Digital MRO Market Outlook:

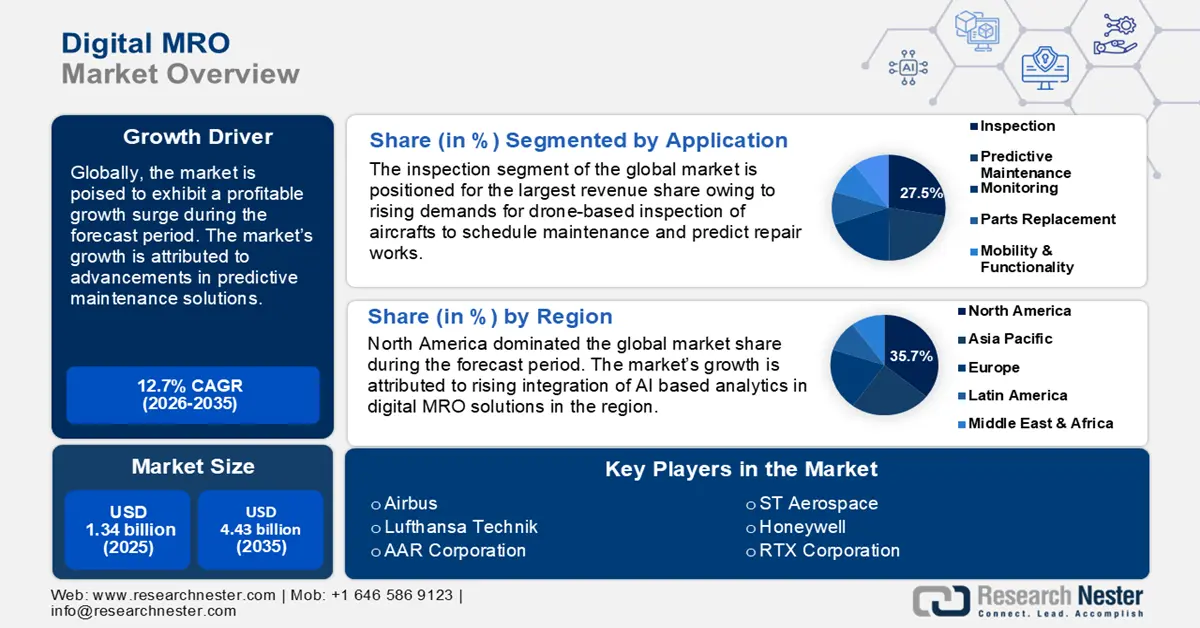

Digital MRO Market size was over USD 1.34 billion in 2025 and is anticipated to cross USD 4.43 billion by 2035, growing at more than 12.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital MRO is estimated at USD 1.49 billion.

The digital MRO market is driven by the rising adoption of advanced technologies within the aviation and aerospace sectors. The digital transformation has pushed MRO providers to streamline processes to reduce turnaround times and enhance operational anxiety. With advancements in IoT, AI, robotics, etc., to perform maintenance, repair, and overhaul (MRO) operations, the digital MRO market is poised to register rapid growth. Businesses are seeking cost reduction through digital MRO that is poised to increase its application by the end of the forecast period.

A key growth driver of the digital MRO market is the growing complexities of new-generation aircraft and the adoption of digital tools such as IoT-based monitoring, predictive maintenance analytics, and cloud solutions have become essential for real-time data collection and analysis. This enables aircraft companies to predict failures, avert disasters, and plan proactive maintenance. It not only allows companies to improve asset uptime but also reduces maintenance costs substantially. The trends are prompting MRO service providers to leverage digital platforms to remain competitive and address client expectations. For instance, in June 2022, Southwest Research Institute (SwRI) announced the development of new robotics image processing tools to automate aircraft surface preparation.

Another prominent significant growth driver rising integration of AR and VR to simulate repair tasks reducing on-the-job errors. The advancements in technology are vital for geographically dispersed teams, as it allows expert technicians to guide onsite staff in real time regardless of location. For instance, in December 2023, Alstom launched the largest digital experience center for next-generation signaling solutions in India. The adoption of digital MRO services is positioned to grow as rail, energy, automotive, and aviation industries continue to prioritize efficiency and safety.

Key Digital MRO Market Insights Summary:

Regional Highlights:

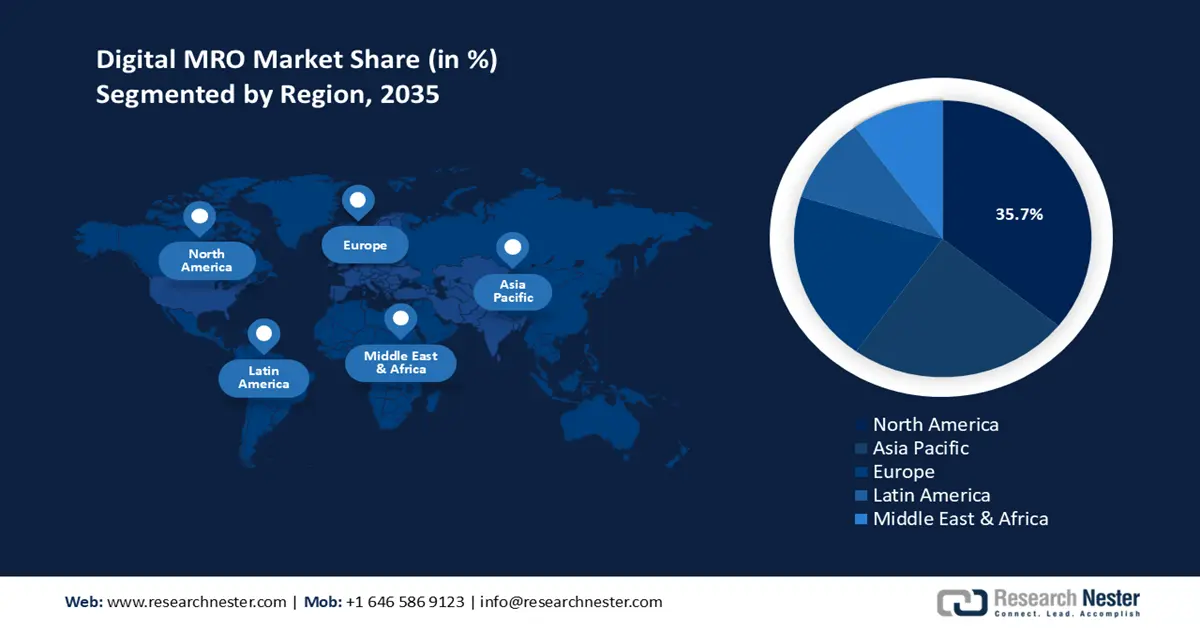

- North America's 35.7% share in the Digital MRO Market, driven by a robust MRO network and digital adoption in aviation, positions it as the leader with strong growth prospects through 2035.

- The APAC Digital MRO Market is expected to see the fastest growth by 2035, attributed to rising demand for cost-effective aviation solutions and IoT-based MRO.

Segment Insights:

- The Inspection segment is projected to hold a notable share by 2035, fueled by streamlined digital services and rising demand for faster, accurate inspections in aviation maintenance.

- The Predictive Maintenance segment is expected to see significant revenue growth by 2035, driven by rising demand from aerospace and train sectors to optimize operational efficiency and minimize downtime through real-time AI and machine learning.

Key Growth Trends:

- Rise in IoT adoption and real-time monitoring

- Expansion of digital twin technology

Major Challenges:

- Cybersecurity risks & data vulnerability

- Integration with legacy systems

- Key Players: Airbus, Lufthansa Technik, AAR Corporation, ST Aerospace, Honeywell, RTX Corporation, Delta TechOps, Ramco Systems Limited, General Electric.

Global Digital MRO Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.34 billion

- 2026 Market Size: USD 1.49 billion

- Projected Market Size: USD 4.43 billion by 2035

- Growth Forecasts: 12.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, UK

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Digital MRO Market Growth Drivers and Challenges:

Growth Drivers

- Rise in IoT adoption and real-time monitoring: Advancements in IoT have transformed MRO services across various sectors. With installation of IoT sensors on critical parts, MRO service providers are able to collect and analyze data in real-time, enabling data-driven maintenance decisions. Real-time monitoring and automotive diagnostic scans improve operational efficiency by alerting technicians regarding problems before they escalate and disrupt flights. The cost-effective features lead to greater demand for digital MRO services benefiting the global digital MRO market. For instance, in April 2024, Sri Lankan Airlines integrated the AMOS NewGen MRO System to reduce costs, automate aircraft maintenance, boost engineering productivity, and optimize operations.

- Expansion of digital twin technology: The emergence of digital twin technology has led to a surge in the adoption of digital MRO services. Digital twin technology can create a virtual replica of an aircraft or its components, leading to it becoming a transformative tool in the MRO sector. Digital Twin assists MRO service providers in conducting remote diagnostics and optimizing maintenance schedules based on asset conditions other than routine checks. The technology allows operational reliability and reduced costs, boosting its adoption and assisting the robust growth of the digital MRO sector. For instance, in December 2023, research published in Science Direct highlights the importance of digital twin for integrated vehicle health management (IVHM) in aerospace and integrated system health management (IVHM) by validating detections and acting as an alternate representation of the aircraft platform.

- Growing demands for cloud-based solutions: The rising popularity of cloud-based MRO solutions bodes well for the global digital MRO sector. Cloud technology allows MRO service providers to store vast amounts of maintenance and operational data while providing remote access to information for teams across different geographical locations. The rising globalization of the aviation industry is poised to benefit the adoption of cloud solutions for digital MRO. For instance, in December 2023, Dassault Systèmes announced that Dassault Aviation had extended its use of the 3D experience platform on an independent cloud to optimize maintenance operations.

Challenges

- Cybersecurity risks & data vulnerability: Digital MRO solutions rely heavily on data collection which can increase vulnerability to cybersecurity threats. The growing use of IoT devices and cloud-based platforms increases susceptibility to data breaches. Loss of sensitive data can prove to be disastrous for MRO operators, reducing the trust in the digital MRO sector and stifling its growth.

- Integration with legacy systems: Numerous MRO service providers and airlines operate with legacy systems that can make it challenging to work seamlessly with advanced digital platforms. Legacy systems may also lack the flexibility to support real-time data exchange or perform predictive analytics. Additionally, businesses can face challenges in updating legacy systems as it drives the cost of operations and can be time-consuming.

Digital MRO Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.7% |

|

Base Year Market Size (2025) |

USD 1.34 billion |

|

Forecast Year Market Size (2035) |

USD 4.43 billion |

|

Regional Scope |

|

Digital MRO Market Segmentation:

Application (Inspection, Predictive Maintenance, Monitoring, Parts Replacement, Mobility and Functionality)

The inspection segment is set to hold more than 27.5% digital MRO market share by 2035. The segment growth is owed to streamlining of operations of time-intensive and labor-heavy inspections through digital inspection services. The inspection segment benefits from rising demands for faster and more accurate inspection processes in aviation maintenance. The growing integration of drones for inspection of external surfaces minimizes aircraft downtime. For instance, in October 2024, the Federal Aviation Administration of the U.S. accepted plans for Delta Airlines to use drones for maintenance operations. Additionally, the segment’s profitable surge is poised to be assisted by the rise of digital twin technology, allowing MRO teams to perform virtual inspections.

The predictive maintenance segment of the global digital MRO market is poised to increase its revenue share by the end of the forecast period. The segment’s growth is attributed to rising demand by the aerospace and train sectors to optimize operational efficiency and minimize unplanned downtime. Predictive maintenance allows data to be interpreted in real-time using AI and machine learning, enabling MRO service providers to anticipate issues before they result in unscheduled repairs. With the growth of low-cost commercial flights, the demand for predictive maintenance is poised to surge to keep high-utilization fleets in peak condition. For instance, in October 2024, Revima and Asia Digital Engineering joined forces to revolutionize fleet management with predictive maintenance integration of Revima’s advanced APU predictive maintenance solution, PREDICARE.

End user (Airlines, MRO Service Providers, OEMs)

The airlines end user segment is poised to register the largest revenue share in the digital MRO market. The growth is owed to the adoption of digital maintenance tools by airlines to improve fleet performance and reduce operational disruptions. The commercial airlines sector is highly competitive and companies invest in improving fleet efficiency and services to maintain an edge in the sector. This is leading to a surge in demand for digital inspection and predictive maintenance to minimize unscheduled downtimes and improve asset utilization. For instance, in November 2023, Vietnam Airlines selected Skywise Predictive Maintenance solution to improve efficiency of operations.

Our in-depth analysis of the digital market includes the following segments:

|

Application |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital MRO Market Regional Analysis:

North America Market Forecast

North America industry is set to hold largest revenue share of 35.7% by 2035. The market’s growth in North America is owed to an established aviation sector in the region with large fleet operators and a robust network of MRO facilities driving demands for digital MRO services. The region’s market is positioned to exhibit considerable growth due to major airlines adopting digital MRO solutions to improve operational efficiency. The regional digital MRO market is expected to continue its profitable growth surge by the end of the forecast period by leveraging the increasing prevalence of AI usage in MRO services. For instance, in September 2024, GE Technologies announced the launch of a new services technology acceleration center that will be the launching base for advanced inspection technologies aimed at simplifying MRO processes.

The U.S. digital MRO market is positioned to register the largest revenue share in the North America market. The market’s growth is attributed to a high-demand, high-utilization fleet landscape in the country. Commercial, government, and private aircraft are investing in predictive maintenance solutions, as precise maintenance planning can significantly reduce unexpected repair costs. Additionally, companies are leveraging custom digital twins for aircraft fleets to leverage virtual assessment and preemptive parts replacement. For instance, in January 2023, the American Institute of Aeronautics and Astronautics (AIAA) released an implementation paper to advance the use of Digital Twins across the aerospace industry at the 2023 AIAA SciTech Forum. The continuous investments and advancements in AI in the country are positioned to improve the efficacy of digital MRO services, boosting the market’s continued growth.

Canada is positioned to increase its revenue share in the digital MRO market by the end of the forecast period. The sector’s growth is attributed to the rising adoption of IoT-based diagnostics for aircraft maintenance in the country. Partnerships between tech firms in the country and aerospace firms boost innovation in digital twins’ technology, assisting the robust growth of the digital MRO market. Additionally, the market benefits from a favorable regulatory environment in the country assisting the growth of AI, which is poised to improve the efficiency of digital MRO solutions. For instance, in March 2022, Pratt and Whitney Canada announced that it is combining artificial intelligence and machine learning with its innovative oil analysis technology to further increase the solution’s precision, predictive, and preventive maintenance capabilities for helicopter engines.

APAC Market Analysis

The APAC market is poised to register the fastest revenue growth in the global digital MRO market. The rapid growth of the market is attributed to rising demand for cost-effective commercial aviation solutions necessitating digital MRO solutions to reduce downtime. The region’s revenue growth is led by China, India, Japan, South Korea, and Singapore. Rising investments in IoT solutions are poised to advance MRO services for different aircraft, boosting the sector. For instance, in February 2024, Korean Air announced that it had enhanced its operational capability with Skywise digital solutions by leveraging Airbus Skywise Predictive Maintenance and Skywise Health Monitoring digital solutions.

The digital MRO market of China is poised to register the largest revenue share in APAC. The rapid growth is attributed to state-owned and private airlines adopting digitization in repair and maintenance to improve operational efficiency. A favorable technological ecosystem in the country boosts research activities in improving predictive maintenance and AI integration in digital MRO services, increasing the rate of adoption. Additionally, other sectors such as energy and power are adopting drone-based inspections, benefiting the digital MRO sector in the country. For instance, in September 2024, drone inspections were announced to be used in the Zhejiang substation inspections leveraging an intelligent inspection system.

India is positioned to increase its revenue share in the global digital MRO market. The market’s growth is owed to a booming aviation sector in the country and rising demands for maintenance for high-utilization fleets. With rapidly expanding domestic and international routes leading to an increase in fleets, the requirement for digital MRO solutions rises exponentially. Additionally, the National Civil Aviation Policy of India ensures strict guidelines on the MRO of aircraft opening opportunities for digital MRO service providers. For instance, in November 2023, Airbus partnered with HAL to service A320 family aircraft and the entry of Airbus is projected to strengthen the digital MRO market in the country.

Key Digital MRO Market Players:

- Airbus

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lufthansa Technik

- AAR Corporation

- ST Aerospace

- Honeywell

- RTX Corporation

- Delta TechOps

- Ramco Systems Limited

- General Electric

The global digital MRO market is poised to register profitable growth during the forecast period. Key players in the market are investing in AI, AR, and VR-based digital solutions to improve MRO services offered.

Here are some key players in the digital MRO market:

Recent Developments

- In September 2024, Ramco Systems announced the launch of aviation software 6.0 for smarter aircraft management. The software will have AI-driven insights, advanced automation, and seamless integration with MRO operations.

- In August 2024, Northop Gunman announced investment in a digital engineering ecosystem and advanced manufacturing to cut engineering rework and accelerate the pace of aircraft maintenance.

- Report ID: 6657

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital MRO Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.