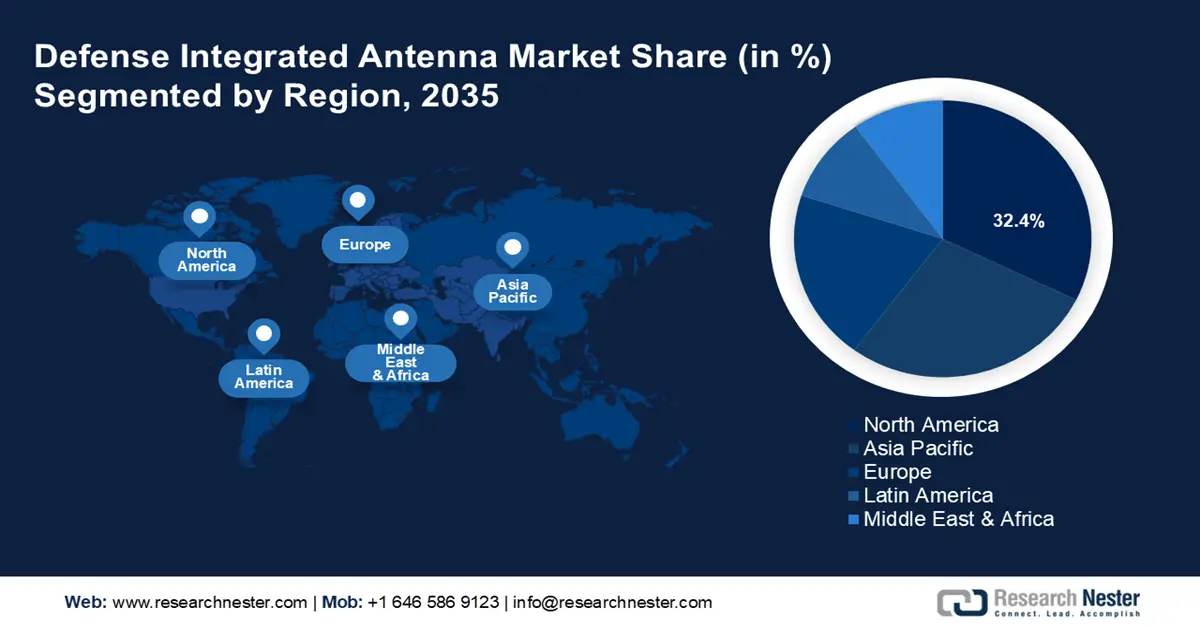

Defense Integrated Antenna Market Regional Analysis:

North America Market Insights

North America defense integrated antenna market is predicted to hold revenue share of more than 32.4% by 2035, owing to large-scale investments in the defense sector and an increasing percentage of defense contracts to supply robust integrated antenna solutions in the region. The market’s profit share is dominated by the U.S. and Canada. The market offers opportunities to manufacturers offering robust integrated antenna solutions for defense that can operate in challenging terrains of the region. Additionally, a robust research & development ecosystem in the region benefits the defense integrated antenna sector in North America. Businesses are leveraging the push for robust strengthening of the defense sectors by governments in the region. For instance, in August 2024, Raytheon won a USD 51.7 million contract for military satcom antennas as part of the Defense Experimentation using Commercial Space Internet (DEUCSI) program.

The U.S. has the largest share in the defense integrated antenna market in North America. The market’s growth in the U.S. is attributed to large-scale spending in defense and investments to improve communications and electronic warfare capabilities. For instance, in August 2024, the country’s defense spending rose by 62%, increasing from USD 506 billion to USD 820 billion in 2023. Additionally, the Space Force was allocated USD 30.1 billion, USD 202.6 billion for navy, USD 53.2 billion for marine corps, and USD 165.6 billion for the army. The push to modernize defense infrastructure is poised to open new opportunities for integrated antenna. The country seeks to maintain its edge in military technology, which makes the domestic market lucrative for businesses as profit opportunities are abundant. In financial year 2024, the defense department laid out details for USD 848.8 trillion budget that is poised to open multiple contract opportunities for integrated antenna manufacturers. For instance, in September 2024, Viasat was awarded a USD 33.6 million U.S. Air Force DEUCSI contract for phased array antenna technology development.

Canada is poised to increase its revenue share in the defense integrated antenna market owing to increasing investments in the defense sector boosting demands for integrated antenna solutions. The demand for reliable communication across remote region is driving demands for robust integrated antenna solutions that can withstand extreme environmental conditions. Additionally, Canada benefits from being a part of the North American Aerospace Defense Command (NORAD) along with the U.S., driving need for advanced communication and early warning systems. Companies are poised to benefit form the rising investments in defense infrastructure by securing contracts. For instance, in May 2023, NovAtel GPS anti-jam technology antennas were selected by the army in Canada for armored vehicles.

APAC Market Insights

APAC market is positioned to register the fastest growth in the global defense integrated antenna sector. The market’s robust growth curve is attributed to increased focus on regional security amid geopolitical disputes in the region. Maritime challenges between countries in the region push for increased investment in improving defense infrastructure, boosting opportunities in the defense integrated antenna sector.

China, India, Japan, and South Korea are leading the market share in APAC. Emerging economies in the region provide lucrative opportunities to market players in the region. For instance, in April 2024, South Korea successfully launched its second military spy satellite into orbit boosting the monitoring and missile attack capabilities. High-performance integrated antennas able to handle high-resolution imaging and data transmission are vital in such missions benefiting the sector’s growth.

China is projected to hold the largest revenue share in the defense integrated antenna market of APAC. The market’s growth is aligned with the country’s rise as a significant military power globally owing to large-scale investments in the defense sector. For instance, SIPRI reported China to have spent USD 296 billion in their defense sector in 2023, a 6% increase from 2022.

The heightened spending is poised to benefit the defense integrated antenna sector in the country. Efforts to advance SATCOM and intelligence, surveillance, and reconnaissance (ISR) capabilities create a steady demand for integrated antenna solutions. For instance, in August 2024, China launched the ChinaSat-4A communications satellite developed by the China Academy of Space Technology.

India is projected to increase its revenue share in the defense integrated antenna market in APAC. The market’s growth in India is owed to surging defense investments and a push to modernize military technology. Flagship government programs like Make in India and Atmanirbhar Bharat position the country to invest in developing an Indigenous manufacturing ecosystem that creates lucrative opportunities for the local players in the defense integrated antenna sector.

Additionally, the requirements to secure its extensive border and maritime territories are driving demand for effective multi-frequency antennas. The country has been actively collaborating with the U.S., Russia, and Japan in the defense sector, further creating opportunities in the market. For instance, in March 2024, Bharat Electronics Ltd. secured a defense contract with the Ministry of Defense for a contract worth USD 3.5 billion to supply an integrated electronic warfare system for the army.