Dibenzyl Toluene Market Outlook:

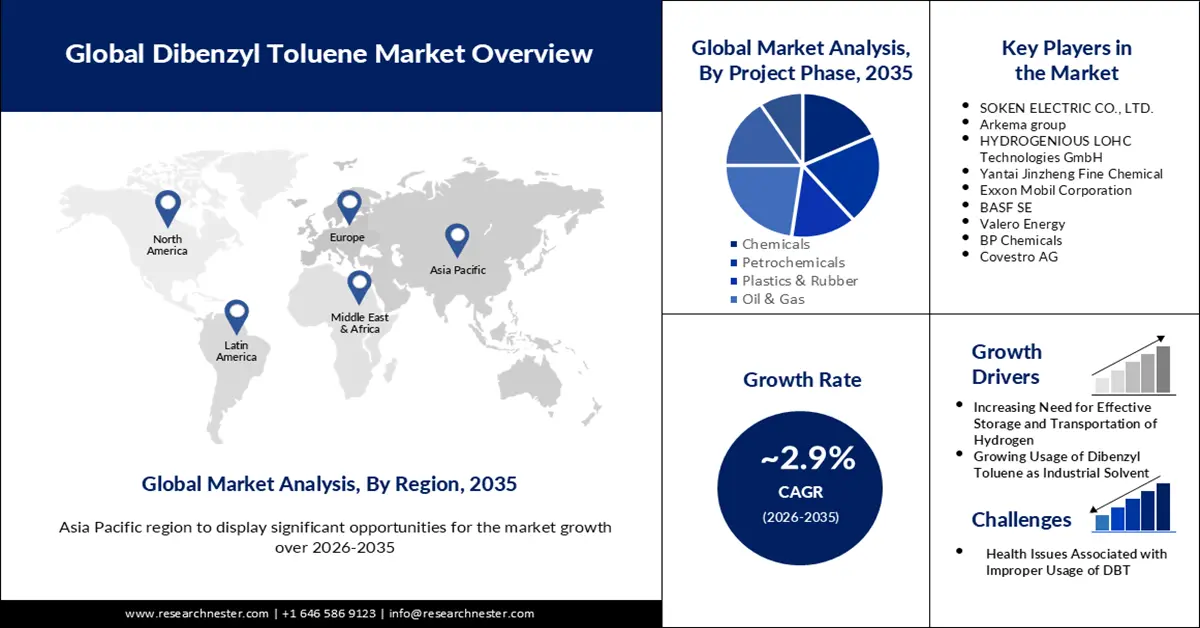

Dibenzyl Toluene Market size was over USD 62.07 million in 2025 and is poised to exceed USD 82.61 million by 2035, witnessing over 2.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dibenzyl toluene is evaluated at USD 63.69 million.

The growth of the market can be attributed to the rising demands from numerous end-use sectors. The industry experienced beneficial development during the period owing to the increased need for temperature control solutions to supply and manage the temperature of multiple goods and compounds. Furthermore, with R&D investments and the use of dependable marketing methods to expand customer portfolios, the market anticipates enormous potential prospects.

Rising growth in chemical industry is also anticipated to propel the market growth over the forecast period. According to the U.S. Bureau of Economic Analysis, in 2020, for the U.S., the value added by chemical products as a percentage of GDP was around 1.9%. Additionally, according to the World Bank, Chemical industry in the U.S. accounted for 16.43% to manufacturing value-added in 2018. With the growing demand from end-users, the market for chemical products is expected to grow in future. According to UNEP (United Nations Environment Program), the sales of chemicals are projected to almost double from 2017 to 2030.

Key Dibenzyl Toluene Market Insights Summary:

Regional Highlights:

- The Asia Pacific market is anticipated to experience significant growth by 2035, impelled by rising oil industry activities, increased investments, and expanding manufacturing output.

- By 2035, Europe is projected to secure the second largest market share, owing to extensive R&D activities and the strong presence of key market players.

Segment Insights:

- The oil & gas segment is projected to account for a 30% share by 2035, propelled by the continuing need for efficient heat transfer equipment for oil storage.

- By 2035, the heat transfer fluid segment is expected to hold a 51% share, driven by its high ignition point, nonflammability, and superior heat transfer properties.

Key Growth Trends:

- Increasing Need for Effective Storage and Transportation of Hydrogen

- Growing Usage of Dibenzyl Toluene as Industrial Solvent

Major Challenges:

- Health Issues Associated with Improper Usage of DBT

- Cost and Demand Fluctuation

Key Players: Eastman Chemical Company, SOKEN ELECTRIC CO., LTD., Arkema group, HYDROGENIOUS LOHC Technologies GmbH, Yantai Jinzheng Fine Chemical, Exxon Mobil Corporation, BASF SE, Valero Energy, BP Chemicals, Covestro AG.

Global Dibenzyl Toluene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 62.07 million

- 2026 Market Size: USD 63.69 million

- Projected Market Size: USD 82.61 million by 2035

- Growth Forecasts: 2.9%

Key Regional Dynamics:

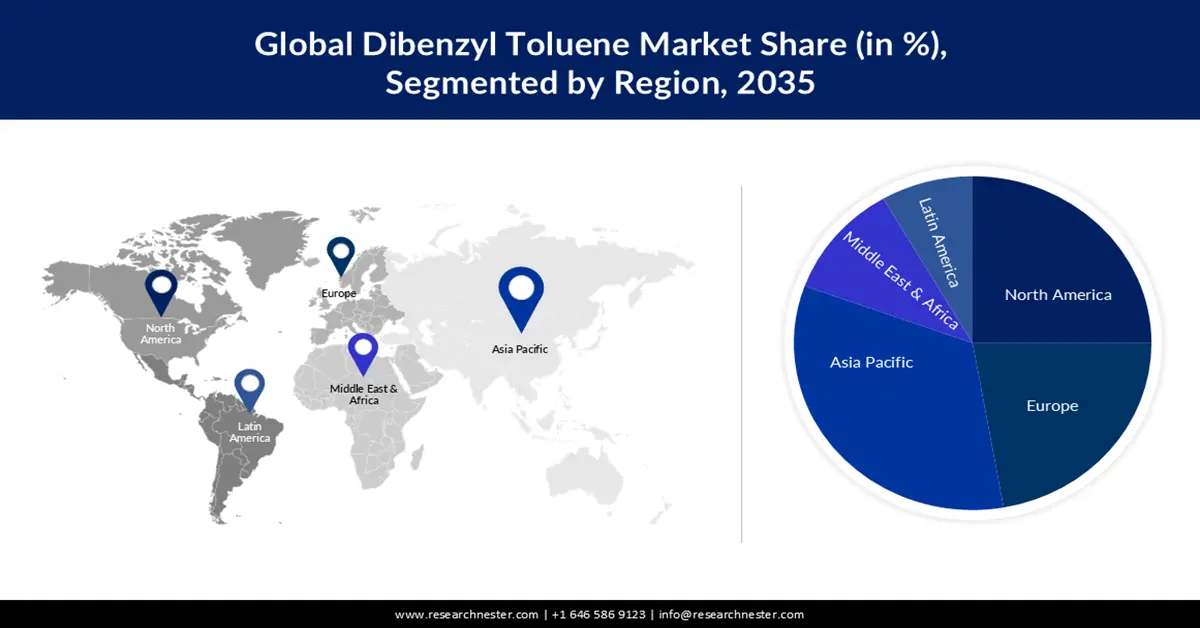

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Brazil, South Korea, Saudi Arabia, Mexico, Indonesia

Last updated on : 19 November, 2025

Dibenzyl Toluene Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Need for Effective Storage and Transportation of Hydrogen - The majority of the hydrogen generated is employed in the chemical industry. As hydrogen is extremely hazardous and combustible in nature, transporting it in the form of liquid or ammonia creates a significant risk to both the carrier and the surroundings. LOHC is one of the lucrative hydrogen transportation systems for addressing the aforementioned issues. Amongst the LOHCs on the marketplace, including Methylcyclohexane (MCH), DBT, and others, DBT offers several potentials for key players to broaden their presence in the European and North American hydrogen distribution networks. The requirement for DBT as LOHC from the logistics industry stakeholders and hydrogen distributors is expected to drive market expansion. More than 30,000 metric tons of liquid hydrogen was utilized in the United States in 2018, with that figure expected to rise to more than 40,000 metric tons by the end of 2024.

- Growing Usage of Dibenzyl Toluene as Industrial Solvent - Dibenzyl toluene is a colorless transparent liquid that is widely used as an industrial solvent in the production of paints, rubbers, glues, lacquers, and sealants due to its effectiveness in drying and dissolving other thin materials. This is viewed as a critical component that is anticipated to drive market expansion in the coming years. Over the forecast duration, the industrial solvents market is expected to grow at a CAGR of 3.7%.

- Rising Growth in Petrochemical Sectors - The increasing demand in the petrochemical and chemical fields provides enormous potential opportunities for the industry. Furthermore, dibenzyl toluene has the potential to cool high-voltage wires and is available in a variety of grades. In the USA, there are 130 refineries and 311 petrochemical firms that produce refined petroleum items including petrol, diesel, and jet fuel.

- Expanding Demand in Pharmaceuticals - In 2018, total global pharmaceutical sales were anticipated to be around USD 900 billion, rising to roughly USD 1500 billion by 2021.

- Significant Applications in Rubber Industry - In 2021, the worldwide synthetic rubber industry was anticipated to be worth 19.1 billion US dollars.

Challenges

- Health Issues Associated with Improper Usage of DBT

- Cost and Demand Fluctuation- BTX (Benzene Toluene Xylene) is the primary petrochemical produced in the refinery from crude oils. Crude oil price fluctuations are expected to affect market toluene pricing, which in turn is expected to affect the cost of dibenzyl toluene. Dibenzyl toluene is an oil that is made with Toluene as the primary raw ingredient. Higher costs lead to lower demand throughout the areas, reducing market demand. Furthermore, shifting market demand and high product costs do not attract new participants, interrupting the DBT supply chain.

- Heat Transfer Oil Alternatives Accessible in the Market

Dibenzyl Toluene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

2.9% |

|

Base Year Market Size (2025) |

USD 62.07 million |

|

Forecast Year Market Size (2035) |

USD 82.61 million |

|

Regional Scope |

|

Dibenzyl Toluene Market Segmentation:

End-userSegment Analysis

The global dibenzyl toluene market is segmented and analyzed for demand and supply by end users into chemicals, petrochemicals, plastics & rubber, oil & gas, pharmaceuticals, and others. Out of these, the oil & gas segment is estimated to gain the largest market share of about 30% in the year 2035. The oil and gas segment is expected to have the greatest market share throughout the forecast period as a result of the substantial quantity of dibenzyl toluene produced while producing petrol and other fuels from crude oil. The continuing need for efficient heat transfer equipment for oil storage is projected to drive segment growth. Between 2012 and 2025, the oil and gas industry is expected to generate $1.6 trillion in government and state tax income in the United States, sustaining the maintenance of educational institutions, medical facilities, and public infrastructure across the entire nation.

Application Segment Analysis

The global dibenzyl toluene market is also segmented and analyzed for demand and supply by application into dielectric fluid, heat transfer fluid, and others. Amongst these three segments, the heat transfer fluid segment is expected to garner a significant share of around 51% in the year 2035. For over three decades, dibenzyl toluene has been employed as a heat transfer fluid. The preferred purity for this kind of application is 98%. Businesses such as petrochemicals, chemicals, plastic and rubber, and many others rely on heat transfer fluids, particularly DBT, as a result of its high ignition point, heat transfer coefficient, nonflammability, and elevated boiling point characteristics, which has prompted the DBT marketplace as a heat transfer fluid. Heat transfer fluid is the target market for competitors such as Arkema and Eastman. As a result of the volume of DBT used as a heat transfer fluid, it takes up the majority of the market.

Our in-depth analysis of the global market includes the following segments:

|

By Grade |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dibenzyl Toluene Market - Regional Analysis

APAC Market Insights

The market in the Asia Pacific is estimated to witness noteworthy growth over the forecast period on the back of the rising number of activities in the oil industry, growing investments of prominent market players, and increasing manufacturing output in the region. According to the International Energy Agency, the oil demand in Asia is estimated to grow by 77 percent from 2021 to 2025. Whereas, the region’s dependence on oil imports is calculated to reach 81 percent in 2025. Moreover, Prominent users such as Evonik, Sinopec, ArcelorMittal, Nippon Steel, Showa Denko, and many other enterprises that make a variety of products are present in the region. These businesses require fluids with high heat transfer coefficients. China is at the leading edge of consumption; the nation is the region's leading consumer of DBT. Therefore, Asia Pacific is expected to dominate the market owing to these factors over the forecast period.

Europe Market Insights

Moreover, the market in Europe is anticipated to acquire the second largest share during the forecast period, which can be credited to the rise in the number of research and development activities related to the chemicals sector, and the strong presence of major market players in the region. Among the LOHCs on the marketplace, such as Methylcyclohexane (MCH), DBT, and others, DBT offers several potentials for stakeholders to broaden their presence in the European hydrogen supply chain. Furthermore, with R&D investments and the implementation of dependable marketing methods to expand customer portfolios, the market anticipates enormous development prospects in this area.

North American Market Insights

North America industry is estimated to account for largest revenue share of 39% by 2035, owing to the rapid growth of the oil and gas industry and increasing demand for DBT from the petrochemicals industry in the United States. North America, accounted for about a quarter of the market share in 2022 due to increased demand in the quickly developing oil and gas industry. In addition to its high flame-resistant qualities, heat generation in specific units of oil and gas extraction attracts DBT popularity in the region.

The existence of LyndollBassel, INEOS, Chevron Phillips, Shell, and a slew of other companies that conduct business in North America necessitates a high demand for dielectric fluids and heat transfer fluids in their factories.

Dibenzyl Toluene Market Players:

- Eastman Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SOKEN ELECTRIC CO., LTD.

- Arkema group

- HYDROGENIOUS LOHC Technologies GmbH

- Yantai Jinzheng Fine Chemical

- Exxon Mobil Corporation

- BASF SE

- Valero Energy

- BP Chemicals

- Covestro AG

Recent Developments

- Arkema Group, an innovator and market leader in superior materials, continued its advancement in additive production by utilizing dielectric fluids and establishing PRO14729, PRO14730, and PRO14731 for radio frequency uses and perfect for 3D printing in sophisticated electronic fields.

- Shell qualified the BASF Durasorb Cryo-HRU technology, which is used to remove water, heavy hydrocarbons, benzene, xylene, toluene, and other compounds to carry out cryogenic processes.

- Report ID: 3348

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dibenzyl Toluene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.