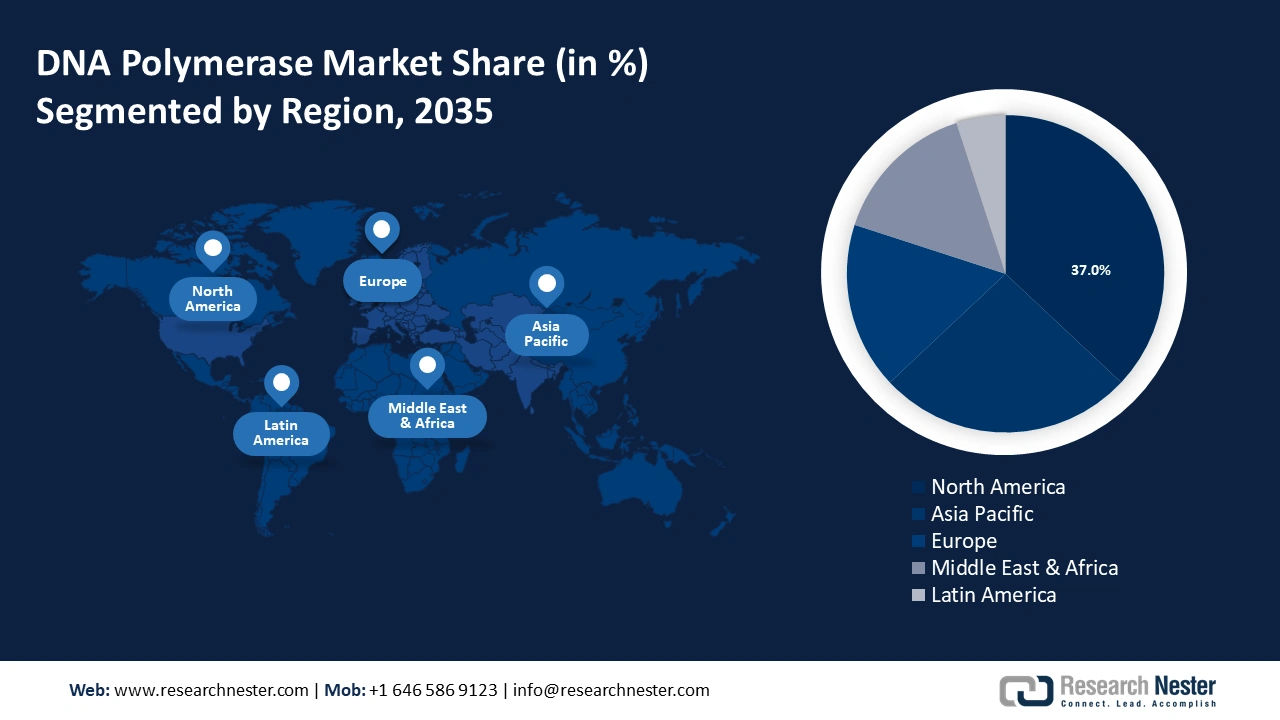

DNA Polymerase Market Regional Analysis:

North America Market Insights

North America industry is anticipated to hold largest revenue share of 37% by 2035. The market growth in the region is expected on account of the presence of well-known biotech and pharmaceutical companies highly investing in the development of novel medications and treatments. These businesses drive the need for DNA polymerases, which depend on them for numerous applications like PCR, sequencing, and genetic engineering.

The U.S. healthcare industry has opportunities for profitable growth due to its easy access to capital and investments in cutting-edge infrastructure. Additionally, a number of contract manufacturing and bioprocessing firms around the country are driving the expansion of the DNA polymerase market. National development will also be aided by financing for the manufacturing of generic biologics when pharmaceutical patents expire. Also, growing investments in healthcare is another factor propelling the market growth. According to the American Medical Association, in 2022, U.S. health spending climbed by 4.1% to reach USD 4.5 trillion, or USD 13,493 per person.

In Canada DNA polymerase has been increasingly used in biotechnology labs for DNA replication. The growth in chronic conditions such as cancer and diabetes is driving the expansion, and this is expected to support market growth in the country. According to the local government, after accounting for the aging population over time, the prevalence of diabetes has been rising at an average annual rate of 3.3% for nearly 3 million Canadians, or 8.9% of the total population.

APAC Market Insights

APAC will witness huge growth in the DNA polymerase market during the forecast period. The growth can be ascribed to the high prevalence of target diseases, rising financing for genomic research, and growing public awareness of genetic testing in the region. Furthermore, domestic and international market players are highly investing in the development of innovative DNA polymerases, which is anticipated to accelerate the region's growth.

The biopharmaceutical industry in China is expected to have favorable growth prospects due to the relocation of drug production facilities by international manufacturers and the presence of various biopharmaceutical contract research companies within the country. According to a 2024 report by the IMD Organization, prominent pharmaceutical corporations have been emphasizing the acquisition of and investment in forward-thinking regional businesses to further integrate themselves into the national Chinese biotech ecosystem. For instance, AstraZeneca is spending USD 1 billion to purchase Gracell Biotechnologies, a leader in CAR-T technology, in the first-ever full acquisition of a cutting-edge Chinese biotech company by a "Big Pharma" corporation.

In India, innovations such as real-time PCR (qPCR), digital PCR (dPCR), and next-generation sequencing have revolutionized the field of molecular diagnostics. Furthermore, the growing applications of PCR technology in oncology is contributing to the expansion of the DNA polymerase market. According to the National Centre for Disease Informatics and Research, with a crude incidence rate of 100.4 cases per 100,000 people, 1,461,427 new cases of cancer were diagnosed in India in 2022. Therefore, the growth in cancer cases will significantly drive the DNA polymerase market.

South Korea's biotechnology industry is booming, with numerous companies and academic institutions actively engaged in developing and utilizing DNA polymerase. For instance, The Korean Agency for Technology and Standards (KATS) Biotechnology Classification Code projected that the output volume of the biotech industry would be around USD 16 million in 2021. Over the last five years, there has been an average yearly increase of 17.8%, compared to figures below USD 75 billion in 2016.