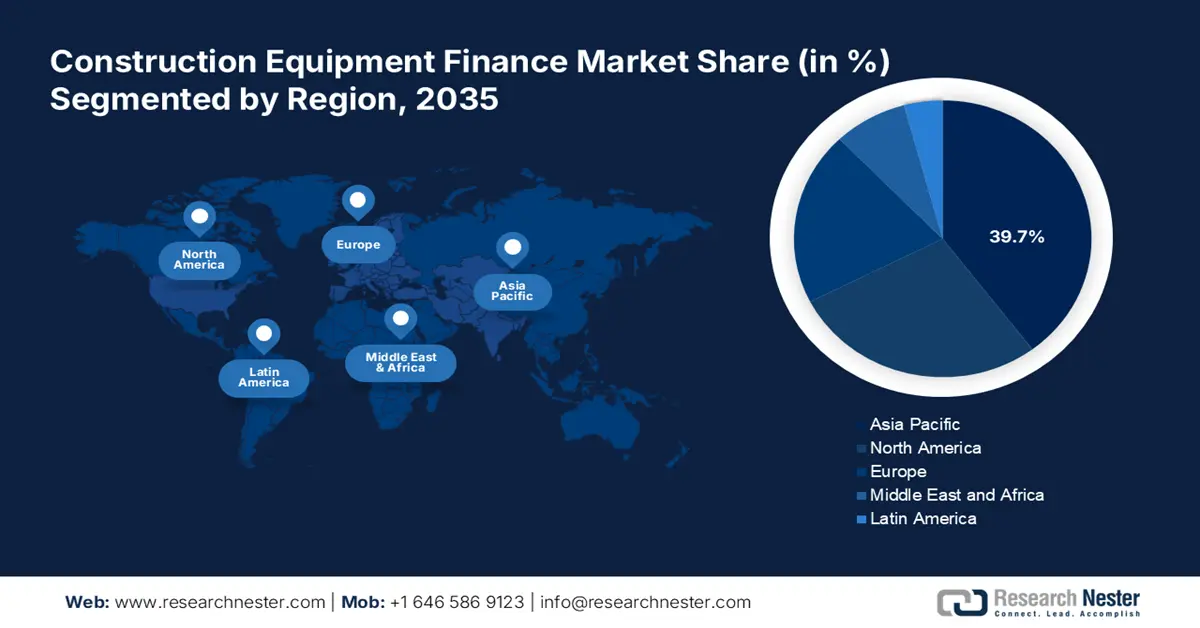

Construction Equipment Finance Market Regional Analysis:

APAC Market Statistics

By the end of 2035, Asia Pacific construction equipment finance market is set to dominate around 39.7% revenue share. The rapid industrial expansion of construction supplies and projects has inflated the need for financial assistance and support in this region. This is further creating a scope of collaboration between financial firms and equipment manufacturers, attracting more capital investors to participate in this sector. For instance, in November 2022, Federal Bank partnered with JCB India to boost the financing options for customers. The partnership offers an option to borrow loans at competitive interest rates to purchase a wide range of world-class equipment from JCB.

India is taking the fast-paced infrastructural development as an opportunity to oppose excessive liquidity in the domestic economy. The country considers investments in the market as accumulating assets for its economic growth. This is further inspiring several equipment suppliers and financial institutions to strengthen their trading relationships to broaden their offerings. For instance, in February 2024, Mahindra Construction Equipment signs an MoU with the Bank of Maharashtra to provide customers with the best interest rate and loan tenure. The partnership aims to offer unique financial assistance for the purchase of current and forthcoming BSV range of construction equipment.

China is showcasing notable progress in the market with the support of government subsidies, plans, and incentives. For instance, in July 2024, the State Council of China released a five-year action plan for deepening the people-centered new urbanization strategy. The plan includes the construction of affordable houses and underground pipelines and the renovation of urban infrastructure to improve intercity commuting efficiency. The country is further promoting sustainable options in manufacturing and adopting construction equipment due to the increasing emissions. This is further creating a new business line for both the domestic and international leaders of this sector.

North America Market Analysis

North America is estimated to become one of the fastest-growing regions in the construction equipment finance market during the forecast period, 2026-2035. The growing demand for construction machinery in both residential and commercial sectors is contributing to the progress of this region. This is attracting many global leaders to invest in this region to empower the construction field of this region. For instance, in November 2021, Hitachi partnered with ITOCHU Corporation and Tokyo Century Corporation to build a joint venture company to offer financial support for construction machinery in North America. The JV company, ZAXIS Financial Services Americas, LLC provides financing for sales of equipment sold by the Hitachi Construction Machinery Group.

The U.S. construction equipment finance market is expected to grow exponentially due to its contribution to availing financial support for its robust construction machinery industry. The manufacturers of this country are eager to promote their product line by offering lucrative financial options to the customers. This has attracted many lending firms to arrange maximum funding to serve this sector. For instance, in December 2023, Machinery Partner raised USD 11 million to offer procurement, financing, and support for a wide range of industrial equipment and heavy machinery.

Canada is also expected to experience significant growth in the market due to its positive impact on the economic growth of this country. The increased number of construction projects in this country is inflating the demand for machinery. Thus, the need for purchasing and leasing these equipment is further expanding the marketplace for investors. For instance, in February 2023, BMO Financial signed a bilateral agreement with BNP Paribas to provide clients with continuity of leasing services across Canada and the U.S. for construction equipment.