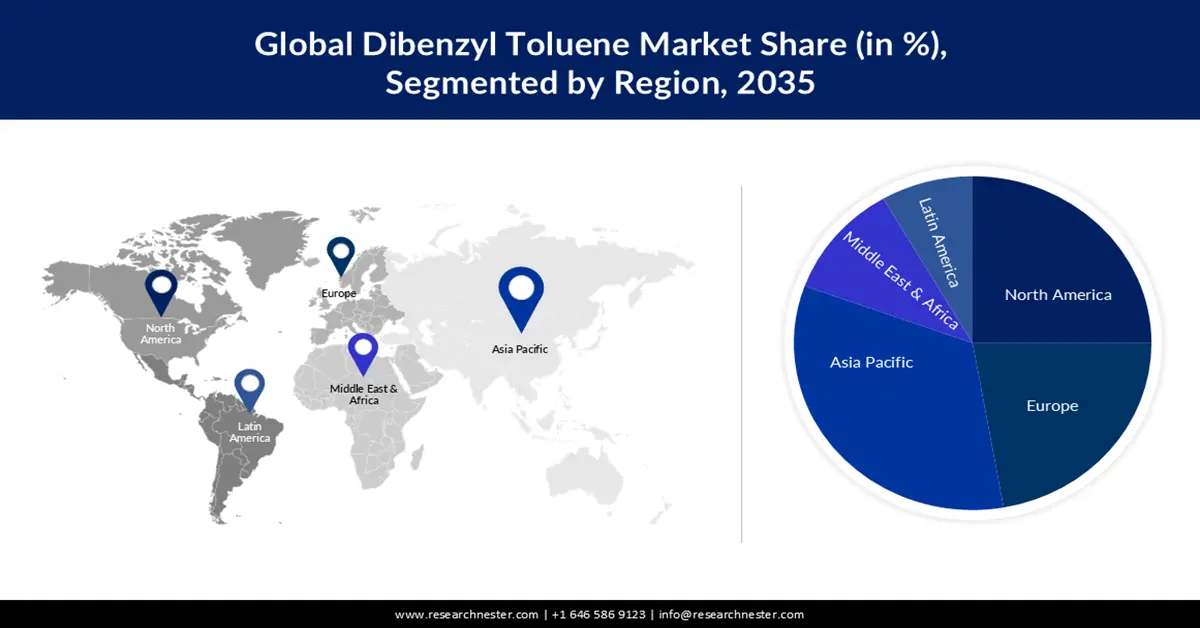

Dibenzyl Toluene Market - Regional Analysis

APAC Market Insights

The market in the Asia Pacific is estimated to witness noteworthy growth over the forecast period on the back of the rising number of activities in the oil industry, growing investments of prominent market players, and increasing manufacturing output in the region. According to the International Energy Agency, the oil demand in Asia is estimated to grow by 77 percent from 2021 to 2025. Whereas, the region’s dependence on oil imports is calculated to reach 81 percent in 2025. Moreover, Prominent users such as Evonik, Sinopec, ArcelorMittal, Nippon Steel, Showa Denko, and many other enterprises that make a variety of products are present in the region. These businesses require fluids with high heat transfer coefficients. China is at the leading edge of consumption; the nation is the region's leading consumer of DBT. Therefore, Asia Pacific is expected to dominate the market owing to these factors over the forecast period.

Europe Market Insights

Moreover, the market in Europe is anticipated to acquire the second largest share during the forecast period, which can be credited to the rise in the number of research and development activities related to the chemicals sector, and the strong presence of major market players in the region. Among the LOHCs on the marketplace, such as Methylcyclohexane (MCH), DBT, and others, DBT offers several potentials for stakeholders to broaden their presence in the European hydrogen supply chain. Furthermore, with R&D investments and the implementation of dependable marketing methods to expand customer portfolios, the market anticipates enormous development prospects in this area.

North American Market Insights

North America industry is estimated to account for largest revenue share of 39% by 2035, owing to the rapid growth of the oil and gas industry and increasing demand for DBT from the petrochemicals industry in the United States. North America, accounted for about a quarter of the market share in 2022 due to increased demand in the quickly developing oil and gas industry. In addition to its high flame-resistant qualities, heat generation in specific units of oil and gas extraction attracts DBT popularity in the region.

The existence of LyndollBassel, INEOS, Chevron Phillips, Shell, and a slew of other companies that conduct business in North America necessitates a high demand for dielectric fluids and heat transfer fluids in their factories.