DNA Polymerase Market Outlook:

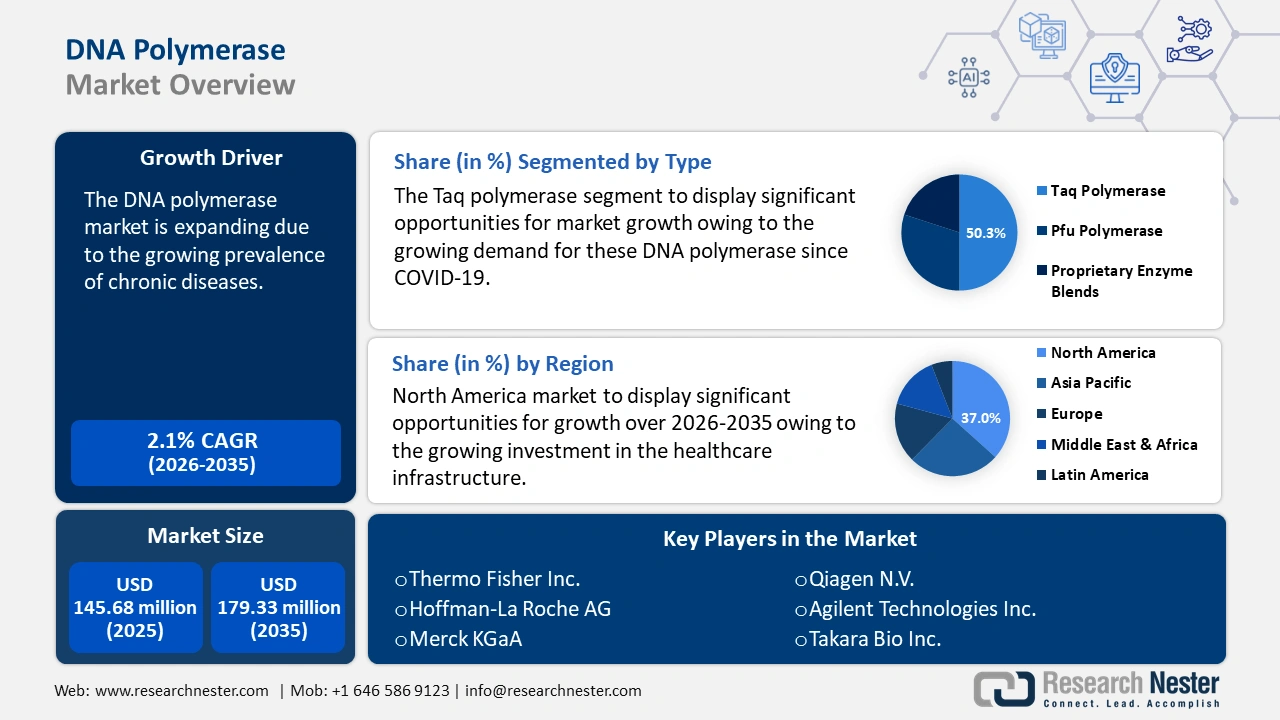

DNA Polymerase Market size was over USD 145.68 million in 2025 and is poised to exceed USD 179.33 million by 2035, witnessing over 2.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of DNA polymerase is estimated at USD 148.43 million.

The growing emphasis on genetic research, including gene sequencing, genome editing, and personalized medicine, drives demand for high-quality DNA polymerase. DNA polymerases are essential for various next-generation sequencing (NGS) platforms, which are widely used in genomics research. Companies such as Illumina and Thermo Fisher Scientific rely on high-quality DNA polymerases for their sequencing technologies. Moreover, CRISPR-Cas9 and other gene editing technologies require precise DNA polymerases for accurate editing and validation.

Additionally, chronic diseases such as cancer, diabetes, and cardiovascular conditions often require advanced diagnostic tools for early detection and ongoing monitoring. For instance, according to the World Health Organization (WHO), globally, cardiovascular diseases (CVDs) account for 17.9 million deaths annually. DNA polymerases are integral to techniques such as Polymerase Chain Reaction (PCR), and NGS, which are used to identify genetic markers and mutations associated with these diseases.

Key DNA Polymerase Market Insights Summary:

Regional Highlights:

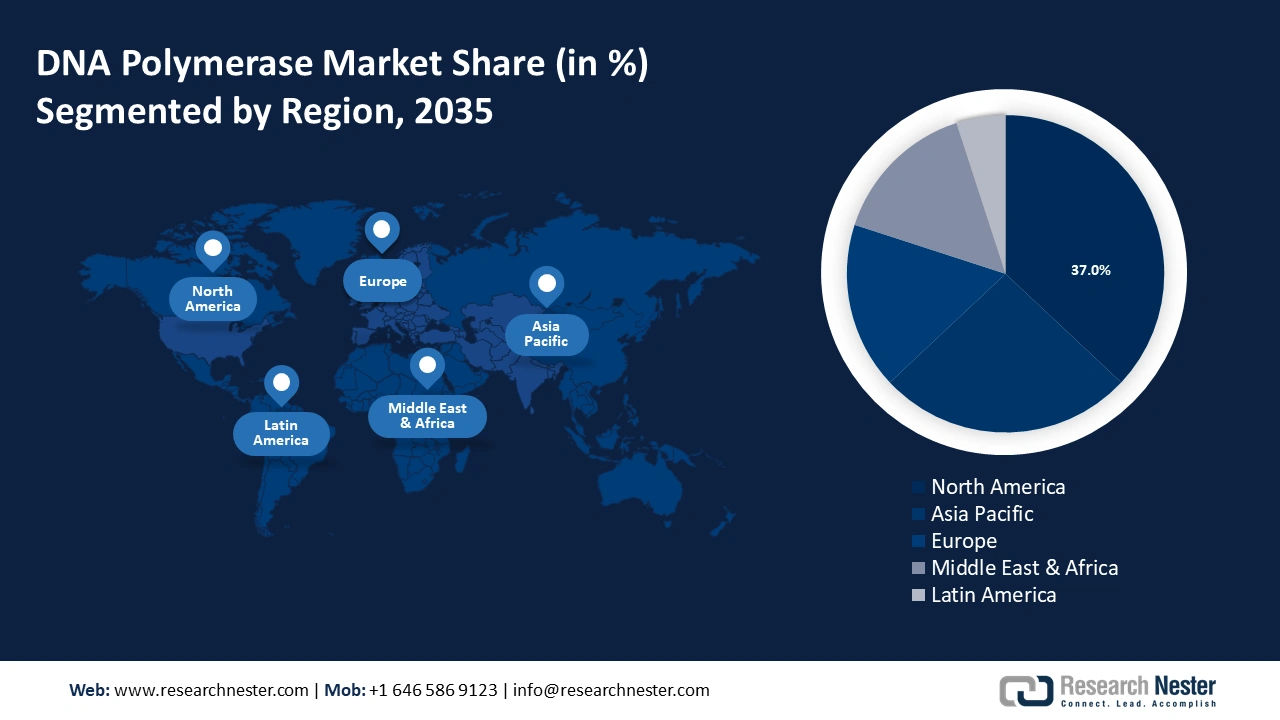

- North America DNA polymerase market will account for 37% share by 2035, driven by presence of biotech and pharma companies investing in novel medications and treatments.

- Asia Pacific market will register huge growth during the forecast timeline, driven by high prevalence of target diseases and rising financing for genomic research and genetic testing.

Segment Insights:

- The taq polymerase segment in the dna polymerase market is forecasted to achieve a 50.30% share by 2035, driven by high processivity and ability to tolerate high temperatures, boosted by COVID-19 demand.

- The polymerase chain reaction segment in the dna polymerase market is projected to achieve notable revenue growth till 2035, driven by increased adoption in molecular biology and diagnostic applications.

Key Growth Trends:

- Surge in the demand for molecular diagnostics

- Increased use in the biotechnology industries

Major Challenges:

- Growing costs of DNA polymerase

- Lack of awareness

Key Players: Thermo Fisher Scientific Inc., Hoffman-La Roche AG, Merck KGaA, Qiagen N.V., Agilent Technologies Inc., Takara Bio Inc., GenScript Biotech Corporation, Illumine Inc., Promega Corporation, New England Biolabs, Inc..

Global DNA Polymerase Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 145.68 million

- 2026 Market Size: USD 148.43 million

- Projected Market Size: USD 179.33 million by 2035

- Growth Forecasts: 2.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

DNA Polymerase Market Growth Drivers and Challenges:

Growth Drivers

- Surge in the demand for molecular diagnostics: The DNA polymerase market is anticipated to expand due to the rising need for molecular diagnostics, particularly for the early diagnosis and monitoring of diseases. Target DNA sequence detection and amplification in molecular diagnostics are made possible by DNA polymerase. Numerous uses of PCR exist, such as DNA fingerprinting, genetic disorder diagnosis, cancer-associated gene detection, tissue typing, transplant donor selection, phylogenetic analysis, molecular epidemiological studies, and pathogen-induced infection diagnosis, including genotyping drug resistance and variant species. For instance, PCR tests are extensively used for detecting pathogens such as SARS-CoV-2, the virus responsible for COVID-19, driving demand for high-quality DNA polymerases.

- Increased use in the biotechnology industries: The expanding applications of DNA polymerases in biotechnology, including gene cloning, synthetic biology, bioinformatics, and drug discovery, drive the DNA polymerase market growth. For instance, pharmaceutical companies use DNA polymerases to analyze gene expression profiles and identify potential drug targets. Additionally, the increasing investments and advancements in these areas further stimulate the demand for DNA polymerases.

- Growing research & development (R&D) activities: Government initiatives to boost R&D funding and healthcare expenditure will boost the DNA polymerase market applications. Regulators like the Food and Drug Administration (FDA), are highlighting the use of molecular diagnostics technology to take advantage of drug patent expiration and the creation of generic biologics with less interference in bioprocessing. Moreover, leading market participants' strategic alliances and technological advancements will drive market growth.

Challenges

- Growing costs of DNA polymerase: The increasing cost of DNA polymerases is impeding the growth of the DNA polymerase industry by preventing the adoption of innovative technologies that need costly enzymes. The DNA polymerase market is significantly impacted by biotechnology breakthroughs, which cause a fast increase in the price of the polymerases. Some medical institutions or research labs may be unable to obtain these polymerases due to their high cost.

- Lack of awareness: Lack of government financing in some emerging nations and lack of awareness in some research institutes may impede the growth of DNA polymerase market.

DNA Polymerase Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

2.1% |

|

Base Year Market Size (2025) |

USD 145.68 million |

|

Forecast Year Market Size (2035) |

USD 179.33 million |

|

Regional Scope |

|

DNA Polymerase Market Segmentation:

Type Segment Analysi

Taq polymerase segment is likely to capture over 50.3% DNA polymerase market share by 2035. By amplifying a particular DNA sequence, the method facilitates analysis and investigation. The ability of Taq polymerases to tolerate high temperatures and their high processivity, which allows them to stretch DNA strands quickly and effectively, are two features that make them very helpful for PCR. During the COVID-19 pandemic, there was a sharp increase in demand for these DNA polymerases since the pandemic spurred various genetics and molecular biology research opportunities.

Application Segment Analysis

The polymerase chain reaction segment in DNA polymerase market is expected to garner a notable share in the forecast period. The segment growth can be attributed to the increased adoption of this technology in several molecular biology techniques. PCR technology is essential in many domains, including biotechnology, forensic sciences, and medical diagnostics, where it can be applied to DNA-based research and the creation of new products. For instance, PCR tests are used for diagnosing diseases such as tuberculosis, HIV, and various other bacterial and viral infections.

Moreover, PCR is also used in forensic and legal applications. In forensic science, PCR is used to amplify and analyze DNA from crime scenes. This application has a major impact on forensic investigations and paternity tests.

End use Segment Analysis

The hospitals & diagnostics centers segment in DNA polymerase market is estimated to gain a significant revenue share in 2035. The segment growth can be attributed to the growing incidence of genetic disorders and infectious diseases, which have increased the demand for PCR testing by these facilities for diagnosis. According to the WHO, in developed nations, genetic illnesses and congenital abnormalities cause over 50% of childhood fatalities, account for up to 30% of pediatric hospital admissions, and affect 2%–5% of live births.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

DNA Polymerase Market Regional Analysis:

North America Market Insights

North America industry is anticipated to hold largest revenue share of 37% by 2035. The market growth in the region is expected on account of the presence of well-known biotech and pharmaceutical companies highly investing in the development of novel medications and treatments. These businesses drive the need for DNA polymerases, which depend on them for numerous applications like PCR, sequencing, and genetic engineering.

The U.S. healthcare industry has opportunities for profitable growth due to its easy access to capital and investments in cutting-edge infrastructure. Additionally, a number of contract manufacturing and bioprocessing firms around the country are driving the expansion of the DNA polymerase market. National development will also be aided by financing for the manufacturing of generic biologics when pharmaceutical patents expire. Also, growing investments in healthcare is another factor propelling the market growth. According to the American Medical Association, in 2022, U.S. health spending climbed by 4.1% to reach USD 4.5 trillion, or USD 13,493 per person.

In Canada DNA polymerase has been increasingly used in biotechnology labs for DNA replication. The growth in chronic conditions such as cancer and diabetes is driving the expansion, and this is expected to support market growth in the country. According to the local government, after accounting for the aging population over time, the prevalence of diabetes has been rising at an average annual rate of 3.3% for nearly 3 million Canadians, or 8.9% of the total population.

APAC Market Insights

APAC will witness huge growth in the DNA polymerase market during the forecast period. The growth can be ascribed to the high prevalence of target diseases, rising financing for genomic research, and growing public awareness of genetic testing in the region. Furthermore, domestic and international market players are highly investing in the development of innovative DNA polymerases, which is anticipated to accelerate the region's growth.

The biopharmaceutical industry in China is expected to have favorable growth prospects due to the relocation of drug production facilities by international manufacturers and the presence of various biopharmaceutical contract research companies within the country. According to a 2024 report by the IMD Organization, prominent pharmaceutical corporations have been emphasizing the acquisition of and investment in forward-thinking regional businesses to further integrate themselves into the national Chinese biotech ecosystem. For instance, AstraZeneca is spending USD 1 billion to purchase Gracell Biotechnologies, a leader in CAR-T technology, in the first-ever full acquisition of a cutting-edge Chinese biotech company by a "Big Pharma" corporation.

In India, innovations such as real-time PCR (qPCR), digital PCR (dPCR), and next-generation sequencing have revolutionized the field of molecular diagnostics. Furthermore, the growing applications of PCR technology in oncology is contributing to the expansion of the DNA polymerase market. According to the National Centre for Disease Informatics and Research, with a crude incidence rate of 100.4 cases per 100,000 people, 1,461,427 new cases of cancer were diagnosed in India in 2022. Therefore, the growth in cancer cases will significantly drive the DNA polymerase market.

South Korea's biotechnology industry is booming, with numerous companies and academic institutions actively engaged in developing and utilizing DNA polymerase. For instance, The Korean Agency for Technology and Standards (KATS) Biotechnology Classification Code projected that the output volume of the biotech industry would be around USD 16 million in 2021. Over the last five years, there has been an average yearly increase of 17.8%, compared to figures below USD 75 billion in 2016.

DNA Polymerase Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hoffman-La Roche AG

- Merck KGaA

- Qiagen N.V.

- Agilent Technologies Inc.

- Takara Bio Inc.

- GenScript Biotech Corporation

- Illumine Inc.

- Promega Corporation

- New England Biolabs, inc.

The DNA polymerase market is highly concentrated worldwide, with major biopharmaceutical companies controlling a sizable portion of the market. Major industry participants are investigating new applications in compliance with local, state, federal, and global regulatory norms, and concentrating more on product research and launch.

Recent Developments

- In July 2022, Thermo Fisher Scientific, the world leader in science services, released the Applied Biosystems TaqPath Respiratory Viral Select Panel, a CE-IVD-marked molecular assay panel for detecting five common viruses, including those that cause the common cold, bronchiolitis, croup, influenza-like illnesses, and pneumonia.

- In November 2021, QIAGEN added StableScript to their OEM offering. The versatile reverse transcriptase is available in bulk quantities and is suitable for one-step RT-qPCR and long-range RT-PCR applications. The discovery of reverse transcriptases made it possible to apply polymerase chain reaction (PCR) to RNA and create cDNA libraries from mRNA. Commercial availability has facilitated RNA cloning, sequencing, and characterization.

- Report ID: 6423

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

DNA Polymerase Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.