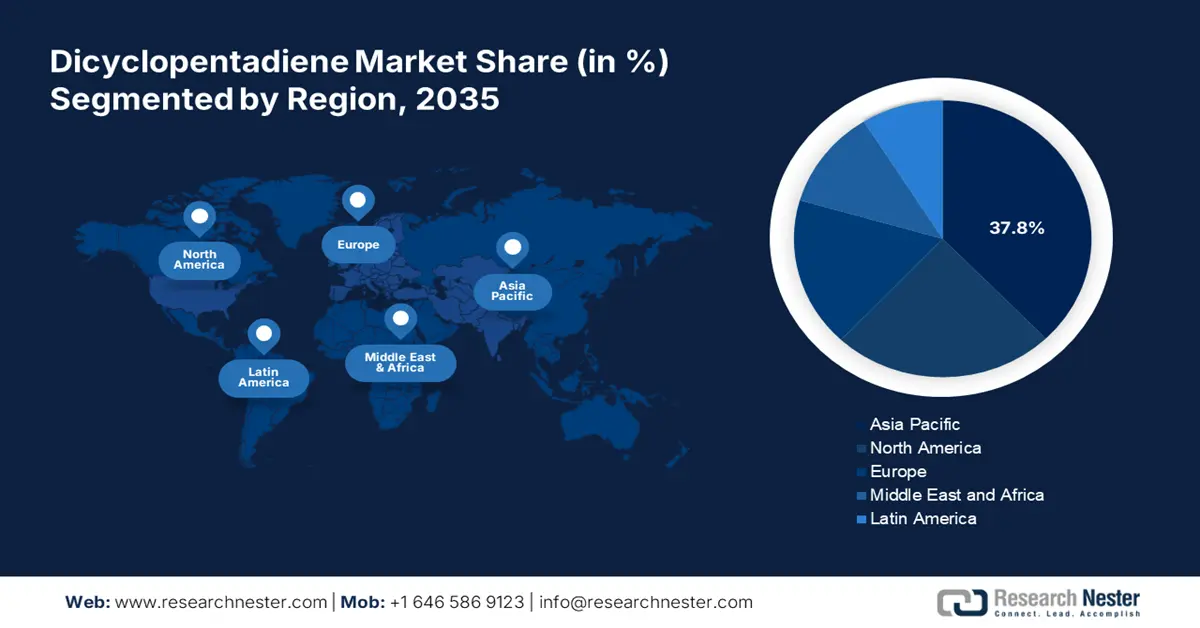

Dicyclopentadiene Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is poised to hold largest revenue share of 37.8% by 2035, Having large reservoirs of raw materials, the region has fostered an uninterrupted supply for manufacturing DCPD-based products. These chemicals are further used by the well-developed automotive industry for producing structural components including body panels and bumpers. Many domestic companies are now expanding their supply chain in the international market. For instance, in April 2020, SONGWON extended its partnership with Biesterfeld to introduce its portfolio of functional monomers to produce bonding agents in Europe. The new addition to the collaboration includes DCPD to optimize the properties of special binders.

India plays a pivotal role in the supply-demand chain of the global DCPD market due to its strong petrochemical industry. Several processing plants in major industrial hubs such as Gujarat and Maharashtra have positively contributed to the mass production of DCPD products in this country. Growing applications in automotive, construction, and electronics have inflated the demand for resins, synthetic rubber, and various chemical intermediates. This has further increased the need for DCPD-based materials to support such manufacturing volume.

The continuous investment in petrochemical technology and research has led to innovation in the China dicyclopentadiene (DCPD) market. Many companies and research institutions are now focusing on developing new methods of DCPD production to strengthen its international exports. The strict government policies are also pushing manufacturers to innovate cleaner ways of producing sustainable products. This is further leading to higher production capacity, solidifying the country’s position as one of the biggest DCPD exporters.

North America Market Analysis

North America is showing great potential for growth in the dicyclopentadiene market during the forecast period, 2025-2035. The regional development is driven by the large industrial presence and expansion of automotive, construction, and chemical manufacturing. The evolving landscape of this region is highly influenced by the innovation in extraction methods from petroleum and natural gas. This presents a promising future with better availability and lower production costs. The increment in the construction industry in developing countries has also inflated the demand for materials for manufacturing pipes, tanks, and composite panels.

The U.S. is one of the leading suppliers of the dicyclopentadiene (DCPD) market in the North America region. With access to the reservoir of raw materials in Texas, many domestic companies have benefited from their production due to the expansion of the oil and gas industry. The leaders are now focusing on integrating advanced technologies to accelerate their manufacturing process to supply the increasing demand for DCPD-based products. For instance, in May 2018, Texmark Chemicals collaborated with Hewlett Packard Enterprise to deploy IoT technology and Wi-Fi connectivity for managing its huge production of DCPD.

Canada is also slowly but steadily paving its progress in the dicyclopentadiene (DCPD) market through its large oil sands reserves such as Alberta. Such availability of raw materials is influencing the DCPD production capacity of this country. Many ongoing infrastructural development and renewal projects are also creating a steady demand for DCPD-based materials, especially in water management. Domestic and international companies are now introducing innovative methods to push production higher to supply the growing industrial need for resins, coatings, and specialized chemicals.