Defense Integrated Antenna Market Outlook:

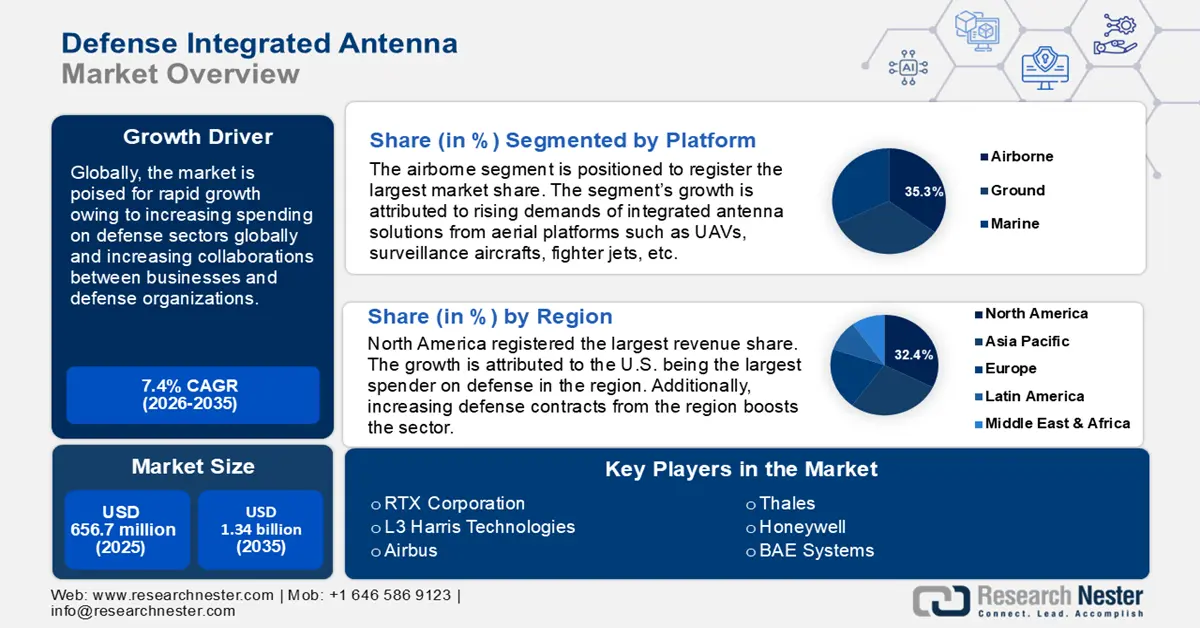

Defense Integrated Antenna Market size was valued at USD 656.7 million in 2025 and is expected to reach USD 1.34 billion by 2035, registering around 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of defense integrated antenna is evaluated at USD 700.44 million.

The growth of the market is attributed to large-scale investments in defense budget and advancements in 5G boosting defense communications allowing secure and fast communication. The trends are boosting demands for versatile antennas that can withstand extreme conditions in the defense sector across land, sea, and air. For instance, in December 2023, TX’s Raytheon announced that it would design, build, and test two high-powered microwave antenna systems under the 3-year USD 31.3 million contract from the Naval Surface Warfare Center Dahlgren Division.

A major growth driver of the defense integrated antenna market is the increasing allocation of funding by governments for innovative technologies to boost communications in the defense sector. Defense agencies worldwide are prioritizing the modernization of communication and data systems, by using integrated antennas capable of high-frequency satellite communication in the Ka-band network. For instance, in May 2023, the U.S. Department of Defense (DoD) announced the second set of projects for funding via the Accelerate the Procurement and Fielding of Innovative Technologies (APFIT) program, opening opportunities for manufacturers of integrated antenna solutions to provide innovative solutions for the contracts.

Additionally, the rising factor of electromagnetic threats that can disrupt communication systems necessitates the requirement of integrated antenna systems that can provide secure signal processing. For instance, in April 2023, the Defense Advanced Research Projects Agency (DARPA) announced that it was looking for ideas from non-traditional defense contractors and small businesses or novel antenna designs, materials, and manufacturing.

The defense-integrated antenna sector provides profitable opportunities to established players as well as new entrants to the market. The sector is positioned to leverage opportunities arising out of the rise of geopolitical tensions. Key market players have the opportunity to provide robust integrated antenna solutions in emerging economies of Asia Pacific that are undergoing an increase in defense spending. Opportunities are available for manufacturers that can integrate multiple offerings in a defense integrated antenna such as satellite communications (SATCOM), radar, GPS, and EMP protection are poised to benefit from the surging demands in the sector. Additionally, growing collaborations between defense agencies and companies foster greater innovation in the defense integrated antenna market. The global sector is positioned to leverage the favorable trends and continue its robust profit surge during the forecast period.

Key Defense Integrated Antenna Market Insights Summary:

Regional Highlights:

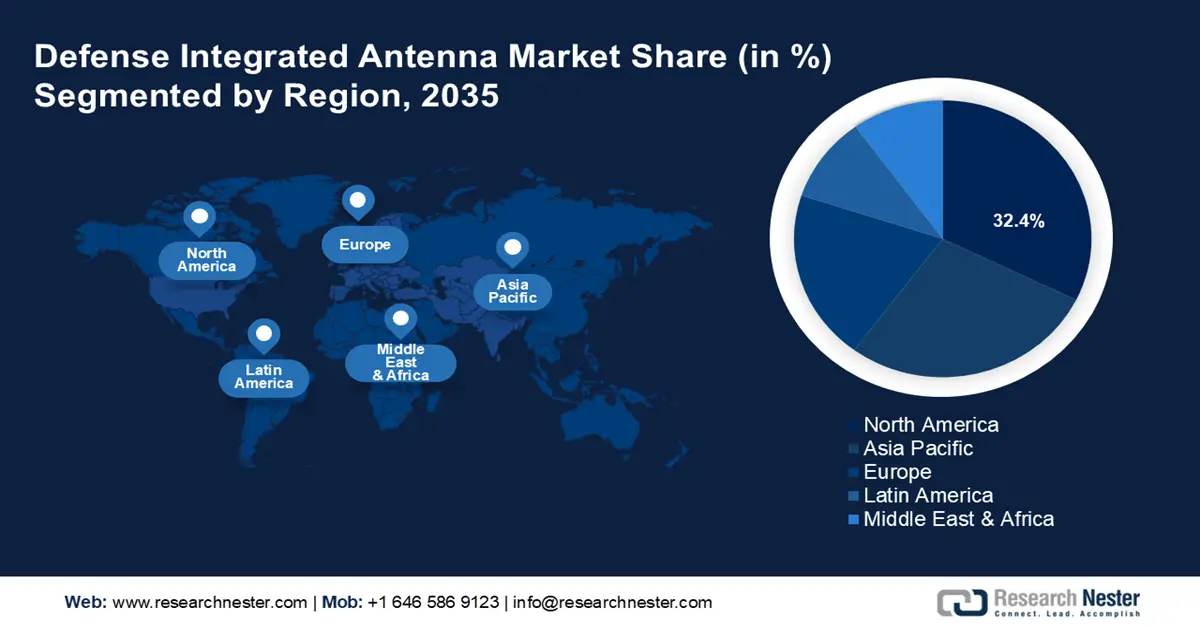

- North America defense integrated antenna market will account for 32.40% share by 2035, driven by large-scale investments and a rising number of defense contracts in the region.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, fueled by geopolitical tensions and increased focus on regional defense capabilities.

Segment Insights:

- The airborne segment in the defense integrated antenna market is expected to secure a 35.30% share by 2035, fueled by increasing deployment of aerial platforms like UAVs and jets.

- The array antenna segment in the defense integrated antenna market is forecasted to secure the largest share by 2035, influenced by demand for directivity and beamforming in satellite communications.

Key Growth Trends:

- Rise of UAVs in the defense sector

- Growing defense initiatives and demands for SATCOM antennas

Major Challenges:

- Higher costs of production

Key Players: RTX Corporation, L3 Harris Technologies, Airbus, Thales, SES, BAE Systems, Honeywell, Kratos Defense and Security Solutions, Rohde & Schwarz, Viasat, Northop Grumman Corporation, Lockheed Martin.

Global Defense Integrated Antenna Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 656.7 million

- 2026 Market Size: USD 700.44 million

- Projected Market Size: USD 1.34 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Russia, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 18 September, 2025

Defense Integrated Antenna Market Growth Drivers and Challenges:

Growth Drivers

- Rise of UAVs in the defense sector: The growing adoption of unmanned aerial vehicles (UAV) in defense sectors for combat and reconnaissance boosts demands for integrated antenna solutions. For instance, in October 2024, IG Drones announced the securing of USD 1 million in funding in the Series A round to craft advanced defense drone technology. The global defense integrated antenna sector is positioned to benefit from the growing adoption of UAVs as they require multi-channel communication and sensor integration that integrated antennas can provide. The lightweight nature of integrated antennas makes them easier to be adopted by UAVs. For instance, in March 2023, Quadsat announced USD 9.6 million in funding for antenna-testing drones to accelerate the production of ready-to-fly antenna testing kits operating in X and Ku-band frequencies.

- Growing defense initiatives and demands for SATCOM antennas: With a growing focus on defense infrastructure modernization, the global defense integrated antenna sector is poised to benefit from investments in space assets for secure communication and surveillance. Space-based missile defense systems heavily rely on advanced communications systems that require integrated antennas for accurate target tracking.

Additionally, space monitoring also requires robust integrated antenna solutions for communication and data-sharing. For instance, in October 2024, Leonardo announced BriteStorm incorporated with a platform-specific antenna, transmit-receive modules, and miniature technique generator that allows armed forces to operate deep in enemy territory by breaching Integrated Air Defense Systems (IADS). Additionally, the rising demands of SATCOM in the defense sector boosts the robust market growth. For instance, in September 2024, Northrop Gunman announced securing of USD 54.7 million contract for military satcom antennas as a part of the Defense Experimentation Using Commercial Space Internet (DEUCSI) program. - Surge in defense investments by governments: The global surge in defense sector investments has created an urgent need for integrated antenna solutions. The burgeoning demands across various countries to modernize defense infrastructure are positioned to boost the growth of the global defense integrated antenna market. For instance, the Stockholm International Peace Research Institute (SIPRI) stated that the 10 largest defense spenders globally increased their military spending in 2023, led by the U.S., China, and Russia.

The report also estimated world military expenditure to have risen for the ninth consecutive year in 2023 to an all-time high of USD 2443 billion. The surge in defense expenditure across all regions is set to contribute to the growth of the defense integrated antenna sector. For instance, in October 2024, Telesat contracted South Korea’s Intellian for 127 gateway antennas for the lightspeed low earth orbit (LEO) broadband network, and LEO networks are positioned to provide improved communication capabilities for defense platforms.

Challenges

- Cybersecurity and signal interference risks: The growing digital ecosystem ushers rising cybersecurity threats. Signal jamming through EMP attacks is a looming threat for the defense sector. Manufacturers face challenges in offering integrated antennas that are EMP-proof and can provide data transmission without interference. Additionally, cybersecurity risks prevail and any breach can severely affect the global defense integrated antenna sector.

- Higher costs of production: The production of advanced integrated antennae meeting stringent military standards can lead to a surge in manufacturing costs. Manufacturing an integrated antenna can be challenging owing to compatibility issues and limited infrastructure in emerging markets can prove to be a challenge in the defense integrated antenna market’s growth curve. Additionally, manufacturing of robust antennas that can withstand extreme weather conditions for military operations can drive costs. This can cause a limitation for the market as only defense agencies with significant spending capacity can access advanced integrated antennas, and cost-sensitive economies may remain untapped.

Defense Integrated Antenna Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 656.7 million |

|

Forecast Year Market Size (2035) |

USD 1.34 billion |

|

Regional Scope |

|

Defense Integrated Antenna Market Segmentation:

Platform Segment Analysis

Based on platform, the airborne segment is projected to capture defense integrated antenna market share of over 35.3% by 2035. The growth of the segment is attributed to the increasing deployment of aerial platforms such as UAVs, fighter jets, surveillance aircraft, etc., boosting demands for high-performance integrated antennas capable of secure, high-speed data communication in high altitudes. A significant driver of the segment is the rising need for situational awareness for airborne units. Growing investment in aerospace defense by counties is poised to maintain the robust growth curve of the airborne segment. For instance, in September 2024, budget documents released by the Ministry of Defense of Japan indicated additional funding to develop an electronic warfare aircraft for the Japan Maritime Self-Defense Force.

The ground segment of the global defense integrated antenna market is poised to exhibit a profitable growth curve during the forecast period. The market’s growth is attributed to advancements in terrestrial army infrastructure. Ground-based integrated antennae are vital for communications across command centers and deployed units. Additionally, investments in the modernization of terrestrial defense infrastructure are poised to continue the robust growth of the segment. For instance, in January 2021, L3 Harris Technologies completed a technology demonstration of a Multi-Band Multi-Mission (MBMM) phased array ground antenna system under a Defense Unit Prototype contract for the U.S. Space Force.

Type Segment Analysis

By type, the array antenna segment of the defense integrated antenna market attained the largest revenue share. The growth of the segment is owed to array antennas enabling directivity and beamforming, leading to increased demands in satellite communications and radar. The rising adoption of phased array technology allows antennas to steer beams without excessive mechanical movement. The segment is positioned to increase its revenue share owing to the surge in the adoption of array antennas in radar systems owing to their ability to operate across multiple frequencies. For instance, in February 2020, Raytheon completed the first lower-tier and missile defense sensor radar antenna array for the U.S. Army.

Our in-depth analysis of the global market includes the following segments:

|

Platform |

|

|

Type |

|

|

Frequency |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Defense Integrated Antenna Market Regional Analysis:

North America Market Insights

North America defense integrated antenna market is predicted to hold revenue share of more than 32.4% by 2035, owing to large-scale investments in the defense sector and an increasing percentage of defense contracts to supply robust integrated antenna solutions in the region. The market’s profit share is dominated by the U.S. and Canada. The market offers opportunities to manufacturers offering robust integrated antenna solutions for defense that can operate in challenging terrains of the region. Additionally, a robust research & development ecosystem in the region benefits the defense integrated antenna sector in North America. Businesses are leveraging the push for robust strengthening of the defense sectors by governments in the region. For instance, in August 2024, Raytheon won a USD 51.7 million contract for military satcom antennas as part of the Defense Experimentation using Commercial Space Internet (DEUCSI) program.

The U.S. has the largest share in the defense integrated antenna market in North America. The market’s growth in the U.S. is attributed to large-scale spending in defense and investments to improve communications and electronic warfare capabilities. For instance, in August 2024, the country’s defense spending rose by 62%, increasing from USD 506 billion to USD 820 billion in 2023. Additionally, the Space Force was allocated USD 30.1 billion, USD 202.6 billion for navy, USD 53.2 billion for marine corps, and USD 165.6 billion for the army. The push to modernize defense infrastructure is poised to open new opportunities for integrated antenna. The country seeks to maintain its edge in military technology, which makes the domestic market lucrative for businesses as profit opportunities are abundant. In financial year 2024, the defense department laid out details for USD 848.8 trillion budget that is poised to open multiple contract opportunities for integrated antenna manufacturers. For instance, in September 2024, Viasat was awarded a USD 33.6 million U.S. Air Force DEUCSI contract for phased array antenna technology development.

Canada is poised to increase its revenue share in the defense integrated antenna market owing to increasing investments in the defense sector boosting demands for integrated antenna solutions. The demand for reliable communication across remote region is driving demands for robust integrated antenna solutions that can withstand extreme environmental conditions. Additionally, Canada benefits from being a part of the North American Aerospace Defense Command (NORAD) along with the U.S., driving need for advanced communication and early warning systems. Companies are poised to benefit form the rising investments in defense infrastructure by securing contracts. For instance, in May 2023, NovAtel GPS anti-jam technology antennas were selected by the army in Canada for armored vehicles.

APAC Market Insights

APAC market is positioned to register the fastest growth in the global defense integrated antenna sector. The market’s robust growth curve is attributed to increased focus on regional security amid geopolitical disputes in the region. Maritime challenges between countries in the region push for increased investment in improving defense infrastructure, boosting opportunities in the defense integrated antenna sector.

China, India, Japan, and South Korea are leading the market share in APAC. Emerging economies in the region provide lucrative opportunities to market players in the region. For instance, in April 2024, South Korea successfully launched its second military spy satellite into orbit boosting the monitoring and missile attack capabilities. High-performance integrated antennas able to handle high-resolution imaging and data transmission are vital in such missions benefiting the sector’s growth.

China is projected to hold the largest revenue share in the defense integrated antenna market of APAC. The market’s growth is aligned with the country’s rise as a significant military power globally owing to large-scale investments in the defense sector. For instance, SIPRI reported China to have spent USD 296 billion in their defense sector in 2023, a 6% increase from 2022.

The heightened spending is poised to benefit the defense integrated antenna sector in the country. Efforts to advance SATCOM and intelligence, surveillance, and reconnaissance (ISR) capabilities create a steady demand for integrated antenna solutions. For instance, in August 2024, China launched the ChinaSat-4A communications satellite developed by the China Academy of Space Technology.

India is projected to increase its revenue share in the defense integrated antenna market in APAC. The market’s growth in India is owed to surging defense investments and a push to modernize military technology. Flagship government programs like Make in India and Atmanirbhar Bharat position the country to invest in developing an Indigenous manufacturing ecosystem that creates lucrative opportunities for the local players in the defense integrated antenna sector.

Additionally, the requirements to secure its extensive border and maritime territories are driving demand for effective multi-frequency antennas. The country has been actively collaborating with the U.S., Russia, and Japan in the defense sector, further creating opportunities in the market. For instance, in March 2024, Bharat Electronics Ltd. secured a defense contract with the Ministry of Defense for a contract worth USD 3.5 billion to supply an integrated electronic warfare system for the army.

Defense Integrated Antenna Market Players:

- RTX Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- L3 Harris Technologies

- Airbus

- Thales

- SES

- BAE Systems

- Honeywell

- Kratos Defense and Security Solutions

- Rohde & Schwarz

- Viasat

- Northop Grumman Corporation

- Lockheed Martin

The global defense integrated antenna sector is projected to register a rapid growth curve during the forecast period. The competitive sector has global and local players vying to increase their revenue share. Key market players are investing in integrated antennas with advanced defense and communication capabilities to leverage the profitable opportunities in the sector.

Here are some key players in the market:

Recent Developments

- In July 2024, SES Space & Defense awarded SATCOM as a managed service pilot contract for the U.S. army under a USD 3.6 million contract. The initiative is poised to streamline commercially leased SATCOM network services to be flexible and tailored to changing mission needs.

- In September 2023, Cambium Networks announced the new PTP 700 Beam Steering outdoor unit with integrated smart antenna that can enable antenna alignment in seconds and provide high level interference mitigation to provide secure communications services in hostile environments.

- Report ID: 6666

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Defense Integrated Antenna Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.