Data Center UPS Market Outlook:

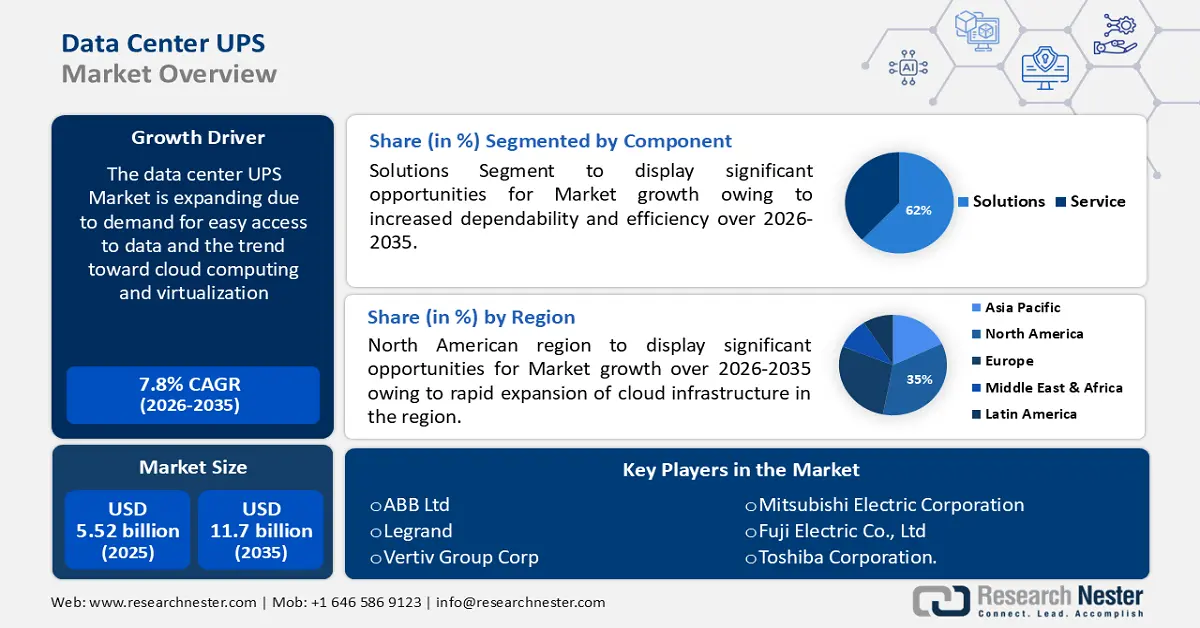

Data Center UPS Market size was valued at USD 5.52 billion in 2025 and is set to exceed USD 11.7 billion by 2035, registering over 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center UPS is estimated at USD 5.91 billion.

The demand for easy access to data and the trend toward cloud computing and virtualization are anticipated to drive the market during the forecast period. The growing use of digital services, the ubiquity of the digital age, and the overall increase in digitalization, particularly in developing economies, will all contribute to the data center UPS market's growth. Furthermore, worries about data loss in the event of a power outage may increase demand for continuous power supply to data centers.

In the 4th quarter of 2023, global spending on cloud infrastructure services increased by 19% year over year to USD 78.1 billion, a rise of USD 12.3 billion. To provide services that increase demand for UPS, cloud services must be available on the Internet.

Key Data Center UPS Market Insights Summary:

Regional Highlights:

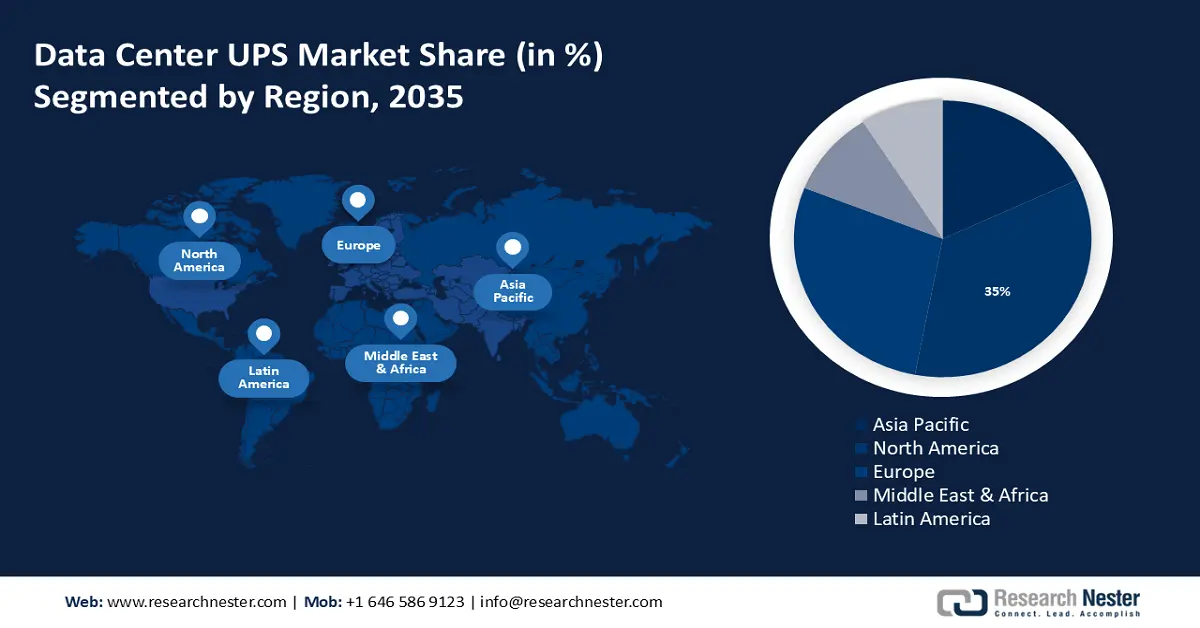

- North America data center ups market will secure over 35% share by 2035, driven by the rapid expansion of cloud infrastructure and the IT & telecom industry.

Segment Insights:

- The solution segment in the data center ups market is expected to capture a 62% share by 2035, fueled by the focus on energy efficiency and advanced power management functions in UPS systems.

- The it & telecom segment in the data center ups market is projected to achieve a 25% share by 2035, driven by increasing data traffic and storage requirements in the IT and telecom sector.

Key Growth Trends:

- Growing data center building for dependable power supply

- Remote management solutions for evolving industry needs

Major Challenges:

- High initial costs limiting adoption to a large extent

- Using unfriendly materials, and outdated models negatively impacts the environment

Key Players: ABB Ltd, Legrand, Vertiv Group Corp, Delta Electronics, Inc., Schneider Electric SE, Huawei Technologies Co., Ltd., Power Innovations International, Inc./L ITEON Group, KOHLER Uninterruptible Power Limited, SOCOMEC Mitsubishi Electric Corporation.

Global Data Center UPS Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.52 billion

- 2026 Market Size: USD 5.91 billion

- Projected Market Size: USD 11.7 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Singapore

- Emerging Countries: China, India, Singapore, Japan, South Korea

Last updated on : 17 September, 2025

Data Center UPS Market Growth Drivers and Challenges:

Growth Drivers

- Growing data center building for dependable power supply - The growth of data centers emphasizes how vital it is to have a stable power infrastructure in order to maintain data integrity and continuous operations. The increasing need for dependable data processing and storage solutions is reflected in the construction industry's boom.

Resilient power system investments, such as those in redundant power supply and backup generators, show the industry's dedication to maintaining uninterrupted uptime in the face of rapidly expanding digital infrastructure. For instance, according to US energy information administration; in 2022, US energy demand is projected to hit 4,027 billion kWh, which would be an all-time high. - Remote management solutions for evolving industry needs - The increasing need for flexible power management encourages the use of remote monitoring tools, which improve scalability and dependability. This is in line with the changing needs of the industry and presents potential prospects for the data center UPS market.

For example, UPS systems with remote power monitoring capabilities can reduce downtime by proactively identifying and resolving power problems. In response to changing operating requirements, there is a trend towards power solutions that are more resilient and efficient. As observed by research Nester analysts, the globe remote monitoring & management tools industry garnered a revenue of around USD 840 million in 2022. - Growing use of IoT and AI to ensure uninterrupted power - The spike in AI and IoT usage in data centers ensures smooth power provisioning by supporting operational efficacy. This pattern encourages innovation in the uninterruptible power supply (UPS) industry, leading to the creation of specialized products to satisfy changing infrastructure requirements. Predictive analytics-enabled smart UPS systems, for example, can foresee power fluctuations and proactively reduce the risk of downtime, which is in line with the dynamic demands of contemporary data center environments.

The data center UPS market is growing and evolving because of this dynamic tendency. AI's integration into data center operations raises transparency and accountability concerns. Sustainability also influences AI decisions in data centers, as resource-intensive workloads require advanced cooling systems, leading to a projected 12% increase in energy consumption by 2030.

Challenges

- High initial costs limiting adoption to a large extent - One of the main obstacles to the widespread use of uninterruptible power supply (UPS) systems in data centers is their high initial costs. The significant initial outlay required for UPS solutions poses a financial hardship, particularly for smaller businesses. This could hinder the incorporation of essential power infrastructure elements and postpone their deployment in data center environments.

- Using unfriendly materials, and outdated models negatively impacts the environment - The data center industry faces sustainability issues due to outdated UPS systems that contain components that are detrimental to the environment. Regulation observance and the growing inclination of consumers toward environmentally friendly products are essential. This might reduce the market for older UPS machines and necessitate expensive updates to comply with environmental regulations.

Data Center UPS Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 5.52 billion |

|

Forecast Year Market Size (2035) |

USD 11.7 billion |

|

Regional Scope |

|

Data Center UPS Market Segmentation:

Data Center Size Segment Analysis

The large data center segment in data center UPS market is slated to garner the majority of revenue share over the forecast period. Large data centers use centralized, highly capacitous UPS systems to protect critical IT equipment from power outages. These systems incorporate the newest power protection technology to reach new heights of efficiency and dependability.

Online double conversion is the most dependable type of data center UPS because it can provide computer-grade output to the viral load under a variety of input situations, including power from backup generators. The market is anticipated to grow as a result of an increase in data center construction worldwide, facility investments, and government campaigns promoting energy-efficient data centers. As observed the global data center construction industry procured a revenue of around USD 229 billion in 2023.

Component Segment Analysis

Solution segment is set to hold data center UPS market share of more than 62% by 2035. The data center solutions provide increased dependability and efficiency. UPS solutions encourage their use. Energy efficiency is a key consideration in the design of modern UPS systems. They include sophisticated energy-saving modes, power management functions, and high-efficiency parts. UPS systems improve power use, cut down on energy waste, and help save operating expenses. The energy efficiency of new energy-efficient UPS ranges from 92% to 95%. They also assist companies in achieving environmental objectives by reducing energy and carbon footprint.

Application Segment Analysis

In data center UPS market, it and telecom segment is likely to hold revenue share of more than 25% by 2035. Growing data traffic and storage requirements in the IT and telecom sector have increased the demand for data center UPS. With the growing demand for data storage and processing, data centers require reliable power solutions to handle increasing data loads.

Global data creation, capture, copying, and consumption are expected to increase significantly in 2020, with 64.2 terabytes projected for 2020. Global data creation is expected to increase to more than 180 terabytes in the next five years up to 2025.UPS systems ensure the availability of power to data center infrastructure, supporting the efficient handling and storage of data.

Our in-depth analysis of the global market includes the following segments:

|

Data Center Size |

|

|

Component |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center UPS Market Regional Analysis:

North America Market Insights

North America industry is poised to hold largest revenue share of 35% by 2035. The rapid expansion of cloud infrastructure is contributing to the regional growth. Moreover, the flourishing It & telecom industry is further positively impacting the industry landscape in North America. Cloudscene estimates that by 2022, there will be over 2,000 data centers in the United States, which will create a huge market for UPS solutions.

The power supply of data centers that were being built in the US was noted to have reached 1.9 gigawatts in 2022—a 52.8% increase over the previous year's supply. These patterns show how the need for data centers is rising in the US, which is driving up demand for the market.

Furthermore, Canada, the nation will include IoT, blockchain, AI, and other cutting-edge technology as it seeks to build more smart cities in the future, which will lead to a greater generation of data. additional than 225 towns indicated interest in exploring the benefits of the plan by submitting their applications for the Government of Canada's Smart Cities Challenge, which was introduced in 2017. This indicates a desire to establish additional smart regions in the future. The widespread deployment of smart devices that are managed by smartphone apps would be made possible by the introduction of 5G edge cloud networks and services and other faster network technologies in smartphones, thus propelling the market’s demand.

European Market Insights

The European region will also encounter huge growth for the data center UPS market during the forecast period, owing to growth in e-commerce and logistics. One of the major drivers for the UPS market in Europe is growing industries and production facilities. As hyperscalers, startups, and enterprises seek space that can cope with their cloud and AI needs, the demand for data centers in Europe is expected to increase by 440 MW until 2024.

Businesses are moving toward locations that provide uninterrupted computing services as a result of the increasing usage of new devices and the deployment of a 5G network to supply the speeds required to utilize these devices to their maximum potential. According to data from the Federal Network Agency of Germany, 5G networks have covered 90% of German territory as of October, compared with 79% in October 2023.

The United Kingdom aims to achieve net-zero emissions by 2050 and a minimum 68% reduction in its economy-wide greenhouse gas emissions from 1990 levels by 2030, according to an article published by the International Energy Agency (IEA). In particular, data centers are

anticipated to achieve carbon neutrality by around 2030

France is ahead of Germany and the UK in Europe for digital product leadership. The majority of French companies think that managing their product line will be greatly impacted by the move to digital items. Furthermore, French companies are leading the way in this technique, with almost 40% of them leveraging data insights to inform their product plan.

Data Center UPS Market Players:

- Eaton Corporation plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd

- Legrand

- Vertiv Group Corp

- Delta Electronics, Inc.

- Schneider Electric SE

- Huawei Technologies Co., Ltd.

- Power Innovations International, Inc./LITEON Group

- KOHLER Uninterruptible Power Limited

Leading market participants are taking action to grow their market shares inorganically. It is anticipated that these efforts will lead to steady expansion in the field. Market participants have traditionally turned to acquisitions, mergers, and partnerships as a means of expanding their global reach and breaking into undiscovered markets.

Recent Developments

- ABB Ltd introduced MegaFlex DPA (Decentralized Parallel Architecture) UPS solutions for the Indian market. The ABB EcoSolutionsTM portfolio includes the first-ever sustainable UPS that conforms with the ABB circularity concept. Its lowest footprint and maximum efficiency rating are suited for high-density computing environments.

- Delta Electronics, Inc. took part in the China International Industrial Fair 2023 (CIIF 2023) in Shanghai. Under the subject "Delta Net Zero Factories," Delta's display had three sections: "Green Manufacturing," "Smart Health Office," and "Factory Microgrid." Over 200,000 people attended the five-day event. Numerous individuals who stopped by Delta's stand expressed interest in its industrial and data center power solutions.

- Report ID: 6171

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center UPS Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.