Digital MRO Market Outlook:

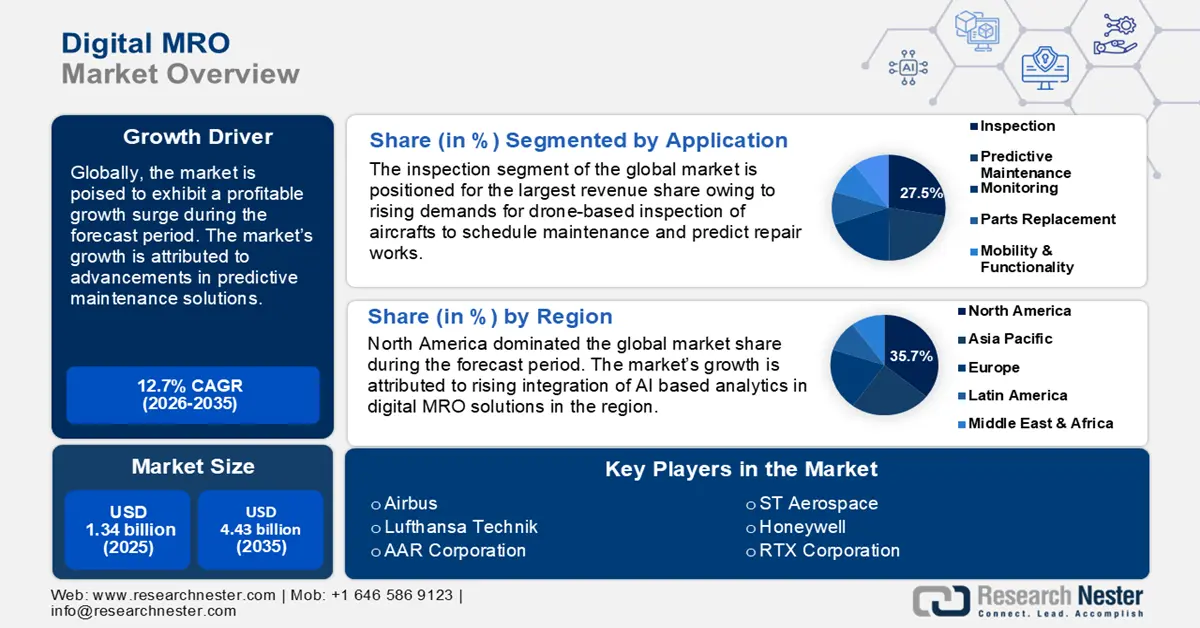

Digital MRO Market size was over USD 1.34 billion in 2025 and is anticipated to cross USD 4.43 billion by 2035, growing at more than 12.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital MRO is estimated at USD 1.49 billion.

The digital MRO market is driven by the rising adoption of advanced technologies within the aviation and aerospace sectors. The digital transformation has pushed MRO providers to streamline processes to reduce turnaround times and enhance operational anxiety. With advancements in IoT, AI, robotics, etc., to perform maintenance, repair, and overhaul (MRO) operations, the digital MRO market is poised to register rapid growth. Businesses are seeking cost reduction through digital MRO that is poised to increase its application by the end of the forecast period.

A key growth driver of the digital MRO market is the growing complexities of new-generation aircraft and the adoption of digital tools such as IoT-based monitoring, predictive maintenance analytics, and cloud solutions have become essential for real-time data collection and analysis. This enables aircraft companies to predict failures, avert disasters, and plan proactive maintenance. It not only allows companies to improve asset uptime but also reduces maintenance costs substantially. The trends are prompting MRO service providers to leverage digital platforms to remain competitive and address client expectations. For instance, in June 2022, Southwest Research Institute (SwRI) announced the development of new robotics image processing tools to automate aircraft surface preparation.

Another prominent significant growth driver rising integration of AR and VR to simulate repair tasks reducing on-the-job errors. The advancements in technology are vital for geographically dispersed teams, as it allows expert technicians to guide onsite staff in real time regardless of location. For instance, in December 2023, Alstom launched the largest digital experience center for next-generation signaling solutions in India. The adoption of digital MRO services is positioned to grow as rail, energy, automotive, and aviation industries continue to prioritize efficiency and safety.