas desulfurization system market is projected to register a dominant global revenue share of 52.1% by the end of the forecast period. The market’s growth is led by China and India with high demands for electricity and large-scale thermal power plant emissions urgently necessitating dry FGD solutions to be retrofitted. Governments are identifying the scourge of air pollution and are actively seeking novel means to combat it, by strictly enforcing environmental regulations on manufacturers to curb the release of greenhouse gases (GHG). For instance, IEA reported China to account for 31.1% share of global emissions from combustible fuels in 2022. This prompts manufacturers to install FGD systems in the plants to ensure GHG emissions are at a permissible limit. Key market players are manufacturing advanced dry FGD systems that offer lesser carbon footprints.

China is projected to dominate the dry flue gas desulfurization system market share in APAC during the forecast period. The surge in profitable opportunities in the market is attributed to the substantial demand for electricity. The IEA estimated the electricity demand in China to have risen by 6.4% in 2023 boosted by the industrial and services sectors and projects the total electricity demand in the country to reach about 1400 TWh more than half of the European Union’s annual consumption. In July 2024, Carbon Brief reported that coal accounted for 53% of power generation in the country.

Although Solar PV is gaining popularity in the country and reducing coal dependency, the percentage of energy generated by coal is high, leading to increasing emissions of SF2. This is evident in growing coal exports by China; in 2023, the country imported 474.2 million tons of coal and the amount is forecasted to increase in 2024 to range between 450 and 500 million tons. The trends are favorable toward the rapid expansion of the dry flue gas desulfurization market as more manufacturers seek to retrofit FGD solutions in thermal power plants.

India is poised to rapidly increase its revenue share in APAC by the end of the forecast period. The growth is attributed to rising calls to install robust FGD systems in the industrial sector. For instance, IEA reported India to account for the third highest per capita CO2 emissions, ranking behind China and the U.S. The push for net zero goals is set to hasten the demands for dry flue gas desulfurization systems in the dry flue gas desulfurization system market. The country still depends on coal for a substantial percentage of power generation evidenced by imports, mainly from Indonesia and South Africa. For instance, the Ministry of Coal reported in February 2024, the overall coal imports in FY 2023-2024 were 123.53 million tons.

The trend is indicative of growing opportunities in the market that key players are taking advantage. For instance, in January 2023, Ducon Infratechnologies Limited increased its footprint in the country’s FGD market by taking advantage of new emission norms in the country to reduce carbon footprint, and estimated market opportunities to account for approximately USD 1.2-1.8 billion.

North America Market Insights

North America dry flue gas desulfurization system market is poised to register the fastest growth during the forecast period. The growth is owed to aging power plants that demand urgent retrofitting of FGD solutions. The cost-effectiveness of dry FGD solutions positions it to lead the race in FGD solutions to be adopted by major thermal power plants. The U.S. and Canada lead the market share in North America. Additionally, the region is investing in the FGD Gypsum byproduct owing to its use in agriculture and construction activities which favorably boosts the adoption of dry FGD solutions.

The U.S. accounts for the largest share in North America. The energy and climate policy reforms introduced by the U.S. boost the rapid growth surge of the dry flue gas desulfurization system market. For instance, the White House announced plans to reduce U.S. GHG emissions by 50% in 2030 and reach 100% carbon pollution-free electricity by 2050. The IEA estimated U.S. to account for 13.5% of global CO2 emissions in 2022. The U.S. accounts for a total of 215 operational coal-fired power plants. In August 2024, the U.S. Environmental Protection Agency stated that the majority of coal-fired power plants had retrofitted FGD systems but uncontrolled power plants remain in operation. This creates opportunities for market players to offer dry FGD services as well as maintenance services of existing FGD systems.

Canada is projected to increase its revenue share by the end of 2035. The market is driven by the push to reduce industrial emissions and stringent environmental regulations. For instance, in 2021, Canada passed the Net-Zero Emissions Accountability Act to push for net zero goals by 2050. This creates a favorable regulatory framework in the country to push for large-scale adoption of dry flue gas desulfurization systems. Additionally, in March 2022, Canada announced the objective to reduce GHG emissions by 20% by 2026, further necessitating the implementation of robust FGD solutions to cut down GHG emissions. These trends are positioned to assist the robust growth of the dry dry flue gas desulfurization system market.

Dry Flue Gas Desulfurization System Market Players:

- Mitsubishi Heavy Industries

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ducon Infratechnologies Limited

- Schneider Electric

- Thermax

- Babcock & Wilcox

- Hamon Corporation

- RAFAKO

- Fujian Longking

- ABB

- John Wood Group PLC

- Doosan Lentjes

The global dry flue gas desulfurization market is projected for a robust growth during the forecast period. Global and local players investing in research and development to improve dry FGD solutions to leverage the global push towards achieving Net-Zero emissions.

Here are some key players in the dry flue gas desulfurization system market:

Recent Developments

- In July 2024, the new ESI Eurosilo designed FGD Gypsum silo went into operation at the Nikol Tesla power plant in Beograd, Serbia. The silo is one of the several Flue Gas Desulfurization plants built by Mitsubishi Heavy Industries in the Balkan region.

- In September 2022, the deadline for coal-based power plants to meet emission standards was extended to December 31, 2027 by the Ministry of Environment, Forest, and Climate Change. The power plants have been directed to urgently install pollution control technologies and meet emission standards set by the government.

- Report ID: 6564

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dry Flue Gas Desulfurization System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.