Data Center UPS Market Regional Analysis:

North America Market Insights

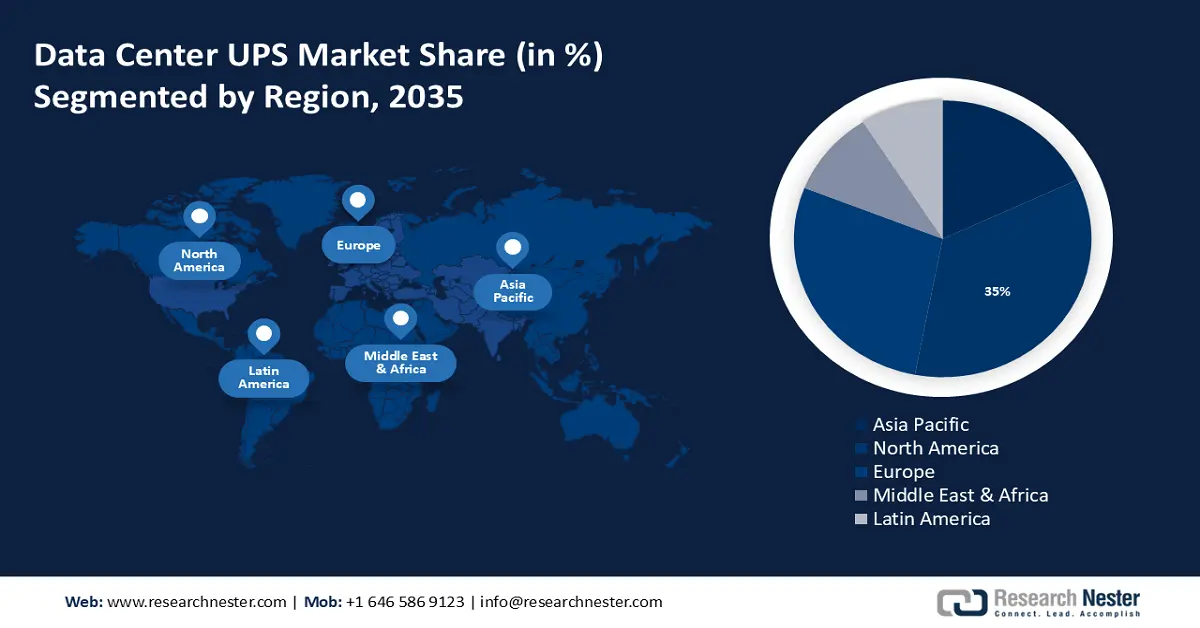

North America industry is poised to hold largest revenue share of 35% by 2035. The rapid expansion of cloud infrastructure is contributing to the regional growth. Moreover, the flourishing It & telecom industry is further positively impacting the industry landscape in North America. Cloudscene estimates that by 2022, there will be over 2,000 data centers in the United States, which will create a huge market for UPS solutions.

The power supply of data centers that were being built in the US was noted to have reached 1.9 gigawatts in 2022—a 52.8% increase over the previous year's supply. These patterns show how the need for data centers is rising in the US, which is driving up demand for the market.

Furthermore, Canada, the nation will include IoT, blockchain, AI, and other cutting-edge technology as it seeks to build more smart cities in the future, which will lead to a greater generation of data. additional than 225 towns indicated interest in exploring the benefits of the plan by submitting their applications for the Government of Canada's Smart Cities Challenge, which was introduced in 2017. This indicates a desire to establish additional smart regions in the future. The widespread deployment of smart devices that are managed by smartphone apps would be made possible by the introduction of 5G edge cloud networks and services and other faster network technologies in smartphones, thus propelling the market’s demand.

European Market Insights

The European region will also encounter huge growth for the data center UPS market during the forecast period, owing to growth in e-commerce and logistics. One of the major drivers for the UPS market in Europe is growing industries and production facilities. As hyperscalers, startups, and enterprises seek space that can cope with their cloud and AI needs, the demand for data centers in Europe is expected to increase by 440 MW until 2024.

Businesses are moving toward locations that provide uninterrupted computing services as a result of the increasing usage of new devices and the deployment of a 5G network to supply the speeds required to utilize these devices to their maximum potential. According to data from the Federal Network Agency of Germany, 5G networks have covered 90% of German territory as of October, compared with 79% in October 2023.

The United Kingdom aims to achieve net-zero emissions by 2050 and a minimum 68% reduction in its economy-wide greenhouse gas emissions from 1990 levels by 2030, according to an article published by the International Energy Agency (IEA). In particular, data centers are

anticipated to achieve carbon neutrality by around 2030

France is ahead of Germany and the UK in Europe for digital product leadership. The majority of French companies think that managing their product line will be greatly impacted by the move to digital items. Furthermore, French companies are leading the way in this technique, with almost 40% of them leveraging data insights to inform their product plan.