Dicyclopentadiene Market Outlook:

Dicyclopentadiene Market size was over USD 1.01 billion in 2025 and is projected to reach USD 1.76 billion by 2035, growing at around 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dicyclopentadiene is assessed at USD 1.06 billion.

The demand for DCPD is growing due to the heavy usage of the components in automobile manufacturing, particularly electric vehicles. With the increasing adoption of sustainable transportation, the need for such high-performing composite material is inflating.

Automakers are utilizing the material to manufacture lightweight and durable body structures, enhancing EV performance. For instance, in February 2023, Wardwizard launched MIHO, an e-bike with advanced storage capacity and comfort. The new electric scooter is built with polydicyclopentadiene, offering resistance to high impact, chemical corrosion, and high heat deflection temperature. This is further creating a new genre of consumer base, enlarging the DCPD market. The industry is now expanding with the penetration of advancements in production methods and new formulations.

Key Dicyclopentadiene Market Market Insights Summary:

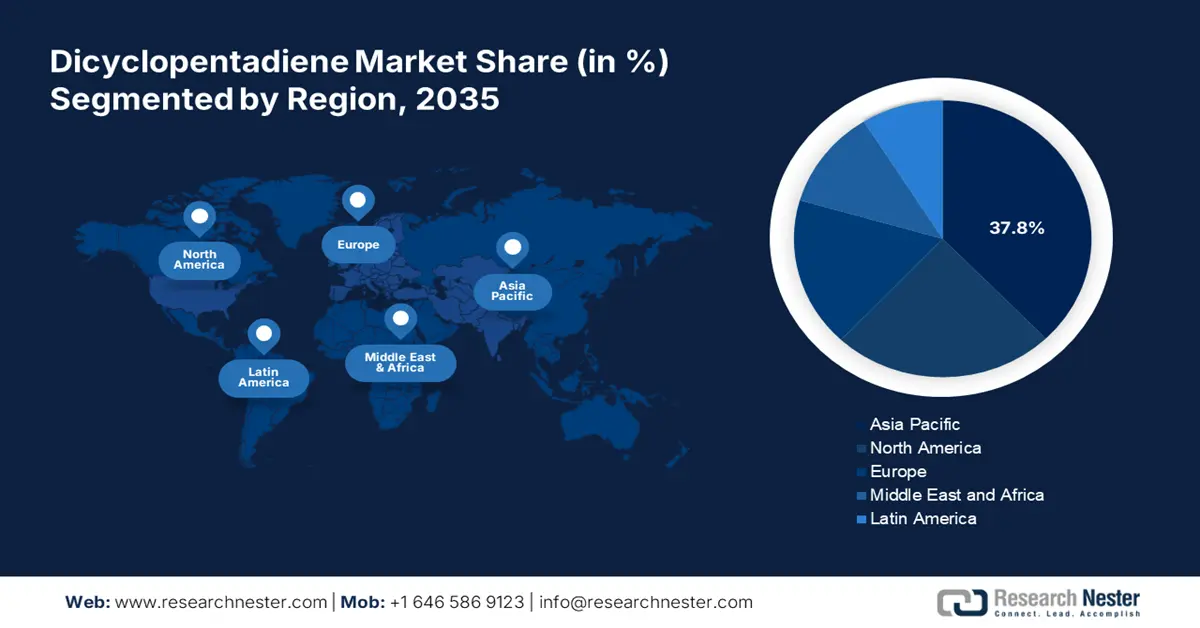

Regional Highlights:

- Asia Pacific dominates the Dicyclopentadiene Market with a 37.80% share, driven by large raw material reserves and rising demand from automotive and construction sectors, positioning it for significant growth by 2035.

- North America's Dicyclopentadiene Market is set to grow steadily by 2035, propelled by industrial base and innovations in petroleum-based extraction methods.

Segment Insights:

- The High Purity segment of the Dicyclopentadiene Market is expected to capture over 42% share by 2035, fueled by robust demand for highly pure DCPD in polymer production and chemical synthesis.

- The Unsaturated Polyester Resin segment anticipates remarkable revenue growth from 2026-2035, driven by demand for reinforced composites in construction, marine, and automotive sectors.

Key Growth Trends:

- Diverse applications in various industries

- Technological advancements in production

Major Challenges:

- Volatility of raw materials

- Increasing awareness about sustainability

- Key Players: Braskem, Royal Dutch Shell plc (Shell Chemicals), China Petrochemical Corporation, Cymetech Corporation, Maruzen Petrochemical, Zibo Luhua Hongjin New Material Co., LyondellBasell Industries Holdings B.V, Chevron Phillips Chemical Company, Nanjing Yuangang Fine Chemical Co., NOVA Chemicals, Texmark Chemicals, Inc., The Dow Chemical Company, Tokyo Chemical Industry Co., Ltd. (TCI Chemicals), Sunny Industrial System GmbH, ORLEN.

Global Dicyclopentadiene Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.01 billion

- 2026 Market Size: USD 1.06 billion

- Projected Market Size: USD 1.76 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 14 August, 2025

Dicyclopentadiene Market Growth Drivers and Challenges:

Growth Drivers

- Diverse applications in various industries: The dicyclopentadiene market offers a wide range of chemicals and composites for various industries. The multi-functional material serves many sectors including construction, electronics, automotive, and aerospace. This has further increased the demand for DCPD-based materials. The component can be used for manufacturing coatings, adhesives, and building materials for these industries. This makes DCPD one of the most preferable components for production houses. The features of resistance to heat, erosion, and harmful chemicals have also inflated the demand for dicyclopentadiene in the paints and coatings industry.

- Technological advancements in production: The dicyclopentadiene (DCPD) market is introducing new production methods to cope with the growing demand. Companies are investing to discover enhanced forms of catalytic and cracking processes to serve the purpose. Such innovative technologies have helped to produce high-quality DCPD cost-effectively and efficiently. The NLM study conducted in February 2022 states, that the Steam Cracking method of ORLEN can process a wide range of valuable hydrocarbons including dicyclopentadiene from gasses and heavy oils. These hydrocarbons can be further used as a profitable monomer in various chemical applications.

Challenges

- Volatility of raw materials: As PCPD is derived from petroleum-based feedstocks, the fluctuation in petroleum prices can create uncertainty in raw material supply for the dicyclopentadiene (DCPD) market. This may further impact the stability and pricing strategy of manufacturing companies. Disruptions in the raw material supply chain due to geopolitical tensions and natural disasters can affect the availability and affordability of these products. Such difficulty in cost management of production can also create difficulties in seamless supply to the market.

- Increasing awareness about sustainability: Changing consumer preferences towards using eco-friendly materials can hinder the progress of the dicyclopentadiene (DCPD) market. The limited recycling of DCPD-based products such as resins raises concerns about their environmental impact. This may further discourage investors, particularly those who are focused on reducing their carbon footprint. Strict regulations on chemical manufacturing and emissions can also hamper the approval of new launches. In addition, this may force consumers to switch to other sustainable alternatives.

Dicyclopentadiene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 1.01 billion |

|

Forecast Year Market Size (2035) |

USD 1.76 billion |

|

Regional Scope |

|

Dicyclopentadiene Market Segmentation:

Grade (High Purity, Hydrocarbon Grade, Polyester Grade)

By 2035, high purity segment is likely to dominate over 42% dicyclopentadiene market share. The growth of this segment is majorly driven by the growing demand for DCPD with 99% or higher purity level for specialized applications such as polymer production and chemical synthesis. The performance of fine chemicals including synthetic lubricants and plasticizers highly depends on the purity of this composite material. Using high purity DCPD can elevate the quality and durability of such end products, meeting strict industry standards. This creates a stable and large consumer base, inspiring companies to introduce new methods for achieving such a purity level.

Application (Hydrocarbon Resins, EPDM Elastomers, Cyclic Olefin Polymer (COP) & Copolymer (COC), Unsaturated Polyester Resin, Poly-DCPD)

Based on the application, the unsaturated polyester resin segment is estimated to generate remarkable revenue from the dicyclopentadiene market by the end of 2035. The enhanced mechanical properties of these resins also contribute to the production of fiberglass-reinforced composites for the construction and automotive sectors. In addition, unsaturated resins are employed in the marine industry due to their utilization for corrosion resistance and structural integrity. Moreover, the increased production of chemicals has inflated the demand for DCPD.

Our in-depth analysis of the market includes the following segments:

|

Grade |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dicyclopentadiene Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is poised to hold largest revenue share of 37.8% by 2035, Having large reservoirs of raw materials, the region has fostered an uninterrupted supply for manufacturing DCPD-based products. These chemicals are further used by the well-developed automotive industry for producing structural components including body panels and bumpers. Many domestic companies are now expanding their supply chain in the international market. For instance, in April 2020, SONGWON extended its partnership with Biesterfeld to introduce its portfolio of functional monomers to produce bonding agents in Europe. The new addition to the collaboration includes DCPD to optimize the properties of special binders.

India plays a pivotal role in the supply-demand chain of the global DCPD market due to its strong petrochemical industry. Several processing plants in major industrial hubs such as Gujarat and Maharashtra have positively contributed to the mass production of DCPD products in this country. Growing applications in automotive, construction, and electronics have inflated the demand for resins, synthetic rubber, and various chemical intermediates. This has further increased the need for DCPD-based materials to support such manufacturing volume.

The continuous investment in petrochemical technology and research has led to innovation in the China dicyclopentadiene (DCPD) market. Many companies and research institutions are now focusing on developing new methods of DCPD production to strengthen its international exports. The strict government policies are also pushing manufacturers to innovate cleaner ways of producing sustainable products. This is further leading to higher production capacity, solidifying the country’s position as one of the biggest DCPD exporters.

North America Market Analysis

North America is showing great potential for growth in the dicyclopentadiene market during the forecast period, 2025-2035. The regional development is driven by the large industrial presence and expansion of automotive, construction, and chemical manufacturing. The evolving landscape of this region is highly influenced by the innovation in extraction methods from petroleum and natural gas. This presents a promising future with better availability and lower production costs. The increment in the construction industry in developing countries has also inflated the demand for materials for manufacturing pipes, tanks, and composite panels.

The U.S. is one of the leading suppliers of the dicyclopentadiene (DCPD) market in the North America region. With access to the reservoir of raw materials in Texas, many domestic companies have benefited from their production due to the expansion of the oil and gas industry. The leaders are now focusing on integrating advanced technologies to accelerate their manufacturing process to supply the increasing demand for DCPD-based products. For instance, in May 2018, Texmark Chemicals collaborated with Hewlett Packard Enterprise to deploy IoT technology and Wi-Fi connectivity for managing its huge production of DCPD.

Canada is also slowly but steadily paving its progress in the dicyclopentadiene (DCPD) market through its large oil sands reserves such as Alberta. Such availability of raw materials is influencing the DCPD production capacity of this country. Many ongoing infrastructural development and renewal projects are also creating a steady demand for DCPD-based materials, especially in water management. Domestic and international companies are now introducing innovative methods to push production higher to supply the growing industrial need for resins, coatings, and specialized chemicals.

Key Dicyclopentadiene Market Players:

- Braskem

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Royal Dutch Shell plc (Shell Chemicals)

- China Petrochemical Corporation

- Cymetech Corporation

- Zibo Luhua Hongjin New Material Co.

- LyondellBasell Industries Holdings B.V

- Chevron Phillips Chemical Company

- Nanjing Yuangang Fine Chemical Co.

- NOVA Chemicals

- Texmark Chemicals, Inc.

- The Dow Chemical Company

- Sunny Industrial System GmbH

- ORLEN

The current dynamics of the dicyclopentadiene sector are focused on increasing production quality and quantity by introducing advanced extracting methods. Many key players are now expanding their product portfolio to supply the growing demand. For instance, in December 2019, SONGWON expanded its range of DCPD resins, ERM-6100. The company introduced the new dicyclopentadiene epoxy resin modifier range at the European Coatings Show in the same year. The new range has also been approved to be used as a hardener for specialty resins such as benzoxazine in high-performance electronic packaging. This expansion further inspires other leaders to increase their reach overseas.

Such key players include:

Recent Developments

- In September 2023, Shell Chemicals collaborated with OQ Chemicals to supply bio-circular precursor DCPD for TCD Alcohol DM production. The collaboration secured the positions of both companies on top of the sustainable material suppliers.

- In October 2022, ORLEN launched a new unit, Litvínov plant in the Czech Republic to increase its DCPD production. The latest manufacturing unit will help the company compete with other large dicyclopentadiene production houses in Europe.

- Report ID: 6732

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dicyclopentadiene Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.